These eight carefully selected apps offer practical solutions to reduce money anxiety while building lasting financial health. Each one addresses different aspects of your financial journey—from emergency access to earnings to long-term investment growth.

Top 8 Financial & Mental Wellness Apps

BrightPlan All-in-one financial planning with advisor access

Questis Personalized budgeting + unlimited financial coaching

Payactiv Emergency access to earned wages (pre-payday relief)

Acorns Micro-investing with round-ups + beginner-friendly ETFs

Betterment Streamlined workplace retirement planning

YNAB Zero-based budgeting for proactive financial control

Credit Karma Credit monitoring + debt payoff strategy

Chime Fee-free digital banking with early paycheck access

Financial & Mental Wellness Apps - In-Depth Reviews

Ready to take control of your money and mindset? These in-depth reviews break down exactly how each app can help you build financial strength while improving your peace of mind.

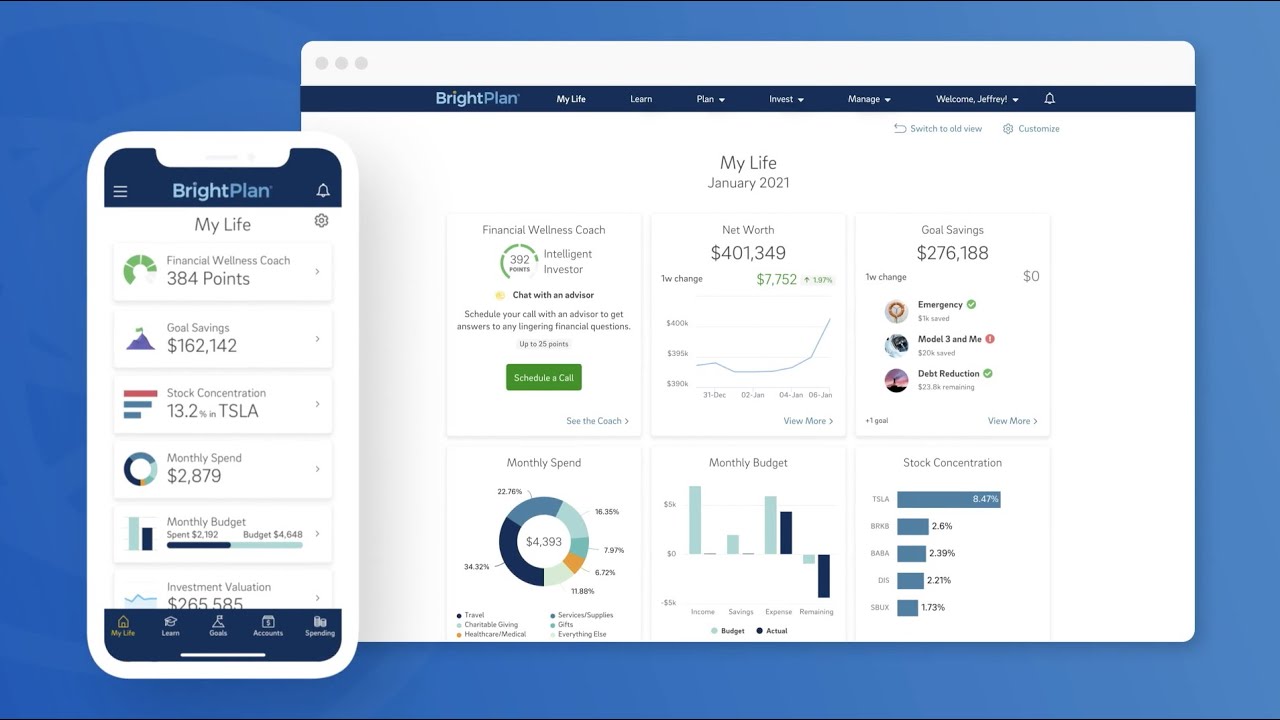

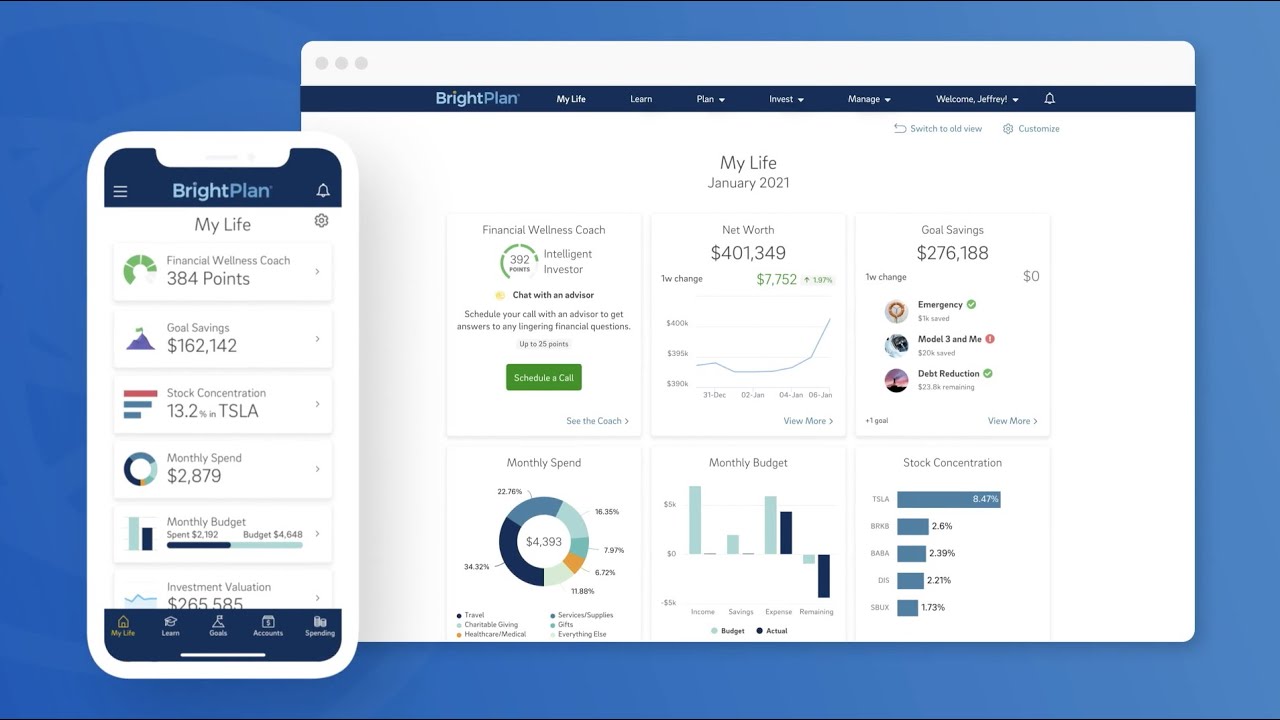

1. BrightPlan - Your Complete Financial Command Center

Best for: Comprehensive financial planning with expert guidance

BrightPlan combines the convenience of digital tools with the wisdom of certified financial advisors—all without additional fees. Think of it as having a financial planning team in your pocket.

What makes it special:

Full-spectrum planning: Budgeting, debt management, retirement planning, and investment tracking in one place

Expert guidance: Access to certified financial advisors for personalized advice

Employee-focused: Designed specifically for workplace financial wellness programs

Progress tracking: Centralized dashboard shows your journey toward financial goals

Perfect if you're: Looking for professional-grade financial planning without the high costs of traditional advisors.

Try Brightplan Now

2. Questis - Budget Mastery with Personal Coaching

Best for: Detailed budget management with unlimited professional support

Questis goes beyond basic budgeting apps by pairing powerful tracking tools with unlimited one-on-one coaching from certified professionals.

Key features:

Automated savings tools that work behind the scenes

Comprehensive budget tracking across all your accounts

Unlimited coaching sessions with certified financial professionals

Personalized roadmaps with achievable milestones

Workplace integration for employer-sponsored programs

Perfect if you're: Someone who learns best with guidance and wants accountability in your budgeting journey.

