United States Insurance Review

September 7, 2025

•

2 min

September 7, 2025

•

2 min

United States Insurance is suitable for anyone who’s just starting the process of finding a new home insurance policy. This online marketplace makes it easy to find home insurance providers in your area and to compare quotes for your property. In addition, this company allows you to compare policies for a wide range of property types including townhomes and condominiums.

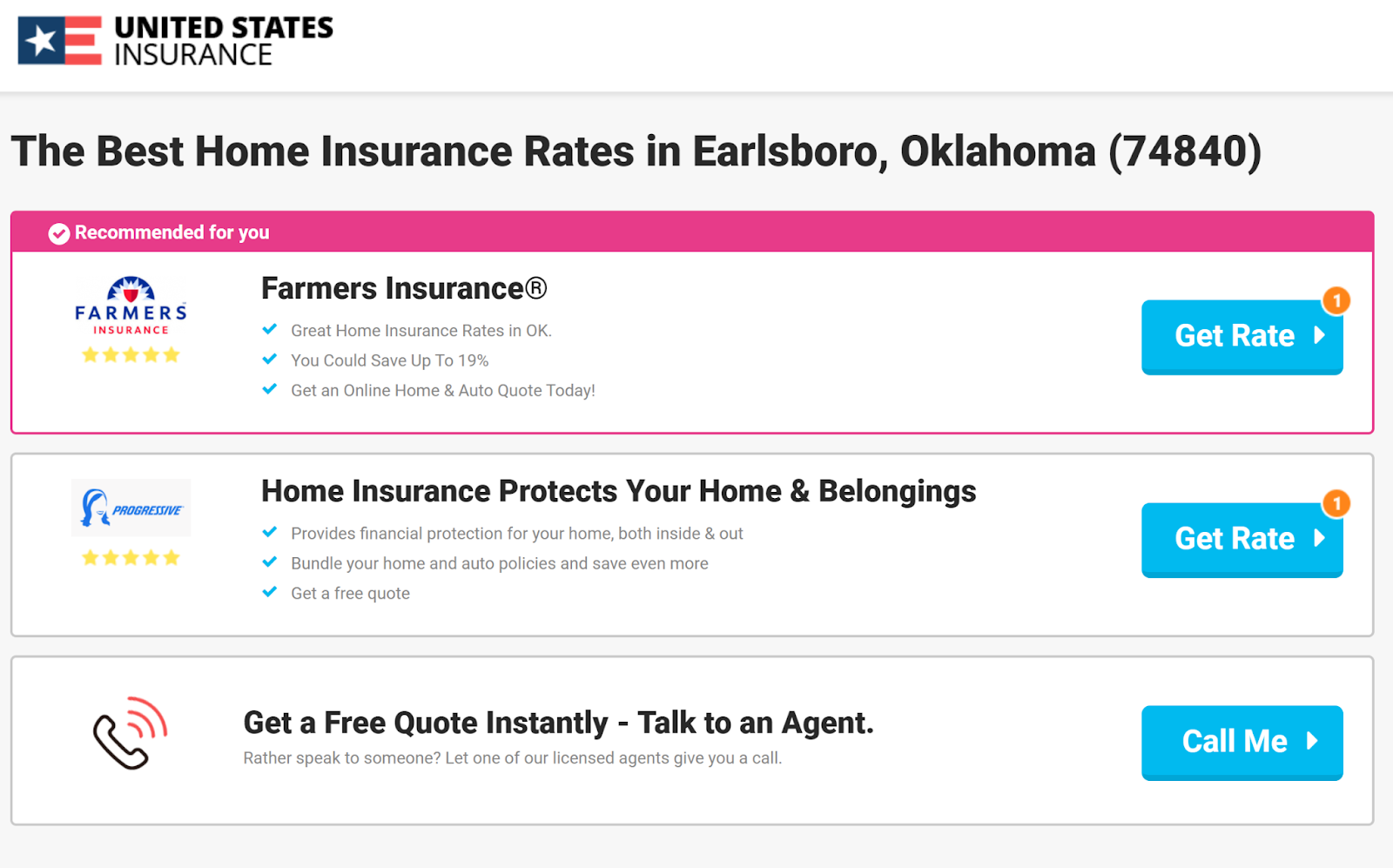

The United States Insurance online comparison tool is completely free to use and you’re never obligated to accept one of the quoted policies. The company works with national home insurance providers such as Liberty Mutual, Progressive, AllState, Lemonade, American Family Insurance, Farmers Insurance, and others.

