used BestMoney to find a car loan last week

A car loan is a financing agreement where a lender provides funds specifically for purchasing a vehicle, and the borrower repays the loan over time with interest. Car loans are increasingly common because vehicles have become essential for daily use, such as commuting, transporting family, or accessing work opportunities.

Vehicle-specific financing means the car (or motorcycle) serves as collateral.

Financing allows borrowers to acquire mobility even if they don’t have full cash on hand.

Understanding how a car loan works helps you make informed decisions and avoid costly mistakes.

PenFed is a national credit union that offers auto loan rates for new and used vehicles. It also offers auto loan refinancing with rates that compete with national banks, plus a car buying service that includes discounted prices and rates.

Pros | Cons |

Car buying service with even more discounted rates | Must join PenFed credit union to receive a PenFed product |

Can borrow over the value of your vehicle | Rates vary based on credit score |

LendingTree is a marketplace where you can set your parameters and then receive a list of relevant loan providers. One of the perks of LendingTree is that you fill out one application and can then review multiple loan options.

Pros | Cons |

Vast network of loan providers may help you find competitive rates | Work with all types of credit |

Not directly a lender, so rates and terms vary | Lack of information about specific loan types and terms |

ConsumersCreditUnion’s online approval process means you can get your personalized down payment and monthly payment on every car before you start shopping. Their customers, on average, can save over $1,000 on their down payment for similar cars on sale elsewhere.

Pros | Cons |

Can be used for both new and used cars | Credit union membership required to receive a loan offer |

Provides 24/7 customer service on the phone | Higher rates for older cars |

Vehicles enable freedom of movement, allowing you to commute to work, transport children, visit relatives, and expand your income potential beyond the limitations of walking or public transit. Given that even budget vehicles often cost thousands of dollars, car loan providers offer affordability and flexibility by:

Allowing borrowers to spread the purchase cost over multiple payments.

Offering financing solutions even when cash liquidity is limited.

Helping consumers access reliable transportation through structured financing.

At BestMoney.com, we understand the importance of making informed financial decisions. Our team of financial experts and editors conducts thorough research across lending, banking, home loans, personal finance, and insurance to provide you with comprehensive comparisons and insights. We continuously update our content to reflect the latest market trends and offerings, ensuring you have access to current, reliable information.

We offer a wide range of services including detailed comparison tools and expert reviews, all designed to meet your specific financial needs. Our mission is to empower you to make confident, well-informed choices that help you achieve your financial goals.

