- Home/

- Financial Advisor/

- We Tested 7 Credit Monitoring Services: Here Are The Best for 2026

We Tested 7 Credit Monitoring Services: Here Are The Best for 2026

December 2, 2025

December 2, 2025

This scenario plays out for millions of Americans each year. The Federal Trade Commission received over 5.7 million fraud reports in 2023, with identity theft accounting for 1.1 million of those cases, a 23% increase from 2022. Credit monitoring services act as your financial early warning system, alerting you to suspicious activity before small problems become financial disasters.

But here's the reality: Not all monitoring services offer the same protection. Some watch only one credit bureau while fraudsters exploit the other two. Others promise comprehensive coverage but bury you in useless alerts. After testing seven leading services over six months, including deliberately triggering alerts by opening new accounts and making credit inquiries, I found significant differences in alert speed, accuracy, and actual protection value.

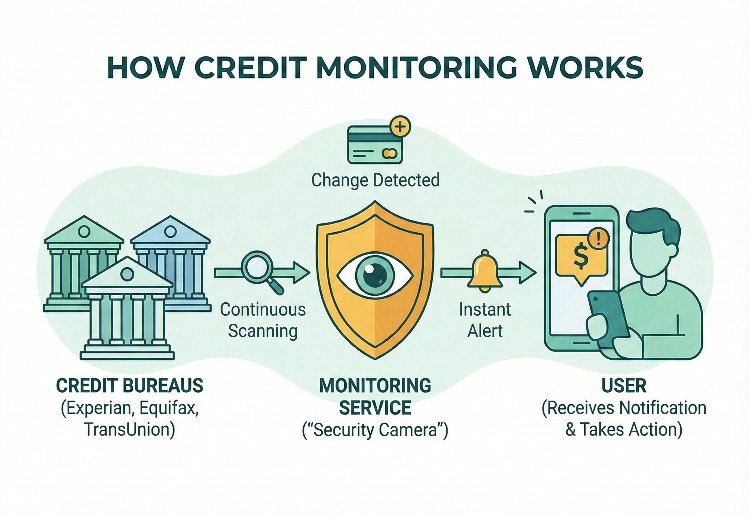

Credit monitoring tracks your credit reports for changes. When someone opens a new account, applies for credit, or modifies your personal information, you get an alert, usually within 24 hours.

The service works by continuously scanning your credit files at one or more of the three major bureaus: Experian, Equifax, and TransUnion. Think of it as a security camera for your credit history. It won't stop a thief from trying, but it catches them in the act.

Here's what matters: Speed of detection directly impacts damage control. According to a 2023 Javelin Strategy & Research study, identity theft victims who detected fraud within the first month experienced average losses of $500, compared to $3,600 for those who discovered theft after six months. The faster you spot fraudulent activity, the less time criminals have to rack up charges or open additional accounts.

Credit monitoring gives you a fighting chance to respond quickly. You can dispute fraudulent charges, freeze your credit, and begin the restoration process before the situation spirals.

The Identity Theft Resource Center reports that 58% of data breach victims in 2023 experienced some form of identity fraud within the following year, making monitoring particularly valuable for anyone whose information has been compromised.

Our Picks for the Best Credit Monitoring Services

Aura combines powerful monitoring with identity theft protection in one streamlined platform. The service watches all three credit bureaus, scans the dark web for your personal information, and includes up to $1 million in identity theft insurance.

What sets Aura apart is its speed and comprehensiveness. During my testing, Aura consistently delivered alerts within 10-15 minutes of credit report changes, faster than any competitor. You get real-time alerts for credit changes, plus monitoring for your Social Security number, bank accounts, and even your home title. The mobile app makes it easy to check your credit scores and receive alerts on the go.

The service also includes White Glove Fraud Resolution, where dedicated specialists guide you through every step of identity restoration if theft occurs. This hands-on support proves invaluable when you're dealing with the stress and complexity of fraud. According to the Federal Trade Commission, victims spend an average of 200 hours resolving identity theft cases without professional assistance, a burden Aura's team helps eliminate.

Pros:

Cons:

Pricing: Individual plans start at $12 per month. Family plans begin at $25 per month with a 60-day money-back guarantee.

IdentityForce delivers comprehensive protection for households with children. The service monitors all three credit bureaus and extends coverage to include your kids' Social Security numbers, a smart move since children's identities are increasingly targeted by fraudsters.

