Attention Drivers: You could be qualified for a considerable reduction on your car insurance. Recent changes in regulations now heavily favor those who drive less than 50 miles per day. As word spreads, insurers are rushing to adjust, especially since drivers in specific zip codes may qualify for even bigger savings.

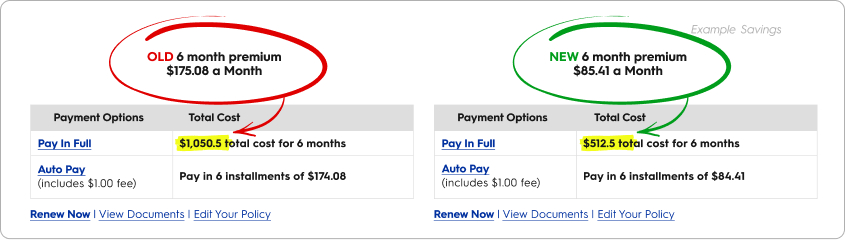

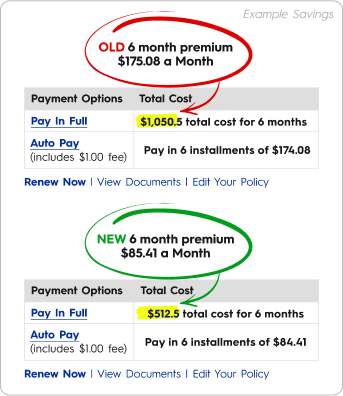

When Marissa completed the short quiz on BestMoney.com, she didn’t believe the results. She found that her local insurance agent had been charging her more than necessary, and she was able to secure much lower premiums.

“We were able to slash our insurance premium by 50%! I am only wondering why I didn’t know about this earlier.” Marissa said.

When drivers use a reliable comparison website like BestMoney.com, they can easily find the best personalized, available rates in their area. Recent studies show that you could save up to $820 annually on car insurance.

How insurance companies manage to charge higher rates is unclear, but you can start saving today in just two minutes.

IMPORTANT: If you secure a better rate, switching is simple. Your current insurer is required by law to reimburse any remaining premium once you cancel.

Here’s How to Get Started:

Step 1: Select your age below & see if you qualify on the next page

Step 2: Answer a few basic questions about your driving habits and get unbeatable quotes from top providers.

He writes for BestMoney and enjoys helping readers make sense of the options on the market.