BestPet Insurance Providersin Iowa 2026

Get your vet bills covered

Your furry friend deserves the very best health care! Compare top insurers now.

Top10.com is designed to help users make confident decisions online, this website contains information about a wide range of products and services. Certain details, including but not limited to prices and special offers, are provided to us directly from our partners and are dynamic and subject to change at any time without prior notice. Though based on meticulous research, the information we share does not constitute legal or professional advice or forecast, and should not be treated as such.

Your furry friend deserves the very best health care! Compare top insurers now.

February 18, 2026

•

9 min

Here’s a quick breakdown of what you can expect from Spot pet Insurance:

| Coverage options | Accident-only, accident and illness, wellness |

| Annual limits | $2,500 to unlimited |

| Deductibles | $100 to $1,000 |

| Reimbursement levels | 70%, 80%, 90% |

| Pets covered | Dogs and cats |

| Discount opportunities | Multi-pet, AAA, employee benefits |

| Availability | 50 states, Washington D.C., and Canada |

Headquartered in Miami and founded in 2019 by Trey Ferro, Spot is a newer pet insurance company. Spot’s mission is to “help pet families get their pets the care they need to live longer, happier lives together.”

The digital insurer strives to offer highly customizable pet insurance plans to accommodate just about every pet parent and budget. Policyholders can enjoy coverage at any licensed vet in the U.S. or Canada plus access to a number of discounts and a 24/7 vet helpline. The company also differentiates itself with no per-incident or lifetime caps.

Spot is a solid choice. They accept dogs of any age, which is great because many other pet insurers have a maximum age for coverage. Also, Spot plans help cover several alternative treatments, such as acupuncture and chiropractic care.

Spot serves pet parents in all 50 states, Washington D.C., and Canada. Its website features useful state-specific pages with premium estimates, local adoption centers and veterinarians, popular dog parks, frequently asked questions, and more.

Spot is a solid choice for dog and cat owners looking for:

Pet insurance coverage depends on the plan you choose. In general, however, I found Spot’s offerings are competitive compared to other insurers that only treat its standard coverages, such as alternative therapies, prescription medications, and dental illnesses as add-ons.

It’s up to you to decide whether you’ll actually use these coverages. Chiropractic care and acupuncture is only covered and recommended as an alternative treatment to treat your pets unexpected accidents/illnesses.

So although it may not be beneficial to your dog now, they may need it later down the line based on any accidents/illnesses they may encounter. Its accident and illness policy is more comprehensive than what you might find elsewhere.

Here’s a breakdown of what you can expect from each plan from Spot:

Accident & Illness

Illnesses (allergies, arthritis, digestive issues, UTIs)

Chronic conditions (cancer, kidney disease, seizures)

Hereditary conditions (disc disease, hip dysplasia)

Injuries (broken bones, bite wounds, swallowed objects, toxic ingestion)

Tooth trauma and dental illnesses

Diagnostic care (X-rays, lab tests, vet exam fees)

Surgery and hospitalization

Advanced and specialist care

Alternative therapies (acupuncture, chiropractic care)

Accident Only

Bite wounds and cuts

Broken bones

Lodged foreign objects

Toxic ingestions

Vet exam fees

MRIs or CT scans and X-rays

Surgery and hospitalizations

IV fluids and medications

Medical supplies

Poison control consultation fees

Prescription medications

Tooth extractions

Alternative therapies

Wellness Coverage: Gold

Dental cleaning

Deworming

Wellness exam

Heartworm test

Fecal test

DHLPP vaccine/titer

Rabies and/or lyme vaccine/titer

Wellness Coverage: Platinum

Dental cleaning or spay/neuter

Deworming

Wellness exam

Heartworm test

Fecal test

Urinalysis

Blood test

Health certificate

Flea/heartworm prevention

DHLPP vaccine/titer

Rabies and/or lyme vaccine/titer

Bordetella vaccine/titer

Spot Pet Insurance offers broad coverage but doesn’t cover the following:

Pre-existing conditions unless your pet has been cured and free of symptoms for at least 180 days

Cosmetic procedures like tail docking, ear cropping, and claw removal

Breeding or pregnancy costs

Preventive care unless you add on Wellness Coverage for an extra cost

The table below shows how much Spot insurance could cost for different types of pets and policies.

I was pretty surprised to learn how much more expensive accident and illness coverage was for senior cats and dogs.

| Pet Type | Accident-Only Plan | Accident and Illness Plan |

| Dog (2 years old)* | $21.07 | $42.18 |

| Dog (11 years old)* | $21.07 | $163.90 |

| Cat (2 years old)** | $17.30 | $18.57 |

| Cat (11 years old)** | $17.30 | $60.93 |

*This is the 2026 monthly rate for a male, Medium Mix dog in the Cleveland, OH area with $10,000 annual limits, an 80% reimbursement rate, and $500 deductible.

**This is the 2026 monthly rate for a female, Domestic Shorthair cat in the Cleveland, OH area with $10,000 annual limits, an 80% reimbursement rate, and $500 deductible.

Below, you’ll find the 2026 monthly rates for Spot’s Preventative Care plans. Note that rates are the same for all pets.

| Preventative Care-Gold | $9.95 |

| Preventative Care-Platinum | $24.95* |

* Note that rates vary based on specific location

The cost of an insurance policy from Spot Pet Insurance ultimately depends on the following factors:

Location:You can expect to pay more if you’re a pet parent in an urban area than someone in a rural town.

Pet breed:Since some breeds are more susceptible to illness and injury than others, the breed of your dog or cat will affect your rate.

Age:Senior pets are more expensive to insure so it’s a good idea to lock in coverage early on, ideally when your pet is a puppy or kitten.

Coverage details:The plan(s) you choose as well as your deductible, annual limits, and reimbursement level will all play a role in your premium.

Discounts:Spot offers a 10% discount for insuring more than one pet plus an additional 10% discount for being an AAA member or working at a company that offers a group benefit.

To get a pet insurance quote from Spot, visit the Spot website and provide some basic information about yourself and your pet. Be prepared to share:

Your zip code and email address

Your first and last name

Whether your pet is a dog or cat

Your pet’s name, age, and breed

Once you submit your details, Spot will share quotes for different types of pet insurance plans. You can play around with the plan options, reimbursement levels, deductibles, and annual limits to see how different factors affect your premium.

If you decide to move forward with a Spot policy, you may enter your payment info and finalize your coverage online. In the event you don’t, expect a few emails or texts from Spot prompting you to do so.

I was pleasantly surprised at how quick and easy the entire process was. It only took a couple of minutes on my iPhone and as an added, unexpected bonus, Spot offered me a $25 Visa gift card for buying a policy.

Spot Pet Insurance has a 14-day waiting period. This means that during the first 14 days of your coverage, Spot will not reimburse you for your vet bills.

Once the 14-day waiting period is up, your policy will officially take effect and you may be reimbursed for eligible claims, according to your plan terms.

