- Home/

- Debt Consolidation/

- America’s Most Frugal Cities: Where Savvy Spending Shapes Everyday Life

America’s Most Frugal Cities: Where Savvy Spending Shapes Everyday Life

January 6, 2026

January 6, 2026

In fact, a new BestMoney study reveals that 83% of Americans consider themselves frugal, but how many are actually walking the walk?

At BestMoney, our mission is to help you make confident financial decisions, whether you’re choosing the right credit card, comparing insurance options, or exploring smarter banking solutions. To better understand how people are stretching their dollars today, we surveyed more than 2,400 residents across 40 major U.S. cities about their real spending habits.

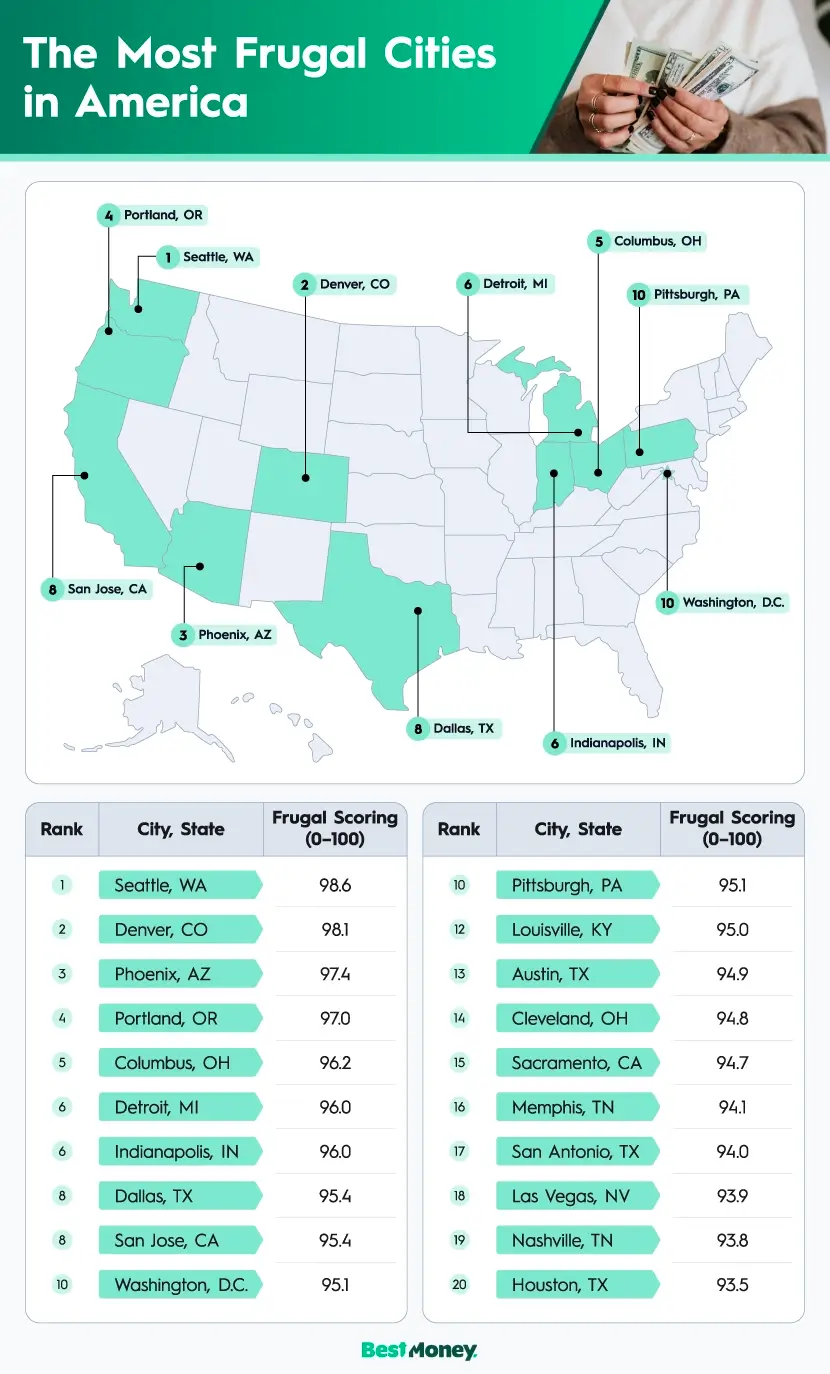

We asked about the sacrifices they make, the swaps they choose, and the small daily decisions that add up—and then used those answers to assign each city a frugality score from 0 to 100. The results revealed surprising patterns in how Americans budget, save, and cut costs. Here’s what we learned.

When people hear the word “frugal,” they often picture Ebenezer Scrooge counting coins in a cold room. But for many Americans today, frugality is less about deprivation and more about stability—and even building wealth.

Part of that stability involves optimizing how you pay off what you owe. For those balancing high-interest balances, timing is key; knowing whether to apply for a debt consolidation loan now or later can be a major factor in your long-term savings strategy.

