Found Summary

Found Pros & Cons

Pros

Cons

Found at a glance

Fees

Security

Customer Service

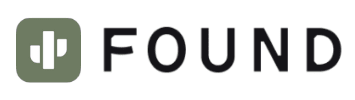

Online and Mobile Experience

Features and Benefits

Advantages Over Traditional Banks

For many small business owners, Found’s most significant advantage over more traditional banking services is likely to be its lack of required monthly fees³, as many of its competitors impose hefty monthly maintenance or account management charges on their small business accounts. Found has no monthly fee³ unless you opt to upgrade to Found+, a paid subscription account, for more benefits.

If you’re concerned about your financial history, you may be reassured to learn that the company won’t run a credit check when you open an account.

Cutting-Edge Banking Services

Several of Found’s most innovative features relate to its tax and invoicing services, rather than business banking.

One interesting feature is the company’s receipt capture tool, which can help ensure you aren’t caught out by lost receipts during tax season. Its automatic expense categorization feature can also dramatically reduce the amount of time you spend getting your accounts in order. You can, for instance, create customized expense categories relevant to your business in areas such as travel costs and office supplies.

The company’s array of tax-specific tools is impressive. You can even see an estimate of your tax bill in real time before it’s due which can help you avoid the nasty surprise of a higher-than-expected charge. Furthermore, Found will automatically generate your Schedule C form or Form 1120/1120-S tax forms to help speed up your filing process.

Key Tax Features

- Integrated income tracking

- Auto-saving for 1099 taxes (i.e. income withholding)

- Maximize deductions with built-in expense tracking

- Receipt capture and built-in substantiation guidance

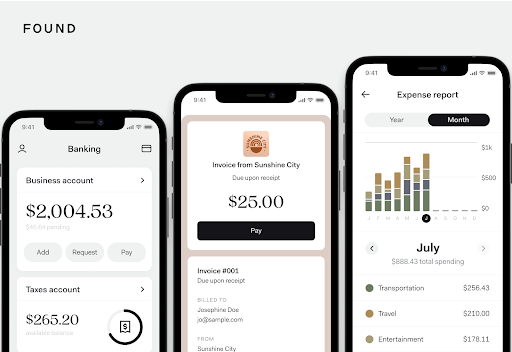

- Writeoff identification

- Profit and loss, expense, and income reports

- Auto-generated schedule-C and Form 1120/1120-S

- Live estimated tax bill

- 1099 sharing

You can also customize your invoices with your business’s branding, which can help create a professional image when communicating with your clients. In addition to this, you can select a payment method for receiving funds. Although this includes credit cards, direct deposits, and payment services such as Zelle, you can’t accept cash payments.

Traditional Banking Services

When you sign up for an account, you’ll receive a free Mastercard debit card². To help you stay on top of your account balance, Found will send instant notifications of purchases made with your card. You can also use the card to withdraw funds at any ATM that accepts Mastercard.

As you would expect from a traditional banking service, your account will include account and routing numbers.

Interest Rates and Fees

One of the most attractive aspects of Found is that there are no required monthly fees³. However, you may have to pay a fee to withdraw cash at an ATM using your Found Mastercard. These fees are not set by Found or Mastercard, and are determined by the company that owns the ATM.

Customer Service and Online Experience

You can contact Found over phone, email, or through its online query form. They offer customer service 7am-5 pm on weekdays and 9 am to 5 pm on weekends.

There is also a detailed selection of FAQs on the company’s website, which provides a lot of helpful information about its services.

You can sign up for an account in as little as five minutes. After entering your email address into the company’s online tool, you'll receive an authorization code. This will allow you to continue with your application by providing further financial details such as your tax ID.

Mobile App

Found’s mobile app is available to download from the App Store and Google Play. It allows you to:

- Lock and cancel your debit card²

- Customize your expense categorization

- Track and send invoices

- Generate your profit-and-loss statements

Security

With security being a top concern for small business owners, entrepreneurs can rest assured by the robustness of Found’s security features.

In addition to a dedicated fraud team, Found 24/7 monitoring service will immediately alert you to any suspicious activity on your account.

All databases are safeguarded via AES-256 encryption, which provides the highest level of protection currently available. Found also operates with a two-factor authentication system by sending verification codes to mobile phones.

Found also has a detailed privacy policy on its website.

Summary

If you're a small business owner and want to save time when organizing your business banking, Found is a great way to streamline all your financial management into one place. While the company doesn't have any physical branches, Found offers many benefits in its impressive selection of tax and bookkeeping tools, and provides comprehensive online guidance that could prove invaluable if you run your own business. Found's banking services are provided by Lead Bank, member FDIC¹. Funds are FDIC insured up to the limit of $250,000 per depositor for each account ownership category.

Methodology

We compiled this review by visiting Found’s website, contacting its customer service team over email, and reading other online reviews of its service.

Disclaimer

¹Found is a financial technology company, not a bank. Banking services are provided by Lead Bank, Member FDIC. The funds in your account are FDIC-insured up to $250,000 per depositor for each account ownership category. FDIC insurance only covers the failure of an FDIC-insured depository institution.

²The Found Mastercard Business debit card is issued by Lead Bank pursuant to a license from Mastercard Inc. and may be used everywhere Mastercard debit cards are accepted.

³Optional subscriptions to Found Plus for $19.99 / month or $149.99 / year or Found Pro for $80 / month or $720 / year. There are no monthly account maintenance fees, but other fees such as transactional fees for wires, instant transfers, and ATM apply. Read Found Fee Schedule.

Katy Ward is an insurance expert at BestMoney.com, specializing in life and home insurance. Over her 15-year career, she has worked with major financial institutions like Barclays, Tandem Bank, and Yahoo! Finance. Katy enjoys identifying complex financial trends and translating them into engaging articles.