- Home/

- Credit Cards/

- Study: 76% of Americans With Credit Card Debt Say It’s Almost Entirely Due to Their Own Choices

Study: 76% of Americans With Credit Card Debt Say It’s Almost Entirely Due to Their Own Choices

October 16, 2025

October 16, 2025

For certain people, it certainly provides comfort to know that in a financial emergency, you can lean on your cards and pay off the balance later. The only issue is that some credit card users struggle to limit their spending.

At Best Money, we research and compare top financial products to help users find the best fit for their needs, so we wanted to learn more about Americans’ credit card debt and what factors led to it. To do this, we surveyed people with credit card debt and asked a variety of questions about their spending, feelings associated with spending, total debt, and more. We found that 76% of people with credit card debt say it’s almost entirely due to their own choices. Read on to learn more about why Americans think that is.

Throughout your life, you have many expenses, both planned and unplanned, that you encounter. One way to prepare for these situations is to create a budget that allows for recurring bills to be accounted for while also putting some funds into savings and an emergency fund. Budgeting can be difficult for some, however, as we learned that 54% of Americans either have a budget and can’t stick to it or don’t have a budget at all.

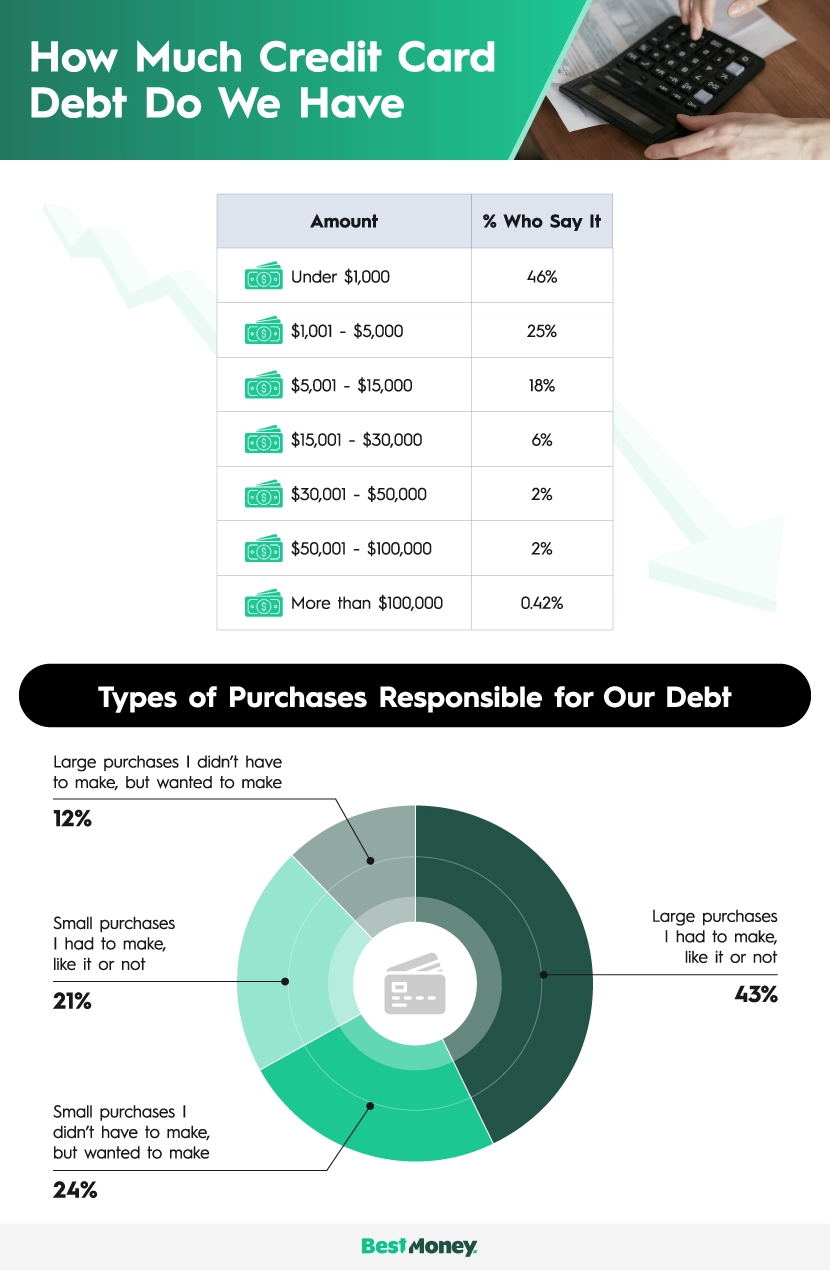

Without a budget in place, you are at risk of unnecessary spending, and for many people, this means relying on credit and watching their credit card balances grow. Through our research, we found that 73% of Americans carry credit card debt, with the average amount being $8,550. While nearly half (46%) of people say their debt is under $1,000, we discovered that 1 in 4 people have a balance between $1,000 and $5,000 on their credit cards.

