- Quick claims & reimbursements 100% online

- 24/7 support for emergencies, advice & more

- Access 20K doctors via telemedicine in minutes

- Option to add 'Cancel for Any Reason'

- Best for app‑first travellers

Must Reads

What is travel insurance and why it matters

Travel insurance protects travelers by reimbursing or supporting them when trips go wrong—such as canceling prepaid travel, facing a medical emergency abroad, losing baggage, or needing an emergency evacuation. Whether you’re booking a domestic flight or searching for the best travel insurance international plan, having coverage in place provides peace of mind.

For overseas travel, your usual health plan may not apply, and that’s where international travel insurance becomes essential. Many individuals choose a travel insured international provider to ensure full support when far from home.

Compare With BestMoney.com, Choose the Best for You

At BestMoney.com, we understand the importance of making informed financial decisions. Our team of financial experts and editors conducts thorough research across lending, banking, home loans, personal finance, and insurance to provide you with comprehensive comparisons and insights. We continuously update our content to reflect the latest market trends and offerings, ensuring you have access to current, reliable information.

We offer a wide range of services including detailed comparison tools and expert reviews, all designed to meet your specific financial needs. Our mission is to empower you to make confident, well-informed choices that help you achieve your financial goals.

Types of travel insurance coverage

Before purchasing a policy, it helps to review a travel insurance comparison of features and costs. Here are the main types of coverage to understand:

Trip cancellation, interruption and delay

This protects you if you must cancel or cut short your trip due to illness, weather disruptions, or emergencies.

- For added flexibility, look into travel insurance cancel for any reason coverage

- Particularly useful for non-refundable flights, tours, or accommodations

Baggage and personal effects

Covers loss, theft, or damage to your luggage and items while traveling

- Critical for international flights where luggage transfers increase risk

- May require filing with your airline or card provider before insurance applies

Medical insurance

Pays for necessary medical care abroad such as hospital stays, doctor visits, and emergency treatment

- Essential for those seeking the best travel insurance for international travel

- Exclusions often apply for pre-existing conditions unless early purchase includes a waiver

Emergency evacuation and repatriation

Covers transportation to the nearest medical facility or back home in severe cases

- A key feature for remote travel or destinations with limited healthcare

- Medical evacuation costs can be extremely high without this protection

Accidental death or flight accident

Provides financial coverage in case of fatal or disabling incidents during your trip

- Usually part of comprehensive policies with higher benefit limits

| Customizable travel insurance |

Key Insights

- Travel insurance is essential for international trips, especially when your U.S. health plan doesn’t cover care abroad or you have non-refundable costs.

- Cancel for any reason (CFAR) coverage adds flexibility—letting you cancel for almost any reason and still recoup up to 75% of your trip value.

- Medical and evacuation coverage are the most critical features, particularly for seniors or travelers visiting remote areas.

- Compare policies early—buy within 14–21 days of booking to access full benefits like pre-existing condition waivers.

- Don’t rely on credit card insurance alone—it often lacks sufficient medical, evacuation, and cancellation coverage for international travel.

What add-ons are available with travel insurance?

Basic plans typically include 24/7 assistance, but optional upgrades provide broader protection:

- Extreme sports coverage for high-risk activities

- Rental car damage and theft protection

- Dental and vision emergency benefits

- Cancel for any reason for full travel flexibility

- Best travel insurance for seniors may offer tailored support and higher medical limits

| Quick quote for travel insurance |

Cost and how much coverage you need

Travel insurance usually costs between 4% and 10% of your total trip value.

Key pricing factors include:

- Destination: international travel insurance usually costs more

- Traveler age: older travelers may pay more, especially for medical coverage

- Duration: longer trips require more coverage

- Risk level: adventure activities or high-cost trips increase premiums

Use travel insurance quotes tools or travel insurance comparison platforms to assess value versus cost and avoid overpaying for unnecessary add-ons.

Should I choose single-trip or multi-trip travel insurance?

