Upgrade offers checking and savings accounts with above-average benefits.

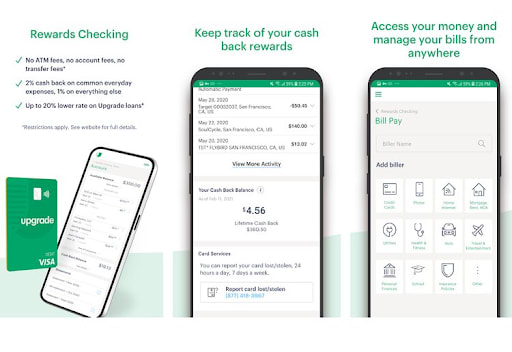

The Upgrade - Rewards Checking account is completely fee-free and there’s no minimum deposit required to open an account. You won’t pay monthly account fees, ATM fees, transfer fees, or even overdraft fees.

In addition, the Upgrade - Rewards Checking account offers cash back on every purchase you make using your Visa debit card. You’ll receive 2% cash back on purchases made at convenience stores, drug stores, gas stations, and restaurants. You’ll also get 2% cash back for many monthly subscriptions and utilities.

The 2% cash back offer is limited to $500 per year in certain categories, after which you’ll receive 1% cash back. All other purchases also receive 1% cash back.

Another benefit of the Rewards Checking account is that existing account holders can receive a discount of up to 20% on the interest rate for a new personal loan or credit card through Upgrade.

The Premier Savings account offers interest of 5.21% APY on savings balances of $1,000 or more. That’s more than 16 times the national average interest rate for savings accounts. Balances under $1,000 do not earn interest.

There is no minimum deposit required to open a Premier Savings account. There are also no monthly account fees, overdraft fees, or transfer fees. Transfers of $100,000 or less are completed the same day that you initiate them.

Upgrade offers a browser-based dashboard as well as mobile apps for iOS and Android to manage your checking and savings accounts. The online dashboard enables you to tag transactions, initiate transfers, and automatically pay your bills online.

Another helpful feature in the dashboard is that you can review your full transaction history for either your checking or savings account. You can also set up alerts for new transactions or incoming transfers.

Upgrade also has an online credit monitoring and education center. You can monitor your credit score for free and get weekly updates on any changes. You can also sign up for email alerts to find out if your score is changing and quickly identify potential fraud.

Upgrade offers personal loans and credit cards in addition to the Rewards Checking and Premier Savings accounts. The company’s six credit cards are all free of annual fees and offer up to 3% cash back on select purchases. One credit card offers unlimited 1.5% cash back in Bitcoin on every purchase.

Importantly, Upgrade does not have any physical branches or in-network ATMs. Upgrade does not charge ATM fees, but you may be charged a fee by the bank that owns any ATM you use.

Upgrade will refund up to five ATM charges per month. To qualify for a refund, you must have an average daily balance of at least $2,500 in your checking account, receive direct deposits totaling at least $1,000, or make at least eight debit card purchases during the prior month.

TheUpgrade - Premier Savings account offers 5.21% APY interest on balances of $1,000 or more. Balances under $1,000 do not receive interest.

The Upgrade - Premier Savings account doesn’t require a minimum account balance. There are no monthly fees, overdraft fees, or transfer fees.

The Upgrade - Rewards Checking account offers cash back on debit card purchases. You’ll earn 2% cash back up to $500 per year on purchases from convenience stores, drug stores, gas stations, and restaurants, as well as subscriptions, and utility purchases. You’ll earn 1% cash back on all other purchases.

The Upgrade - Rewards Checking account doesn’t require a minimum account balance and doesn’t charge any monthly fees. There are also no ATM, transfer, or overdraft fees.

| Account | Interest/Rewards | Account Fee | Minimum Balance | ATM Fee | Overdraft Fee |

|---|---|---|---|---|---|

| Rewards Checking | Up to 2% cash back on common everyday expenses | None | None | None | None |

| Premier Savings | 5.21% APY on balances of $1,000 or more | None | None | None | None |

Upgrade offers customer support by phone and email. You can get in touch from 6AM-6PM (PT) Monday-Friday and from 6AM-5PM Saturday-Sunday. There’s also a detailed online knowledge base where you can find out more about how to use your Rewards Checking dashboard and Upgrade’s other products.

Upgrade’s online dashboard is easy to use. You can see a list of all your transactions and tag them for organization. You can also see your current cash back balance and view your transaction history for your checking and savings accounts.. A bill pay center enables you to set up automatic payments for utilities, credit cards, loans, and other recurring bills.

Upgrade has a 4.7-star rating on Trustpilot, with more than 25,000 reviews, and an A+ rating with the Better Business Bureau.

Upgrade has a free mobile app for iOS and Android devices. The mobile app offers much of the same functionality of the online dashboard, including the ability to track transactions and set up automatic bill pay. You can also lock your debit card if it’s ever lost or stolen.

The Upgrade Visa debit card is compatible with both Google Pay and Apple Pay.

Upgrade secures your account with SSL and 256-bit AES encryption. Both the Rewards Checking and Premier Savings accounts are FDIC-insured through Cross River Bank for up to $250,000. You can also sign up for credit monitoring and email alerts through Upgrade to quickly detect potential fraud in your account.

Upgrade is a financial technology company that offers checking and savings accounts, personal loans, and annual fee-free cards. The Upgrade - Rewards Checking account offers up to 2% cash back on everyday purchases up to $500 per year and 1% cash back on all other purchases. The Upgrade - Premier Savings account offers 5.21% APY interest on balances of $1,000 or more. Neither account has monthly fees, transfer fees, ATM fees, or overdraft fees, and you’re not required to keep a minimum balance in your accounts. You can manage your transactions through an online dashboard or the Upgrade mobile app for iOS and Android.

This review was created using information from the Upgrade website, Trustpilot, and the Better Business Bureau.

Upgrade is a financial technology company, not a bank. Rewards Checking services provided by Cross River Bank, Member FDIC. Upgrade VISA ® Debit Cards issued by Cross River Bank, Member FDIC, pursuant to a license from Visa U.S.A. Inc.