With the national average commute time sitting at approximately 26.8 minutes and gas prices and insurance costs fluctuating across states, some commuters face significantly higher financial burdens than others.

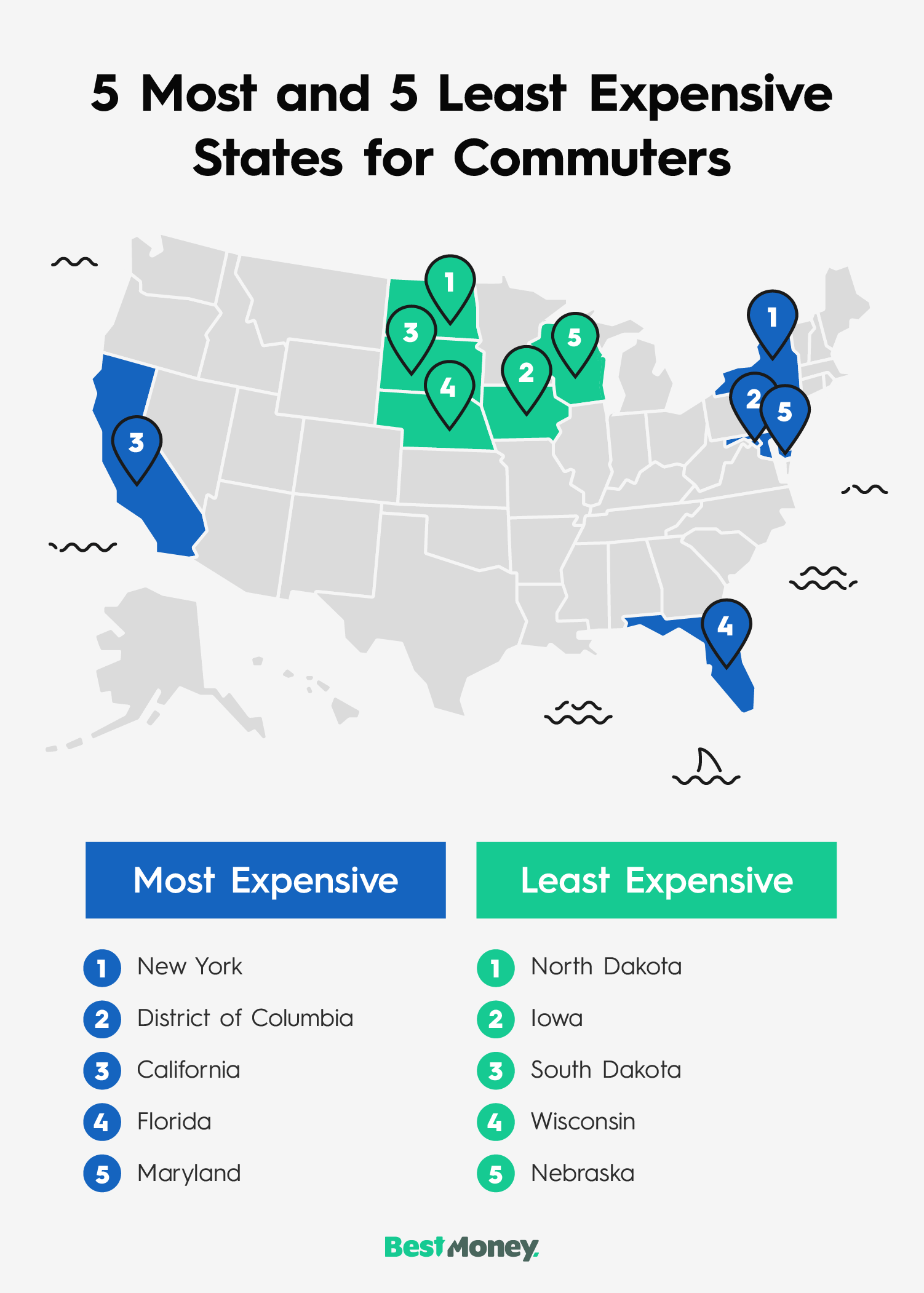

Our team analyzed the data to rank the states based on the costs of the average work commutes. New York took the top spot as the most expensive state for commuters, while North Dakota ranked as the least expensive.

In this post, we’ll examine these rankings, showcasing how much state-level factors can impact the different costs of commuting by car to work.

We’ll also identify additional benefits for your health and the environment and share practical tips to lower your commuting expenses, such as finding ways to save on car insurance by reducing your mileage through a shorter commute.

5 Most Expensive States for Commuting by Car

| State | Average Commute Time (minutes) | Average Gas Price | Average Car Insurance Premium |

