The CFPB reports that children using structured money apps show improved saving behaviors within months, while Federal Reserve data indicates that kids with early financial education are more likely to maintain emergency funds as adults. These apps blend chore tracking, savings goals, and real-world spending via FDIC-insured prepaid debit cards designed for ages 3–18.

Quick Comparison: Top 7 Kids’ Money Apps (2025)

Feature comparison of seven leading kids’ money apps in 2025

| App Name | Best For | Age Range | Monthly Cost | Investment Features | Chore Tracking |

|---|---|---|---|---|---|

| BusyKid | Stock investing introduction | 5–17 | $4/month (billed annually) | Fee-free stocks | Yes |

| Greenlight | Comprehensive parental control | All ages | From $4.99/month | Parent-approved investing | Yes |

| FamZoo | Family banking simulation | 3–College | $5.99/month | None | Yes |

| GoHenry | Visual goal tracking | 6–18 | From $4.99/month | None | Yes |

| Rooster Money | Beginner-friendly savings | 3–18 | Free / Premium | None | Yes |

| Step | Teen credit building | 13–18 | Free | Credit building | No |

| Till | No-fee flexibility | 8–18 | Free | None | No |

Detailed App Reviews: Top 7 Kids’ Money Apps (2025)

1. BusyKid: Fee-Free Stock Investing for Kids

BusyKid, rated 4.7 stars in 2025, connects chores to real earnings and introduces kids as young as 5 to stock investing.It’s one of the few apps that lets children buy real shares without trading fees, under full parental oversight.

Key Features:

- Prepaid Visa card in the $4/month plan (covers up to 5 kids)

- Customizable chore lists with real-time payment tracking

- Fee-free stock investing with parental approval

- Built-in charitable donation options

- Goal-setting dashboard tracking savings, spending, and investments

Why Parents Choose BusyKid:Practical allowance management plus genuine investment education, with parents maintaining full control.

Potential Drawbacks:

- Chore system setup can be time-consuming

- Investment features may feel advanced for kids under 8

Pricing:$4/month (billed annually after 30-day trial)

» We tried BusyKid. Now it’s your turn

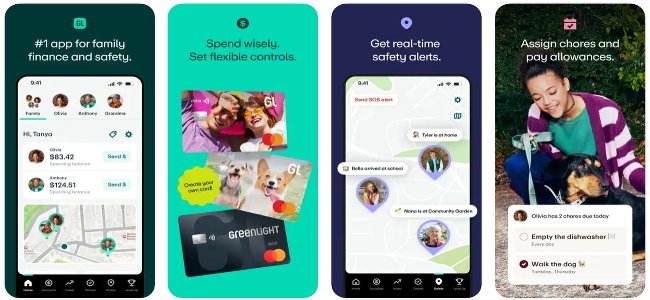

2. Greenlight: Comprehensive Parental Control Platform

Greenlight, with 4.8-star ratings across 6 million families in 2025, offers extensive spending controls and investment tools.Real-time transaction monitoring, category-based limits, and parent-approved investing support children of all ages.

Key Features:

- Spending categories with custom limits

- Instant alerts for every transaction

- High-yield savings up to 6% APY

- Built-in investing with mandatory parent approval

- Identity theft protection up to $1M

Why Parents Choose Greenlight:A comprehensive platform that grows from elementary to college years.

Potential Drawbacks:

- Premium savings/investing require higher-tier plans

- Monthly costs can add up for tight budgets

Pricing:From $4.99/month; premium tiers up to $14.98/month

3. FamZoo: Family Banking Simulation System

FamZoo, serving families for 15+ years with 4.5-star ratings in 2025, creates a private family banking system.It covers earning, spending, saving, and educational borrowing from preschool through college.

Key Features:

- Parent-paid interest on goal subaccounts

- Family loan system for debt education

- Real-time controls, alerts, and dashboards

- Suitable from preschool through college

- Allowance automation and bill pay

Why Parents Choose FamZoo:Real-world banking simulation with full parental oversight—unique educational loan feature.

Potential Drawbacks:

- UI feels dated

- Initial setup can be time-intensive

Pricing:$5.99/month (discounts for annual payment)

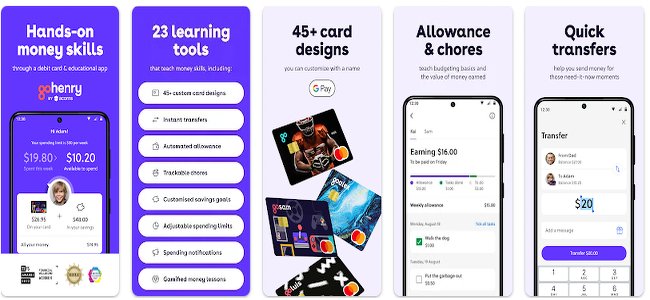

4. GoHenry: Visual Goal-Setting for Young Savers

GoHenry, rated 4.6 stars by UK and US families in 2025, uses progress tracking and milestone celebrations to engage kids.