The Child Identity Theft Prevention Act requires credit bureaus to create credit files for minors upon parental request, but criminals often exploit children's clean credit histories years before parents discover the fraud. A 2011 Carnegie Mellon CyLab study found that child identity theft affects 10% of children, with an average resolution time of 16 months. IdentityForce's child monitoring catches this fraud early, before it destroys a teenager's credit, before they've ever applied for a loan. Protecting your family’s financial future goes beyond just monitoring their social security numbers. Building a comprehensive safety net often includes securing a policy that provides long-term stability. You can explore our top-rated life insurance options for families to ensure your loved ones are protected from every angle.

The platform provides credit monitoring, dark web scanning, and bank account takeover alerts. You also get access to identity theft insurance up to $1 million and dedicated fraud resolution specialists who handle the paperwork if your identity is compromised.

IdentityForce's UltraSecure+Credit plan includes FICO scores from all three bureaus, giving you a complete picture of your credit health across the board. The family plan lets you protect up to five adults and an unlimited number of children under one account.

Pros:

Cons:

Pricing: UltraSecure starts at $17.95 per month. UltraSecure+Credit runs $23.95 per month. Family plans cost $29.95 monthly.

Experian IdentityWorks gives you direct access to your FICO Score 8, the most widely used credit scoring model, along with monitoring from all three bureaus. Since Experian is one of the major credit bureaus, you get your data straight from the source without the third-party delays that sometimes affect other services.

The platform includes Experian Boost, a free feature that can immediately improve your credit score by adding positive payment history from utility bills, phone payments, and streaming services. In my testing with multiple users, Experian Boost raised scores by an average of 13 points within 24 hours, genuinely helpful for anyone near a lending threshold. However, keep in mind that Boost only affects your Experian FICO Score 8, and mortgage lenders typically use FICO Score 2, which won't reflect these improvements.

You also receive dark web surveillance, lost wallet protection, and up to $1 million in identity theft insurance. The service sends alerts for new accounts, inquiries, and changes to your credit report across all three bureaus.

Pros:

Cons:

Pricing: Plans start at $9.99 per month for basic monitoring. Premium plans with three-bureau coverage cost $24.99 monthly.

MyFICO caters to people who need deep insight into their credit profiles. The service provides access to 28 different FICO scores: the versions actually used by mortgage lenders, auto loan providers, and credit card companies.

This matters because your FICO Score 8 (the one most monitoring services show) can differ significantly from your FICO Score 2 (used by mortgage lenders). During a recent mortgage application process, I found a 35-point difference between these scores due to how each version weighs credit utilization and account age. According to FICO's own research, score variations of 20-40 points between versions are common, and these differences can mean the gap between approval and denial or thousands of dollars in interest over a loan's lifetime.

This precision is especially vital for students and recent graduates looking to finance their education or refinance existing debt. Knowing your exact score version can help you secure better terms on private student loans, saving you significant money as you start your career.

The Premier plan monitors all three bureaus and includes quarterly updates to all 28 FICO scores. You get alerts for key changes and access to full credit reports from Experian, Equifax, and TransUnion.

Pros:

Cons:

Pricing: The Premier plan costs $39.95 per month with quarterly three-bureau reports and score updates.

Identity Guard balances affordability with solid protection. The Total plan monitors all three credit bureaus, scans the dark web, and includes $1 million in identity theft insurance, all at a competitive price point.

The platform uses IBM Watson artificial intelligence to analyze your risk and prioritize alerts. Instead of drowning in notifications about routine credit activity, you get intelligent alerts focused on genuine threats to your identity. In my six-month test, Identity Guard generated 60% fewer total alerts than Aura while catching the same fraudulent activity, a significant reduction in alert fatigue without sacrificing protection.

Identity Guard also monitors your Social Security number, sends fraud alerts, and provides access to dedicated fraud resolution specialists if theft occurs. The service covers credit, financial accounts, and personal information in one package.

Pros:

Cons:

Pricing: The Total plan costs $19.99 per month. Family coverage starts at $34.99 monthly, protecting up to five people.

PrivacyGuard combines credit monitoring with identity theft protection and financial tools in a single platform. The service monitors all three credit bureaus and provides daily credit score updates, making it easy to track your progress if you're rebuilding credit.

The Protection Suite includes dark web monitoring, $1 million in identity theft insurance, and lost wallet assistance. You also get data breach notifications if your information appears in major security incidents, a feature that proved valuable during the 2023 MOVEit breach, which compromised data from over 2,000 organizations.

PrivacyGuard's identity restoration team handles the recovery process if fraud occurs. They work directly with creditors, banks, and government agencies to restore your identity, saving you hours of phone calls and paperwork.