Spot Pet Insurance offers seven annual payout limits, including:

$2,500:This would be a good option if you’re looking for coverage for common illnesses and illnesses.

$3,000:If you believe your pet has moderate health needs, $3,000 will likely be enough.

$4,000:For a solid middle ground that can cover more serious accidents but not necessarily surgery or major care, $4,000 makes sense.

$5,000:This is ideal if you’d like coverage for more serious incidents and advanced care in the form of surgery, hospitalization, etc.

$7,000:If your pet has complex health needs or is living with a chronic or hereditary condition, $7,000 could be a smart move.

$10,000:This might be a smart move if your dog or cat has a chronic illness or frequently gets into accidents but you don’t want to invest in unlimited coverage.

Unlimited:For no caps on your annual coverage and the most peace of mind, unlimited annual limits might be worth the higher price tag, especially if you don’t have the funds to cover high vet bills out-of-pocket.

The annual payout limit you choose will be the maximum amount Spot will pay for covered vet bills each year.

Spot Pet Insurance offers three reimbursement models, including:

70%

80%

90%

In addition, you can choose from five deductibles, including:

$100

$250

$500

$750

$1,000

Reimbursement level refers to the percentage of your vet bill Spot will cover after you meet your deductible.

Your deductible is the amount of money you’ll owe out-of-pocket after a covered claim before Spot steps in and takes care of the rest.

Spot Pet Insurance offers a straightforward reimbursement process, allowing you to focus on your pet’s care rather than paperwork. Unlike some providers, Spot does not require pre-approval before you visit a licensed vet or emergency clinic.

Here is the step-by-step process for managing your expenses:

Visit Any Vet:Take your pet to any licensed veterinarian or emergency clinic for treatment.

Pay Upfront:Pay your vet bill at the time of service.

Submit Your Claim:Use the Spot mobile app or online member portal to upload an image of your invoice. You have up to 270 days after treatment to file.

Await Review:Spot may occasionally contact you or your vet for medical records or extra details. While payout speeds vary, you can track your claim status 24/7 through your online account.

Get Reimbursed:Receive payment for covered expenses based on your specific plan’s parameters.

Customizable policies:Spot Pet Insurance offers highly customizable insurance plans that cover accidents, illnesses, and injuries after a 14-day waiting period.

No approvals required:You don’t have to get approval before taking your pet into a clinic, emergencies included. Spot will reimburse you for any covered treatment from any licensed vet or clinic in the U.S.

Discount opportunities:Spot advertises discounts for multi-pet owners, AAA members, Blue Cross Blue Shield Blue365 members, and employee benefits discounts at some companies.

Of course, Spot’s website makes the pet insurance company look like the ultimate choice. I wanted to see how real customers feel about its offerings and service so I read reviews and ratings on TrustPilot and Better Business Bureau (BBB).

At the time of this writing, Spot has 4.7 out of 5 stars, based on almost 10,000 reviews on TrustPilot and holds an A+ rating on the BBB. This gave me a lot of reassurance and confidence to actually go ahead and seal the deal with Spot.

As you can see from the real reviews below, Spot’s policyholders praise the insurer for its easy, fast claims process and reimbursement. There are countless reviews like these so if you prioritize exceptional service, Spot should definitely be on your radar.

Negative reviews like the one below were minimal but Spot responded to most of them in a friendly, professional manner. That gives them extra brownie points in my book and speaks volumes about their commitment to their customers.

Limited coverage for pre-existing conditions:Unless your pet has been symptom-free for 180 days, Spot Pet Insurance doesn’t cover anypre-existing conditions.Note this is typical in the pet insurance industry.

Wellness plans cost extra:If you’d like coverage forpreventative care treatment,you’ll have to purchase a Wellness Coverage add-on, which is only available with an accident and illness or accident only plan.

Higher premiums:Even though Spot offers broad coverage and plenty of unique perks, its rates may be higher than other pet insurance companies for some pet owners.

Spot is just one pet insurance company on the market. Before you buy a policy through the insurer, it’s a good idea to compare it to other providers. Here’s how Spot compares to Pets Best, Fetch, and Pumpkin.

While both Spot and Pets Best offer accident-and-illness, accident only, and wellness coverage, Spot’s plans offer more opportunities for customization. However, you’ll likely find cheaper premiums with Pets Best.

Pets Best also has a shorter waiting period of 3 to 14 days, which might be a plus if you’re seeking more immediate coverage. In addition, Pets Best lets you choose from a low $50 deductible whereas Spot’s starting deductible is $100.

Spot and Fetch both sell accident-and-illness coverage but only Spot offers a standalone accident only policy. Also, Spot lets you choose unlimited annual limits while Spot’s limits cap out at $15,000.

Where Fetch shines, however, is its unique coverages that you won’t find with Spot, including boarding fees, lost pet advertising and rewards, and more. When it comes to discounts, Spot advertises a multi-pet discount and Fetch offers savings for military members.

If you’re seeking an accident-only policy, you’ll only find it at Spot as Pumpkin does not sell this more type of coverage. Spot also offers more discount opportunities while Pumpkin’s sole discount is for insuring multiple pets.

Unlike Spot, however, Pumpkin lets you buy standalone wellness coverage to save on preventative vet care. Spot’s wellness plans are only available as add-ons to its main coverages.

| Spot | Pets Best | Fetch | Pumpkin | |

| Waiting period | 14 days | 3-14 days | 15 days | 14 days |

| Reimbursement rate | 70%-90% | 70%-90% | 70%-90% | 80%-90% |

| Annual deductible | $100-$1,000 | $50-$1,000 | $250-$2,500 | $100-$1,000 |

| Coverage limit | $2,500-unlimited | $5,000 or unlimited | $5,000-$15,000 | $5,000-unlimited |

Spot Pet Insurance, recognized as one of the best pet insurance options, offers flexible pet insurance policies with customizable deductibles, coverage limits, and reimbursement rates.

You can also choose to add preventative care to your plan or opt for an accident-only plan. Spot’s coverage might not work with all budgets, but the fact that you can take your pet to any licensed vet or emergency clinic will be a plus for some pet owners.

No, Spot operates on a reimbursement model. Once you pay your vet for a covered service, you’ll submit a claim and Spot will reimburse you.

Yes, Spot is a reputable pet insurer. Even though it’s only been around since 2019, it has high rankings and positive reviews on sites, such as TrustPilot and Better Business Bureau (BBB). Plus, it was acquired by Independence Pet Holdings, which owns many other well-known pet insurance companies.

Yes, Spot usually increases pet insurance premiums as a dog or cat gets older. This is due to their increased risk of illnesses and injuries. The younger you insure your pet, the better deal you can expect.

Our experienced team at BestMoney uses a comprehensivemethodologyto rate and review pet insurers across the following categories:

Costs:We compared Spot’s premiums to industry averages and considered the value of its policies and discounts. To do this accurately, we pulled online quotes for multiple pet insurance companies.

Coverage terms:We considered Spot’s plan types, flexibility, special waiting periods, exclusions, and additional features or add-ons.