|---|---|---|---|

| 1. New York | 33.2 | $3.151 | $1,634.94 |

| 2. District of Columbia | 30.5 | $3.176 | $1,559.42 |

| 3. California | 29.2 | $4.485 | $1,212.81 |

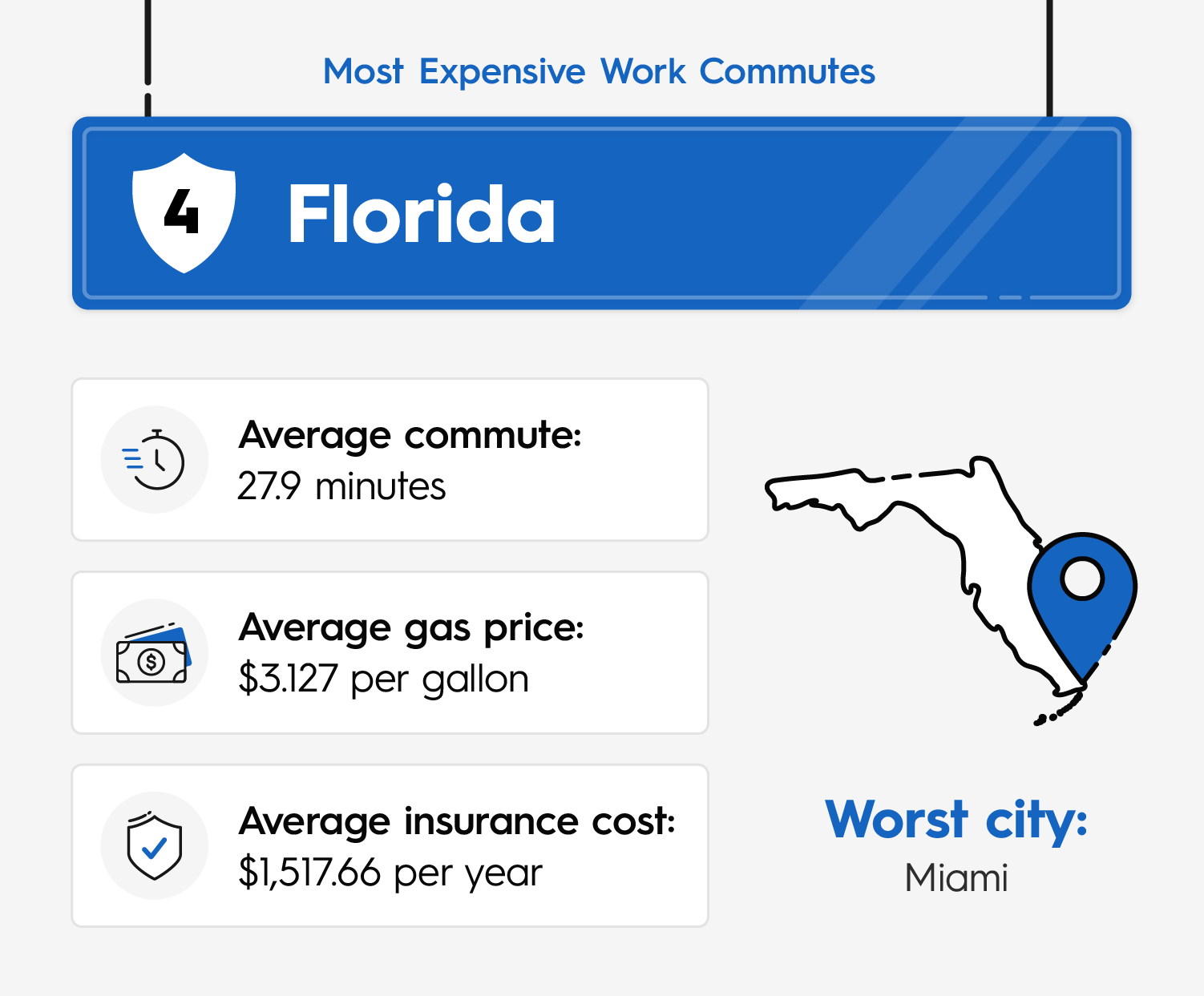

| 4. Florida | 27.9 | $3.127 | $1,517.66 |

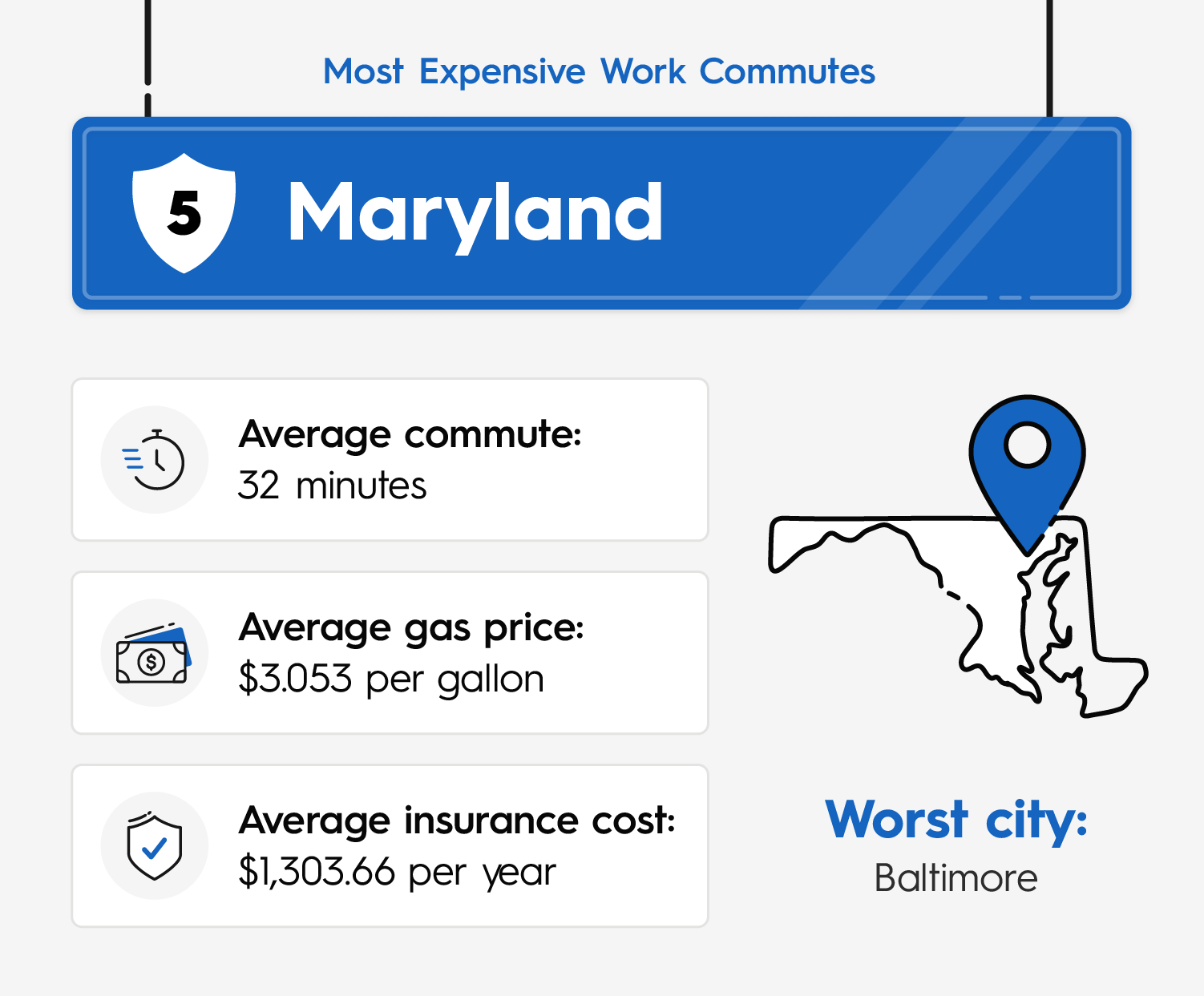

| 5. Maryland | 32 | $3.053 | $1,303.66 |

For residents of the five states where commuting costs the most, the related daily expenses can strain monthly budgets, impacting everything from disposable income to savings goals. They also often spend more time in traffic, increasing stress and reducing time for other priorities.

Over time, even small differences in commuting costs can add up, making location a crucial factor for affordability.

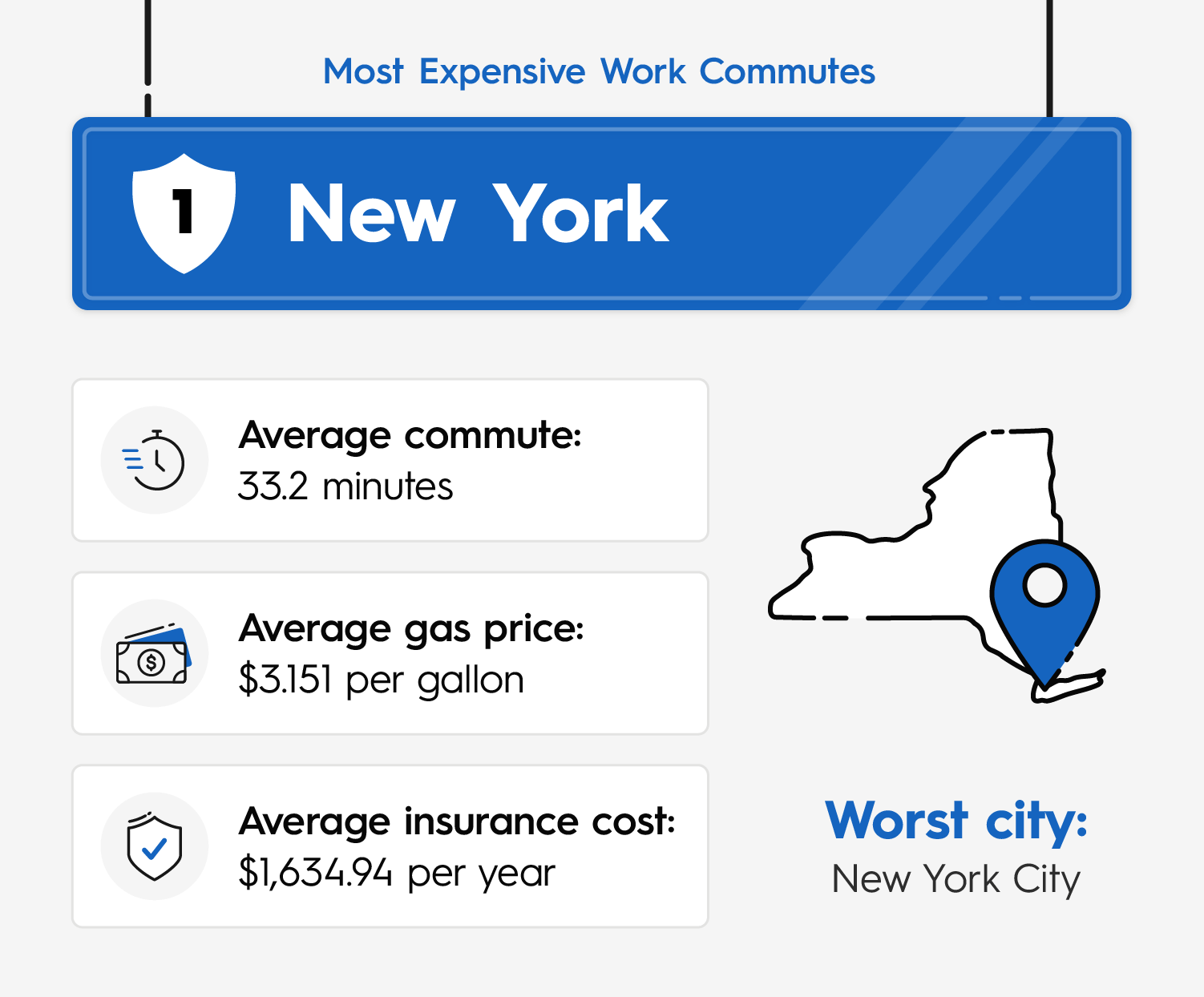

1. New York

New York tops the list of most expensive states for commuting, and it’s no surprise given the combination of factors driving up costs.