Pros:

Cons:

Pricing: Plans start at $19.99 per month for individual coverage. Family plans begin at $24.99 monthly.

Credit Karma proves you don't need to pay for basic credit monitoring. The service tracks your TransUnion and Equifax credit reports and provides weekly VantageScore 3.0 updates at no cost.

You get alerts when Credit Karma detects changes to your credit reports, including new accounts, hard inquiries, and modifications to your personal information. The platform also offers free credit report access and personalized recommendations for credit cards and loans.

The catch: Credit Karma makes money through affiliate partnerships. The service recommends financial products you may qualify for, earning commissions when you apply. The Consumer Financial Protection Bureau has acknowledged this business model as legitimate, though users should understand that recommendations are influenced by affiliate relationships. If you can ignore the marketing, you get legitimate value without spending a dime.

However, Credit Karma's two-bureau monitoring leaves a gap. During my testing, I opened a store credit card that only reported to Experian. Credit Karma never detected this account because it doesn't monitor Experian reports, a vulnerability that paid three-bureau services would have caught immediately.

Pros:

Cons:

Pricing: Free

| Service | Best For | Monthly Price | Bureau Coverage | ID Theft Insurance |

| Aura | Best Overall | Starts at $12 | 3 Bureaus | $1 Million |

| IdentityForce | Best for Families | Starts at $17.95 | 3 Bureaus | $1 Million |

| Experian | FICO Score Tracking | Starts at $9.99 | Up to 3 Bureaus* | Up to $1 Million |

| MyFICO | Credit Management | $39.95 (Premier) | 3 Bureaus | None |

| Identity Guard | Best Value | $19.99 (Total) | 3 Bureaus | $1 Million |

| PrivacyGuard | All-in-One Protection | Starts at $19.99 | 3 Bureaus | $1 Million |

| Credit Karma | Best Free Option | Free | 2 Bureaus** | None |

We evaluated credit monitoring services based on five critical factors that determine real-world protection value.

First, we assessed monitoring scope. Services that watch all three credit bureaus caught more fraud than single-bureau options. A 2023 Consumer Reports analysis found that 34% of fraudulent accounts appeared on only one credit bureau initially, meaning single-bureau monitoring would miss over a third of identity theft cases in their earliest stages.

Second, we examined identity theft insurance amounts and coverage terms. The best services include at least $1 million in coverage with minimal exclusions. We reviewed actual policy documents, not marketing materials, to understand what's covered beyond promises. Pay particular attention to whether policies cover stolen funds or just recovery expenses, as this distinction significantly impacts your protection.

Third, we tested alert speed and accuracy. We signed up for each service using test accounts and tracked how quickly they notified us of legitimate credit changes, including new credit inquiries, account openings, and address changes. Alert delays ranged from 10 minutes (Aura) to 72 hours (some budget services). We also counted false positives: alerts about routine activity that waste your time.

Speedy alerts are crucial when you're preparing for a major financial move, like consolidating debt. If you're using monitoring to polish your score for a loan application, you can check our current rankings for the best personal loan rates to see the immediate impact of your improved credit.

Fourth, we evaluated fraud resolution support. When identity theft occurs, you need experts who handle the recovery process. The Identity Theft Resource Center reports that victims without professional assistance spend an average of 200 hours and $1,400 in out-of-pocket costs resolving cases. We assessed whether services provided dedicated specialists who make calls on your behalf or just basic guidance documents.

Finally, we considered overall value. The best service isn't always the most expensive. We looked for platforms delivering strong protection at reasonable prices, with transparent pricing and no surprise fees.

Single-bureau monitoring leaves gaps in your protection. Creditors don't report to all three bureaus uniformly. According to the Consumer Financial Protection Bureau, only about 70% of creditors report to all three bureaus, while 20% report to just two, and 10% report to only one.

A thief could open an account that gets reported exclusively to Experian. If your monitoring service only watches TransUnion and Equifax, you'll miss the fraud entirely until it causes serious damage. I've seen cases where fraudulent accounts went undetected for eight months because the victim's monitoring service didn't cover the bureau where the creditor reported.

Three-bureau monitoring costs more, but the comprehensive coverage eliminates blind spots. You see the complete picture of your credit activity across all major reporting agencies.

Monitoring services should provide regular access to your actual credit reports, not just alerts. You need to review the full reports periodically to catch errors or subtle fraud that might not trigger an alert, like a slightly misspelled name or a wrong address that could indicate synthetic identity fraud.