Availability:We looked at where Spot sells its pet insurance plans.

Claims process:We reviewed Spot’s claims processing and reimbursement times as well as the availability of direct pay to vets.

Customer service:Our team used reputable third-party review sites such as Trustpilot and the Better Business Bureau (BBB) to gauge Spot’s customer service and reputation.

This review was created using information from Spot’s website and quote tool. It also drew on information from the Pets Best and ASPCA insurance websites.

Phone:

1-800-905-1595

Email:

service@customer.spotpetins.com

Address:

303 Banyan Blvd Suite 101,

West Palm Beach, FL 33401

Waiting periods, annual deductible, co-insurance, benefit limits and exclusions may apply. For all terms visit https://spotpet.com/sample-policy. Products, schedules, discounts, and rates may vary and are subject to change. 10% multi-pet discount is available on all pets after the first. Premiums are based on and may increase or decrease due to the age of your pet, the species or breed of your pet, and your home address.

Insurance plans are underwritten by either Independence American Insurance Company (NAIC #26581. A Delaware insurance company located at 11333 N. Scottsdale Rd, Ste. 160, Scottsdale, AZ 85254) or United States Fire Insurance Company (NAIC #21113. Morristown, NJ), and are produced by Spot Pet Insurance Services, LLC. (NPN # 19246385. 990 Biscayne Boulevard Suite 603, Miami, FL 33132. CA License #6000188).

Anna Baluch is an insurance and finance expert at BestMoney.com. She has written for Forbes, Newsweek, Credit Karma, CNN, and many other top publications.

August 21, 2025

•

3 min

A basic Lemonade policy will cover these costs:

Diagnostics:Blood tests, urinalysis, x-rays, MRIs, lab work, CT scans, and ultrasounds

Procedures:Outpatient, specialty and emergency care, hospitalization, and surgery

Medication:Injections and prescription meds

You can also add on one of Lemonade’s Preventative Care plans for an additional monthly cost.

The Routine Vet Care add-on plan covers:

Annual wellness exam

Up to 3 vaccines

Annual heartworm and parasite test

Annual blood work

The Routine Vet Care Plus add on plan covers:

Annual wellness exam

Up to 3 vaccines

Annual heartworm and parasite test

Annual blood work

Routine dental cleaning

The Routine Vet Care add-on for puppies and kittens covers:

2 wellness exams

2 fecal or internal parasite tests

1 bloodwork

Up to 6 vaccines

1 heartworm or FeLV/FIV test

Flea/tick or heartworm medication

Spay/neuter procedure

Microchipping

Additionally, Lemonade gives you the options to choose accident and illness add-ons that can cover fees associated with the following:

Vet visits

Dental illness

Therapies and treatments for behavioral conditions,

Physical therapy treatments, such as chiropractic care

End Of Life Coverage to cover costs related to vet-recommended euthanasia, cremation, and memorial items.

Pet owners can choose both add-on insurances or select which one they prefer.

These add-ons come with additional charges, but in many cases, a Lemonade policy with these add-ons can end up cheaper than many competitors' basic policies.

Pricing varies on location, pet, and deductible amount. Pet owners can opt for 70%, 80%, or 90% coverage with an annual deductible of $100, $250, $500,or $750 and an annual limit anywhere from $5,000-$100,000. Choosing different coverage options will change your monthly price, but it’s entirely customizable, with flexibility to continue to customize coverage mid-term.

Here are a few examples of coverage costs:

Four-year-old dachshund from Los Angeles, Calif. could cost $32.67 per month with 80% coverage, $20,000 max coverage, and an annual deductible of $250.

One-year-old mixed breed cat from New York, New York could cost $10 per month with 70% coverage, $20,000 max coverage, and a $500 deductible.

Two-month-old medium mixed breed puppy from Raleigh, North Carolina, could cost $24.33 per month for 90% coverage, $100,000 max coverage, and a $100 deductible.

Lemonade does not cover animals younger than two months. Pre-existing conditions and illnesses are also not covered. Pet owners will not be covered in these events either:

Elective surgery

Alternative and experimental treatments

RX food

Orthodontics

Breeds that are domestic/wild hybrids

Depending on where you live, your policy could have different waiting periods. Here are a few different waiting periods your policy may include:

14 days for illnesses

30 days for orthopedic conditions

No waiting period for preventative care or accidents**

6 months for cruciate ligament events (a common knee injury for dogs, similar to a human tearing their ACL)

**For now, this waiting period applies to the following states: Arkansas, Wisconsin, Colorado, Pennsylvania, New Jersey, New York, Rhode Island, Massachusetts, Virginia, Illinois, Texas, New Mexico, Iowa, Tennessee, Georgia, Alabama, Connecticut, South Carolina, Maryland, Indiana, Ohio, Washington, Nebraska, New Hampshire, Mississippi, Washington, D.C., Utah.

For other states, there is a 2-day waiting period for accidents.

Pet owners can choose their coverage limits from $5,000 to $100,000. Usually, the difference in coverage limits only costs pet owners an extra dollar or two per month, so be sure to select different scenarios Lemonade’s automatic claims quote to find the right coverage and price for your pet.

Lemonade allows pet parents to choose between a 70, 80, or 90% reimbursement rate and an annual deductible of $100 to $750. The deductible is what you must first pay for insurance coverage to kick in.

For example, if you have an 80% reimbursement rate and $250 deductible for your two-month-old puppy and they swallow a toy, your vet might charge $5,000 to remove it. With Lemonade, you will pay $1,250, and insurance will cover $3,750. If another incident or vet visit happens within that year, you will not have to pay your deductible again.

All Lemonade claims are made through their app. Once you sign-in to the app, just file a quick claim. Lemonade makes the claim process quick and simple, and many times claims are reimbursed the same day. Lemonade must connect with your bank account to send you your reimbursement.

Pet owners will love that Lemonade has a minimal waiting period for accidents and illnesses. Coverage is also very affordable for most young pets, and there is a multi-pet discount of up to 10% available for eligible policyholders. The fast claim filing process is easily done through the Lemonade app, so you can possibly get reimbursed even before you leave the vet’s office. Additionally, they are one of the more flexible options, offering most customers the ability to reduce coverage mid-term.

While Lemonade is an excellent pet insurance option, they are not as widely available as some other options yet.

To contact Lemonade, use the company’s website AI chat or talk to a representative through the app. Additionally, here is Lemonade’s phone number and support email address:

Phone: (844) 733-8666

Email: help@lemonade.com

For pet insurance that is streamlined and flexible, Lemonade offers great premium prices for young and healthy pets.

This review was gathered through researching Lemonade’s website and gathering quotes from possible pet scenarios. The reviewer also took into account the information and reviews left on BBB and Trustpilot about Lemonade.