- Commute time: With an average commute time of 33.2 minutes — well above the national average — New Yorkers spend more time on the road, leading to increased fuel consumption and wear-and-tear on vehicles.

- Fuel costs: The state’s average gas price of $3.151 per gallon also exacerbates costs, especially for those driving long distances or navigating high-traffic areas.

- Insurance rates: Adding to the financial strain, New York drivers face one of the highest average car insurance premiums in the country at $1,634.94, reflecting both the state’s dense population and elevated risk of accidents and claims.

- Worst place to commute: A closer look at New York City, home to the state’s worst commutes, highlights the challenges. Ranked #1 on Inrix’s Global Traffic Scorecard, NYC commuters lost an average of 101 hours in traffic in 2023 — the only city in the world to exceed 100 hours.

Traffic congestion and an average last-mile speed of just 11 mph make driving in the city inefficient. These factors, combined with steep parking costs and high toll fees, make NYC’s commutes particularly grueling.

The city's extensive subway and bus network couples with its pedestrian-friendly design to offer viable alternatives to driving. Given the high costs associated with driving in NYC, a shorter commute could be achieved by opting for more walkable neighborhoods or relying on public transportation.

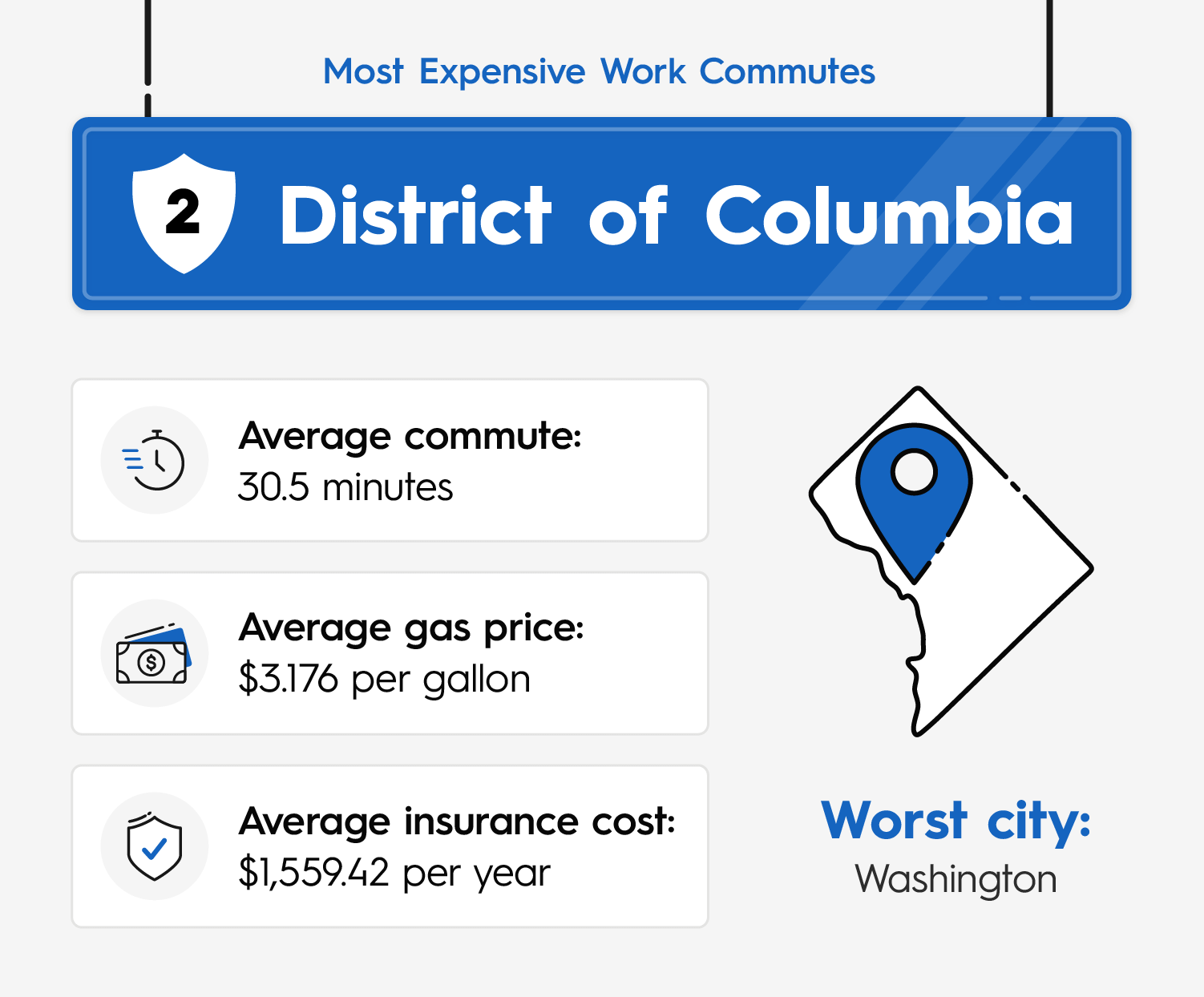

2. District of Columbia

Washington, DC, ranks as the second most expensive place for commuting, driven by a mix of long commute times, elevated gas prices, and high car insurance premiums.

- Commute time: With an average commute of 30.5 minutes, residents spend a lot of time navigating congested roads, which increases fuel consumption.

- Fuel costs: Gas prices in DC average $3.176 per gallon, further straining commuters’ wallets.

- Insurance rates: The average car insurance premium in DC is $1,559.42, reflecting a heightened risk of accidents and claims. Traffic congestion plays a significant role in these high costs, particularly in the city itself.

- Worst place to commute: Ranked #18 on Inrix’s Global Traffic Scorecard, DC drivers lost an average of 63 hours to traffic in 2023, marking a sharp 20% increase from 2022. Despite this recent rise, traffic levels are still 9% lower than in 2019.

The average last-mile speed in DC is just 11 mph, emphasizing the inefficiency of driving in urban areas, where stop-and-go traffic burns more fuel and increases vehicle maintenance needs.