- Single-trip policies: Ideal for one-time vacations, often valid for up to 30 days

- Multi-trip (annual) policies: Suitable for frequent travelers taking several trips per year

Each has duration limits, so check how long each trip can be and whether destinations fall under coverage. Many travelers insurance providers offer both options with flexible terms.

How to choose the best travel insurance provider

Finding the best travel insurance requires more than a low price:

- Review exclusions and what each policy does not cover

- Understand age-based coverage limits, especially for older travelers

- Consider customer reviews and response time for claims

- Compare travel insurance quotes based on family vs solo travelers, trip purpose, and destination

- If going abroad, prioritize best travel insurance international providers that include emergency services and higher limits

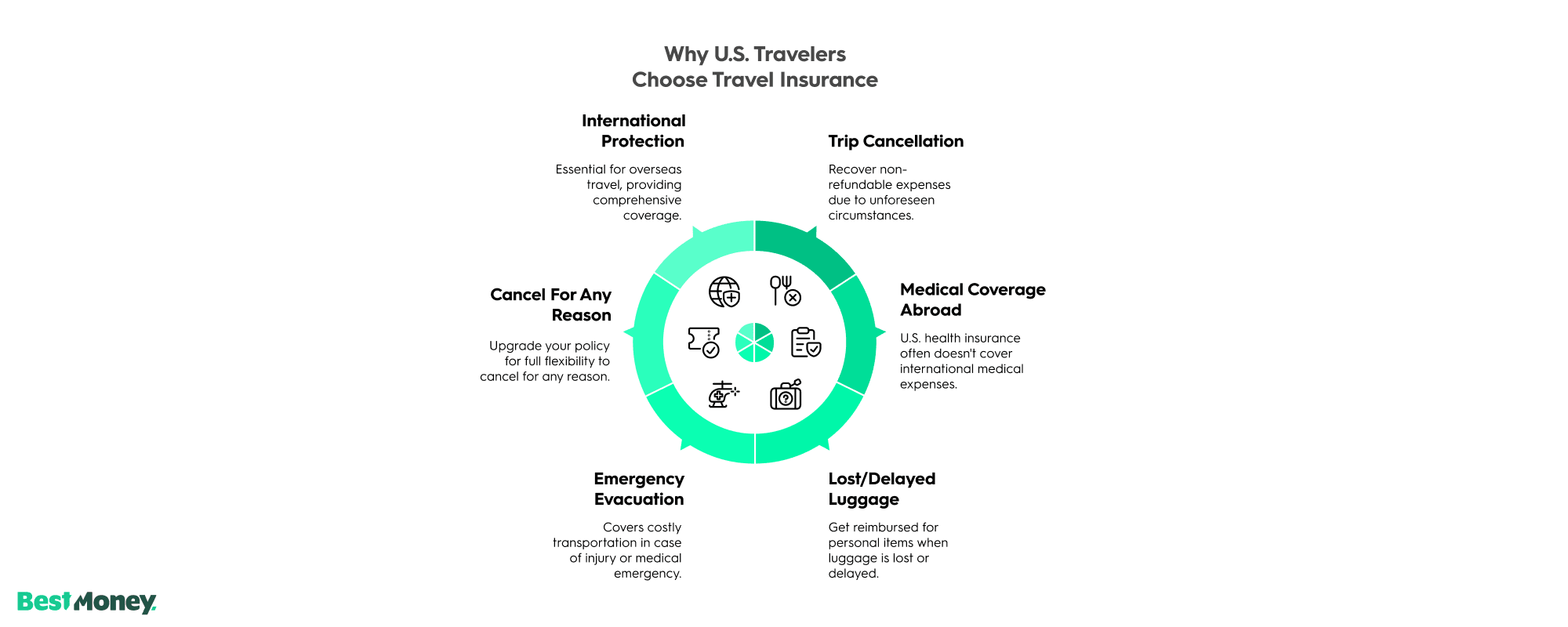

Top reasons why U.S. travelers choose travel insurance

Travel insurance is more than a backup plan—it protects your investment, your health, and your peace of mind. From medical emergencies abroad to lost luggage or last-minute cancellations, here’s why smart travelers are choosing to get covered before they go.