Anna Baluch is an insurance and finance expert at BestMoney.com. She has written for Forbes, Newsweek, Credit Karma, CNN, and many other top publications.

insured their pet via BestMoney this week

February 18, 2026

•

9 min

Here’s a quick breakdown of what you can expect from Spot pet Insurance:

| Coverage options | Accident-only, accident and illness, wellness |

| Annual limits | $2,500 to unlimited |

| Deductibles | $100 to $1,000 |

| Reimbursement levels | 70%, 80%, 90% |

| Pets covered | Dogs and cats |

| Discount opportunities | Multi-pet, AAA, employee benefits |

| Availability | 50 states, Washington D.C., and Canada |

Headquartered in Miami and founded in 2019 by Trey Ferro, Spot is a newer pet insurance company. Spot’s mission is to “help pet families get their pets the care they need to live longer, happier lives together.”

The digital insurer strives to offer highly customizable pet insurance plans to accommodate just about every pet parent and budget. Policyholders can enjoy coverage at any licensed vet in the U.S. or Canada plus access to a number of discounts and a 24/7 vet helpline. The company also differentiates itself with no per-incident or lifetime caps.

Spot is a solid choice. They accept dogs of any age, which is great because many other pet insurers have a maximum age for coverage. Also, Spot plans help cover several alternative treatments, such as acupuncture and chiropractic care.

Spot serves pet parents in all 50 states, Washington D.C., and Canada. Its website features useful state-specific pages with premium estimates, local adoption centers and veterinarians, popular dog parks, frequently asked questions, and more.

Spot is a solid choice for dog and cat owners looking for:

Pet insurance coverage depends on the plan you choose. In general, however, I found Spot’s offerings are competitive compared to other insurers that only treat its standard coverages, such as alternative therapies, prescription medications, and dental illnesses as add-ons.

It’s up to you to decide whether you’ll actually use these coverages. Chiropractic care and acupuncture is only covered and recommended as an alternative treatment to treat your pets unexpected accidents/illnesses.

So although it may not be beneficial to your dog now, they may need it later down the line based on any accidents/illnesses they may encounter. Its accident and illness policy is more comprehensive than what you might find elsewhere.

Here’s a breakdown of what you can expect from each plan from Spot:

Accident & Illness

Illnesses (allergies, arthritis, digestive issues, UTIs)

Chronic conditions (cancer, kidney disease, seizures)

Hereditary conditions (disc disease, hip dysplasia)

Injuries (broken bones, bite wounds, swallowed objects, toxic ingestion)

Tooth trauma and dental illnesses

Diagnostic care (X-rays, lab tests, vet exam fees)

Surgery and hospitalization

Advanced and specialist care

Alternative therapies (acupuncture, chiropractic care)

Accident Only

Bite wounds and cuts

Broken bones

Lodged foreign objects

Toxic ingestions

Vet exam fees

MRIs or CT scans and X-rays

Surgery and hospitalizations

IV fluids and medications

Medical supplies

Poison control consultation fees

Prescription medications

Tooth extractions

Alternative therapies

Wellness Coverage: Gold

Dental cleaning

Deworming

Wellness exam

Heartworm test

Fecal test

DHLPP vaccine/titer

Rabies and/or lyme vaccine/titer

Wellness Coverage: Platinum

Dental cleaning or spay/neuter

Deworming

Wellness exam

Heartworm test

Fecal test

Urinalysis

Blood test

Health certificate

Flea/heartworm prevention

DHLPP vaccine/titer

Rabies and/or lyme vaccine/titer

Bordetella vaccine/titer

Spot Pet Insurance offers broad coverage but doesn’t cover the following:

Pre-existing conditions unless your pet has been cured and free of symptoms for at least 180 days

Cosmetic procedures like tail docking, ear cropping, and claw removal

Breeding or pregnancy costs

Preventive care unless you add on Wellness Coverage for an extra cost

The table below shows how much Spot insurance could cost for different types of pets and policies.

I was pretty surprised to learn how much more expensive accident and illness coverage was for senior cats and dogs.

| Pet Type | Accident-Only Plan | Accident and Illness Plan |

| Dog (2 years old)* | $21.07 | $42.18 |

| Dog (11 years old)* | $21.07 | $163.90 |

| Cat (2 years old)** | $17.30 | $18.57 |

| Cat (11 years old)** | $17.30 | $60.93 |

*This is the 2026 monthly rate for a male, Medium Mix dog in the Cleveland, OH area with $10,000 annual limits, an 80% reimbursement rate, and $500 deductible.

**This is the 2026 monthly rate for a female, Domestic Shorthair cat in the Cleveland, OH area with $10,000 annual limits, an 80% reimbursement rate, and $500 deductible.

Below, you’ll find the 2026 monthly rates for Spot’s Preventative Care plans. Note that rates are the same for all pets.

| Preventative Care-Gold | $9.95 |

| Preventative Care-Platinum | $24.95* |

* Note that rates vary based on specific location

The cost of an insurance policy from Spot Pet Insurance ultimately depends on the following factors:

Location:You can expect to pay more if you’re a pet parent in an urban area than someone in a rural town.

Pet breed:Since some breeds are more susceptible to illness and injury than others, the breed of your dog or cat will affect your rate.

Age:Senior pets are more expensive to insure so it’s a good idea to lock in coverage early on, ideally when your pet is a puppy or kitten.

Coverage details:The plan(s) you choose as well as your deductible, annual limits, and reimbursement level will all play a role in your premium.

Discounts:Spot offers a 10% discount for insuring more than one pet plus an additional 10% discount for being an AAA member or working at a company that offers a group benefit.

To get a pet insurance quote from Spot, visit the Spot website and provide some basic information about yourself and your pet. Be prepared to share:

Your zip code and email address

Your first and last name

Whether your pet is a dog or cat

Your pet’s name, age, and breed

Once you submit your details, Spot will share quotes for different types of pet insurance plans. You can play around with the plan options, reimbursement levels, deductibles, and annual limits to see how different factors affect your premium.

If you decide to move forward with a Spot policy, you may enter your payment info and finalize your coverage online. In the event you don’t, expect a few emails or texts from Spot prompting you to do so.

I was pleasantly surprised at how quick and easy the entire process was. It only took a couple of minutes on my iPhone and as an added, unexpected bonus, Spot offered me a $25 Visa gift card for buying a policy.

Spot Pet Insurance has a 14-day waiting period. This means that during the first 14 days of your coverage, Spot will not reimburse you for your vet bills.

Once the 14-day waiting period is up, your policy will officially take effect and you may be reimbursed for eligible claims, according to your plan terms.

Spot Pet Insurance offers seven annual payout limits, including:

$2,500:This would be a good option if you’re looking for coverage for common illnesses and illnesses.

$3,000:If you believe your pet has moderate health needs, $3,000 will likely be enough.

$4,000:For a solid middle ground that can cover more serious accidents but not necessarily surgery or major care, $4,000 makes sense.

$5,000:This is ideal if you’d like coverage for more serious incidents and advanced care in the form of surgery, hospitalization, etc.

$7,000:If your pet has complex health needs or is living with a chronic or hereditary condition, $7,000 could be a smart move.