Key Features:

- Custom savings pots with names, images, and target dates

- Dynamic progress bars and celebration notifications

- Family pricing for multiple children

- Chore tracking with automatic allowance

- Spending category controls and merchant blocks

Why Parents Choose GoHenry:Highly engaging visuals that reinforce saving habits.

Potential Drawbacks:

- Education tools sit on higher tiers

- No investing/advanced finance features

Pricing:$4.99/month per child; family plan $9.98/month (up to 4 kids)

5. Rooster Money: Age-Adaptive Financial Foundation

Rooster Money, with 4.5-star ratings and 500k+ families in 2025, adapts to children’s stages—from star charts to prepaid debit.

Key Features:

- Three-pot system: Spend, Save, Give

- Age-appropriate progression from visuals to prepaid

- Parent-set custom interest on savings

- Prepaid-only, no overdraft risk

- Robust parental controls

Why Parents Choose Rooster Money:Grows with kids; values-based education including giving.

Potential Drawbacks:

- No teen credit-building

- Premium features require upgrade

Pricing:Free tier; premium subscription adds features

6. Step: Modern Teen Banking and Credit Building

Step, rated 4.6 stars and serving 2M+ teens in 2025, focuses on teen independence with safe credit building.

Key Features:

- Fee-free banking; no overdraft

- P2P transfers and real-time balances

- Credit building via secured model

- Teen-centric design and insights

- Direct deposit for teen jobs

Why Parents Choose Step:Helps teens build history before college/careers.

Step offers a great 'starter' experience for teens, but as they approach adulthood, they’ll need a robust platform to manage their growing independence. You cancompare the best online banking accountsto find a full-service partner that offers the same high-tech convenience for your own finances.

Potential Drawbacks:

- Not designed for younger kids

- Less parental control than family suites

Pricing:Free

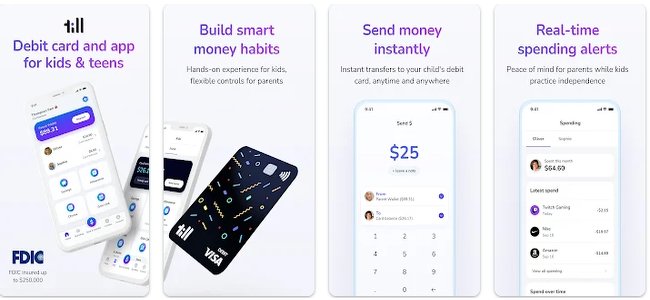

7. Till: Streamlined Allowance Management

Till, with 4.4-star ratings in 2025, keeps allowance management simple—no subscription needed.

Key Features:

- Instant transfers with real-time notifications

- Personalized goals and category tracking

- Prepaid card with real-time oversight

- No monthly fees for core features

- Straightforward interface

Why Parents Choose Till:Basic coordination without costs or complexity.

Potential Drawbacks:

- No robust chore/task system

- No investing or advanced education tools

Pricing:Free

Best Money Apps for Toddlers and Preschoolers (Ages 3–5)

Rooster Moneyleads in the apps for younger children with its three-pot system (Spend, Save, Give) and star charts. Visual learning and milestone celebrations make concepts accessible to preschoolers. Parents can set custom interest rates and track progress via age-appropriate dashboards.

FamZooalso works for preschoolers through subaccounts for distinct goals, while parents retain full oversight of transactions.

Best Money Apps for Elementary School Kids (Ages 6–12)

BusyKidties chore completion to earnings and introduces basic investing via fee-free stock purchases. Kids can see real-time payments and learn about giving alongside saving.

GoHenryexcels with visual goal-setting—custom savings pots, progress bars, and celebration prompts keep younger kids engaged.

Best Money Apps for Teenagers (Ages 13–18)

Steptargets teens with fee-free accounts, P2P transfers, and credit building through a secured model—allowing safe history building.

Greenlightoffers advanced investment and control features appropriate for teens learning more complex financial concepts under supervision.

Best Free Money Apps for Kids

Step (100% Free):No fees, no overdraft; real-time balances, P2P, and credit building for teens (13–18).

Till (No Subscription Required):Instant transfers, goals, and a prepaid card for simple allowance management.

Rooster Money (Free Tier):Core allowance and savings tools; upgrade for advanced features.

Best Apps for Teaching Kids About Investing

BusyKid: Fee-Free Stock Investing for Kids

Invest chore earnings into real stocks with full parental oversight; learn dividends and long-term strategies.

- Real stock ownership without trading fees

- Age-appropriate education modules

- Parent approval required for every trade

- Portfolio tracking/performance monitoring

Greenlight: Parent-Supervised Investment Learning

Research and request stocks with parent approval; track investments with educational resources on fundamentals.