When is travel insurance worth it

When is travel insurance worth it

You should consider a policy if:

- You’ve prepaid non-refundable travel costs

- Your US health insurance doesn’t cover care overseas

- You plan to participate in adventure sports or remote travel

- You’re seeking peace of mind with best travel insurance for international travel coverage

Travel insurance is especially important if you're booking expensive tours, traveling with children or seniors, or visiting areas with political or health instability.

Does travel insurance cover COVID-19 or pandemics?

Not all policies cover pandemic-related cancellations or medical needs. However, many providers now include COVID-19 coverage under trip cancellation and medical insurance.

- Check for clauses related to illness, border closures, or travel advisories

- Some offer cancel for any reason upgrades, which are more flexible

- Compare policies to see how COVID-19 is addressed and whether testing, quarantine, or isolation is covered

| Award-winning coverage |

What are common mistakes travelers make when buying insurance?

Avoid these pitfalls when choosing travel insurance:

- Buying too late and missing out on full coverage benefits, like pre-existing condition waivers

- Assuming credit card travel insurance is enough—it usually isn’t for international medical needs

- Failing to read exclusions that may deny claims

- Underestimating the value of emergency evacuation or repatriation

- Not comparing travel insurance quotes or understanding benefit caps

Taking time to research your plan ensures you get meaningful coverage when you need it most.

Does travel insurance cover pre-existing medical conditions?

Pre-existing conditions are one of the most misunderstood areas of travel insurance. A pre-existing condition refers to any illness or medical issue you had before buying your policy. While many plans exclude coverage for these, there are ways to ensure protection:

- Some policies offer pre-existing condition waivers if you buy within 14 to 21 days of your first trip payment

- This waiver allows coverage for medical treatment or trip cancellation due to those known health issues

- Best travel insurance for seniors often includes enhanced pre-existing condition options

- Always read the definition of pre-existing condition in the policy—it may vary

Travelers with chronic illnesses, recent surgeries, or ongoing treatments should prioritize policies that allow for waivers or explicitly include medical history coverage.

What is CFAR and when should I use cancel for any reason insurance?

Cancel for any reason (CFAR) insurance is an optional upgrade that provides maximum flexibility if your plans change unexpectedly. Unlike standard trip cancellation, which only reimburses for specific listed reasons like illness or death, CFAR allows broader cancellation options.

- You can typically cancel up to 48–72 hours before departure and still get 50% to 75% of your costs refunded

- CFAR must be added soon after your initial trip payment—often within 14 to 21 days

- Ideal for travelers who want flexibility due to political unrest, evolving travel restrictions, or personal concerns

- It's often included in the best travel insurance international packages, especially for complex or expensive trips

How does travel insurance work with trip delays or missed connections?

Travel delays and missed connections can disrupt your itinerary and lead to extra costs. Fortunately, many travel insurance plans offer compensation for these issues.

- If your flight is delayed due to weather, mechanical issues, or strikes, insurance may cover meals, lodging, and rebooking fees

- Missed connection coverage typically applies if you miss a segment of your journey due to a delay outside your control

- Policies often require delays of 6+ hours before benefits apply

- To qualify, you’ll need documentation like airline delay notices and receipts for expenses

This is especially important for international travel insurance since missed layovers or rebookings can cost hundreds—or more—when abroad.

What documents do I need to file a travel insurance claim?

Filing a travel insurance claim can be straightforward if you gather the right documents. Keeping digital and physical copies ensures a smooth process:

- Original receipts for any covered expenses (e.g., hotel, flights, medical bills)

- Proof of loss (e.g., police reports for stolen baggage, airline notices for delays or cancellations)

- Physician’s statement for medical-related claims

- Trip cancellation or interruption reason documentation

- Your full policy number and details

Promptly filing with accurate information increases your chances of fast reimbursement. Travelers insurance providers often let you submit claims online or through mobile apps, streamlining the process