According to the CFPB, the total amount paid in annual fees more than doubled between 2015 and 2022, jumping from $3.0 billion to $6.4 billion.

BestMoney’s goal is to give consumers the data and tools they need to make the best possible financial decisions, which is why we set out to learn more about Americans’ experiences with annual fees credit cards.

Recently, we surveyed more than 1,100 people across the U.S. who either have at least one credit card with an annual fee or have recently canceled a card with an annual fee. We asked a variety of questions about how much they pay for their cards, how statement credits impact their spending, what benefits that matter most to them, and more.

Key Takeaways

- Earning cash back is the #1 motivator for having a card with an annual fee.

- 83% of consumers who pay an annual card fee pay less than $250.

- Men, Gen Zers, and high-earners are most likely to enjoy tracking and optimizing their card benefits.

- High-earners are more interested in airline and hotel points than other consumers.

- Men are more likely than women to have a high-fee card ($250+ annually).

- 68% are sensitive to "benefit bloat" and would prefer fewer benefits and lower fees in general.

What keeps cardholders loyal to these cards? Read on to learn more about the survey's findings.

Even as Costs Climb, Cardholders Still Find Premium Credit Cards Worth It

Despite rising annual fees, many cardholders still see value in premium cards. When asked what keeps them paying those yearly charges, we found it was the feeling of earning something back each time they swiped their card.

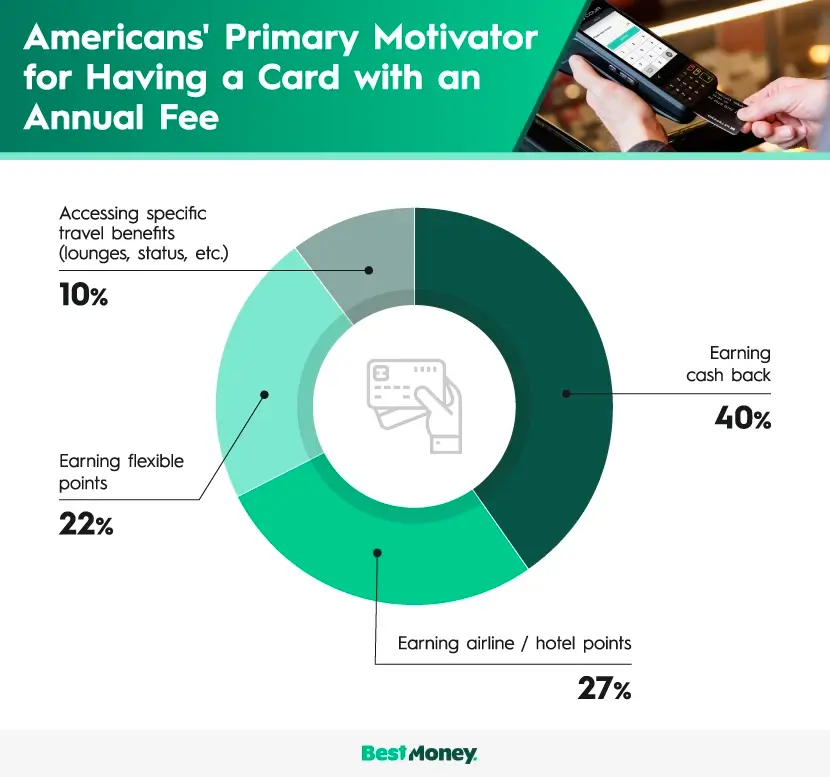

As for the most popular motivator, 40% of cardholders report that getting cash back is king. With a cash back credit card, you are rewarded for buying things you already spend on, which helps to put some of that money back into your pocket.

Coming in second place for motivators is earning airline and/or hotel points, which is most popular among 27% of cardholders. Whether you travel frequently for business or leisure, having a travel credit card that turns your money spent into points can be a smart way to offset travel costs. As a frequent traveler, these cards can recoup hundreds in airfare, lounge access, flight upgrades, hotel stays, and more each year.

For nearly 1 in 4 Americans, the ability to earn flexible points is the main motivator for having these cards. Flexible points stand out because they are not tied to a specific brand or purpose, allowing cardholders to choose whichever options work best for them. Finally, we found that accessing specific travel benefits like lounge access is the biggest motivator for 1 in 10 people.

When looking at annual card fees, we discovered that most consumers who pay them only have one card with a fee, though 30% carry multiple cards with fees. As for the specific amount paid each year, 83% of cardholders pay less than $250 in fees each year. Among those who pay the highest annual fees ($250+), we found that flexible points are their biggest motivator.

How Cardholders Optimize Their Benefits

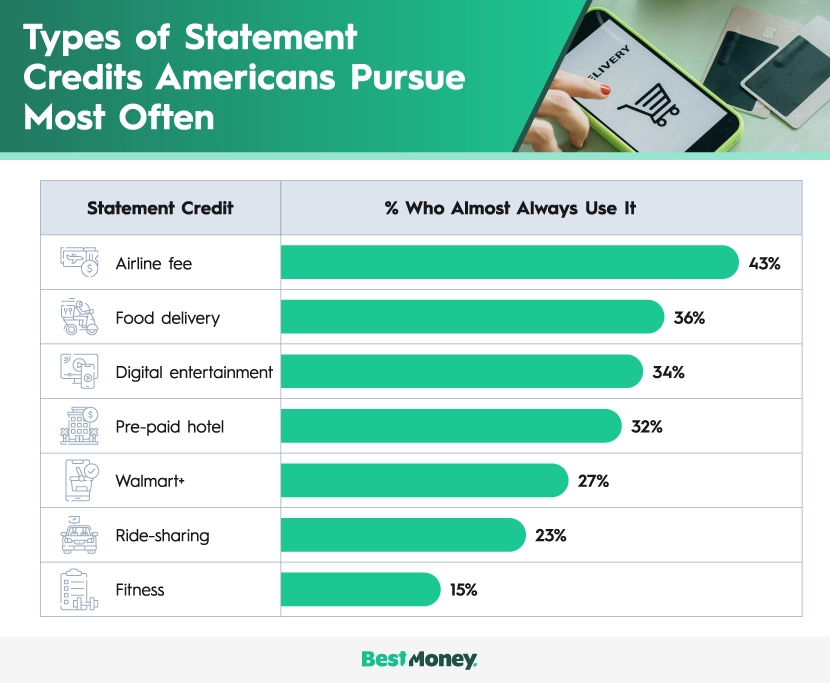

Credit cards with annual fees come with a variety of benefits, but which do cardholders take advantage of the most? Taking first place, more than two-fifths of people say they get the full value of their airline fees. While these fees may not seem like much to infrequent travelers, airline fees can add up quickly. So having a card that provides funds to put toward the extra charges can help you save money for a future adventure.

Food delivery is the second most used benefit among cardholders with more than a third stating they take full advantage of it. From Grubhub to Uber Eats, many credit cards offer a monthly credit to make it easier to order food straight to your door.

Digital entertainment is third, with 34% of people utilizing its full value. This benefit includes statement credits that can be used to cover the cost of your favorite streaming services like Disney+ and Netflix, as well as early access to event seating and more.

Overall, 82% of cardholders say they take advantage of card-linked offers at least some of the time, while only 11% are “power users” who check regularly for offers. Among high-fee-paying users, these numbers jump significantly, however, as 92% say they use them at least some of the time and 21% check regularly.

For 27% of cardholders, tracking and optimizing benefits is something they genuinely enjoy, while 39% find it annoying or don’t track anything. When it comes to tracking these benefits, we discovered men, Gen Zers, and those making $150,000 or more a year are most likely to enjoy it. Similarly, those who pay the highest fees ($250+) tend to enjoy the process of optimizing more than others (37%).

Main Causes of Americans Canceling Their Credit Cards

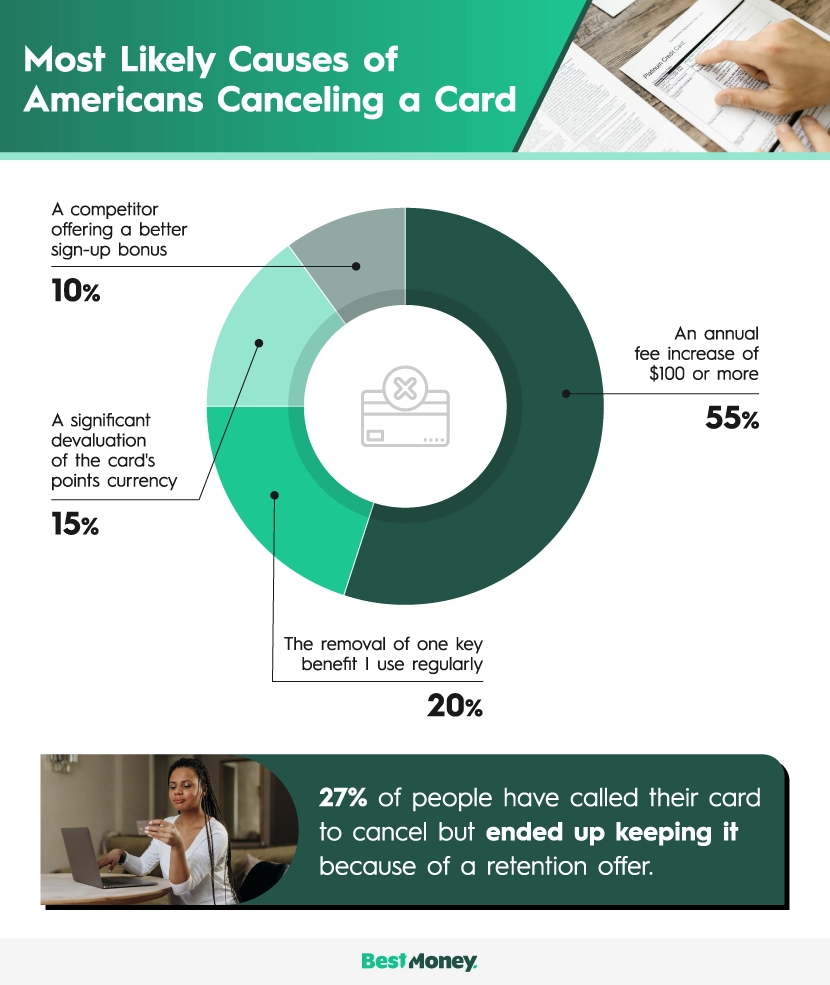

While some people hold onto a credit card for years and years, others part ways after a year or so. Because of this, we wanted to learn about the reasons that lead Americans to cancel their cards. We discovered that for more than half of Americans, an annual fee increase of $100 or more would cause them to cancel their cards, making it the most common reason reported.

The next most common catalyst for card cancellation is the removal of a key benefit that a user enjoys. One in five consumers say this would cause them to cancel. Similarly, 1 in 6 people say a significant devaluation of the card's points currency would lead them to cancel their credit card. Finally, 1 in 10 cardholders say a competitor offering a better sign-up bonus is enough to make them part ways with their current credit card.

We also found that 36% of people say they have kept a card open mainly to avoid losing a large accumulation of points. For 27% of cardholders, they attempted to cancel their card but changed their mind after receiving a retention offer when calling to cancel.

Compare Cards That Deliver Real Value on Best Money

Fee-based credit cards can be a great choice when their perks align with your plans, whether that be seeking the best travel cards to offset those pesky airline fees or rewards cards that compensate you for simply shopping at your favorite stores. When you aren’t aligned, however, the fee can begin to feel like dead weight.

We want to help you find the cards that work best for you. That’s why we provide comprehensive reviews and in-depth comparisons of cards to help simplify your decision-making process, while ensuring you find the card that will set you up for success.

You can get started today by checking out our credit card overview where you can filter by the types of cards you want. So whether you are seeking cash back cards or cards with no annual fee, you can quickly compare one card to another to help you make the best selection for your financial needs.

Methodology

From September 24 to 25, we surveyed 1,164 American consumers 18 years and older, who have at least one credit card with an annual fee (or very recently canceled a card with an annual fee). For the purposes of this study, we define high earners as those with an annual household income of $150,000 or more, and high-fee credit cards as those that cost $250 or more per year.

The BestMoney editorial team is composed of writers and experts covering a full range of financial services. Our mission is to simplify the process of selecting the right provider for every need, leveraging our extensive industry knowledge to deliver clear, reliable advice.