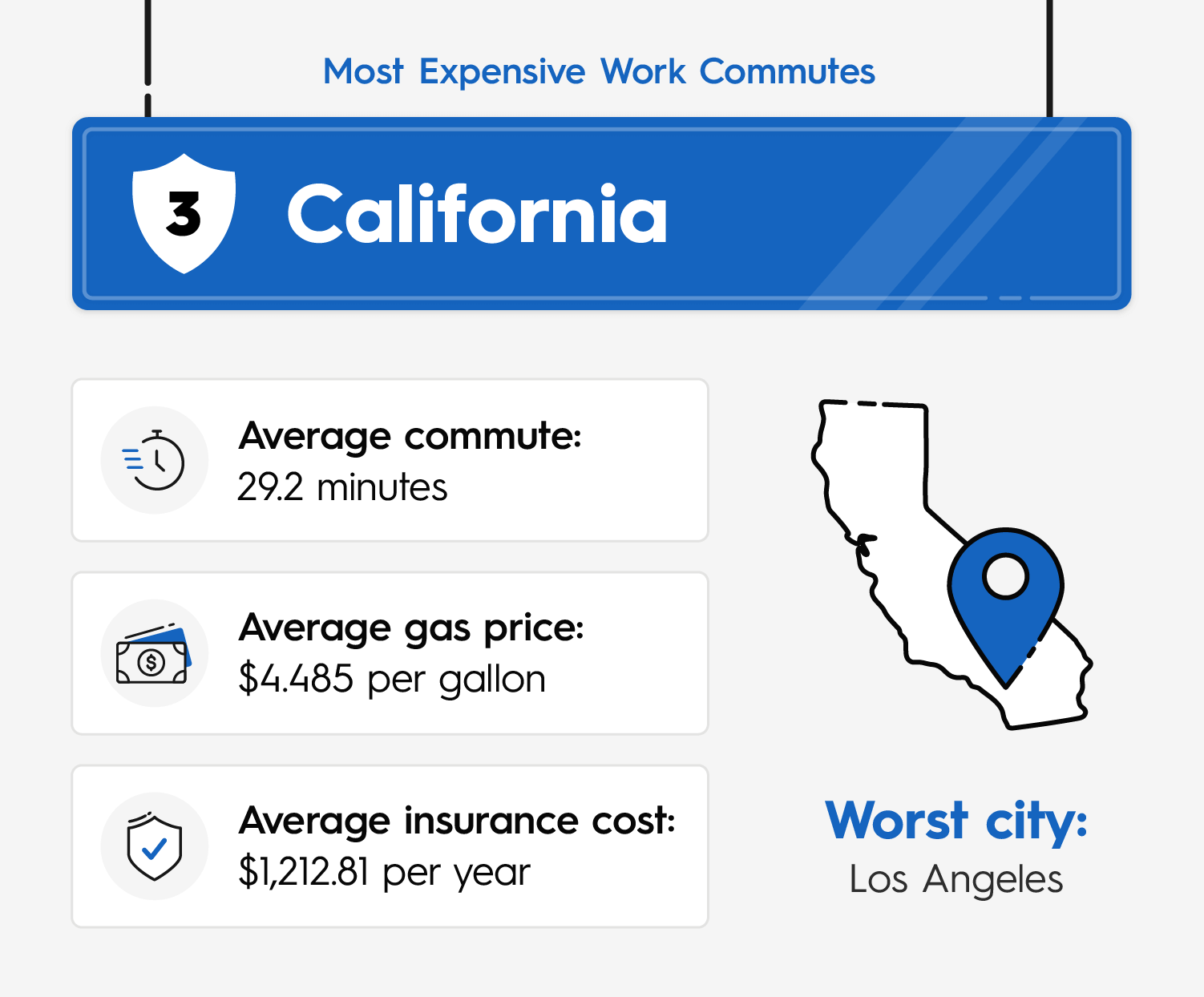

3. California

California ranks third among the most expensive states for commuting, largely due to its high gas prices and lengthy travel times.

- Commute time: Commuters have an average commute time of 29.2 minutes, amplifying fuel costs and increasing vehicle wear and tear.

- Fuel costs: The state’s average price for regular gas is $4.485 per gallon, significantly higher than the national average of $3.08 at the time of this research.

- Insurance rates: While car insurance premiums in California are somewhat lower than in other top-ranking states at $1,212.81, they still contribute to the overall financial burden of daily commutes. But many insurance companies offer discounts to drivers who log fewer miles each year.

- Worst place to commute: Los Angeles, home to the state’s most congested commutes, provides a clear example of these challenges. Ranked #7 on Inrix’s Global Traffic Scorecard, LA drivers lost an average of 89 hours in traffic in 2023, marking a 13% increase from 2022.

LA’s infamous traffic lives up to its reputation. With an average last-mile speed of 19 mph, drivers face slowdowns that extend commute times, resulting in inefficiencies like excessive idling and frequent stops.

As a state, California has fewer refineries than other parts of the country and more strict environmental regulations than the federal government’s gasoline program. Both factors contribute to the high cost of gas in the Golden State.

However, by reducing their reliance on a car and opting for walking, cycling, or carpooling, Californians could see a significant decrease in their annual premium. They can help the environment by reducing emissions, while simultaneously saving some money.

4. Florida

The fourth most expensive state for commuters is Florida, with above-average car insurance premiums and commute times.

- Commute time: With an average commute time of 27.9 minutes, drivers in Florida spend significant time on the road.

- Fuel costs: That time-consuming commute led to higher fuel expenses despite relatively moderate gas prices of $3.127 per gallon. Together, these factors make commuting in Florida a substantial financial consideration for many residents.

- Insurance rates: The state’s average insurance cost of $1,517.66 reflects factors like high traffic volumes, frequent accidents, and exposure to extreme weather risks.

- Worst place to commute: Miami, the state’s most congested city, ranked #11 on Inrix’s Global Traffic Scorecard, Miami drivers lost an average of 70 hours in traffic in 2023, reflecting an 18% rise since 2019.

The city’s average last-mile speed of 14 mph underscores the gridlock that slows drivers, particularly in downtown areas and along major highways. These delays not only extend travel times but also contribute to fuel inefficiencies and driver frustration.

5. Maryland

Maryland lands fifth on the list of the most expensive states for commuting, with high car insurance premiums and lengthy travel times contributing to the financial strain on residents.

- Commute time: Maryland’s average commute time of 32 minutes is among the longest in the nation — second only to New York — reflecting the state’s proximity to major metro hubs like Washington, DC, and Baltimore. Long hours spent on the road increase fuel consumption, vehicle wear, and overall commuting costs.

- Fuel costs: While the state’s gas prices, averaging $3.053 per gallon, are not the highest in the country, they still add up over extended travel distances.

- Insurance rates: Maryland drivers pay an average car insurance premium of $1,303.66, reflecting risks associated with dense traffic and urban driving conditions.

- Worst place to commute: In Baltimore, Maryland’s largest city and ranked #81 on Inrix’s Global Traffic Scorecard, commuters face unique challenges. Drivers there lost an average of 44 hours in traffic in 2023, representing a sharp 26% increase from the previous year.

With an average last-mile speed of just 13 mph, navigating the city’s streets is slow and frustrating, particularly during peak travel hours. These delays amplify the time and cost burden for commuters, whether traveling within Baltimore or to nearby regions.

5 Least Expensive States for Commuting by Car

| State | Average Commute Time (minutes) | Average Gas Price | Average Car Insurance Premium |

