NASB was founded in Kansas City, Missouri in 1927, and continues to offer loans through 11 branches in Missouri and through its online portal to borrowers from around the United States.

NASB specializes in tailoring mortgages to the following types of borrowers:

Active and former military personnel and their relatives can apply for a VA loan.

Anyone who has at least 30-40% of the purchase price vested in a self-directed IRA can apply to buy a rental property with an IRA non-recourse loan.

People with poor credit or other tough financial circumstances can apply through NASB for an FHA loan or for a non-conforming loan.

North American Savings Bank offers conventional and non-conventional loans to suit different personal and financial circumstances. Customers benefit from the following features:

No origination fees for certain loan types (such as VA and FHA loans), although there is a 1% origination fee for other types (such as IRA non-recourse loan).

No lender fees for certain loan types.

In-house processing and fast closing times.

Dedicated loan officer who can tailor your loan to your situation.

Online application for residents of all 50 states, or in-branch application for Missouri residents.

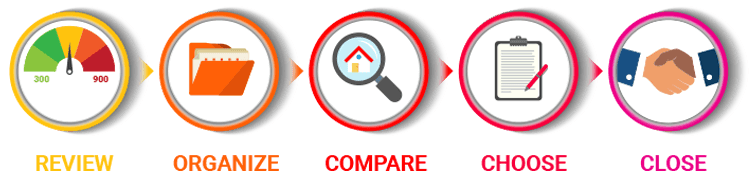

The application process varies between the different types of loans. As a general rule, NASB is quicker to approve borrowers than the average lender. Pre-qualifying can be done online or over the phone, and usually takes just a few minutes. For a conventional loan, NASB will then ask you for the following in order to decide if it can offer you a loan:

Copy of driver’s license, passport, or state ID card.

Pay stubs for most recent 30-day pay period.

Bank statements for past 2 months

W-2 IRS forms for last 2 years.

Purchase agreement for the home you are buying.

Copy of cleared deposit check.

Contact information of title company handling settlement, if not in contract.

Contract information of homeowner’s insurance company.

E-signature on loan application documents.

North American Savings Bank excels at tailoring programs to people in unique financial situations. It’s one of the few lenders in the country to offer a program enabling IRA account holders to use their IRA to purchase rental properties. With its non-conforming loans, it’s also one of only a handful of lenders to go out of their way to provide a space for people with very poor credit or with a recent history of bankruptcy or short sale to find a way back into the housing market.

Perhaps the main downside to NASB is that it doesn’t offer real-time information about rates and APRs unless you fill out a short online form and include your contact details. NASB doesn’t have physical branches outside Missouri, although this isn’t such a big deal given it offers home buyers from around the country the chance to conduct the entire application online and by phone.

North American Savings Bank offers the following types of loans:

Conventional fixed-rate and adjustable-rate loans: These are open to qualifying home buyers who are able to put at least a 20% down payment on their home.

Jumbo loans: For loans of around $500,000 or more (depending on the borrower’s location), with stricter application requirements.

VA loans: Open to service members, veterans, and surviving spouses who wish to buy, build, repair, retain, or refurbish their primary residence. The federal government’s Department of Veteran Affairs guarantees up to 25% of the loan, ensuring the borrower gets favorable rates.

FHA loans: Designed for people who have poor credit or are cash-strapped, this federal-government backed loan helps borrowers secure a mortgage for as low as a 3.5% down payment.

IRA non-recourse loans: NASB is one of the few lenders in the country to offer this type of loan, which is designed to assist anyone who has at least 30-40% of the purchase price vested in a self-directed IRA to buy a rental property. The IRA account holder is not personally liable for repayment of the loan. In the event of default or foreclosure, NASB can only use the property as a source of repayment and cannot pursue other assets owned by the account holder or IRA.

Non-conforming loans: These are for people who have unusual financial circumstances, such as a credit score of 640 or less, recent completion of a short sale, recent filing for bankruptcy, ownership of more than 5 properties with mortgage loans, or substantial investment assets or savings with little or no monthly income.

Loan terms and APRs vary for the different types of loans on offer. For example, conventional fixed-rate loans are offered over 15-year or 30-year terms. IRA non-recourse loans are offered for 10-year, 15-year, or 20-year terms. VA loans and FHA loans are available for terms of up to 30 years.

To speak to a loan officer, call 855-465-0753 between business hours, request a call from a loan officer at a time convenient to you, or contact one of NASB’s loan officers directly. To enquire about IRA lending, call 866-735-6272 during business hours or email NASB. The online feedback for North American Savings Bank’s mortgage is overwhelmingly positive, with customers praising loan officers for attention to detail and their willingness to go the extra mile for them.

North American Savings Bank specializes in solutions for military veterans, real estate investors, and home buyers who are unable to find a lender due to unique financial circumstances, first-time buyers and non-conforming buyers.

North American Savings Bank

12498 S. 71 Highway

Grandview, MO 64030