$10,000:This might be a smart move if your dog or cat has a chronic illness or frequently gets into accidents but you don’t want to invest in unlimited coverage.

Unlimited:For no caps on your annual coverage and the most peace of mind, unlimited annual limits might be worth the higher price tag, especially if you don’t have the funds to cover high vet bills out-of-pocket.

The annual payout limit you choose will be the maximum amount Spot will pay for covered vet bills each year.

Spot Pet Insurance offers three reimbursement models, including:

70%

80%

90%

In addition, you can choose from five deductibles, including:

$100

$250

$500

$750

$1,000

Reimbursement level refers to the percentage of your vet bill Spot will cover after you meet your deductible.

Your deductible is the amount of money you’ll owe out-of-pocket after a covered claim before Spot steps in and takes care of the rest.

Spot Pet Insurance offers a straightforward reimbursement process, allowing you to focus on your pet’s care rather than paperwork. Unlike some providers, Spot does not require pre-approval before you visit a licensed vet or emergency clinic.

Here is the step-by-step process for managing your expenses:

Visit Any Vet:Take your pet to any licensed veterinarian or emergency clinic for treatment.

Pay Upfront:Pay your vet bill at the time of service.

Submit Your Claim:Use the Spot mobile app or online member portal to upload an image of your invoice. You have up to 270 days after treatment to file.

Await Review:Spot may occasionally contact you or your vet for medical records or extra details. While payout speeds vary, you can track your claim status 24/7 through your online account.

Get Reimbursed:Receive payment for covered expenses based on your specific plan’s parameters.

Customizable policies:Spot Pet Insurance offers highly customizable insurance plans that cover accidents, illnesses, and injuries after a 14-day waiting period.

No approvals required:You don’t have to get approval before taking your pet into a clinic, emergencies included. Spot will reimburse you for any covered treatment from any licensed vet or clinic in the U.S.

Discount opportunities:Spot advertises discounts for multi-pet owners, AAA members, Blue Cross Blue Shield Blue365 members, and employee benefits discounts at some companies.

Of course, Spot’s website makes the pet insurance company look like the ultimate choice. I wanted to see how real customers feel about its offerings and service so I read reviews and ratings on TrustPilot and Better Business Bureau (BBB).

At the time of this writing, Spot has 4.7 out of 5 stars, based on almost 10,000 reviews on TrustPilot and holds an A+ rating on the BBB. This gave me a lot of reassurance and confidence to actually go ahead and seal the deal with Spot.

As you can see from the real reviews below, Spot’s policyholders praise the insurer for its easy, fast claims process and reimbursement. There are countless reviews like these so if you prioritize exceptional service, Spot should definitely be on your radar.

Negative reviews like the one below were minimal but Spot responded to most of them in a friendly, professional manner. That gives them extra brownie points in my book and speaks volumes about their commitment to their customers.

Limited coverage for pre-existing conditions:Unless your pet has been symptom-free for 180 days, Spot Pet Insurance doesn’t cover anypre-existing conditions.Note this is typical in the pet insurance industry.

Wellness plans cost extra:If you’d like coverage forpreventative care treatment,you’ll have to purchase a Wellness Coverage add-on, which is only available with an accident and illness or accident only plan.

Higher premiums:Even though Spot offers broad coverage and plenty of unique perks, its rates may be higher than other pet insurance companies for some pet owners.

Spot is just one pet insurance company on the market. Before you buy a policy through the insurer, it’s a good idea to compare it to other providers. Here’s how Spot compares to Pets Best, Fetch, and Pumpkin.

While both Spot and Pets Best offer accident-and-illness, accident only, and wellness coverage, Spot’s plans offer more opportunities for customization. However, you’ll likely find cheaper premiums with Pets Best.

Pets Best also has a shorter waiting period of 3 to 14 days, which might be a plus if you’re seeking more immediate coverage. In addition, Pets Best lets you choose from a low $50 deductible whereas Spot’s starting deductible is $100.

Spot and Fetch both sell accident-and-illness coverage but only Spot offers a standalone accident only policy. Also, Spot lets you choose unlimited annual limits while Spot’s limits cap out at $15,000.

Where Fetch shines, however, is its unique coverages that you won’t find with Spot, including boarding fees, lost pet advertising and rewards, and more. When it comes to discounts, Spot advertises a multi-pet discount and Fetch offers savings for military members.

If you’re seeking an accident-only policy, you’ll only find it at Spot as Pumpkin does not sell this more type of coverage. Spot also offers more discount opportunities while Pumpkin’s sole discount is for insuring multiple pets.

Unlike Spot, however, Pumpkin lets you buy standalone wellness coverage to save on preventative vet care. Spot’s wellness plans are only available as add-ons to its main coverages.

| Spot | Pets Best | Fetch | Pumpkin | |

| Waiting period | 14 days | 3-14 days | 15 days | 14 days |

| Reimbursement rate | 70%-90% | 70%-90% | 70%-90% | 80%-90% |

| Annual deductible | $100-$1,000 | $50-$1,000 | $250-$2,500 | $100-$1,000 |

| Coverage limit | $2,500-unlimited | $5,000 or unlimited | $5,000-$15,000 | $5,000-unlimited |

Spot Pet Insurance, recognized as one of the best pet insurance options, offers flexible pet insurance policies with customizable deductibles, coverage limits, and reimbursement rates.

You can also choose to add preventative care to your plan or opt for an accident-only plan. Spot’s coverage might not work with all budgets, but the fact that you can take your pet to any licensed vet or emergency clinic will be a plus for some pet owners.

No, Spot operates on a reimbursement model. Once you pay your vet for a covered service, you’ll submit a claim and Spot will reimburse you.

Yes, Spot is a reputable pet insurer. Even though it’s only been around since 2019, it has high rankings and positive reviews on sites, such as TrustPilot and Better Business Bureau (BBB). Plus, it was acquired by Independence Pet Holdings, which owns many other well-known pet insurance companies.

Yes, Spot usually increases pet insurance premiums as a dog or cat gets older. This is due to their increased risk of illnesses and injuries. The younger you insure your pet, the better deal you can expect.

Our experienced team at BestMoney uses a comprehensivemethodologyto rate and review pet insurers across the following categories:

Costs:We compared Spot’s premiums to industry averages and considered the value of its policies and discounts. To do this accurately, we pulled online quotes for multiple pet insurance companies.

Coverage terms:We considered Spot’s plan types, flexibility, special waiting periods, exclusions, and additional features or add-ons.

Availability:We looked at where Spot sells its pet insurance plans.

Claims process:We reviewed Spot’s claims processing and reimbursement times as well as the availability of direct pay to vets.

Customer service:Our team used reputable third-party review sites such as Trustpilot and the Better Business Bureau (BBB) to gauge Spot’s customer service and reputation.

This review was created using information from Spot’s website and quote tool. It also drew on information from the Pets Best and ASPCA insurance websites.

