15,773 users

picked a lender via BestMoney this week

Editor's Picks

Best Ways to Tap Home Equity 2026

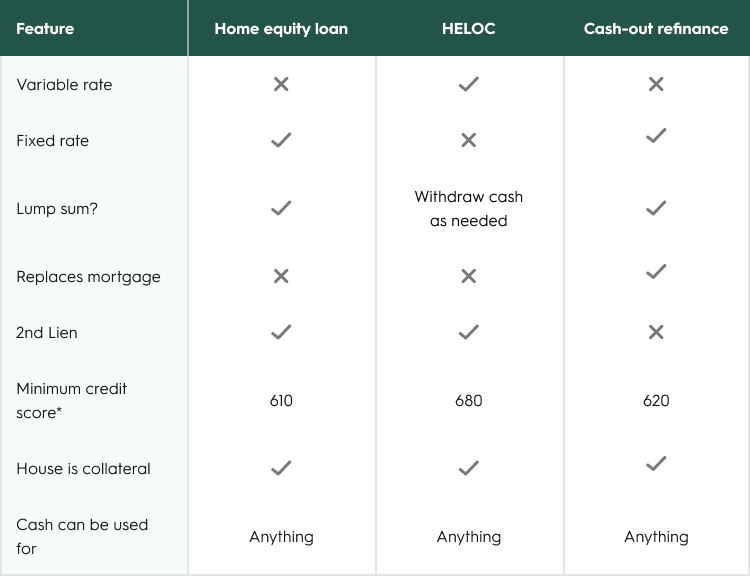

This comparison table aims to highlight some main distinctions between 3 of the most popular ways to into your home equity:

*Minimum qualifying credit scores can vary between lenders. Other criteria that factor into home equity loan eligibility include, but are not limited to; LTV (loan-to-value) ratio, debt-to-income ratio, and the amount of equity that you have in your home.

What is a home equity loan?

A home equity loan allows you to borrow money against the equity in your home. Home equity is the value of the home less the amount or any mortgage debt outstanding. With a home equity loan you receive a lump sum payment and then repay the loan over a set period of time at a fixed interest rate. A home equity loan is typically a loan for a fixed amount. These loans generally have a fixed rate of interest and are paid over a fixed term, just like your original mortgage.

Home Equity Loan VS HELOC

A home equity loan differs from a home equity line of credit or HELOC. A HELOC is a line of credit against the equity in your home that you tap as needed. Repayment terms can vary and in some cases there can be a balloon payment due at the end of the loan term. The interest rate might also be variable.

The current tax rules based on the tax reform passed at the end of 2017 no longer allow the interest paid on home equity loans or HELOCs to be deducted for tax purposes unless the money is specifically used for home improvements or related items as specified by the IRS.

Top Home Equity FAQs

1. What is home equity, and why do people want to tap into it?

2. How can I tap into the home equity that I have?

3. Is home equity a retirement resource?

4. How do I choose the right home equity product and lender for me?

How to choose the best home equity lender

Finding the best lender for a home equity loan will depend upon your unique situation and needs.

- Do you have poor credit or blemishes on your financial record?

- Certain lenders tend to be better for different loan purposes.

- Are you looking for a home equity loan or a HELOC? Some lenders will tend to be better for one or the other.

- The amount you need to borrow will also be a factor as some lenders may be a better fit for larger amounts than others.

Choosing the right lender for our situation will require some homework on your part to determine what loan features are important to you and what type of borrower you are.

Popular Reasons Homeowners Take Home Equity Loans in 2026

You might need a home equity loan to refinance a home improvement, to pay down other higher cost debt, to cover major unexpected medical bills, to pay the costs of college for your children or other major expenditures.

A home equity loan may be a less expensive option than an unsecured personal loan. This is due to the added security having your home as collateral offers to lenders. The secured nature of the loan may offer an opportunity for borrowers with lower credit scores.

On the other hand, it is important for borrowers to understand the fact that they are using the equity in their home as collateral for this loan. If they run into financial difficulties that prevent them from making the required payments they may be putting their home at risk. They should also look at the useful life of what they are using the money for versus the time horizon over which they will need to make payments on the home equity loan to fully evaluate the economics of using this type of loan.

Home equity loans after COVID-19

Just as with other types of mortgages, many lenders have tightened their lending requirements for borrowers looking for a home equity loan in light of the economic decline resulting from the COVID-19 pandemic. This may include requiring a higher credit score and perhaps a stronger financial situation than in past years.

The Consumer Financial Protection Bureau has recently waived some of the requirements when applying for mortgages, including home equity loans. One requirement that has been waived is the three day right to rescind the loan. This was designed to get money into the borrower’s hands more quickly during the COVID-19 situation. While this can be helpful, it’s important to be sure that you understand all loan terms and conditions before moving ahead.

As far as HELOCs, there have been a number of lenders who have suspended activity with these lines or who have tightened their requirements in the wake of the financial fallout from the pandemic.

Is now the right time to tap into my home equity?

Some factors that might be enticing to borrowers include low interest rates and perhaps the need to access emergency cash due to some sort of economic hardship. Whether or not now is the right time for a home equity loan will depend upon the individual circumstances of each borrower.

Factors to consider include the stability of the borrower’s employment situation, likely trend of home values in their area and their need for the money.

.20220323115256.svg)