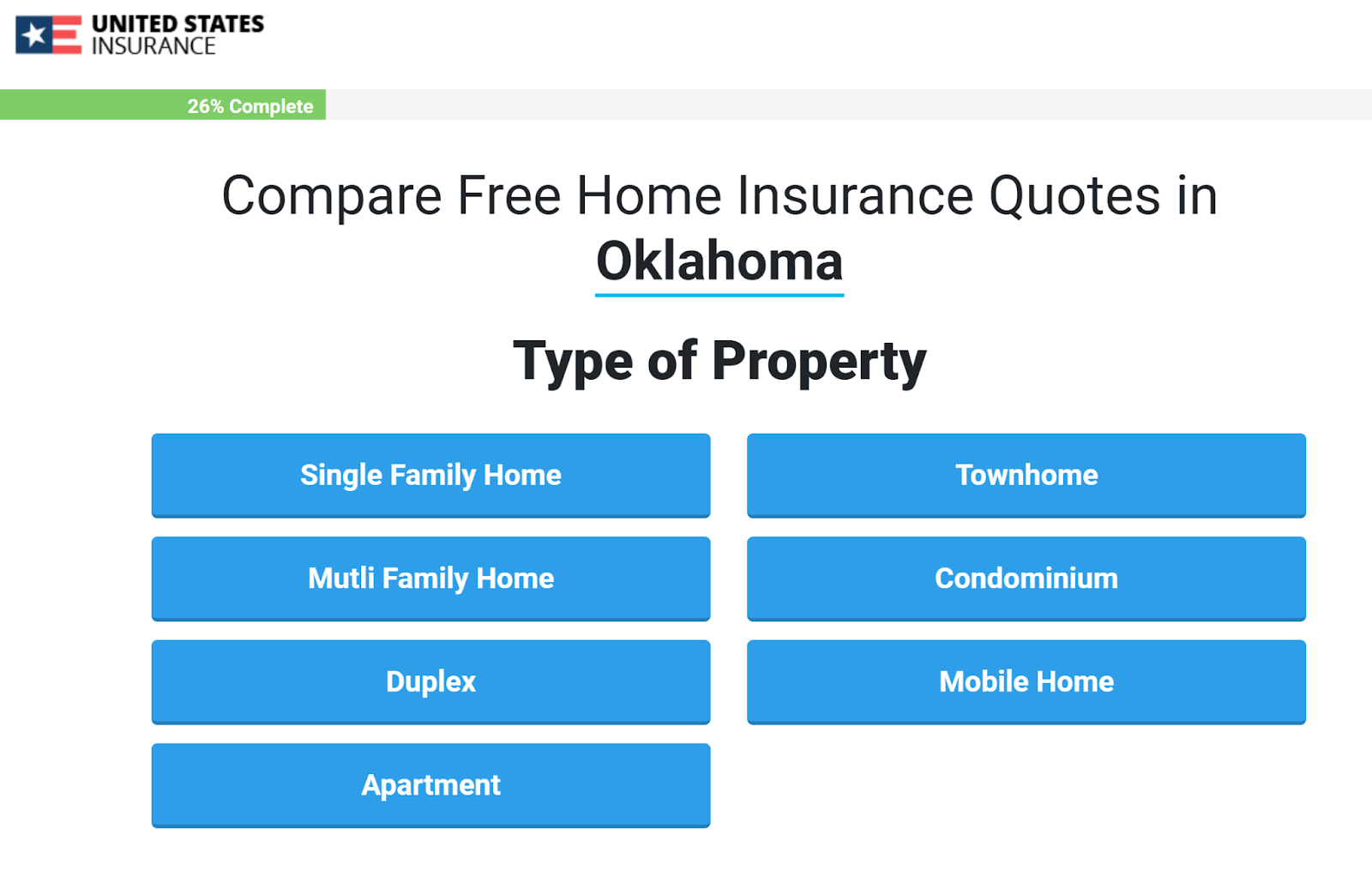

Coverage options vary by provider. Unfortunately, there is no way to sort quotes by coverage options when using the United States Insurance online comparison tool. However, you can search specifically for quotes for different types of properties, including:

Additional coverage varies by insurance provider. United States Insurance does not provide information about additional coverage options when you are comparing providers online. You may be able to get more information about policy options suited for your specific needs by requesting a callback from a United States Insurance agent.

United States Insurance offers an online tool that you can use to compare home insurance quotes at no cost. Simply enter your zip code and select the type of property you are interested in insuring, and the online tool will automatically find providers available in your area. You can also request a callback from a United States Insurance agent to learn more about your home insurance policy options.

United States Insurance does not offer any discounts when you sign up for a policy using this service. The service doesn’t enable you to search for bundled quotes, which might offer a discount if you are looking for both home and auto insurance. You can speak with an insurance agent to find out more about which providers offer discounts for bundling or other qualifications.

United States Insurance does not require you to enter any personal or financial information, including the exact address of your home. You also do not need to submit your phone or email to see providers in your area. The United States Insurance website is encrypted with SSL (Secure Socket Layer) to protect you while you use the online comparison tool.

United States Insurance is an online marketplace that helps you compare insurance policies, not a direct insurer. If you have claims after signing up for a policy through United States Insurance, you must contact your insurance provider directly.

If you need help comparing quotes or learning more about your policy options, you can request a callback from a United States Insurance agent. You can expect to receive a callback within one business day.

United States Insurance simplifies the process of finding a home insurance policy by allowing you to compare quotes from multiple providers online. United States Insurance works with top national insurance companies such as Progressive, AllState, Lemonade, Liberty Mutual, and more. The platform’s comparison tool is free to use and can display provider options for single- and multi-family homes, townhomes, condominiums, and more. Plus, you can speak with a United States Insurance agent to get more information about your policy options. United States Insurance does not provide insurance policies itself, so you must contact your insurance provider directly if you need help with your policy or want to file a claim.

This review was created with information from the United States Insurance website.

Michael Graw is a personal finance expert at BestMoney.com, specializing in online banking and insurance. His work has appeared in print magazines and on high-impact websites. With a passion for clarity and practicality, Michael helps readers navigate today’s financial landscape.