Our Best Money Transfer Services March 2026

Safe. Simple. Fast.

Save money with low-fee transfers & bank-beating exchange rates. Compare our best money transfer services for quick, safe transfers 24/7.

Save money with low-fee transfers & bank-beating exchange rates. Compare our best money transfer services for quick, safe transfers 24/7.

used BestMoney to find a provider last week.

Online international money transfer refers to using digital services to send funds from your bank account or card in the USA to a recipient’s bank account, e-wallet, or cash pickup location abroad. Instead of moving paper currency, you are initiating a data-driven currency transfer that affects changes in account balances across borders. Because the service is digital, it can be much faster and more convenient than traditional bank wire transfers.

Sending money internationally online is now widely used because it eliminates the need for trips to bank branches or wire centers. With a computer or smartphone, you can transfer money overseas to people, companies, merchants, and banks around the world.

Sending money domestically is often even faster and cheaper than international transfers. Most U.S.-based transfer services support quick peer-to-peer (P2P) payments through bank transfers, mobile apps, or debit cards. These transactions typically complete within minutes, especially when using services like Zelle, Venmo, or Cash App. Domestic transfers often have fewer compliance checks and typically don't involve currency conversion, making the process simpler and more cost-effective.

Company | Transfer Time | Explore |

|---|---|---|

In minutes | ||

In minutes via Zelle® | ||

| Cash pickup ready in minutes¹ |

Globalization means that more families, workers, and freelancers send funds from the USA to other countries for support, services, or business purposes.

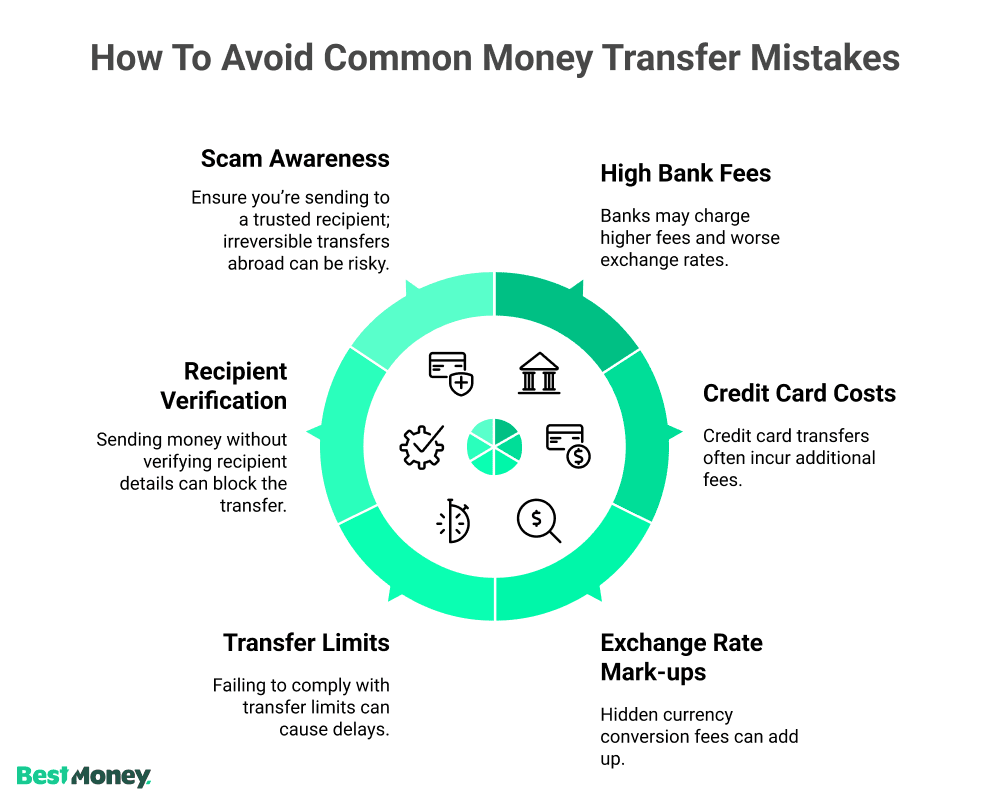

Traditional bank wires for overseas transfers have higher fees and worse exchange-rate mark-ups compared to specialist services.

Specialist digital platforms offer better transparency, lower costs, and faster delivery times, making money transfer overseas more affordable and accessible.