|---|---|---|---|

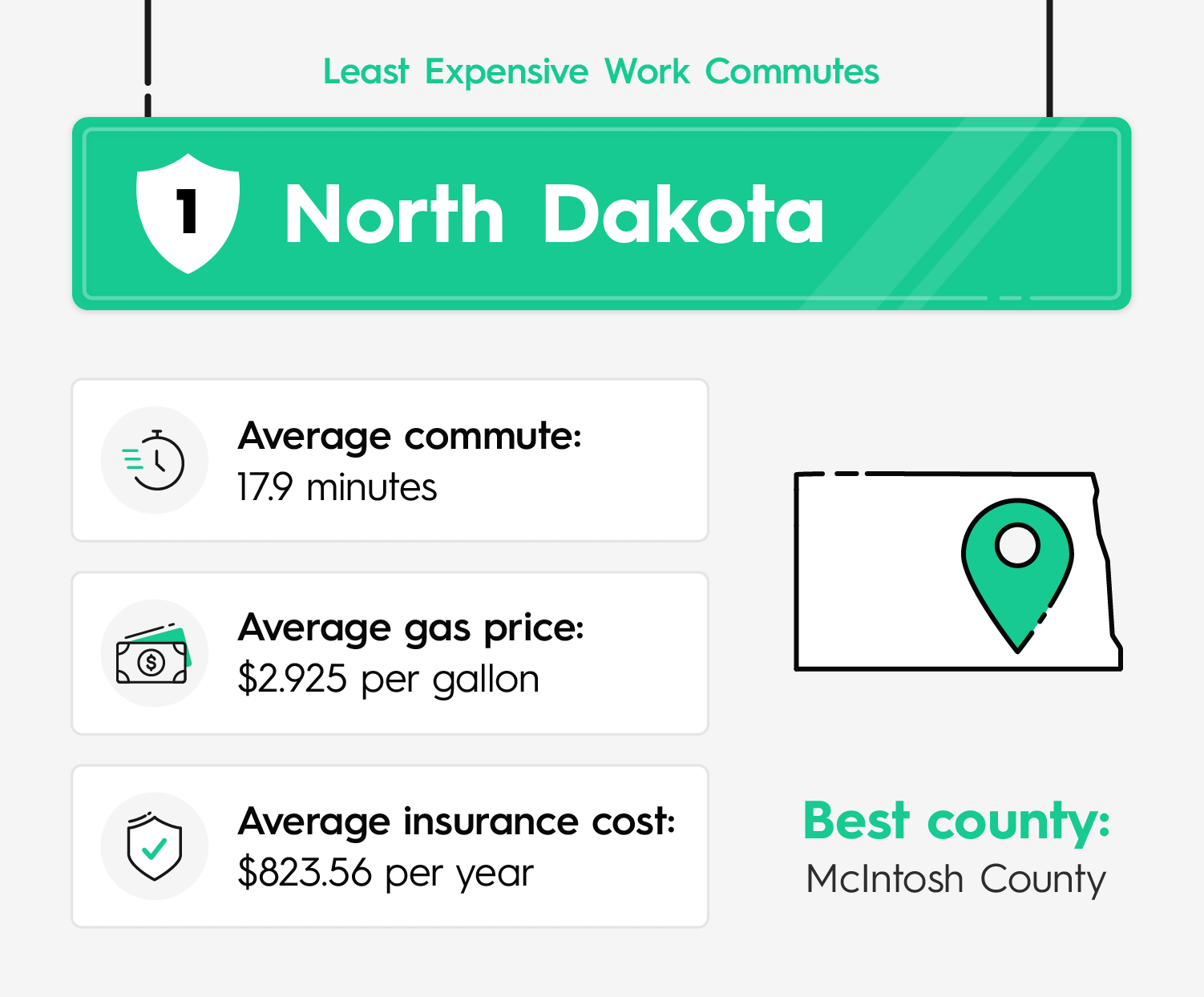

| 1. North Dakota | 17.9 | $2.925 | $823.56 |

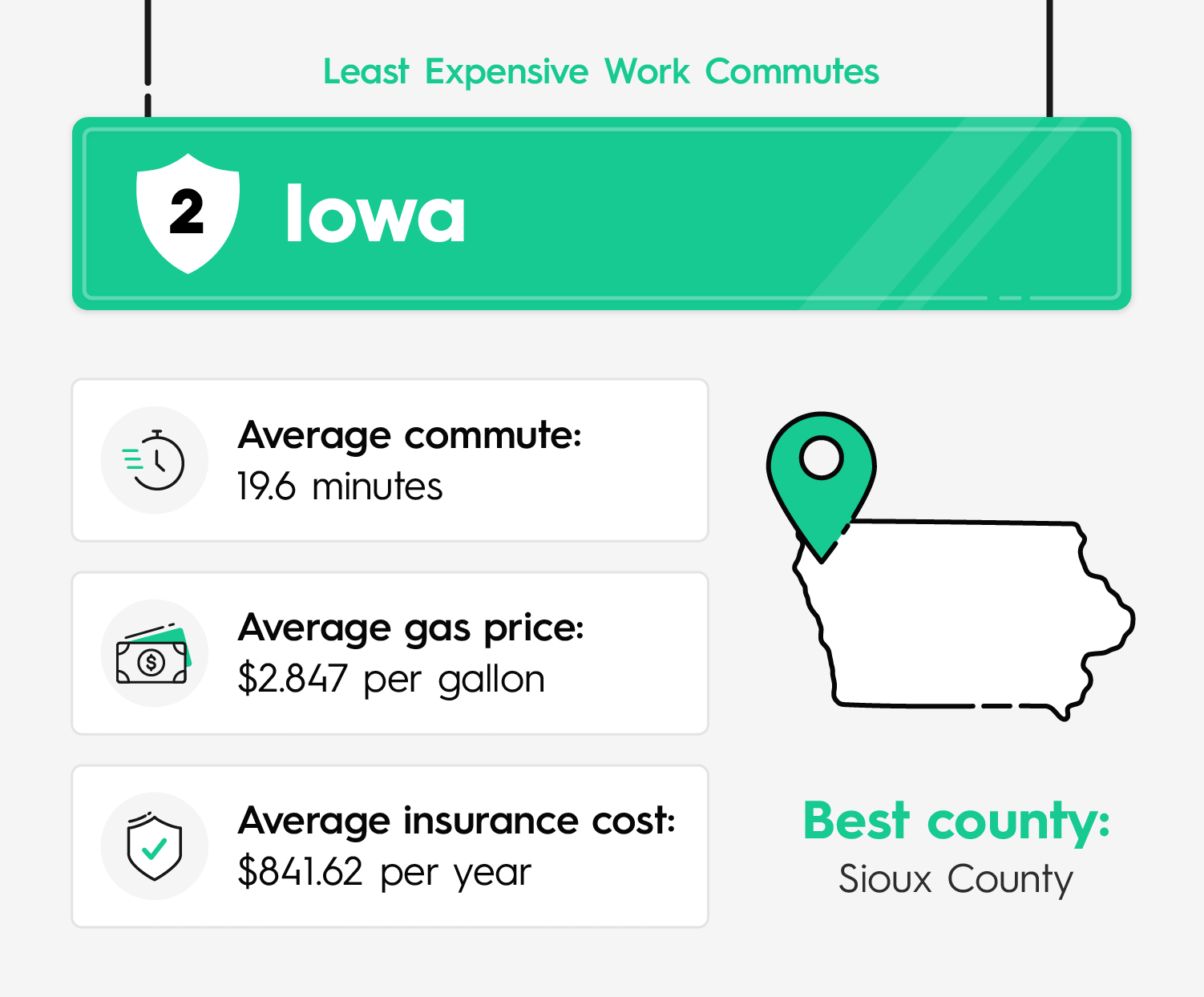

| 2. Iowa | 19.6 | $2.847 | $841.62 |

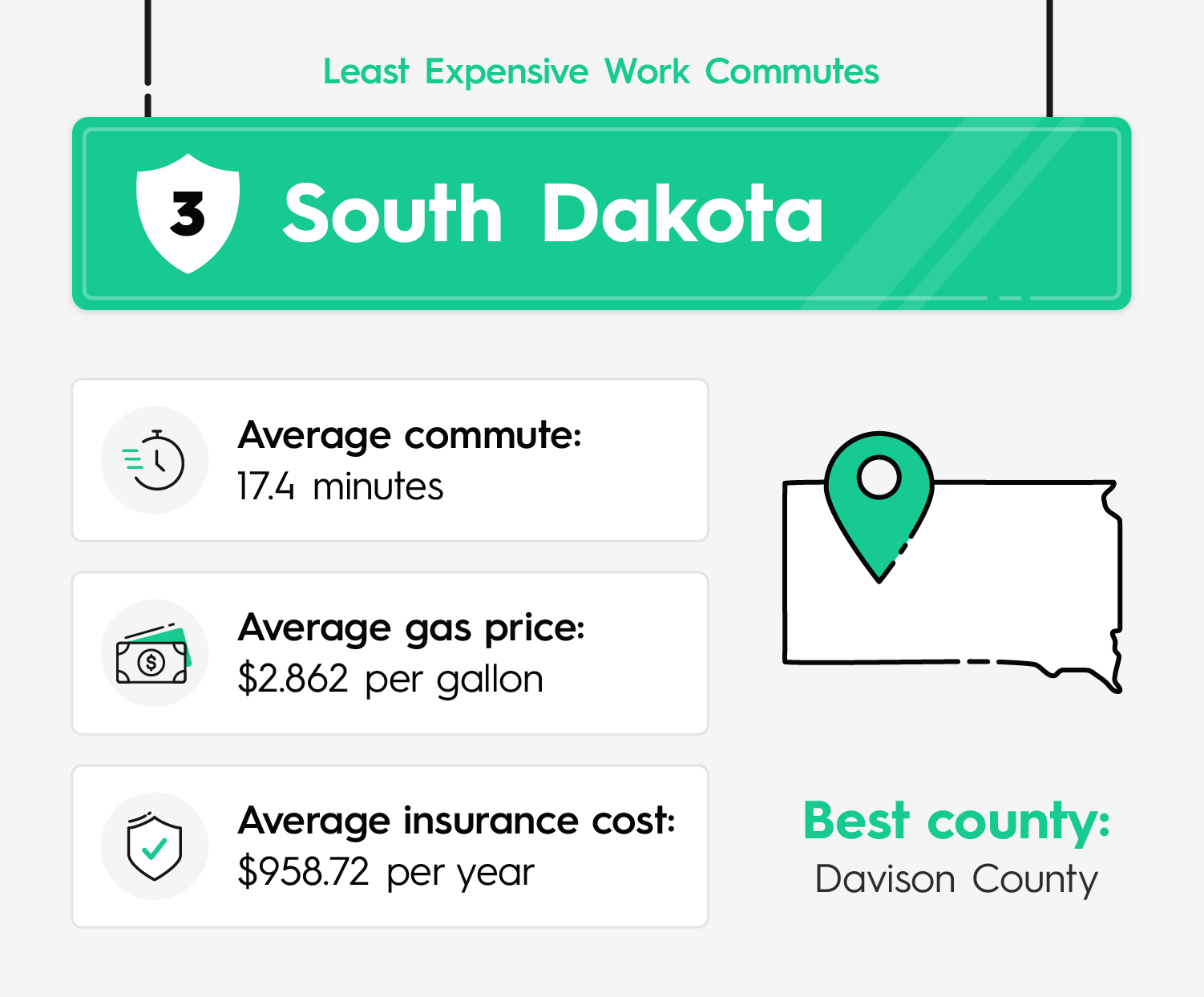

| 3. South Dakota | 17.4 | $2.862 | $958.72 |

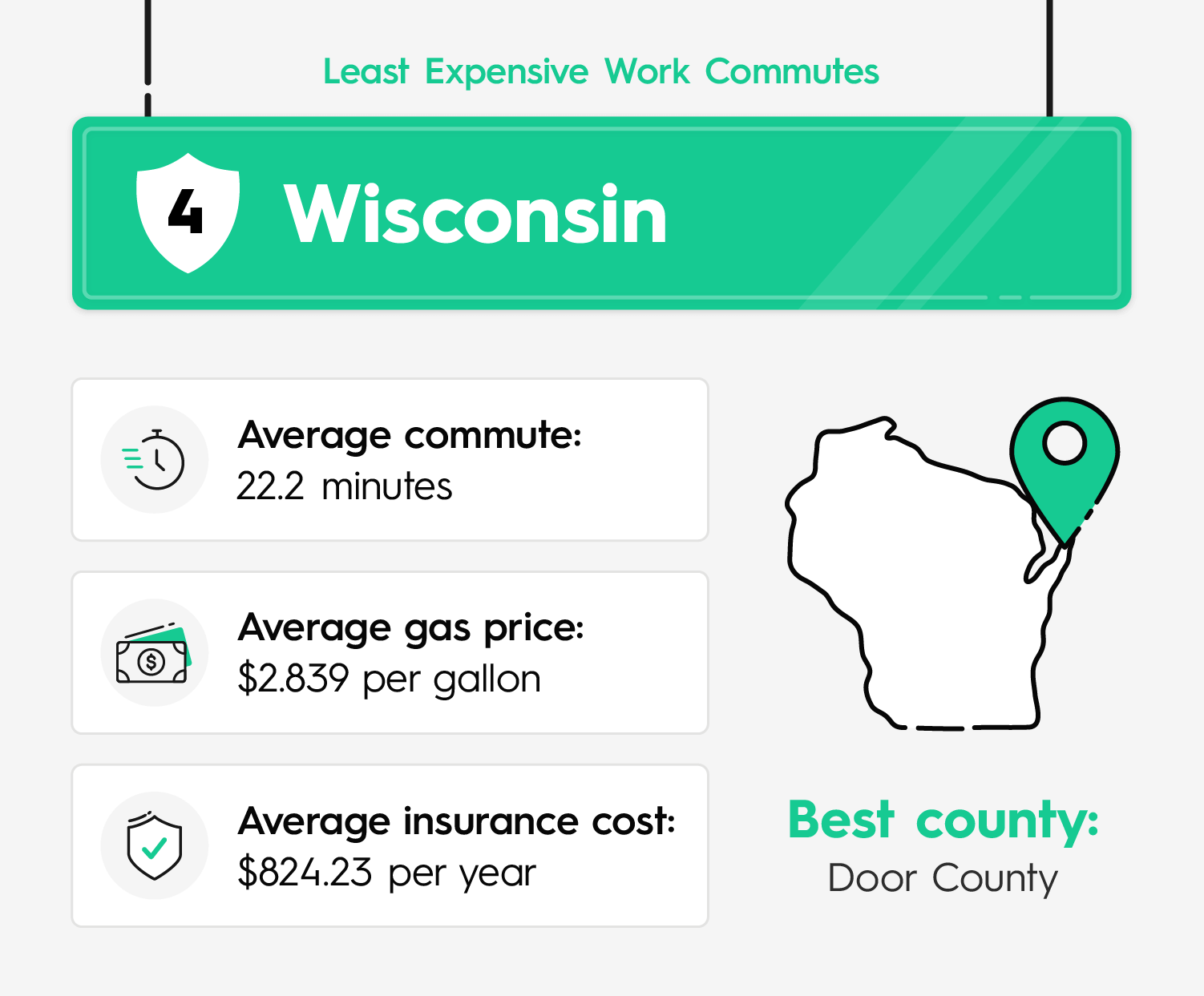

| 4. Wisconsin | 22.2 | $2.839 | $824.23 |

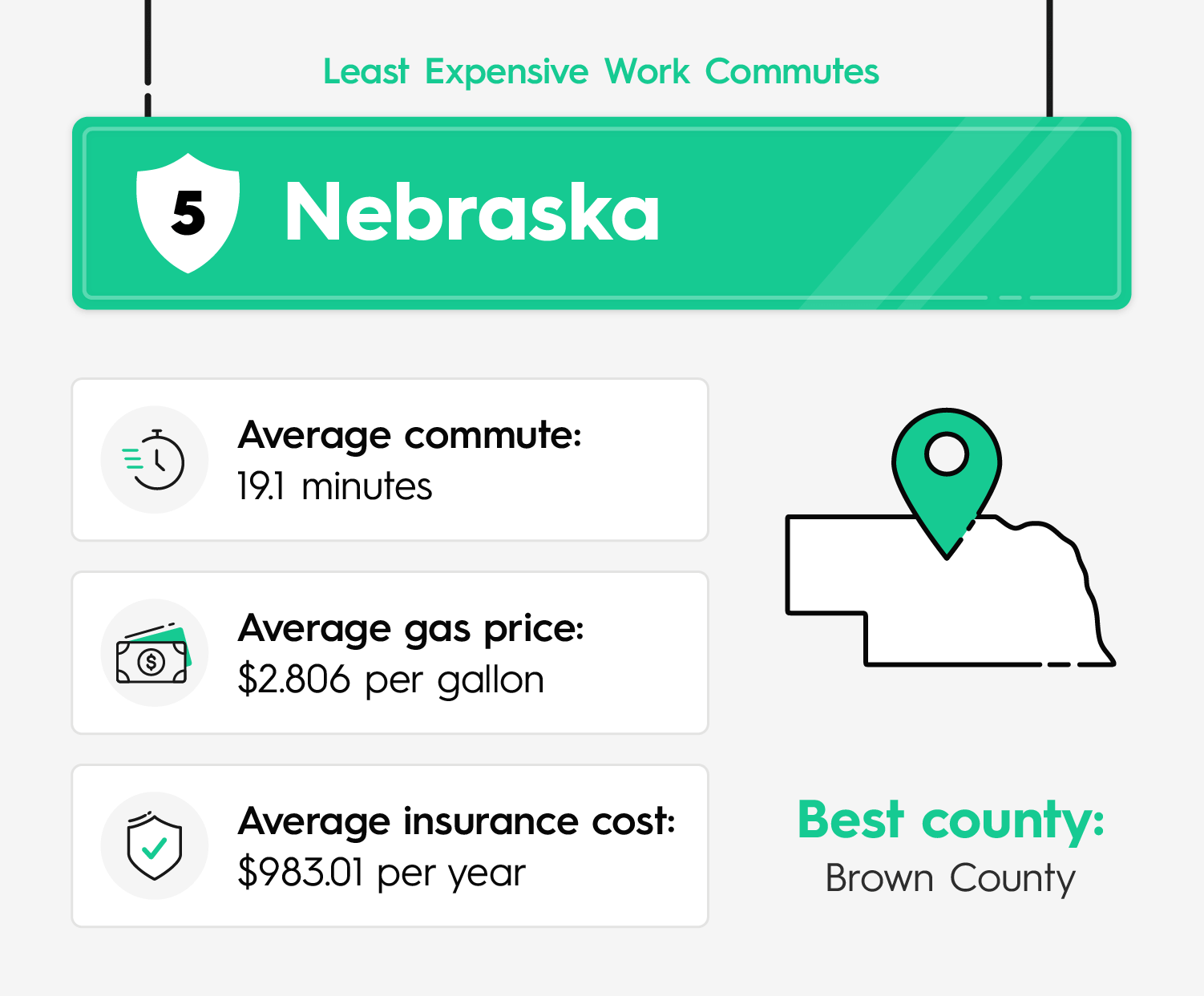

| 5. Nebraska | 19.1 | $2.806 | $983.01 |

For drivers in the five least expensive states, commuting offers a far more manageable impact on both finances and time. With shorter travel distances, lower gas prices, and more affordable car insurance premiums, residents in these states can enjoy significant savings compared to their counterparts in costlier regions.

In addition to financial benefits, less congested roads and shorter commutes often translate into a better quality of life. Drivers spend less time stuck in traffic and more time focused on what matters most.

1. North Dakota

North Dakota claims the top spot as the least expensive state for commuting, offering residents significant financial and time-saving advantages.

- Commute time: One key factor is the state’s remarkably short average commute time of 17.9 minutes, well below the national average. With fewer vehicles on the road and less congestion, drivers can reach their destinations more efficiently, reducing fuel consumption and vehicle wear.

- Fuel costs: North Dakota’s gas prices average $2.925 per gallon, further minimizing commuting costs for residents. That price is $1.56 less than California’s high prices.

- Insurance rates: Another contributing factor is the state’s low car insurance premiums, which average just $823.56 — the second cheapest in the country. The lower rates reflect North Dakota’s lower population density, reduced traffic accident rates, and safer driving conditions.

- Best place to commute: McIntosh County exemplifies North Dakota’s commuter-friendly environment, boasting the shortest average commute time of 11.1 minutes. Less than 1% of workers in this county face commutes exceeding an hour, and only 5.9% travel outside their county of residence for work.

With no reliable data on cities with the best commutes in the least expensive states, we turned to county-level data for North Dakota and the other least expensive commute states.

McIntosh County’s localized commuting pattern, combined with the state’s open roads and minimal congestion, allows McIntosh County residents to enjoy efficient and low-cost commutes.