Best Apps with Chore Tracking Integration

BusyKid: Comprehensive Chore-to-Pay System

Custom lists, schedules, and automatic transfers to prepaid cards; recurring tasks and bonus jobs supported.

FamZoo: Flexible Allowance and Chore Management

Customizable chores with parent-paid interest to reinforce saving behavior.

Greenlight: Integrated Chore and Spending Platform

Earn via chores and learn responsible spending with category limits and alerts.

Parental Control Features Comparison

Advanced Controls: Greenlight

Category limits, real-time alerts, merchant blocking, granular analytics, and remote control.

Family Banking: FamZoo

Subaccounts, spending limits, transaction monitoring—simulating real banking with parental authority.

Visual Monitoring: GoHenry

Dashboards, goal progress, customizable alerts, and detailed histories for coaching moments.

Monthly Cost Analysis (2025)

Premium Tier Pricing

- FamZoo: $5.99/month (great value for complete family banking)

- Greenlight: From $4.99/month (advanced features justify cost)

- BusyKid: $4/month (billed annually; includes investing)

- GoHenry: $4.99/month per child; family plan $9.98 (4 kids)

Free Options

- Step: Free teen banking with credit building

- Till: Free allowance tools and prepaid card

- Rooster Money: Free core features; premium upgrades

Family Plan Value

For multi-child households, plans like GoHenry’s family tier reduce per-child costs versus individual subscriptions.

Age-Appropriate Financial Education Features

Early Childhood (Ages 3–6): Visual Learning

Emphasize visual rewards and simple cause-and-effect. Rooster Money and FamZoo shine with charts, progress bars, and celebrations.

School Age (Ages 7–12): Practical Application

Connect chores to earnings and introduce saving/spending. BusyKid and GoHenry are strong fits.

Teenage Years (Ages 13–18): Advanced Concepts

Step and Greenlight introduce credit building, investing, and greater independence within guardrails.

Security and Safety Features

FDIC Protection and Insurance

Funds are typicallyFDIC-insuredvia partner banks (up to $250,000). Greenlight also offers identity protection up to $1M.

Transaction Monitoring

Real-time alerts, spending limits, and merchant restrictions support safe autonomy.

Data Protection

Bank-level encryption, secure auth, and privacy protections designed for minors (COPPA-aligned).

Setting Up Your First Kids’ Money App

Account Creation Process

- Choose an age-appropriate appbased on developmental stage

- Complete parent verification(ID and bank link)

- Set initial limitsand category restrictions

- Order prepaid cardsfor real-world practice

- Configure choresand allowance schedules

Best Practices for Parents

- Start with lower limits; increase with demonstrated responsibility

- Use alerts as teaching prompts, not punishments

- Set savings goals aligned to interests and timelines

- Review spending together during regular family check-ins

Frequently Asked Questions About Kids Money Apps

What Age Should Children Start Using Money Management Apps?

Children as young as 3 can benefit from visual money apps like Rooster Money, according to child development experts from the American Academy of Pediatrics.Comprehensive features become most valuable around ages 6-8 when children understand basic math concepts, cause-effect relationships, and can follow multi-step instructions for financial tasks.

Are Kids Money Apps Safe and Secure?

Reputable kids money apps provide FDIC insurance protection up to $250,000, bank-level encryption, and specialized privacy protections underCOPPA regulations.Real-time transaction monitoring and spending limits offer greater security than traditional cash allowances, with parents maintaining complete oversight through detailed transaction histories and instant alert systems.

Do These Apps Actually Improve Financial Literacy?

Research from the Jump$tart Coalition shows children using structured money management apps demonstrate 89% better understanding of saving concepts.Studies indicate improved budgeting skills, delayed gratification, and higher likelihood of maintaining emergency funds as adults compared to traditional allowance methods.

How Much Should Parents Budget for Kids Money Apps?

Monthly costs range from free (Step, Till, Rooster Money basic) to $14.98 for premium Greenlight plans.Family plans like GoHenry's $9.98 for four children offer best value for multi-child households, while single-child families often find mid-tier options ($4.99-$5.99) provide comprehensive features without premium costs.

Can Kids Money Apps Replace Traditional Allowances?

Digital allowance management through apps offers advantages including automatic tracking, savings incentives, and real-world spending experience through prepaid cards.However, experts recommend combining digital tools with cash handling experience to ensure children understand physical money concepts alongside digital financial management.

What Happens to Money if an App Company Shuts Down?

FDIC insurance protects deposited funds even if app companies cease operations, with funds transferred to partner banks or returned to parents.Established platforms like Greenlight (6 million users) and FamZoo (15+ years operation) show strong financial stability, while newer apps may carry higher discontinuation risks.

This guide was last updated in January 2025. App features, pricing, and availability may change. Verify details with providers before making financial decisions for your children.

The BestMoney editorial team is composed of writers and experts covering a full range of financial services. Our mission is to simplify the process of selecting the right provider for every need, leveraging our extensive industry knowledge to deliver clear, reliable advice.