Best Cat Insurance Providers of 2026

Get your vet bills covered

Your feline friend deserves the best health care. Compare these top cat health insurance companies and keep your cat purring for all nine lives.

Your feline friend deserves the best health care. Compare these top cat health insurance companies and keep your cat purring for all nine lives.

insured their pet via BestMoney this week

Cat insurance is a health insurance policy tailored specifically for your feline companion. As veterinary medicine advances, treatments like MRI scans and specialized surgeries have become life-saving but expensive. A cat insurance policy acts as a financial safety net, ensuring you can say "yes" to critical care without worrying about a massive, unexpected bill.

Why Get Cat Insurance?

Whether your cat is an adventurous outdoor explorer or a quiet indoor lounger, accidents and illnesses can strike at any time. By paying a manageable monthly premium, you mitigate the risk of high out-of-pocket costs.

| Customizable coverage for cats |

How Does Cat Insurance Work?

Unlike human health insurance, which often uses "in-network" providers, most pet insurance for cats gives you the freedom to visit any licensed veterinarian.

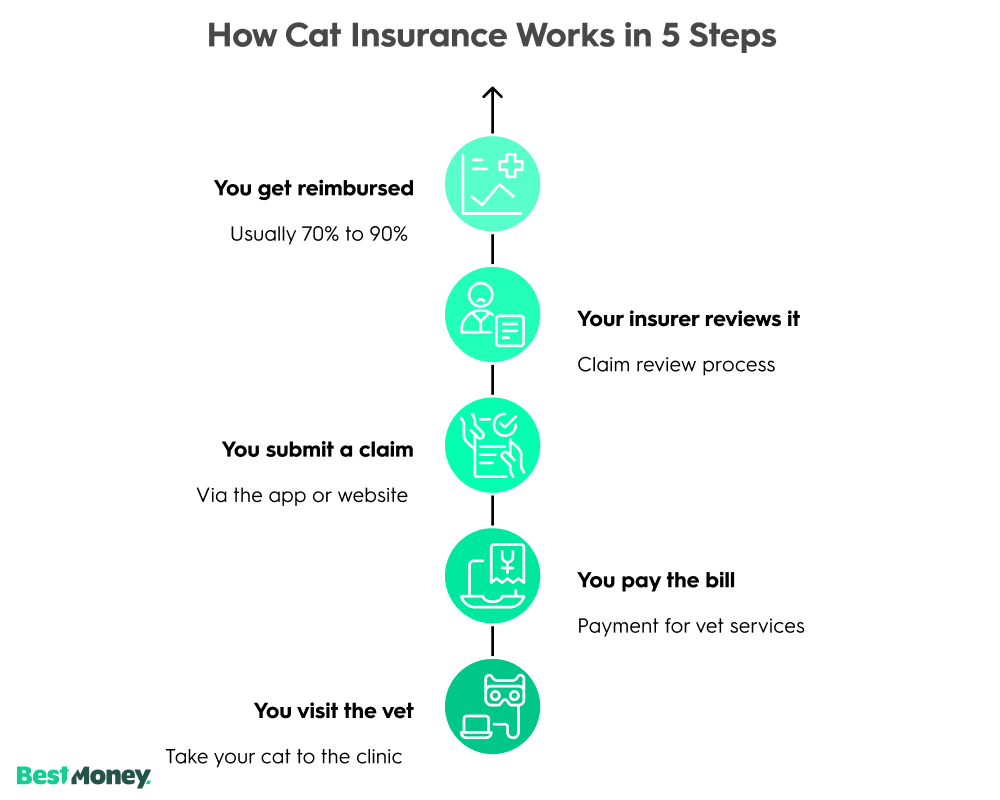

The process typically follows these steps:

Visit the Vet: You take your cat to your preferred clinic for treatment.

Pay Upfront: In most cases, you pay the veterinarian directly at the time of service.

Submit a Claim: You upload your itemized invoice to your provider’s app or website.

Get Reimbursed: Once your annual deductible is met, the insurer sends you a percentage of the covered costs (usually 70% to 90%).

While the reimbursement model is standard, some modern providers in 2026 now offer "direct pay" options, where they settle the bill with your vet instantly, so you only have to cover your portion of the cost.

“Aside from being generally lower in cost than pet insurance for dogs, it works in the same way. In general, pet insurance is a financial safety net that helps pet parents manage the cost of veterinary care.”