Although some use credit cards to cover some necessities, we found that nearly 1 in 4 people say their debt is due to small purchases they didn’t have to make but wanted to. Similarly 1 in 9 people say their credit card debt is the result of large purchases they didn’t have to make, but wanted to make.

As for the biggest contributing factors of Americans’ credit card debt, we learned that nearly 1 in 3 people blame their debt on their spending habits and financial discipline. For 7% of people with debt, it’s the buy now, pay later culture in the country that takes blame. While the concept of breaking down a larger purchase into smaller payments over a period of time can sound enticing, experts warn consumers are “playing with fire.”

If all payments are made on time, then yes, you only pay the original price, but the problem comes when payments are late. Now you face the risk of a late fee and even interest, increasing the overall amount spent. Now add in the aspect of putting these purchases on credit cards, and the interest on the item purchased is even higher than before as you work to pay down your card balance.

To be clear, these are all aspects of credit cards that can be avoided. By setting clear boundaries and avoiding excessive spending, you can sit back and reap the benefits of having a card instead of stressing over debt. When used responsibly, a credit card can help you build your credit history, protect you from fraud, earn rewards, and more. Perhaps that is why 81% of Americans view having access to credit via credit cards as a privilege.

Our survey reveals that for many Americans, credit card debt isn’t just about dollars and cents. It’s about emotions, habits, and shifting economic realities that make overspending easy but repayment difficult. So we took a look inside the emotional triggers and situational pressures that make overspending feel easy in the moment but hard to escape later.

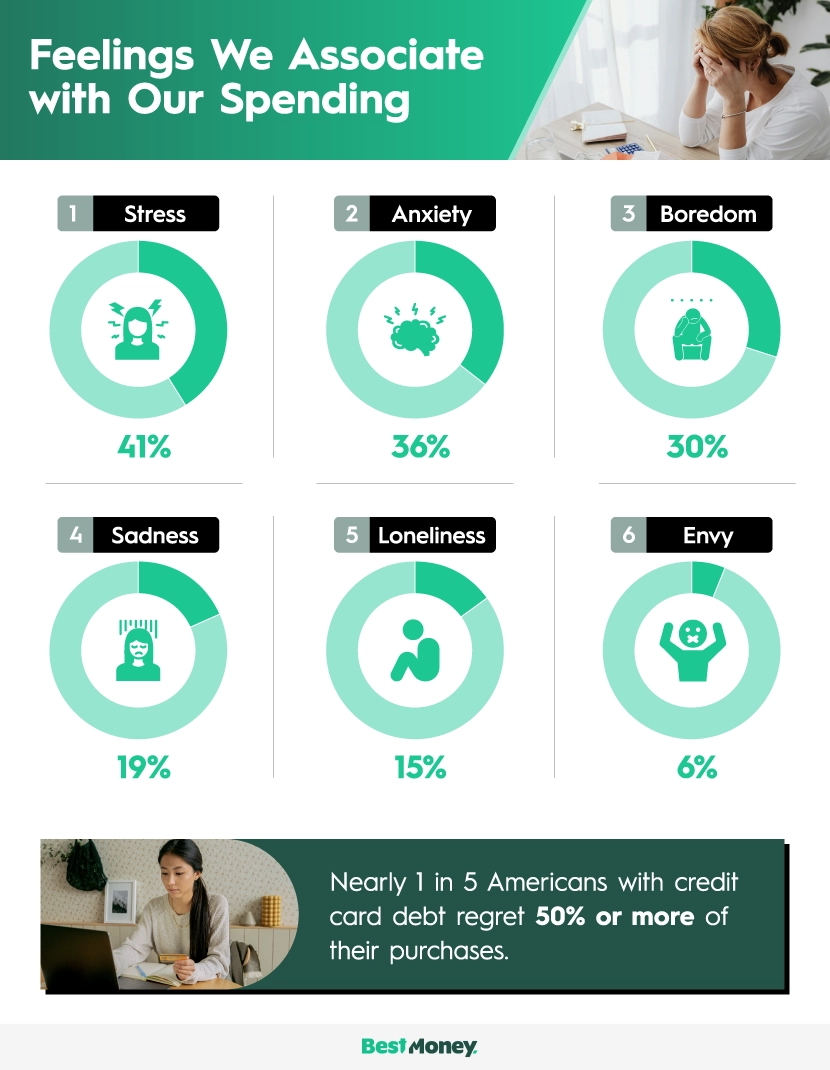

Stress and anxiety dominate the emotional landscape of credit card spending, with 41% linking debt to stress and anxiety coming in second. These two emotions can leave a lasting impact on credit card debt though, as 52% of people admit to regularly making unplanned comfort purchases at the end of a stressful week. Over time, those purchases can add up, leading to a high or even maxed out credit card balance.