And some cities stand out as leaders in strategic saving.

Seattle tops the list as the most frugal city in America. One of the biggest drivers? Cooking at home. Residents reported preparing at least 14 meals per week, making them the most likely city to consistently skip costly takeout and restaurant dining. Small habits like this helped Seattle secure its No. 1 ranking.

Denver follows close behind, with 98% of residents purchasing store-brand or generic items to trim their grocery bills. An impressive 85% also reported using coupons, promo codes, or price matching, making cost-savvy shopping a clear cultural norm.

Phoenix residents stand out for energy-saving behavior. Despite scorching 105º summers, they’re the most likely to set their thermostats to specific money-saving temperatures, resisting the urge to blast the AC, which is no easy feat in the desert heat.

When viewing spending habits by age, we found it was millennials and baby boomers who were most likely to consider themselves frugal. We also discovered that Americans with an annual household income of less than $65,000 are most likely to say they are frugal.

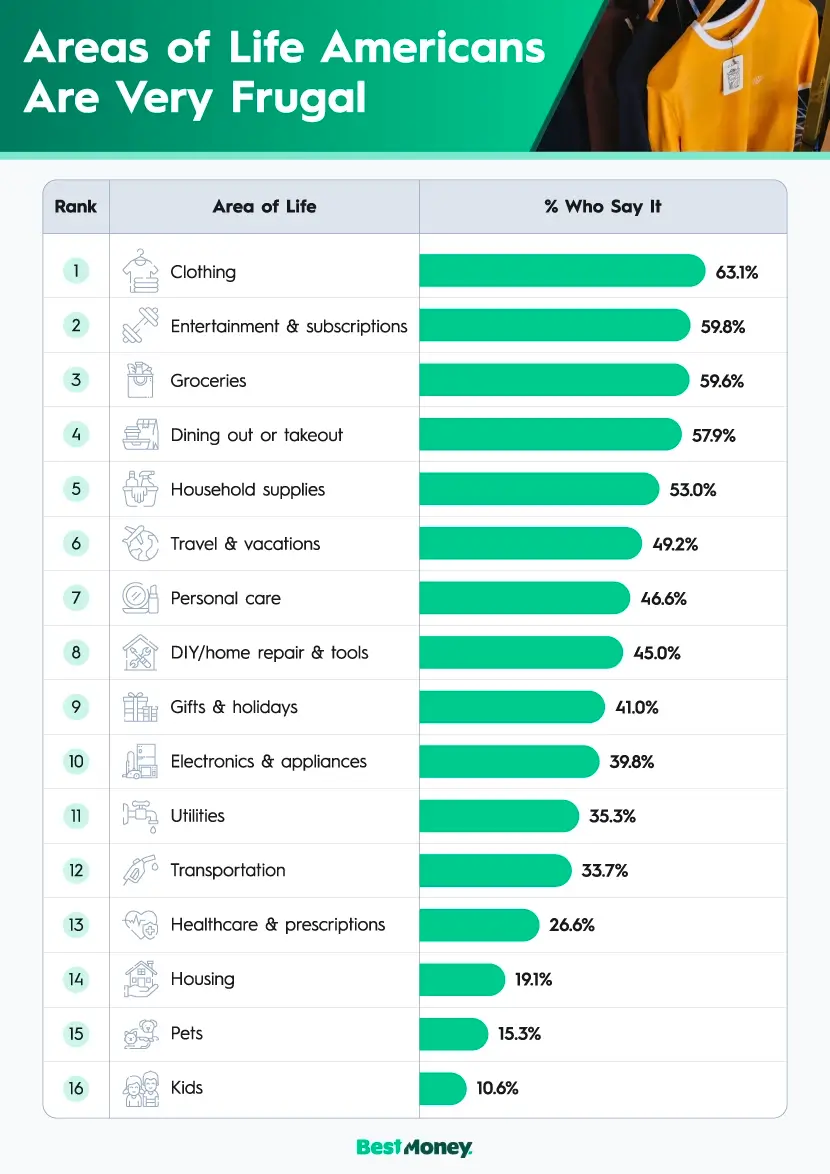

To expand on our frugality research, we wanted to gain insight into the things Americans are cutting out or spending less on to save money when possible. Up first is clothing with 63% of people saying they are very frugal when purchasing clothes. Whether you opt for thrifted items or simply seek out deals, you can find many opportunities to save when shopping for attire.

Next up for saving categories are entertainment and subscriptions, with 60% of people reporting this is an area in which they are very frugal. While many businesses offer convenient subscriptions, from streaming services to gyms, frugal consumers figure out which ones are really worth the expense. This was the case for 67% of Americans who say they canceled at least one subscription in the past year. While some cut out subscriptions that aren’t getting used, we found that 1 in 6 people already avoid all paid subscriptions to save money.

In third place we found nearly two thirds of Americans are especially thrifty when shopping for groceries. For 65% of people that means frequently buying the store brand or generic items instead of the name brand. For another 59%, this includes cutting out coupons or searching for promo codes and price checking other stores to ensure they are getting the best price at the register.