Because consumers raise concerns about hidden fees, delays, and a lack of clarity, services that clearly display costs, transfer times, and delivery options win trust.

Even though many layers operate behind the scenes, the basic process is straightforward:

You open or log into an account with a money-transfer provider.

You initiate a transfer: fund it via bank account, debit card, or credit card in the USA.

You enter the recipient’s details (bank account or e-wallet, or cash-pickup location abroad).

The service converts the USD into the target currency (if applicable) and instructs the transfer network to deliver funds.

The recipient receives the money in their local currency at their bank, e-wallet, or cash pickup point.

Because all this is done digitally, wire money abroad via online platforms can often arrive in minutes or hours — though bank-based routes may still take 1–2 days or more.

| Best for transfers abroad |

Cost is often where people get surprised. For international money transfer, the total cost includes more than a simple fixed fee:

The provider’s transaction fee (which might vary by amount, funding method, or destination).

The exchange-rate margin or currency conversion cost (how far the rate deviates from the mid-market rate).

Delivery method impact: e.g., bank account deposit, e-wallet, cash pickup may incur different charges.

Funding method: Paying with a credit card tends to cost more than using a bank debit or account transfer.

The key factors that determine cost are:

Which company do you use (bank vs specialist online transfer provider)?

How much money are you transferring?

Where are you sending (destination country, currency)?

How are you sending (funding method, delivery method)?

At BestMoney.com, we understand the importance of making informed financial decisions. Our team of financial experts and editors conducts thorough research across lending, banking, home loans, personal finance, and insurance to provide you with comprehensive comparisons and insights. We continually update our content to reflect the latest market trends and offerings, ensuring you have access to current and reliable information.

We offer a wide range of services, including detailed comparison tools and expert reviews, all designed to meet your specific financial needs. Our mission is to empower you to make confident, well-informed choices that help you achieve your financial goals.

Transfer speed varies with method:

Online transfers funded via card to e-wallet or cash pickup can be almost instantaneous or take a few minutes.

Depositing funds into a bank account abroad may take 1–2 business days, although it may sometimes take longer due to international routing, time zone differences, or additional compliance requirements.

Bank wires are generally slower because of intermediary banks and strict anti-fraud measures.

Thus, if you need to send money internationally quickly, choose a service that offers rapid delivery and clearly states the expected arrival time.

Most online transfer services in the USA impose limits for regulatory, risk, and compliance reasons. Typical features:

A maximum dollar amount per transfer, or per day/month.

A limit may be higher if you have a verified account or frequently use the service.

For large sums, you may be required to provide additional verification documentation

| Ideal for domestic transfers |

If one company offers better rates and another offers faster transfers, you can use each one to suit your needs for each particular money transfer. Just because you start out using one company doesn’t mean you can’t switch to a different company or use 2 simultaneously. Remember, you’re paying for the service, so you deserve to get the most out of it.

Virtually anywhere — today’s online transfer services enable sending money abroad to:

Bank accounts in recipient countries

E-wallets or mobile wallets

Cash-pickup locations

This flexibility is particularly helpful when recipients lack bank accounts or when you’re supporting someone living abroad, working remotely, or sending funds from the USA to their home country.

Selecting the right service for your needs involves a few steps. After reading unbiased reviews, you should compare the following:

Rates and fees: Look for transparent fee structures and exchange rates that closely approximate the mid-market rate.

Speed and delivery options: Decide whether you prioritise the lowest cost or the fastest delivery.

Security and licensing: Ensure the company is regulated and uses strong security protections (encryption, identity verification).

User experience and customer support: Ease of use, mobile app, tracking, and support are key considerations.

*Funds may be delayed or services unavailable based on certain transaction conditions, including amount sent, destination country, currency availability, regulatory issues, identification requirements, Agent location hours, differences in time zones, or selection of delayed options.

Chime® is a financial technology company, not a bank. Banking services provided by The Bancorp Bank, N.A. or Stride Bank, N.A.,Members FDIC.

OnePay is a financial technology company, not a bank. Banking services provided by Coastal Community Bank or Lead Bank, Members FDIC.

1. Subject to agent operating hours and compliance with regulatory requirements.

*Disclosure: SoFi does not charge any account, service, or maintenance fees for SoFi Checking and Savings. SoFi charges a transaction fee to process each outgoing wire transfer. SoFi does not charge a fee for incoming wire transfers; however, the sending bank may charge a fee. SoFi's fee policy is subject to change at any time.