Boredom, sadness, and loneliness don't just trigger spending — they can also heighten stress and anxiety, creating a feedback loop of emotional strains and impulse buys. Boredom, reported by 1 in 3 Americans, is the third feeling most associated with spending, followed by sadness and loneliness in fourth and fifth place, respectively. It’s no wonder that 40% admit to making unplanned purchases to feel better about other parts of their lives, even if it risks deepening their debt.

Experts warn that giving into these emotional impulses can lead to a more severe problem like compulsive buying disorder. Also known as a shopping addiction, compulsive buying disorder can impact our lives in many ways from increased debt to impacts on personal relationships.

Aside from feelings, we discovered another aspect raising Americans’ credit card debt — the YOLO (you only live once) mindset. This concept has led to 44% of people with debt regularly making unplanned purchases. Additionally, 1 in 3 people with credit card debt make purchases based on the idea that it's "nearly impossible to save in this economy, so I might as well just spend and enjoy life while I can."

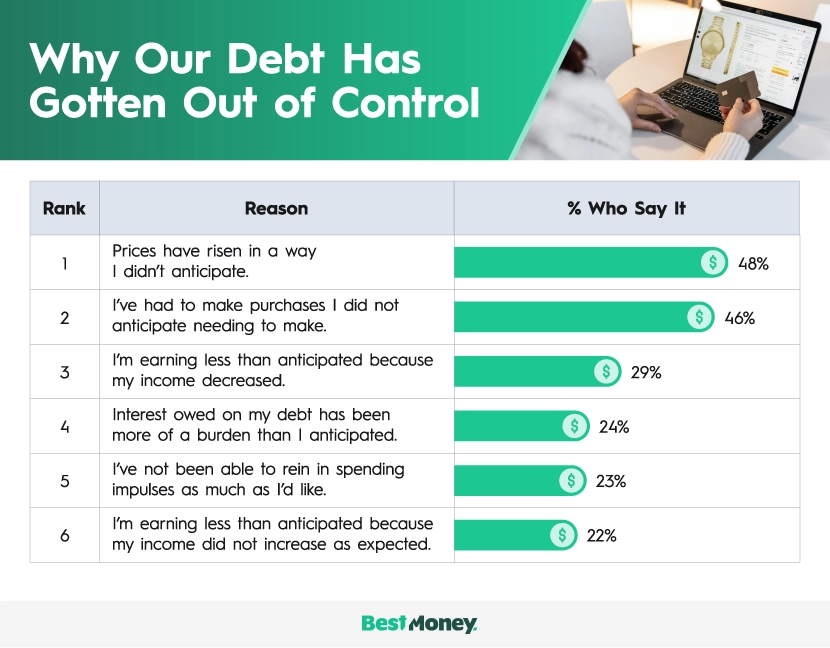

Americans point to rising prices and uncontrolled spending as the biggest culprits for their growing credit card debt. Leading the way, nearly 1 in 2 people report that prices rising in a way they didn’t anticipate has caused their credit card balances to climb. Similarly, 46% of people say their debt is a result of them making purchases they did not anticipate needing to make.

Income instability compounds the problem, which makes it difficult to keep up with payments, causing debt to spiral out of control. Nearly 1 in 3 Americans say their lingering debt stems from a drop in earnings while another 1 in 5 point to stagnant wages that failed to increase as they had expected.

Excessive buying can lead to high credit card balances, but high interest rates can keep debt lingering. We found that nearly 1 in 4 people say the interest owed on their debt has been more of a burden than they anticipated.

Signing up for a credit card is a big responsibility. It is important to keep spending in check and ensure that any purchases you make are payable in the future to avoid high interest rates and mountains of debt. Credit cards can unlock convenience and rewards, but only when wielded responsibly.

Are you ready to make the commitment? Well, you’re in luck, because the team at Best Money is here to help. We have done the research for you so you can easily browse which of our best credit cards offer the highest welcome bonus, their reward rates, annual fees, and more.

Think of Best Money as your own personal card concierge, as you tell us which perks matter to you. Whether you're a frequent flyer seeking a travel credit card, or an avid shopper seeking a cashback credit card, we will spotlight the options that align best with your priorities.

In this study, we set out to learn about Americans spending habits and their credit card usage. To do this, we surveyed more than 1,200 people across the country and asked a variety of questions including how they budget, if they have credit card debt, what factors contributed to their credit card debt, how feelings impact their spending, and more.

The BestMoney editorial team is composed of writers and experts covering a full range of financial services. Our mission is to simplify the process of selecting the right provider for every need, leveraging our extensive industry knowledge to deliver clear, reliable advice.