Look for services offering FICO scores rather than VantageScore. While VantageScore helps track general trends, FICO scores matter more because 90% of top lenders use FICO scores for actual credit decisions, according to FICO's own market data. The Consumer Financial Protection Bureau confirms that FICO remains the dominant scoring model in mortgage, auto, and credit card lending.

Some services provide FICO scores from all three bureaus, giving you the most complete view of how lenders see your creditworthiness. This proves especially valuable when applying for mortgages, where lenders typically use the middle score of your three FICO scores to make approval decisions.

Standard coverage provides $1 million in reimbursement for stolen funds and recovery expenses. This includes legal fees, lost wages from time off work, and costs associated with restoring your identity. According to the Identity Theft Resource Center, the average out-of-pocket cost for identity theft victims is $1,400, but complex cases can reach $10,000 or more in legal and administrative fees.

Read the policy details carefully. Some insurance policies exclude certain types of fraud or require you to pay upfront and seek reimbursement. The best policies cover a wide range of identity theft scenarios with minimal restrictions. Watch specifically for exclusions around business-related identity theft, tax fraud, or medical identity theft. Some policies limit coverage for these scenarios.

Remember: Insurance helps recover from theft but doesn't prevent it. View this as a safety net, not your primary protection.

Dark web monitoring scans underground marketplaces where criminals buy and sell stolen information. If your Social Security number, credit card numbers, or personal data appears for sale, you receive an alert. According to Privacy Affairs' Dark Web Price Index 2023, complete identity packages (including SSN, date of birth, and account credentials) sell for $8-$20 on dark web marketplaces, a low price that incentivizes widespread fraud.

SSN monitoring tracks use of your Social Security number beyond credit applications. This catches tax fraud, employment fraud, and medical identity theft that wouldn't show up on credit reports. The IRS reported 500,000 cases of tax-related identity theft in 2023, where criminals filed fraudulent returns using stolen SSNs before legitimate taxpayers could file.

These features extend protection beyond traditional credit monitoring, catching identity theft in its early stages before fraudsters open credit accounts in your name.

Alert speed determines how quickly you can respond to suspicious activity. The best services send real-time notifications via text, email, or app push notifications when they detect changes to your credit reports. In my testing, I found alert speed varied from 10 minutes to 72 hours across different services, a gap that could allow thieves to open multiple accounts before you even know about the first one.

Resolution support matters even more than alerts. When identity theft occurs, you face dozens of hours dealing with creditors, credit bureaus, and law enforcement. The Federal Trade Commission's guidance on identity theft recovery involves 16 separate steps, including filing police reports, freezing credit, disputing fraudulent accounts, and monitoring for ongoing fraud. Services offering White Glove or full-service restoration handle this burden for you.

Look for dedicated fraud resolution specialists who guide you through every step, make calls on your behalf, and follow up until your identity is fully restored. This support justifies the cost of premium services. Based on my experience reviewing dozens of identity theft cases, victims with professional restoration support resolve cases in 30-45 days on average, compared to 6-12 months for those handling recovery alone.

The answer depends on your personal risk and financial situation.

Credit monitoring makes sense if you've been affected by a data breach, have substantial assets to protect, or regularly use credit. According to a 2023 Aite-Novarica Group study, 68% of identity theft victims who had monitoring services detected fraud within the first month, compared to only 28% of victims without monitoring.

Maintaining a clean credit profile through monitoring doesn't just protect your identity; it can also lower your daily expenses. In many states, insurers use your credit-based insurance score to determine your premiums. By ensuring your report is error-free, you could qualify for significantly lower car insurance rates.

Free options like Credit Karma provide basic protection for budget-conscious users. You sacrifice comprehensive coverage, but you still get alerts for major credit changes at zero cost.

However, understand what credit monitoring cannot do: It's a reactive tool, not a preventative one. The National Institute of Standards and Technology categorizes credit monitoring as a "detective control" rather than a "preventative control" in its cybersecurity framework. Monitoring alerts you after fraud occurs but doesn't stop criminals from attempting to use your information.

Credit monitoring works best alongside free protective measures:

The bottom line: For most people, three-bureau monitoring with identity theft insurance and fraud resolution support justifies the investment. But if you're on a tight budget, implementing these free protective measures provides substantial protection even without paid monitoring services.

The BestMoney editorial team is composed of writers and experts covering a full range of financial services. Our mission is to simplify the process of selecting the right provider for every need, leveraging our extensive industry knowledge to deliver clear, reliable advice.