Phone:

1-800-905-1595

Email:

service@customer.spotpetins.com

Address:

303 Banyan Blvd Suite 101,

West Palm Beach, FL 33401

Waiting periods, annual deductible, co-insurance, benefit limits and exclusions may apply. For all terms visit https://spotpet.com/sample-policy. Products, schedules, discounts, and rates may vary and are subject to change. 10% multi-pet discount is available on all pets after the first. Premiums are based on and may increase or decrease due to the age of your pet, the species or breed of your pet, and your home address.

Insurance plans are underwritten by either Independence American Insurance Company (NAIC #26581. A Delaware insurance company located at 11333 N. Scottsdale Rd, Ste. 160, Scottsdale, AZ 85254) or United States Fire Insurance Company (NAIC #21113. Morristown, NJ), and are produced by Spot Pet Insurance Services, LLC. (NPN # 19246385. 990 Biscayne Boulevard Suite 603, Miami, FL 33132. CA License #6000188).

Anna Baluch is an insurance and finance expert at BestMoney.com. She has written for Forbes, Newsweek, Credit Karma, CNN, and many other top publications.

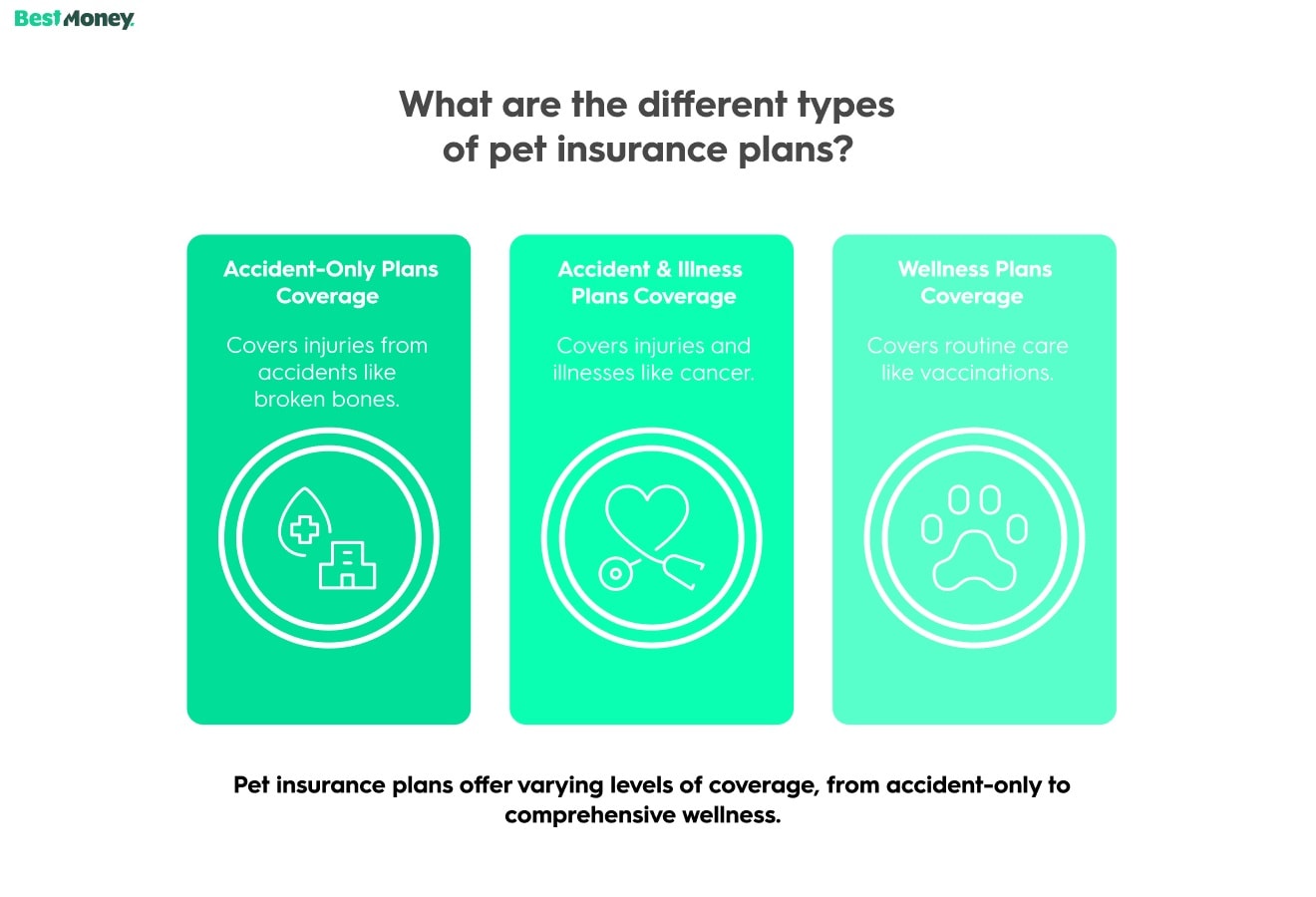

Pet insurance is health insurance for pets. It typically covers medical care for accidents, like leg breaks, cuts, and eye pokes, and illnesses, like cancer, kennel cough, and canine influenza.

This coverage is becoming increasingly essential as veterinary service costs continue to rise—they increased by7.9% between 2023 and 2024. This inflation is especially noticeable in emergency care, where complex procedures like emergency surgerycan run from $2,000 to over $10,000.

There are also specialized pet insurance policies or add-ons that cover preventative care, like annual checkups, vaccines, dental cleanings, and spaying or neutering procedures.

| Customizable coverage for puppies and kittens |

Unlike traditional health insurance, pet insurance plans generally require that you pay out-of-pocket for your pet's medical care and file a claim for reimbursement. However, a few insurers, like Pets Best and Trupanion, offer a vet direct pay option.

How much you’ll ultimately get reimbursed depends largely on the following policy terms:

Coverage limits:The maximum amount the insurer covers in a given year; annual coverage limits generally range from $2,500 to unlimited.

Deductible:The amount of money you'll pay before coverage kicks in; pet insurance deductibles generally range from $0 to $2,500.

Reimbursement rate:The percentage an insurer will pay for each covered claim, once your deductible is met; reimbursement rates are generally 70%, 80%, or 90%.

To get coverage, you’ll make a monthly or annual payment, known as the policy’s premium. Higher coverage limits, higher reimbursement rates, and lower deductibles lead to higher premiums than lower coverage limits, lower reimbursement rates, and higher deductibles.

The best time to get pet insurance is when your pet is young and healthy. Most pet insurance providers do not cover pre-existing conditions, meaning any illness or injury diagnosed before your policy starts — or during the waiting period — will likely be excluded from coverage.

Enrolling early helps lock in lower premiums and ensures your pet is protected before costly conditions develop. Puppies and kittens are generally cheaper to insure because they’re less likely to need medical care, and there’s less chance of exclusions limiting future claims.

