This site is a free online resource that strives to offer helpful content and comparison features to our visitors. We accept advertising compensation from companies that appear on the site. Company listings on this page DO NOT imply endorsement. We do not feature all providers on the market. Except as expressly set forth in our Terms of Use, all representations and warranties regarding the information presented on this page are disclaimed. The information, including pricing, which appears on this site is subject to change at any time.

With an extensive portfolio of home equity, home purchase, and refinancing options, CrossCountry is a solid choice for first-time home buyers. CrossCountry is licensed in all 50 states and takes great pride in going above and beyond to meet customers’ needs while exceeding expectations. CrossCountry is an established mortgage loan company with a team of knowledgeable loan officers who accompany customers throughout the entire mortgage process.

CrossCountry provides a wide variety of financial products and is well known for its home purchase and refinance loans. While CrossCountry strives to help first-time home buyers purchase their first starter home, it is also a great option for anyone who’s in the market to refinance, or wants to check the equity of their home. Anyone looking for a loan to consolidate their debt can also rely on CrossCountry.

CrossCountry offers traditional fixed rate and adjustable rate mortgages, as well as a wide variety of other loans. The lender offers multiple rates and terms on traditional loans, adjustable rate loans, VA loans, and even FHA loans.

Some loans, like USDA loans, have 100% financing, which means no down payment whatsoever

VA home loans also require no down payment

FHA loans are suitable for borrowers with low credit scores

Mortgage insurance is not required on all types of loans

Two types of FHA 203k loans are offered, but mortgage insurance is required

Some rates are fixed and some are adjustable which determines how much interest you ultimately pay in the end

Mortgage insurance is offered with all loans, but not required for all loans

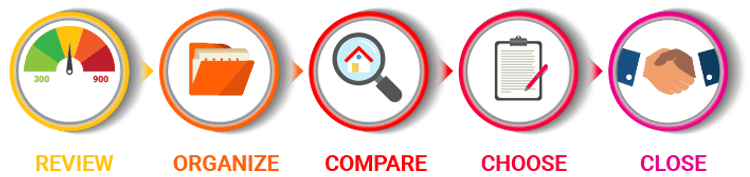

The application process at CrossCountry is simple and fast and you can get prequalified by filling out the easy online application. Alternatively, you can call the loan officers at CrossCountry to apply for a mortgage over the phone.

The application process is completely confidential and secure, and applications are reviewed in a timely manner. Financial information, such as bank account information, and Social Security numbers are required. A loan officers will get in touch with you promptly to review your loan options.

For fixed rate mortgages terms typically range between 10 to 30 years. Adjustable Rate loans are also offered by CrossCountry with common terms of 5/1, 7/1 and 10/1.

A mortgage calculator can help determine how much payments and interest rates would be on your loan

The normal length of a home loan is 20 to 30 years

Cosigners may be needed for those with less than ideal credit

Most loans require a down payment with the exception of VA loans and USDA loans

Credit score information, Social Security numbers, driver’s licenses, and wage information are all required in order to determine your loan terms

Special benefits for applicants who prequalify

Payments can automatically be deducted from your checking or savings account

Repayment terms vary from loan to loan but a licensed loan officer can inform you of the repayment terms on the various loan options.

The support staff at CrossCountry have been specially trained and licensed to guide buyers through every step of the mortgage process. Help and support is available if you have questions or concerns regarding your mortgage or if you just want to check the status of an application.

CrossCountry offers a wide range of purchase and refinance options great for first-time homebuyers, as well as traditional home loans such as FHA and VA loans. For applicants who need help during the process, CrossCountry's team of highly-skilled loan officers are always on hand to offer advice.

6850 Miller Road

Brecksville

Ohio

44141