Yes, cat insurance is worth it for many pet owners because it helps manage the financial risk of unexpected veterinary bills and makes ongoing care more affordable. Whether it’s the right choice depends on your cat’s health, your budget, and how comfortable you are paying for emergency care out of pocket.

Cat insurance is especially valuable because veterinary costs can add up quickly—even for indoor or generally healthy cats. Diagnostics, imaging, and specialized treatments often cost far more than routine checkups, and those expenses are difficult to predict.

Many pet owners also ask whether insurance makes sense for cats that rarely go outside. While indoor cats face fewer risks, they can still develop illnesses, require imaging, or need emergency care.

Cat insurance may be worth it if you want to:

Avoid large, unexpected vet bills from accidents or sudden illnesses

Say yes to recommended treatments without financial stress

Spread veterinary costs into predictable monthly payments

Protect against expensive diagnostics, surgeries, or chronic conditions

Plan ahead as your cat ages and health risks increase

Cat insurance may be less appealing if you:

Have significant savings set aside specifically for pet medical care

Are comfortable covering high emergency costs out of pocket

Prefer to self-insure rather than pay ongoing premiums

| Super fast claims payouts |

“Pet insurance for cats can provide coverage for medical expenses relating to accidents, illnesses, routine care, and more depending on your insurance plan. It may be a great option if you’d like peace of mind, as costly and unexpected care can get expensive.”

There are several types of cat insurance plans, each offering different levels of coverage and cost protection: Accident-Only, Time-Limited, Maximum Benefit, and Lifetime. Understanding these options makes it easier to choose coverage that fits your cat’s health needs and your financial comfort level.

The main types of cat insurance include:

Accident-only cat insurance

Accident-only plans cover injuries caused by unexpected events such as falls, broken bones, or ingestion of foreign objects. These plans are usually the most affordable but do not cover illnesses, chronic conditions, or preventive care.

Accident and illness cat insurance

Accident and illness plans are the most common and comprehensive option. They cover treatment for injuries and medical conditions such as infections, digestive issues, cancer, diabetes, and hereditary conditions. If you’re unsure which plan to choose, this option generally offers the best balance of cost and coverage.

Wellness or preventive care add-ons

Wellness plans are optional add-ons that help pay for routine care like exams, vaccinations, and basic diagnostic tests. These plans are often used to offset predictable costs and are separate from accident and illness coverage.

Lifetime or chronic condition coverage

Some insurers offer plans that continue covering chronic or recurring conditions for the life of your cat, as long as the policy remains active. This can be especially valuable for long-term conditions that require ongoing treatment.

Choosing the right plan depends on your cat’s age, health history, and how much financial protection you want. Kittens often benefit from broader coverage early on, while adult and senior cats may need plans that prioritize illness and long-term care.

Cat insurance covers veterinary treatment for unexpected medical issues, focusing on accidents, illnesses, and long-term health conditions rather than routine or elective care. Coverage details vary by plan, but most standard policies are designed to protect you from high, unpredictable costs.

Most accident and illness cat insurance plans cover:

Injuries from accidents, such as fractures, wounds, or toxin ingestion

Illnesses, including infections, digestive issues, urinary conditions, and cancer

Diagnostic testing, such as blood work, X-rays, ultrasounds, and advanced imaging

Hospitalization, surgery, and emergency treatment

Prescription medications

Chronic and hereditary conditions, if they are not pre-existing

Some alternative therapies, such as acupuncture or physical therapy, depending on the insurer

Does cat insurance cover neutering or spaying? Typically no, unless you add a wellness or preventive care plan.

Does cat insurance cover vaccinations? Vaccines are generally excluded from base policies but may be partially reimbursed through a wellness add-on.

Optional wellness coverage may include:

Annual wellness exams

Core vaccinations

Spaying or neutering reimbursement (often capped)

Basic dental cleanings or preventive services

It’s also important to understand exclusions. Most policies do not cover pre-existing conditions, elective or cosmetic procedures, grooming, or prescription diets.

Overall, cat insurance is meant to help you manage large, unexpected veterinary expenses—not everyday vet visits. Choosing the right mix of core coverage and optional wellness benefits helps ensure your plan matches both your cat’s health needs and your budget.

Cat insurance typically costs between $20 and $40 per month for a standard accident-and-illness policy.

Pet owners looking for cheap pet insurance for cats can often lower their monthly premiums by choosing higher deductibles, lower reimbursement rates, or accident-only coverage while still maintaining essential protection.

While this range covers most healthy adult cats, the specific premium is determined by the coverage you choose, your cat’s age, breed, and where you live.

Typical cost ranges for cat insurance:

Average monthly premium: Most plans fall in a moderate range, with many cat owners paying around the low-to-mid $20s per month for comprehensive accident and illness coverage.

Accident-only plans: These are more budget-friendly and may cost less because they cover injuries but not illnesses.

Wellness add-ons: If you add preventive or wellness coverage (for routine care like vaccinations and check-ups), your total cost will be higher than a basic accident and illness plan.

Key factors that affect how much cat insurance costs:

Coverage level: Policies with higher annual payout limits, lower deductibles, and higher reimbursement rates cost more.

Your cat’s age: Younger cats often have lower premiums; older cats usually cost more to insure.

Breed and health history: Cats prone to hereditary or chronic conditions can have higher rates.

Location and vet costs: Regions with higher veterinary fees typically result in higher insurance premiums.

Pet insurance costs are calculated based on risk and coverage, not on how often you visit the vet. Insurers estimate how likely your cat is to need care and how much they may need to pay out under your policy.

Pricing is primarily based on:

Your coverage selections

The deductible, reimbursement percentage, and annual limit you choose have the biggest impact on cost. More generous coverage increases premiums, while higher out-of-pocket responsibility lowers them.

Your cat’s age at enrollment

Younger cats are typically cheaper to insure. As cats age, the likelihood of medical issues increases, which is reflected in higher premiums over time.

Breed-related risk factors

Some breeds are statistically more prone to inherited or chronic conditions, which can raise insurance costs.

Health history

Pre-existing conditions are usually excluded from coverage and can limit plan options, though they don’t directly increase premiums for covered conditions.

Veterinary costs in your area

Insurance pricing reflects local vet fees, meaning premiums tend to be higher in areas where medical care is more expensive.

Unlike routine vet bills, insurance premiums are designed to stay predictable. Understanding how these factors work together helps you choose coverage that balances affordability with protection—without paying for features you don’t need.

| Up to 90% reimbursement |

The best cat insurance plan is one that matches your cat’s health needs, your budget, and how you prefer to manage veterinary costs. Choosing the right plan type and provider requires looking beyond price and focusing on coverage details that actually matter when you need to file a claim.

Start by choosing the right plan type:

Accident-only plans are best if you want low-cost protection for emergencies but are comfortable paying out of pocket for illnesses.

Accident and illness plans offer the most balanced coverage and are the most common choice for long-term protection.

Plans with wellness add-ons may be worth considering if you want help covering routine care like exams or vaccinations.

Then evaluate the insurance company itself:

Coverage customization: Look for insurers that let you adjust deductibles, reimbursement rates, and annual limits so the plan fits your budget.

Clear definitions: Review how the company defines pre-existing conditions, waiting periods, and exclusions.

Waiting periods: Shorter waiting periods mean your coverage starts sooner, but all insurers require some delay before benefits apply.

Claim process: A simple digital claims process and fast reimbursements make a big difference during stressful situations.

Veterinarian flexibility: Most top providers let you visit any licensed veterinarian, which gives you more freedom of choice.

Key questions to ask before enrolling:

How much will my monthly premium be, and can it increase over time?

What percentage of the bill will be reimbursed after the deductible?

Are there annual or per-condition payout limits?

Are chronic or hereditary conditions covered if they are not pre-existing?

Are there discounts available, such as multi-pet or annual payment discounts?

The best cat insurance plan isn’t the one with the lowest monthly cost—it’s the one that provides reliable coverage when your cat actually needs medical care. Comparing both plan structure and provider reliability helps ensure you’re protected long term.

Buying a pet insurance plan is a straightforward process that starts with understanding your cat’s needs and ends with selecting coverage that fits your budget. The key is to compare plans carefully before enrolling, rather than choosing based on price alone.

Steps to buying a pet insurance plan:

Assess your cat’s health and lifestyle

Consider your cat’s age, breed, medical history, and whether they are indoor or outdoor. These factors help determine how much coverage you may need.

Choose your coverage level

Select an annual coverage limit, deductible, and reimbursement percentage. Higher limits and reimbursement rates increase premiums but reduce out-of-pocket costs when you file a claim.

Decide on plan type

Choose between accident-only coverage or a more comprehensive accident and illness plan. Add wellness coverage if you want help paying for routine care like exams or vaccinations.

Compare multiple providers

Get quotes from several insurers using the same coverage settings so you can make an accurate comparison. Look closely at exclusions, waiting periods, and benefit limits.

Review the policy details

Read the sample policy to understand what is covered, what isn’t, and how pre-existing conditions are defined. Pay special attention to waiting periods and claim requirements.

Top Cat Insurance Providers Comparison

| Provider | Coverage Types | Reimbursement Options | Coverage Limits | Notable Features |

|---|---|---|---|---|

| Spot Pet Insurance | Accident-only, accident & illness | Up to 90% | Customizable | Highly customizable plans, 24/7 vet helpline |

| Lemonade | Accident & illness | Up to 90% | Customizable | Fast digital claims, app-based policy management |

| Healthy Paws | Accident & illness | Up to 90% | Unlimited | No annual or lifetime caps, fast claims |

| ASPCA Pet Health Insurance | Accident-only, accident & illness | Up to 90% | Customizable | Any licensed vet, hereditary coverage |

| Pets Best | Accident-only, accident & illness | Up to 90% | Customizable | Covers cats of any age or breed |

| Pumpkin | Accident & illness | 90% | High annual limits | Emergency-focused coverage, simple plans |

| MetLife | Accident-only, accident & illness | Up to 90% | Customizable | Shorter waiting periods, broad eligibility |

| WagWalking.com | Accident & illness, Wellness | Up to 90% | Varies by plan | Side-by-side plan comparison |

| Fetch | Accident & illness | Up to 90% | Customizable | Broad diagnostic and treatment coverage |

| Embrace | Accident & illness | Up to 90% | Customizable | Lifetime coverage for chronic conditions |

Recent Trends: Increases in Pet Health Problems

Pet health issues and veterinary costs continue to rise, making long-term care more complex and expensive for cat owners. Advances in veterinary medicine have improved diagnosis and treatment, but they have also increased the cost of care—especially for imaging, specialist visits, and chronic condition management.

Several trends are shaping this shift:

More chronic conditions: Cats are living longer, which increases the likelihood of long-term illnesses such as kidney disease, diabetes, and arthritis.

Greater use of advanced diagnostics: Tests like ultrasounds, blood panels, and imaging are now commonly recommended, even for non-emergency cases.

Higher expectations for preventive care: Routine wellness, dental care, and early intervention are becoming standard, increasing lifetime veterinary spending.

Rising overall veterinary costs: Staffing, technology, and treatment advancements continue to drive higher fees across the industry.

Together, these trends explain why many pet owners view insurance as a way to manage growing and unpredictable veterinary expenses. Planning ahead with coverage can help offset the financial impact of both sudden medical events and long-term health needs.

At BestMoney.com, we understand the importance of making informed financial decisions. Our team of financial experts and editors conducts thorough research across lending, banking, home loans, personal finance, and insurance to provide you with comprehensive comparisons and insights. We continuously update our content to reflect the latest market trends and offerings, ensuring you have access to current, reliable information.

We offer a wide range of services including detailed comparison tools and expert reviews, all designed to meet your specific financial needs. Our mission is to empower you to make confident, well-informed choices that help you achieve your financial goals.

Methodology: How We Reviewed the Cat Insurance Companies

To zero in on the best pet insurance companies, the BestMoney team focused on the following categories:

Plan offerings: We considered whether each pet insurance company offers the most common plan types, accident-only, accident-and-illness, and wellness coverage. Our team also reviewed plan flexibility, including deductible, annual limit, and reimbursement rate options, along with standard and condition-specific waiting periods. We also evaluated exclusions and whether insurers cover items that are often left out of basic plans.

Costs and add-ons: We compared average pricing to industry benchmarks and competing pet insurance providers. We also looked at overall value, whether a plan’s price is justified by its coverage and add-on options.

Claims process and payout: We identified how easy it is to file a claim with each pet insurer. Claim filing options plus reviews from real customers helped us get a good grasp of the insurer’s typical claims process.

Customer support: We looked at how long each pet insurance company has been in business. Plus, we reviewed its scores on reputable, third-party sites like Trustpilot and the Better Business Bureau (BBB).

Bundles: We evaluated providers’ discount breadth, with a focus on insurers that offer multiple ways to save, especially multi-pet and multi-policy discounts. We also looked for additional savings opportunities, such as military, employer, referral, or annual payment discounts.

FAQs about Cat Insurance

Why should I get cat insurance?

You should get cat insurance to protect yourself from unexpected veterinary costs and to make medical care more affordable over your cat’s lifetime. Insurance helps cover expensive treatments, diagnostics, and chronic conditions so you can focus on care decisions rather than cost.

