Suitable For?

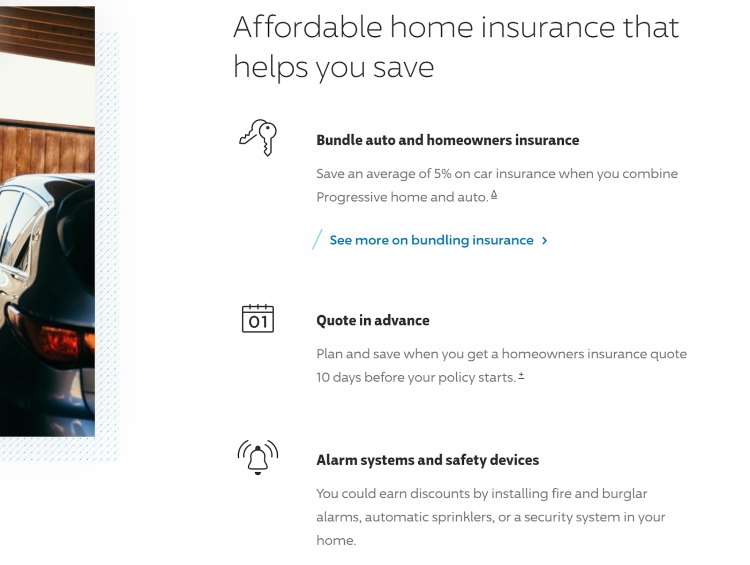

Progressive offers a variety of discounts for homeowners looking for a comprehensive but affordable home insurance policy. You can get a discount for bundling your home and auto insurance or if you switch to home insurance from an existing Progressive renter’s insurance policy. You can also get lower prices by searching for a quote up to 10 days before you need your policy to start or by installing a security or fire prevention system in your home.

What Coverage Includes

Progressive offers a standard homeowners policy that covers your home, personal property, and personal liability. The policy will pay to rebuild your home’s structure and includes coverage for outdoor structures like a garage and patio. It also covers your belongings, even if they are damaged or stolen while they’re not inside your home. Progressive’s home insurance policy also provides liability protection if someone is injured in your home and will help to cover any associated medical bills.

- Property damage coverage

- Personal property coverage (including outside the home)

- Liability coverage

- Pays for lodging if you are displaced from your home

- Pays for medical bills if someone is injured in your home

Additional Coverage

Progressive offers a home warranty insurance policy through a third-party partner called Cinch. This policy provides coverage for your appliances and plumbing, HVAC, and electrical systems. A home warranty policy can help pay for the costs of repairs or replacement, and comes with discounts on new appliance purchases.

The personal property coverage included in your home insurance policy has limits for valuables like jewelry and art. You can add a rider to your policy to increase your coverage for these high-value items.

- Home warranty policy

- Extra coverage for high-value items

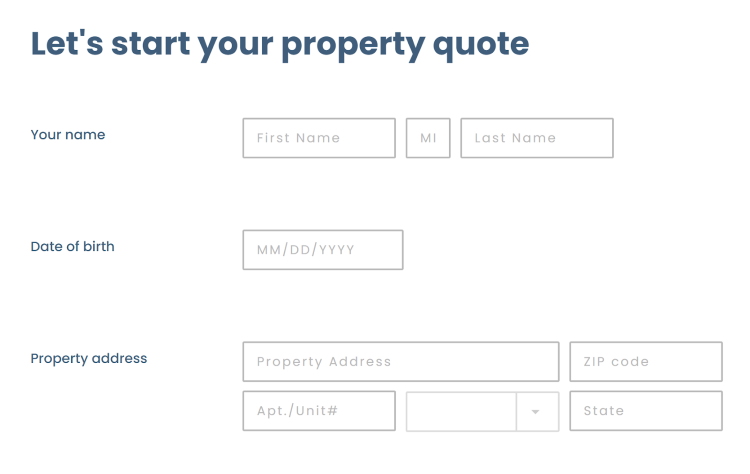

Application Process

You can apply for a quote online in minutes with Progressive. You must provide information about yourself and your home’s structure, including the interior, exterior, and utilities. The company works with third-party insurance providers to offer coverage in all 50 states, so the policy quotes you receive are offered by these third-party providers and not Progressive itself.

Discounts

Progressive discounts when you switch to a home insurance policy from an existing renter’s policy or when you bundle home and auto insurance. You can also get a discount when you search for quotes up to 10 days in advance of when you need your policy to begin. Progressive offers lower rates for new homes and you may be able to lower your rate by installing a home security system or fire prevention system.

How Safe is it?

Progressive is a national insurance provider with an A+ financial rating from A.M. Best. That means that the company should have no trouble paying out your claims, even if your home is damaged by a widespread event.

Claims & Customer Support

Progressive does not have a standardized claim system since you must submit your claim through the third-party insurance company that underwrites your policy. Depending on the specific company Progressive uses in your area, you may be able to submit a claim online or you may have to talk with an agent over the phone. Progressive also has a mobile app where you can view your policy, make a claim, request roadside assistance, upload documents and more.

Progressive offers 24/7 phone support 365 days a year, and the company can help you through the process of filing a claim with the third-party provider behind your policy.

Phone: (855) 347-3939

Summary

Progressive offers home insurance in all 50 states through a network of third-party insurance companies. You can get a discount on your policy in a variety of ways, including by bundling auto insurance or installing a home security system. Progressive doesn’t have a standardized claims process, but you can get help over the phone or on their mobile app at any time. Progressive has an A+ rating from A.M. Best, so the company should be able to pay out claims without a problem.

Methodology

This information was created with information from the Progressive website, the Better Business Bureau, and A.M. Best.