That said, senior pet insurance for older dogs and senior cats can still be a good idea. Many insurers accept pets well into their senior years, though premiums tend to be higher and some plans may impose coverage limits or longer waiting periods. For older pets, accident-and-illness plans can still provide valuable financial protection against unexpected emergencies or serious diagnoses.

Consider the following steps tofind the coverage you needat an affordable price.

“I recommend pet owners understand different choices for percentage reimbursement, deductible levels if there are any waiting periods, and if there are any annual or per-incident maximums … Additionally, pet owners should review sample policies on the website to understand what is covered and what is excluded. Comparison tools help to highlight how provider coverage differs”

When comparing pet insurance providers, price alone doesn’t tell the full story. Two plans with similar monthly premiums can deliver very different value depending on how coverage is structured.

Key features to compare include:

Deductibles:Lower deductibles increase monthly premiums but reduce out-of-pocket costs when filing claims.

Reimbursement rates:Most insurers offer 70%, 80%, or 90% reimbursement after the deductible is met.

Annual coverage limits:Some plans cap payouts at $2,500–$5,000 per year, while others offer unlimited coverage.

Coverage scope:Look for plans that include hereditary, congenital, and chronic conditions.

Wellness add-ons:Optional plans may help offset routine care like vaccines, dental cleanings, and annual exams.

Direct vet pay options:Some insurers can pay veterinarians directly, reducing upfront expenses.

Comparing these features side by side helps ensure you’re choosing a plan that aligns with both your budget and your pet’s long-term health needs.

“As you look over these plans, please be sure to focus on coverage limits and exclusions. Also, pay attention to when policies actually begin and will pay out benefits. This can help you avoid unwanted financial surprises and make the most informed decision for your furry friend.”

Pet insurance covers some of your pet's medical bills, but the type of health care expenses your policy will pay for depends on your plan type.

These plans cover treatment for injuries incurred as a result of an accident, including, but not limited to:

Broken bones

Lacerations

Poisoning

Swallowed objects

Burns

These plans cover treatments for accidental injuries and medical illnesses, including, but not limited to:

Cancer

Allergies

Diabetes

Arthritis

Parvovirus

Typically sold as an add-on, pet wellness plans help cover routine and preventive care such as:

Annual exams

Vaccinations

Dental cleanings

Spaying/neutering procedures

Medications for flea and tick or heartworm prevention

Pet insurance that covers dental care is usually offered through wellness plan add-ons, though coverage is often limited to cleanings and preventive care rather than advanced dental procedures.

Almost all pet insurance plans exclude certain types of care. While exclusions vary, they often include:

Pregnancy or breeding-related expenses

Cosmetic procedures

Care related to owner negligence

Genetic testing

Most policies also include waiting periods. Accident waiting periods typically range from one to 14 days, while illness waiting periods are usually 14 to 30 days. Some conditions, such as hip dysplasia, may have longer waiting periods.

Pet owners often search for pet insurance for pre-existing conditions, but it’s important to understand that most pet insurance plans do not cover pre-existing conditions. In general, pet insurance that covers pre-existing conditions is extremely limited, and what pet insurance covers pre-existing conditions depends on whether a condition is considered curable, temporary, or permanently excluded by the insurer.

Learn more aboutwhat pet insurance does and doesn’t cover.

The average monthly cost for an accident and illness policy is $59.73. Cat insurance costs typically range between $29.46 and $56.60 per month, while dog insurance averages between $50.28 and $102.26 per month.

Cheap pet insurance plans do exist, but the most affordable pet insurance options often come with higher deductibles, lower reimbursement rates, or coverage limits that reduce payouts for expensive treatments.

| Customized pet coverage for your needs |

The cost of pet insurance varies by the terms of your policy, but it’s also affected by your pet’s age, type, breed, location, gender, and other personal information.

For instance, young pets are typically cheaper to insure as they're less prone to illness. Conversely, pets in areas with a high living cost are generally more expensive to insure as local vet bills are pricier.

Beyond that, some breeds are more prone to congenital or hereditary diseases than others or are known to engage in riskier behaviors that lead to injuries. These breeds typically cost more to insure.

| No maximum annual or lifetime payout limits |

A study fromAdvisorSmithfound the following breeds rank among the most costlier to insure:

Rottweilers:

$1,489 per year

English bulldogs:

$1,395 per year

Doberman pinschers:

$1,347 per year

French bulldogs

: $1,328 per year

Boxers:

$1,238 per year

AdvisorSmith found the following feline breeds are among the most costlier to insure:

Exotic cat:

$528 per year

Devon rex:

$513 per year

Absynnian:

$473 per year

Maine coon:

$462 per year

Scottish fold:

$538 per year

The past five years have seen significant changes in the pet health industry. According to a recent study, nearly a quarter of pet owners reported increased pet care costs in the past year, driven by inflation, higher veterinary staff wages, and the high cost of new medications.

Additionally, over a third of pet owners said it would be financially challenging to pay for a minor operation for their pet.

These factors have led to increased demand for pet insurance and higher premiums, up to 20% in the last year. It's crucial for pet owners to research, compare policies, and consider the costs of pet insurance so that they're not taken advantage of.

Not all pet insurance policies offer the same level of protection, and certain plan features can significantly limit your coverage when you need it most.

Common pitfalls to watch for include:

No coverage for hereditary or breed-specific conditions

High deductibles paired with low annual limits

Exclusions for chronic or long-term conditions

Vague definitions of pre-existing conditions

No direct vet payment options

Lengthy or condition-specific waiting periods

Understanding these limitations upfront can help you avoid unpleasant surprises later.

To understand the real-world experiences of pet owners with insurance, we delved into online discussions, analyzing over 200 user comments from recent Reddit posts specifically focusing on pet insurance choices and company experiences.

Here’s a summary of the key insights shared by everyday people:

Navigating pet insurance can be complex, but Reddit users offer valuable real-world advice. A primary motivator for many is peace of mind against potentially crippling vet bills. As one vet tech shared:

"I can tell you this, no one ever regrets having pet insurance when they need it, but plenty regret putting it off or not getting it at all."

- KasparTheresa

While some suggest a dedicated savings account, many users argue it's challenging to accumulate enough for major, unexpected emergencies, especially early in a pet's life. One user questioned the savings approach:

"This in theory is great, but who really puts aside $20,000 for pet health?... Also, what happens if you adopt a dog or cat and they get sick or need a surgery within the first year or two?"

- Possible_You_4637

Understanding the policy's mechanics, like deductibles, reimbursement rates, and annual limits is paramount. One knowledgeable user broke it down:

"The deductible is the portion of the vet bill you’re responsible for paying before the provider pays out or reimburses your claim. [...] The reimbursement is the percentage of a claim eligible for repayment... The payout limit is the most money a pet insurer will reimburse..."

- canine_journal

Redditors also highlight the practical realities: expect premiums to rise as your pet ages, and insure them early to avoid pre-existing condition exclusions.

"Yes also, you might think if you get early rates will stay the same, this is false. They will increase almost every year."

- isitfiveyet

"Cannot have any pre-existing conditions pop up or else those may not be covered later so you want to get them insured right away."