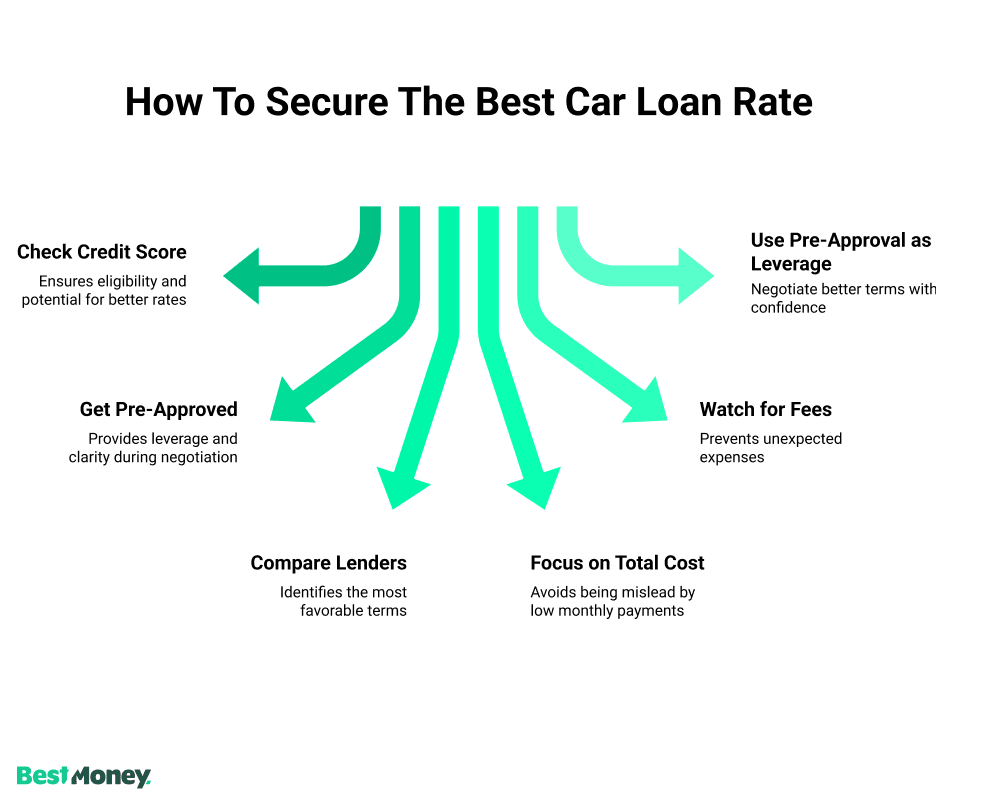

Optimize your credit profile

Focus on total cost, not just the monthly payment

Treat dealer financing as a last resort

Shop multiple lenders within a short period

Use pre-approval as leverage

Explore all options: banks, credit unions, online platforms, and dealerships.

Compare rates, terms, fees, and flexibility to find the best option for you.

Use lender competition to your advantage.

Validate lenders through consumer reviews and watchdog sites.

Use pre-approval to benchmark dealer and lender offers.

Ensure pre-approval includes all expected costs.

Align the final contract with pre-approval terms..

Prepayment penalties: Some loans charge fees for early repayment.

Mandatory binding arbitration: Disputes cannot be resolved through the court system.

Variable interest rates: May start low but increase unpredictably.

Contract discrepancies: Ensure all agreements are in writing.

PenFed:

The auto purchase and refinance cash bonus of $200 will apply to loans over $10,000 when the first two recurring payments are made from a PenFed Checking account. Applies to all purchase and refinance loan applications received at PenFed until 12/17/2024; refinance loans must be refinanced from another institution.

PenFed internal refinances and refinance loans originated from 3rd party partners are not eligible for this promotion. A PenFed Checking account does not have to be opened prior to 6/30/2024 but must be used to make the first two recurring payments and remain open until December 1, 2024, to qualify for the bonus.

The loan must be currently active and have the first two recurring monthly payments posted to the auto loan from a PenFed Checking account to qualify for the bonus. The $200 bonus will be deposited to the member’s PenFed Checking or Savings account within 60 days of eligibility completion or by December 1, 2024, whichever is sooner. The promotional bonus will be reported on the year-end Form 1099-INT as taxable income.

PenFed may discontinue or change the promotion at any time. Other restrictions may apply.

PNC Disclaimer:

Annual Percentage Rates (APRs) for loans amounts from $5,000 to $100,000 with repayment terms from 12 to 72 months currently range from 5.74% to 22.04 %. Available rates within this range may vary by loan amount, repayment term and model year.

The lowest rates are available to well-qualified applicants. Your actual APR may be higher than the lowest available rate and will be based upon multiple factors such as credit qualifications, loan amount, repayment term, model year, automated payment from a PNC checking account and number of days to first payment.

APRs include a 0.25% discount for automated payment from a PNC checking account. Automated payment must be set up at loan closing to qualify for the 0.25% discount. If automated payment is discontinued, you may no longer receive an automated payment discount and your rate will increase 0.25%.

Model Years: Auto Loans to be secured by a 2014-2023 model year non-commercial vehicle with up to 100,000 miles. Repayment term restrictions apply for vehicles with model years 2014-2017. Certain restrictions apply for mileage from 80,000 to 100,000.

Credit is subject to approval. Certain restrictions and conditions apply. Rates are effective as of 11/13/2022 . Rates, terms and conditions are subject to change at any time. For more information, visit pnc.com/checkready.

Loan Payment Example: The monthly payment per $1,000 borrowed at 5.74 % APR for a term of 72 months would require 72 monthly payments of $16.45 based on 30 days to first payment. The monthly payment per $1,000 borrowed at 5.74% APR for a term of 12 months would require 12 monthly payments of $85.95 based on 30 days to first payment.

NOTE: The credit score ranges utilized to define "Excellent", "Good", "Fair" and "Poor " in the "Credit Score" drop down option are established by BestMoney.com as a guideline. Standards for rating credit scores and associated available rates may vary by lender.