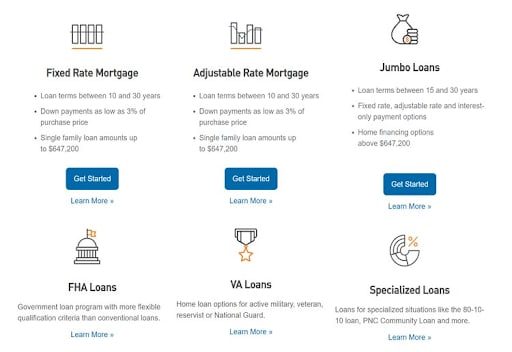

PNC Bank offers a wide range of mortgage products, including conventional and jumbo mortgages, government-backed FHA and VA mortgages, and specialized 80-10-10 and PNC Community mortgages. The 80-10-10 and PNC Community mortgages enable you to minimize your down payment without paying for private mortgage insurance.

PNC Bank makes it easy to check current rates online. You can get pre-qualified and apply online or visit one of more than 2,600 PNC Bank branches across 27 states. PNC Bank services most of its own mortgages, so you can continue to work with your local branch after your mortgage closes.

PNC Bank mortgages are engineered for homebuyers who want to minimize their down payment. The bank enables you to put down as little as 3% on most conventional mortgages. In addition, the 80-10-10 mortgage enables you to take out a loan for half of your down payment, while the PNC Community mortgage enables you to use gift funds for most of your down payment.

PNC Bank is also suitable for low-income borrowers. The bank offers grants up to $5,000 for borrowers below certain income thresholds. You can apply these grants towards your down payment or closing costs.

PNC Bank offers conventional fixed-rate and adjustable-rate loans for up to $647,200. If you need to borrow more, the bank offers jumbo loans up to $5 million. Conventional loans have terms of 10-30 years, while jumbo loans have terms of 15-30 years. PNC Bank also offers VA and FHA loans for borrowers with a minimum credit score of 620.

The 80-10-10 loan enables you to make a 10% down payment and take out a loan to pay an additional 10% down on your mortgage for a total of 20% down, which eliminates the need for private mortgage insurance. The PNC Community loan enables you to put just 3% down, and only $500 must come from the borrower. The remainder of your down payment can come from gift funds.

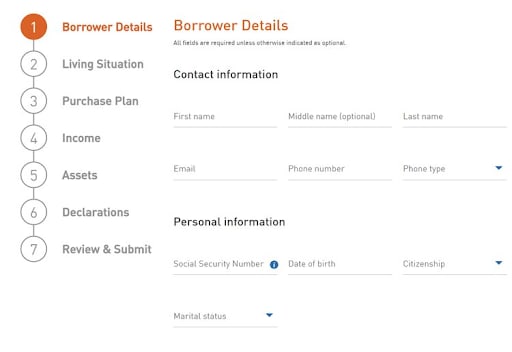

PNC Bank enables you to pre-qualify and apply for a mortgage online, over the phone, or in person at any PNC Bank branch. To start, PNC Bank requires basic information about the property you want to purchase and your income. PNC Bank will check your credit and verify your employment and income, then issue a pre-approval letter immediately.

To continue with your application, you must create an account on PNC Bank’s mortgage portal. The portal enables you to upload documents and offers a handy status bar so you can see which milestones your application has reached. You can contact a loan officer at any time if you need help with your application.

PNC offers repayment terms of 10-30 years for conventional mortgages or 15-30 years for jumbo mortgages. You must choose a 30-year term to qualify for PNC’s $5,000 grant program.

As of May 12, 2022, PNC is offering rates from 4.985% APR for a 30-year fixed-rate conventional mortgage or 4.251% APR for a 15-year fixed-rate conventional mortgage.

PNC Bank offers customer support by phone from 8am-10pm ET Monday-Thursday, 8am-6pm Friday, and 8am-5pm Saturday-Sunday. You can also visit a local PNC Bank branch to speak with a loan officer. PNC Bank’s website offers a basic FAQs page for current borrowers.

| PNC Bank | Quicken Loans | US Bank | |

|---|---|---|---|

| Minimum Credit Score | 620 | 620 | 620 |

| Minimum Down Payment | 3% | 3% | 3% |

| DTI Ratio | <=45% | <=43% | <=50% |

| 30-year Fixed-rate APR | 4.985% | 5.549% | 5.579% |

| Best For | Low down payments | Applying online | Wide range of mortgage options |

PNC Bank offers a wide range of mortgage products, including several specialized loans that offer low down payments. You can apply online, over the phone, or in person at more than 2,600 PNC Bank branches. Loans are available up to $5 million and with terms ranging from 10-30 years. You can check current mortgage rates on PNC Bank’s website.

PNC Bank offers conventional loans up to $647,200 and jumbo loans up to $5 million.

The PNC Community mortgage enables you to make a 3% down payment, and only $500 must come from the borrower. The remainder of the down payment can come from gift funds.

PNC Bank offers instant pre-approval. You can get pre-approved online, over the phone, or by visiting a PNC Bank branch.

PNC Bank offers mortgages to borrowers with a minimum credit score of 620.

One PNC Plaza, 249 Fifth Ave, Pittsburgh, PA 15222

This review is based on information available from the PNC Bank website and online pre-qualification tool.