North Dakota’s unique combination of affordability and convenience highlights the advantages of living and working in less congested areas. Together, these factors create a cost-effective environment for commuters, making it easier for residents to balance work and personal expenses.

2. Iowa

Iowa ranks second among the least expensive states for commuting, offering residents a combination of both time and cost savings.

- Commute time: The state’s average commute time is just 19.6 minutes, reflecting the benefits of low traffic congestion and shorter travel distances.

- Fuel costs: Lower fuel costs also contribute to affordability, with gas prices averaging $2.847 per gallon. Drivers can keep more money in their pockets while spending less time on the road.

- Insurance rates: Car insurance premiums in Iowa average just $841.62 annually — well below the national average premium of $1,189.50. These low rates stem from the state’s lower population density, fewer accidents, and reduced claims frequency, making driving here less financially burdensome.

- Best place to commute: Sioux County stands out as the best place for commuting in Iowa, with a mean travel time of only 13.1 minutes for its 36,000+ residents. A mere 2.1% of workers face commutes longer than an hour, and just 8.2% commute outside the county for work.

When combined, these factors make Iowa a prime example of how efficient roadways and affordable essentials can simplify the daily commute.

The strong local employment base and absence of major traffic bottlenecks make commuting in Iowa’s rural and suburban regions highly efficient. With shorter travel times and smoother drives, residents enjoy a mostly stress-free and cost-effective journey to work.

3. South Dakota

South Dakota ranks third among the most budget-friendly states for commuting.

- Commute time: The state’s average commute time of 17.4 minutes is the lowest in the entire U.S. This efficiency is largely due to the state’s low population density and well-maintained road networks, allowing residents to travel to work quickly and with minimal delays.

- Fuel costs: The average price for regular gas in South Dakota is $2.862 per gallon.

- Insurance rates: With car insurance premiums averaging $958.72 annually, South Dakota offers a financial advantage for drivers compared to many other states.

- Best place to commute: Davison County in southeastern South Dakota exemplifies the state’s commuter-friendly conditions, boasting a mean travel time of just 11.9 minutes. Only 2.8% of workers endure commutes longer than an hour, and just 5.0% of residents work outside the county lines.