- Justanobserver2life

Ultimately, users stress the importance of thoroughly researching policy details and choosing a plan that aligns with your budget and your pet's potential health needs.

Pet insurance can provide valuable financial protection and peace of mind, especially as veterinary care becomes more advanced — and more expensive. Emergency surgeries, specialty treatments, and chronic illness management can easily cost thousands of dollars.

This financial security translates directly into better care: a 2024 study showed that insured dogs visit the veterinarian 4.2 times per year on average, compared to just 2.4 times for uninsured dogs and are 51% more likely to receive surgical treatment when needed.

While insurance isn’t the right fit for every pet owner, it often proves worthwhile for pets with higher health risks, breeds prone to illness, or households that want protection from unpredictable vet bills. Comparing policies carefully and choosing coverage that fits your budget is key to making pet insurance work in your favor.

Learn more about how todetermine if pet insurance is worth it.

At BestMoney.com, we understand the importance of making informed financial decisions. Our team of financial experts and editors conducts thorough research across lending, banking, home loans, personal finance, and insurance to provide you with comprehensive comparisons and insights. We continuously update our content to reflect the latest market trends and offerings, ensuring you have access to current, reliable information.

We offer a wide range of services including detailed comparison tools and expert reviews, all designed to meet your specific financial needs. Our mission is to empower you to make confident, well-informed choices that help you achieve your financial goals.

To zero in on the best pet insurance companies, the BestMoney team focused on the following categories:

Spot Pet Insurance offers the best travel coverage for pets. It lets you visit any licensed vet in the U.S. or abroad, provides up to 90% reimbursement, and includes 24/7 telehealth support for emergencies while traveling. Generally, the best travel insurance for pets includes emergency medical coverage while traveling.

Spot Pet Insurance is the most worth it overall, compared to other pet insurers. It combines flexible plans, comprehensive coverage, and fast claims, while Embrace and Pets Best also offer strong value depending on your pet’s age and needs.

We've found that pet parents typically pay around $60 per month or $720 per year for a pet insurance policy, but the exact cost varies depending on factors such as pet type, age, location, and more. For instance, cats generally cost less to insure than dogs, and breeds prone to illness, like French bulldogs, are more expensive than less risky breeds, like mixes.

You can often find a policy in your budget by selecting a higher deductible or reimbursement rate, although this requires you to pay more out of pocket for care.

Pet insurers generally ask for at least one year's worth of veterinary records when you apply for a policy or file your first claim. Some insurers require a medical exam within 30 days or so of buying a plan. During this exam or records review, the insurer will identify pre-existing conditions.

Typically, pet insurance is not tax-deductible, though there are exceptions for service animals.

Some carriers also cover amphibians, reptiles, birds, small mammals, and horses, though these coverages are less common. ASPCA Pet Health, for instance, offers horse insurance, while Nationwide will insureexotic pets

We've found that Lemonade, Pets Best, Figo, and CarePlus by Chewy offer particularly competitive rates for dog insurance. However, the best insurance for your dog may vary by pet type, location, and other personal information. It's helpful to compare pet insurance quotes from multiple top insurers to find the best policy for your canine.

Pets can benefit from insurance at any age. Kittens and puppies may need accident coverage, while older pets may need illness coverage. Wellness care add-ons benefit pets of all ages. Getting pet insurance as soon as possible is often worthwhile as younger cats or dogs are cheaper to insure (given they're less likely to develop an illness), and there's less time for a pre-existing condition to develop.

| Insurance Provider | Explore | |

|---|---|---|

| Our top pick for policy customizations |

Annual coverage limits:$2,500, $3,000, $4,000, $5,000, $7,000, $10,000, unlimited

Reimbursement rates:70%, 80%, 90%

Deductibles:$100, $250, $500, $750, $1,000

Why we picked Spot as a top pet insurer:Count Spot as one of the most well-rounded pet insurers on the market. There are many reasons why Spot is ranked the best pet insurance on our list. It has affordable pricing, an industry-leading choice of seven annual coverage limits, and solid customer service scores.

In fact, Spot’s 4.7 Trustpilot score is matched only by Pumpkin and its BBB customer review score is the highest among the pet insurers we reviewed.

Customer service at a glance

Trustpilot score:4.7

BBB rating:A- (accredited)

Common complaints?Unexpected claim denials, slow reimbursements

Common praise?Easy claim processing, compassionate customer service reps

Contact channels:Phone, email (provided to policyholders), online complaint form

Pros:

Cons:

| Insurance Provider | Explore | |

|---|---|---|

| Our top pick for extra ways to save |

Annual coverage limits:$5,000, $8,000, $10,000, $15,000, unlimited

Note:Accident-only plans are capped at $5,000. Higher limits apply only to accident-and-illness plans.

Reimbursement rates:70%, 80%, 90%

Deductibles:$100, $250, $500, $750, $1,000

Why we picked Embrace as a top pet insurer:Embrace offers affordable base rates with plenty of extra ways to save on coverage, including a 10% multi-pet discount, a 5% military discount, and $12 off for paying annually. It’ll also lower your annual deductible by $50 each year that you don't receive a claim reimbursement.

Plus, Embrace has an industry-leading zero-day waiting period for accidents and a competitive 14-day waiting period for illnesses, on par with only MetLife, which offers similar short timeframes before coverage starts.

Embrace also offers a customizable accident-and-illness coverage, which provides five annual coverage limit options for your pet, including unlimited annual coverage. With unlimited annual coverage, there’s no yearly limit on reimbursements once you’ve met your deductible.

Customer service at a glance

Trustpilot score:4.0

BBB rating:A+ (accredited)

Common complaints?Premium increases, confusing claim denials

Common praise?Intuitive mobile app, simple claims processing

Contact channels:Phone, AI chat

Pros:

Cons:

| Insurance Provider | Explore | |

|---|---|---|

| Our top pick for broad coverage |

Annual coverage limits:$2,500, $5,000, $7,000, $10,000, unlimited

Note:Unlimited is available only on specific tiers and may not apply to accident-only or base plans. Confirm availability by plan level.

Reimbursement rates:70%, 80%, 90%

Deductibles:$100, $250, $500

Why we picked ASPCA Pet Health as a top pet insurer:ASPCA is another notably well-rounded pet insurer, offering all major pet plan types with plenty of customization options to help you stay on budget.

Its affordable pricing is particularly noteworthy, given its base accident-and-illness plan covers some commonly excluded care, like behavioral issues, alternative therapies, and congenital conditions. ASPCA Pet Health also covers “curable” pre-existing conditions if your pet goes 180 days without symptoms (one of the shortest windows for this type of coverage on the market, on par with Spot and Pumpkin).

Customer service at a glance

Trustpilot score:4.0

BBB rating:Not rated

Common complaints?Difficult to cancel coverage, significant premium increases

Common praise?Responsive customer service reps, easy claims processing

Contact channels:Phone, email

Pros:

Cons: