You can open a Bank of America Business Advantage Banking account online without ever having to leave your home, which can save you a lot of time and effort. Monthly fees are competitive, and the ability to have them waived can help your business save more.

The company also has a team of dedicated small business specialists to provide you with guidance when you need it.

Bank of America Business Advantage Banking provides helpful cash flow insights that let you see projections, view category balances, and monitor all transactions.

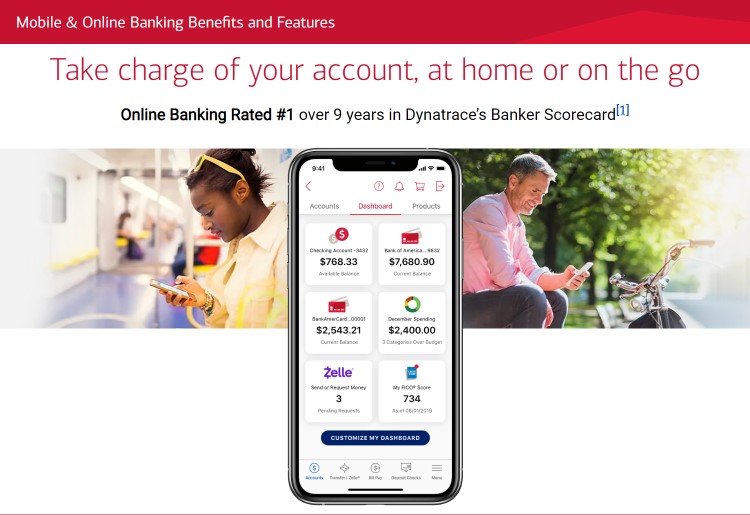

Managing your Bank of America Business Advantage Banking account on the go with the mobile app is easy, as well. The app lets you deposit checks remotely, transfer funds, view balances and transactions, pay bills, and more.

With its history dating back hundreds of years, Bank of America offers plenty of traditional banking services. There are thousands of financial centers and ATMs across the country.

In addition to business checking, Bank of America offers business credit cards, savings accounts, and cash management solutions. It also provides a host of personal banking services like investing, personal accounts, credit cards, loans, mortgages, and more.

While there’s a single Business Advantage Banking account, it comes with two account settings. There’s Business Advantage Fundamentals Banking and Business Advantage Relationship Banking.

Business Advantage Fundamentals Banking comes with a $16 monthly fee, but this can be waived if you maintain a $5,000 average monthly balance or spend at least $250 in new net purchases on your business debt card each billing cycle.

This account setting comes with no fees on the first 200 transactions per statement cycle, and charges extra fees for incoming wires, stop payments, and more.

There is no fee for the first 500 transactions per statement cycle with this account setting, and you don’t pay for incoming wires or stop payments.

Going with Advantage Relationship Banking also lets you open and use a Business Advantage Savings account without paying a monthly fee. You can even open a Second Business Advantage Banking account without having to pay a monthly fee.

| Monthly fee | Fees for incoming wires and stop payments | Included transactions | Monthly cost to use a Business Advantage Savings account | Monthly cost to open a Second Business Advantage Banking account | |

| Business Advantage Fundamentals Banking | $16 or $0/month | Fees vary | 200/month | $10/month | $16/month |

| Business Advantage Relationship Banking | $29.95 or $0/month | $0/month | 500/month | $0/month | $0/month |

Customer support is available over the phone at 866-283-4075 between the hours of 8 am to 10pm ET Monday-Friday. In addition to a phone call, customer support is available via live chat and on social media platforms like Facebook and Twitter.

The company has largely positive reviews for its customer service, and everything from signing up for an account online to using the app is straightforward. Bank of America’s website provides a comprehensive and helpful knowledge center that makes it easy to get answers to common questions.

Bank of America has a fully functioned mobile app that is available on both Android and iOS devices. The app lets you deposit checks, customize alerts, replace your card, move money between accounts, learn about your credit, and more.

Its website contains several videos and guided demos to help ensure you know how to use the app and take advantage of the many features it provides. This app has favorable reviews (4.6 on Google Play store and 4.8 on Apple App store), is user-friendly, and makes managing your business checking account on the go easy.

Bank of America takes security seriously and has SSL encryption on its website, plus two-factor authentication to protect customer accounts. The company is also a member of the FDIC, which means your deposits are protected up to $250,000.

It has a dedicated fraud team that is available 24/7, and there’s a $0 liability guarantee, which states you’re never liable for unauthorized transactions, as long as they’re reported promptly. Bank of America monitors for fraudulent activity and provides resources to help you learn how to spot scams and protect your accounts.

The privacy policy details how the company collects personal information, what it’s used for, how it’s shared, and more. It also gives customers some control as you can choose how your information is shared and how you’re marketed to.

The Bank of America Business Advantage Banking account offers two account settings to meet the needs of a variety of different businesses. You can get hundreds of transactions each month, a competitive monthly fee (which can be waived), and a host of efficiency tools and solutions to easily manage your finances.

This review was created using information from the Bank of America website, including its privacy policy and security center.

Emma Street is a finance writer at BestMoney.com specializing in debt consolidation and loans. With a BSc in Computer Science and over 15 years in software development, her experience in InsureTech and FinTech fuels her passion for exploring the intersection of technology and personal finance.