This combination of short travel times and localized employment opportunities highlights the financial convenience of living and working in South Dakota. With open roads and minimal congestion, commuting here is affordable and low-stress, offering residents more time and resources to dedicate to their personal lives.

4. Wisconsin

The state of Wisconsin offers the fourth least expensive commute for workers.

- Commute time: Thanks to the state’s rural and suburban landscape minimizing traffic congestion, quicker and more predictable travel is possible. This leads to a relatively short average commute time of 22.2 minutes.

- Fuel costs: With gas prices averaging $2.839 per gallon, Wisconsin drivers benefit from a combination of low fuel and insurance costs.

- Insurance rates: The state also has exceptionally low car insurance premiums, averaging $824.23 annually.

- Best place to commute: Based on US Census data, Door County stands out as Wisconsin’s most commuter-friendly county. With a mean travel time of just 17.5 minutes, it highlights the ease of getting to work in this region. This efficiency reflects the region’s spread-out population and accessible road networks, which help avoid traffic bottlenecks.

While 9.7% of residents commute outside the county for work, only 2.9% of residents commute over an hour. The proximity of job opportunities within the region ensures minimal disruption to daily routines.

Wisconsin’s commuting conditions, as seen in Door County, emphasize more than just cost savings. The predictability and accessibility of travel reduce stress for residents, promoting a lifestyle that balances affordability with practical convenience.

5. Nebraska

Nebraska is the fifth least expensive state for commuting, thanks to its efficient travel times and low fuel and insurance costs.

- Commute time: The state’s average commute time is just 19.1 minutes, reflecting minimal congestion and the accessibility of work opportunities within proximity.

- Fuel costs: Gas prices in Nebraska average $2.806 per gallon, which keeps fuel costs manageable for most residents.

- Insurance rates: Annual car insurance premiums average $983.01, saving drivers over $200 each yearly compared to the national average.

- Best place to commute: Brown County emerges as the best region for commuting in Nebraska, boasting a mean travel time of just 10 minutes. Only 1.9% of workers face commutes longer than an hour, and just 7.4% work outside their county of residence.