Rounding out the top five categories in which Americans are most frugal include dining out or takeout (58%) and buying household supplies (53%) in fourth and fifth place, respectively. Although cutting purchases can save you money, using smart tactics to get what you want for less allows you to stay frugal without feeling like you’re missing out.

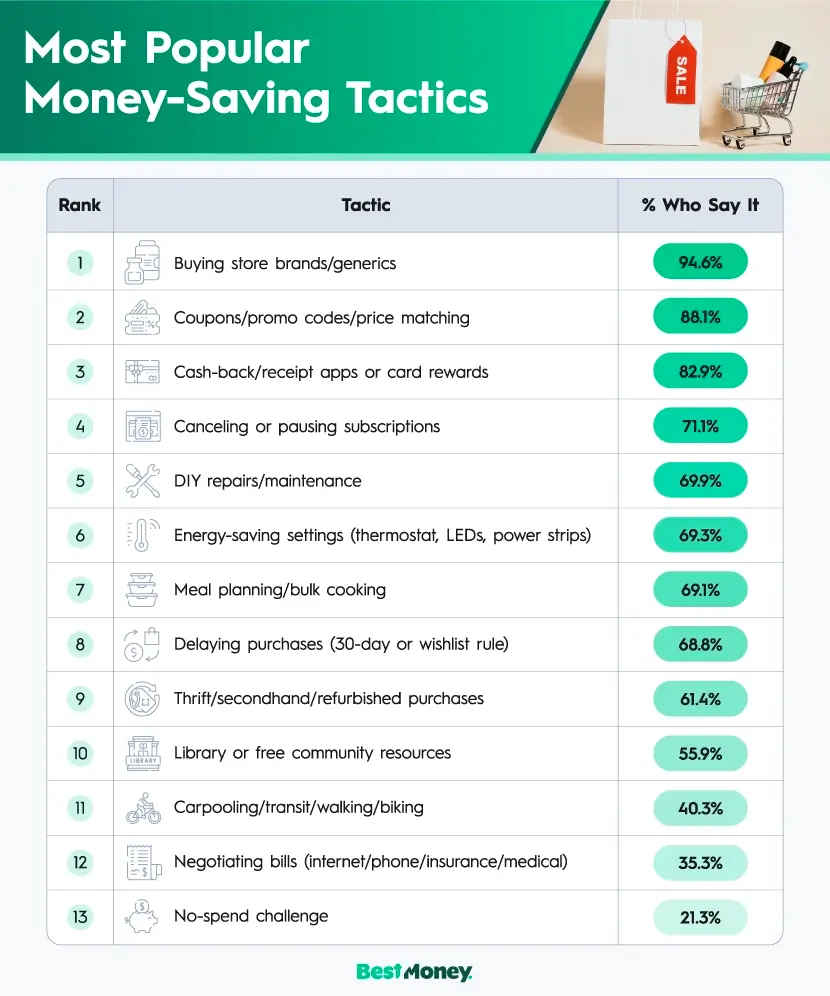

If you find yourself wishing you were more financially responsible, it’s never too late to start picking up new money-saving tactics. When asking Americans about their recently used methods, we found buying store brands (95%) and using coupons (88%) were the most popular.

In third place, we found that 83% of people are using cash-back, receipt apps, or card rewards. With the help of cash back credit cards, you can build your credit and put more money back into your wallet by simply using them for items you already buy. This is followed by canceling or pausing subscriptions which 71% of Americans say they have recently done.

Sometimes hobbies or skillsets you have can aid in saving money. This may be the case for our fifth-place tactic of DIY repairs and maintenance, which 70% of Americans say they have recently done. For 69% of people, using energy-saving settings on items like a thermostat, LEDs, and power strips has helped avoid unnecessary spending.

Small choices add up. The cities that save the most money do so by maintaining steady habits, rather than trying one big hack. The takeaway is simple: Consistent, thoughtful spending wins. Frugality works best when you align it with your real life. Things like groceries and gas are items that can help you earn something back when using the right card.

At Best Money, we want to help you embrace your frugal habits, while also putting more money in your pocket. Whether you are interested in a cash back credit card that will reward you for purchases you already make or you want a travel credit card that will help build points to save money on future trips, we’re here to help. Get started today by checking out our comparisons for a variety of credit cards and other financial products to continue working toward your goals.

In this study, we set out to learn where Americans are most frugal. To do this, we surveyed residents in 40 of the largest U.S. cities and asked about their spending habits. We asked a variety of questions including which areas of their life they are very frugal, the money-saving tactics they have recently used, and more. We then awarded points to responses that represent frugal habits and calculated the average score by city. Finally, we adjusted those scores on a scale of 0 to 100, with 100 representing the most frugal.

The BestMoney editorial team is composed of writers and experts covering a full range of financial services. Our mission is to simplify the process of selecting the right provider for every need, leveraging our extensive industry knowledge to deliver clear, reliable advice.