The biggest advantage of Discovery’s CD account is the high-interest rates—relative to other, more traditional banks. The website offers easy-to-use comparison tools to check your rate against major competitors, making it one of the best online banking options available.

Additionally, Discover’s CD account has no account fees, making it cheaper to save—as long as you’re not planning to withdraw your money early, which will incur a fee.

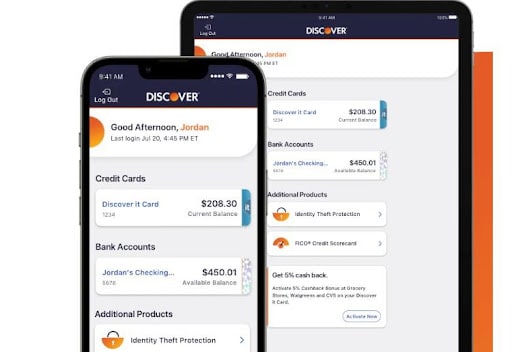

Discover’s mobile banking app has a few features that make it easier to manage your money. These include mobile check deposits, online bill management, and seamless transfers between your accounts. However, it doesn’t boast any features that you can’t find on most mobile banking apps these days. For example, it lacks innovative sub-accounts or auto-saving features. Despite this, it’s still great to have an app you can use to manage your money on the go.

In addition to a CD account, you can also use Discover to open a checking account, regular savings account, money market (accessible savings) account, and a retirement account. Discover also offers loans, including home loans, and credit cards. Furthermore, you can access over 60,000 fee-free ATMs across the United States.

The interest rate APY that you will get on your account will depend on the fixed term you agree to for your CD account. The actual rate may vary from those stated below, and it will be fixed for the agreed term when you open your account.

Discover’s CD account has no account fees to pay. However, if you want to withdraw your money before the end of your fixed term, you will incur a penalty fee. The amount of penalty depends on the length of your agreed term.

Therefore, it’s best to use the Discover CD account if you’re prepared to put your money away for the duration of your selected term.

Discover’s website has a comprehensive FAQ, so this is a useful first port-of-call if you need help. For further support, there’s a series of 24/7 phone lines for different issues, which is a really helpful feature. It’s great that support is available at any time, so that if any problems arise, you know there’s someone there to help.

You can register for your Discover CD account online, which makes it quick and easy to get started. However, it’s worth pointing out that reviews of the Discover service are mixed.

Discover’s mobile banking app is available for both iOS and Android. It has a range of handy features including mobile check deposit—so you can deposit a check by photo without needing to visit a branch, ATM finder, and automatic bill payments. You can also set up alerts so you can keep a close eye on your finances, and freeze your cards if they are lost or stolen.

Users on the Google Play and App Store report that the app is well-designed and integrates the different Discover services well. A few users report bugs, especially when logging in. Despite this, the overall level of satisfaction is high, and the app has an average rating of 4.7/5 on Google Play and 4.9/5 on the App Store.

Discover clearly takes security seriously. SSL encryption is used for all online banking, so if anyone were to access your information they wouldn’t be able to read it. Everything is password-protected and there’s identity verification through a passcode if you log in from a new device. It’s great that Discover also monitors your account for fraud and that your money is FDIC-insured, which means up to $250,000 of your savings are covered.

There’s lots to like about Discover’s CD account. It’s a great way to lock in a fixed interest rate. If you’re prepared to put your money aside for a decent amount of time, you can earn excellent interest compared to some of the other banks out there. No account fees make it an appealing choice of savings account, and the 24/7 support is a brilliant feature. Discover’s online services make it quick and easy to open and manage your account—although the mobile app doesn’t come with a lot of bells and whistles once you’ve done so.

While you need to be aware of the penalty fees for early withdrawal, if you’re looking for a higher-interest account for longer-term savings, the Discover CD could be the ideal savings vehicle for you.

This review was created using the Discover website, App Store/Google Play, and Trustpilot reviews.