Should I get pet insurance for my indoor cat?

Yes, you should consider pet insurance for your indoor cat because indoor cats can still develop illnesses, require emergency care, or need costly diagnostics. Conditions like urinary blockages, cancer, or chronic disease are unrelated to outdoor exposure and can be expensive to treat without insurance.

What does pet insurance typically cover?

Pet insurance typically covers treatment for accidents and illnesses, including diagnostics, hospitalization, surgery, and prescription medications. Some plans also cover chronic and hereditary conditions, while routine care like vaccinations or spaying usually requires an optional wellness add-on.

How much does pet insurance cost?

Pet insurance costs vary based on coverage choices, your cat’s age, and location, but most plans fall within a manageable monthly range. Adjusting deductibles, reimbursement rates, and annual limits is the most effective way to control how much pet insurance costs.

When is the best time to get pet insurance?

The best time to get pet insurance is when your cat is young and healthy, before any medical conditions develop. Enrolling early helps avoid exclusions for pre-existing conditions and often results in lower premiums over time.

How much does a cat scan cost without insurance?

A cat scan without insurance typically costs anywhere from a few hundred dollars for basic X-rays to several thousand dollars for advanced imaging like a CT scan or MRI. The exact price depends on the type of scan, your veterinarian or referral hospital, and your location, with specialty clinics generally charging more for advanced diagnostics.

| Our choice for flexible plans for cats |

Spot Pet Insurance offers flexible accident-only and accident & illness plans for cats that reimburse up to 90% of eligible vet bills after your deductible. Spot’s coverage can include alternative therapies (like acupuncture and chiropractic treatments when vet-prescribed) and helps with many common cat illnesses. Plans may also cover behavioral issues when vet-diagnosed. Preventive care is available as an optional add-on, letting you offset routine care costs such as vaccines and dental cleaning for an extra monthly cost.

Key Features:

Accident & illness + accident-only plans: choose the level of coverage that fits your budget.

Optional preventive care add-ons: two tiers (Gold and Platinum) for routine wellness benefits.

Up to 90% reimbursement: flexible choices (70%, 80%, or 90%).

Multi-pet discount: Spot offers about 10% off for additional pets.

No upper age limit for enrollment.

Pros

Broad coverage with both accident-only and accident + illness plans.

Flexible reimbursement and deductible options (including unlimited limit).

Preventive wellness add-on available.

Covers alternative therapies and behavioral issues typically not standard with every insurer.

Cons

Spot reimburses the pet parent rather than paying your vet directly for most claims.

Premiums can be higher than some competitors.

Waiting periods apply (14 days typical).

| Our choice for fast digital claims |

Lemonade stands out for its streamlined, tech-forward experience and fast digital claims processing, making it a strong choice for cat owners who prefer managing policies entirely online. Coverage is highly customizable, with optional add-ons for vet visit fees and preventive care. Lemonade also offers competitive pricing and the convenience of bundling pet insurance with other Lemonade policies, like renters or homeowners insurance.

Key Features:

Accident & Illness coverage: includes diagnostics, treatments, and medications.

Optional preventive care add-ons: cover routine exams, vaccines, and parasite testing.

Flexible policy customization: choose reimbursement rates, deductibles, and annual limits.

Pros

Fast, app-based claims submission and reimbursement.

Customizable plans with multiple add-on options.

Potential discounts when bundling with other Lemonade insurance products.

Cons

No unlimited coverage option; annual limits apply.

Wellness coverage requires an additional add-on.

May not be available in all states or for all pet ages.

Healthy Paws focuses on comprehensive accident + illness coverage with no annual or lifetime payout caps, which is a standout if your cat develops serious chronic conditions. The policy is simple and flexible in reimbursement and deductible choices, and claims are typically processed quickly.

Key Features:

Unlimited claim payouts: no annual or lifetime limits on covered vet bills.

Reimbursement options: up to 90% of eligible costs.

Direct vet payment available: on a case-by-case basis with prior approval to minimize out-of-pocket costs.

Covers many treatments: accidents, illnesses, hereditary, congenital, chronic conditions, diagnostics, surgery, and more.

Pros

Unlimited payouts without caps.

Direct pay option (with clinic agreement).

Claims processed quickly (often within days).

Cons

No dedicated wellness or accident-only plans — must be included in base policy, which may cost more.

May apply age restrictions on some conditions (e.g., hip dysplasia coverage only if enrolled early).