The Brown County statistics illustrate the benefits of local employment opportunities and Nebraska’s rural infrastructure, allowing smooth and quick travel. For commuters across the state, Nebraska offers a stress-free and cost-effective commuting experience, enhancing overall quality of life.

What Are the Different Costs of Commuting by Car to Work?

Commute costs and experiences are shaped by several key factors that vary significantly based on location, individual choices, and broader economic conditions. Understanding these elements can help commuters identify areas for potential savings or lifestyle adjustments.

Let’s examine the primary factors influencing commute costs:

Time

- The length of your commute directly impacts costs by increasing fuel consumption, wear and tear on your vehicle, and potential maintenance needs.

- Long commutes also add non-monetary costs, such as lost personal time and increased stress, which can impact physical and mental well-being.

- The opportunity cost of a long commute refers to the time spent stuck in traffic that could be used for hobbies, spending time with loved ones, or professional development. Every hour spent commuting is an hour less for activities that contribute to your overall quality of life.

Gas Prices

- Fuel costs are one of the most variable factors affecting commute expenses, fluctuating with global oil markets, regional taxes, and seasonal demand. Even short trips can become costly for commuters in states with high gas prices, such as California.

Car Insurance Rates

- Urban commuters in states like New York or Florida often pay higher insurance premiums due to greater congestion, higher accident risks, and theft rates, while rural areas generally see lower costs.

- Factors such as age, driving history, and credit scores play a role, with long-distance commuters potentially facing increased premiums due to higher accident likelihood.

- Cars driven daily for long commutes typically have higher insurance rates than those used less frequently. Reducing mileage through strategies like carpooling or remote work can help lower costs.

- Drivers can save by selecting policies tailored to their habits, such as usage-based plans that reward lower mileage or safe driving practices.

Method of Transport

- The way you commute has a profound impact on costs. Driving alone tends to be more expensive than carpooling, using public transportation, or biking.

- Urban areas with extensive transit systems, like Washington, DC, may offer cost-effective alternatives, while rural regions with limited options may leave drivers more reliant on personal vehicles.

- The availability of electric vehicles (EVs) and charging infrastructure also shifts the financial and environmental dynamics of commuting.

Environmental Concerns

- Long commutes in gas-powered vehicles contribute to higher carbon emissions, impacting air quality and climate change. Choosing eco-friendly transportation options, such as EVs, biking, or public transit, can reduce a commuter's environmental footprint.

- Reducing commute lengths through remote work or relocation benefits personal finances and the environment, promoting a more sustainable lifestyle.

Lowering the Cost of Your Commute Can Save You More Than Money

While the financial benefits of a less expensive commute are undeniable, the advantages extend far beyond dollars and cents. A shorter or more cost-effective commute can significantly enhance your quality of life.

Mental Health

- Reduced commute times and costs can alleviate stress, a key contributor to mental health challenges. Long commutes are often linked to higher levels of anxiety, frustration, and burnout.

- A less stressful commute frees up mental space for personal growth, creativity, and maintaining better emotional balance.

Physical Health

- Commuting less often or for shorter durations leaves more time for physical activity, whether through exercise, walking, or biking to work.

- Fewer hours in a car can also reduce sedentary behavior, which has been linked to health risks like cardiovascular issues and musculoskeletal pain.

Environmental Impact

- Opting for eco-friendly commuting methods like biking, carpooling, or public transportation can significantly reduce carbon emissions, contributing to cleaner air and a healthier planet.

- Reduced environmental impact benefits the individual and supports global sustainability efforts.

Improved Productivity

- With less commuting time, individuals often have more energy and focus to devote to work or personal projects.

- Employers also often benefit, as shorter commutes can lead to higher job satisfaction and lower absenteeism, creating a win-win for workers and businesses alike.

Tips for Decreasing Your Commute Costs

Reducing the costs of your daily commute doesn’t have to require drastic changes. Simple, actionable strategies can lead to significant savings over time.

Consider a Smaller, More Fuel-Efficient Vehicle

Switching to a more fuel-efficient car can lead to noticeable savings on your daily commute. These vehicles tend to have higher miles per gallon (MPG), so you'll spend less on gas, especially during long commutes.

Smaller cars also typically come with lower insurance premiums. This is because they are less expensive to repair and pose a lower risk of causing major damage in an accident. Insurance companies factor in the vehicle's value, repair costs, and safety features when setting rates, so a smaller, more efficient car can also translate to lower insurance costs.

Find the Right Car Insurance

Switching your car insurance can yield significant savings by ensuring your policy fits your needs. Factors like driving habits, vehicle usage, and coverage requirements can influence premiums, so regularly reviewing options is key.

When comparing providers, focus on more than just cost. Look for coverage levels, deductibles, and additional perks like accident forgiveness or roadside assistance. Adjusting your policy to reflect recent changes, such as reduced mileage, might unlock discounts on your car insurance.

Carpool or Rideshare

By carpooling or using rideshare services, you can split the cost of gas, tolls, and parking with others, reducing your overall transportation expenses. This is especially beneficial for longer commutes, where these costs can add up quickly.

In addition to saving money, carpooling offers environmental benefits by reducing the number of cars on the road, which lowers emissions and traffic congestion. A lower mileage could also reduce your car insurance premiums, as some providers offer discounts for lower mileage.

Maintain Your Vehicle

Regular vehicle maintenance is key to improving fuel efficiency and avoiding costly breakdowns. Simple tasks like checking tire pressure, changing the oil, and replacing air filters can help your car run more efficiently, saving you money on fuel over time.

A well-maintained vehicle is also less likely to experience major issues, which can lead to expensive repairs and unexpected downtime. But a well-kept car can also impact your insurance premiums.

Many insurance companies consider the condition of your vehicle when determining rates, with newer or better-maintained cars often receiving lower premiums. This is because a well-maintained vehicle is less likely to be involved in accidents or require expensive repairs, which lowers the insurer's risk.

Public Transportation

Using public transportation is one of the most cost-effective ways to reduce commuting expenses. It typically costs a fraction of the price of driving, saving you money on gas, parking, and maintenance.

In many cities, monthly passes offer additional savings, providing unlimited travel for a fixed fee. This can be particularly beneficial for commuters who face long distances or high parking fees.

Public transportation also offers convenience and stress relief. It allows you to avoid the hassle of traffic and the stress of finding parking, offering a more relaxed commute. For many, public transportation offers a smoother and more predictable daily routine.

Talk to Your Employer About Remote Work

Working remotely eliminates the daily commute, cutting costs on gas, car maintenance, and parking. With less time spent driving, your car insurance premiums may also decrease due to lower mileage, reducing the risk of accidents and wear on your vehicle.

Remote work also offers flexibility and boosts work-life balance. By cutting out the commute, you gain extra time for personal activities, which can reduce stress and increase overall productivity. Discussing remote work options with your employer can lead to both financial and personal benefits.

Take Control of Your Commute Costs

Based on our findings, states with longer commutes, higher gas prices, and expensive insurance premiums can place a large financial burden on drivers. And states with shorter travel times and lower costs offer notable savings.

Whether you're looking to cut down on expenses in a high-cost state or maximize savings in an affordable one, re-evaluating your car insurance can be a smart first step. Use BestMoney’s car insurance comparison tool to explore plans that help keep more money in your pocket.

Methodology

This state study was completed using data sourced in November 2024. We gathered publicly available data from the U.S. Census Bureau on the mean travel time to work in every state, average regular gas prices from Gas Buddy, and the combined average auto insurance premiums from the National Association of Insurance Commissioners.

The NAIC defines “combined average premiums” as the sum of liability insurance average premiums plus collision average premiums plus comprehensive average premiums.

Weights for each metric are available below:

The BestMoney editorial team is composed of writers and experts covering a full range of financial services. Our mission is to simplify the process of selecting the right provider for every need, leveraging our extensive industry knowledge to deliver clear, reliable advice.