Unlike some banks, Capital One 360 CD accounts do not require you to make a minimum deposit. This means that anyone can open up a Capital One 360 CD and start earning interest on their savings.

Capital One 360 offers a wide array of CD terms, ranging from six months to five years.

This flexibility lets you set up your accounts so that you’ll always have money earning interest. At the same time, you’ll have access to the portion of your money that isn’t subject to early withdrawal penalties.

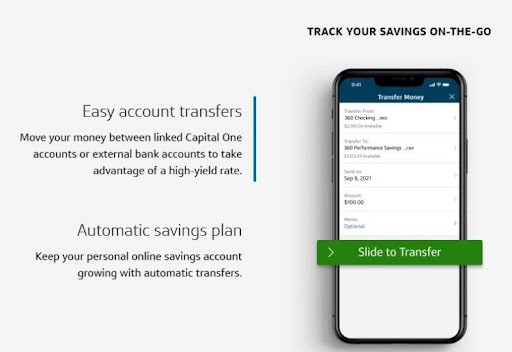

As a technology-focused bank, Capital One prioritizes solutions that make it convenient to manage your accounts no matter where you are. You can open a Capital One 360 CD account in less than five minutes on your computer or mobile phone. Moreover, with the Capital One mobile app, you can easily scan your CD accounts and adjust your settings for how you receive interest payments from your deposits.

In addition to CDs, Capital One 360 provides other financial services such as checking and savings accounts, auto loans, and credit cards. While you can open an individual retirement account (IRA) or IRA CD account with Capital One 360, it no longer originates or services residential mortgages as of 2017.

With Capital One, you can access more than 70,000 fee-free Capital One, MoneyPass®, and Allpoint® ATMs across the United States. If you enjoy banking in person, you can visit one of 55 Capital One Cafes nationwide. These cafes function not only as coffee shops but also as full-service bank branches where you can do everything from opening an account to making a withdrawal.

Although Capital One 360 CD accounts offer competitive rates when compared to major banks, you can likely find higher APYs at smaller banks or credit unions. Rates and fees do not differ by region, and CD accounts are available in all 50 states. Terms start at six months and go all the way up to five years.

Capital One 360 charges a penalty if you withdraw funds from your CD prior to your grace period. This is the time when you can withdraw funds from your account penalty free, lasting for 10 days starting from the end of your term. The early withdrawal penalty varies depending on the length of your CD. For terms of 12 months or less, the fee is three months’ interest, while terms longer than 12 months have a penalty of six months’ interest.

If you need assistance, you can contact Capital One 360’s customer service team from 8am to 11pm (ET), Monday-Friday. Support is available over the phone or via live chat through the Capital One mobile app. Outside of normal business hours, you can use Capital One’s automated support system 24/7 to answer basic questions about your account, such as your balance.

Capital One has a score of 1.3 out of five stars on Trustpilot. While some reviews state that its customer service is slow and unresponsive, most complaints focus on the high interest rates charged on Capital One credit cards.

Whether you want to view current CD rates or check out some FAQs, it’s easy to navigate Capital One’s website. You can sign up for a CD account in less than five minutes online or at a Capital One Cafe branch near you.

The Capital One 360 mobile app is available for download on iOS and Android devices from the Apple and Google Play stores, respectively. You can use it to check on your CD account balance and adjust how, when, and where your CD pays interest. It also offers a full suite of mobile banking services, including mobile check deposit, automatic saving features, and credit score tracking.

Capital One 360 uses a variety of data privacy features to protect your personal and financial information. It employs SSL encryption to deter hackers, and its dedicated fraud team monitors accounts 24/7 to detect signs of suspicious activity.

In addition, Capital One’s login process utilizes two-factor authentication to secure your account details, and you can also opt to use biometric eye or fingerprint security when you log into the mobile app.

If you have a little money that you want to invest risk-free, but you don’t qualify for an account at a major bank, a Capital One 360 CD account may be right for you. It offers a great selection of CD terms and doesn’t require a minimum deposit. You can open an account online in minutes and manage your interest payments on the move with the Capital One mobile app.

This review was based upon information gathered from Capital One 360’s website and customer reviews.