Visit Questis Now

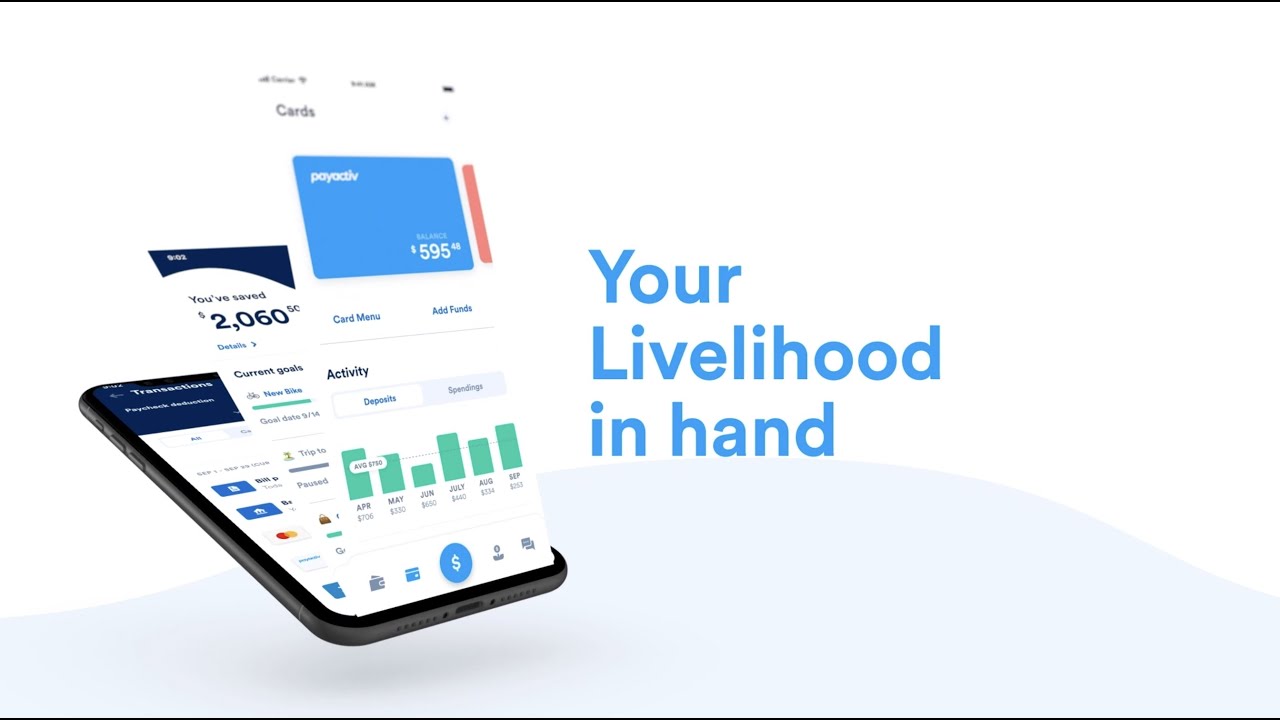

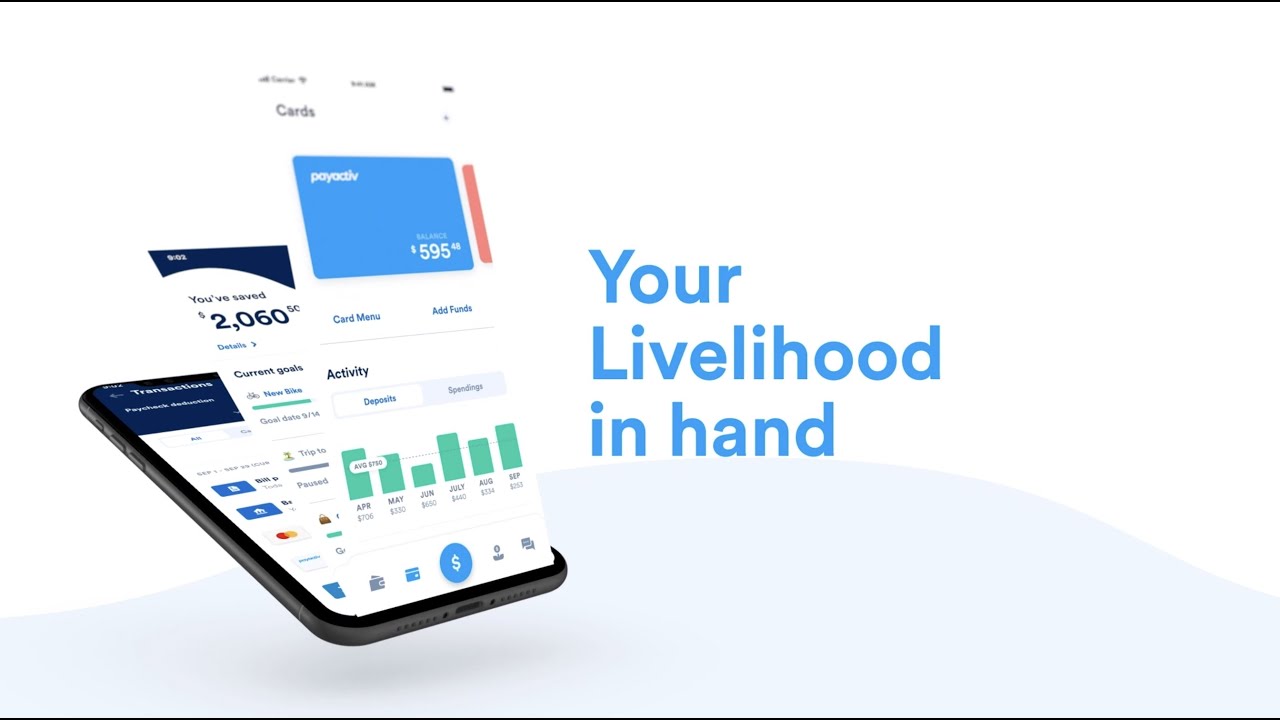

3. Payactiv - Emergency Financial Relief

Best for: Accessing earned wages before payday

When unexpected expenses hit between paychecks, Payactiv provides a responsible alternative to high-interest loans by giving you access to money you've already earned.

How it works:

Immediate access: Withdraw up to 50% of earned wages for just $1/day (max $5 bi-weekly)

Multiple access options: Instant bank deposits or cash pickup at Walmart

Stability tools: Spending trackers, savings features, and bill payment capabilities

Free coaching: Financial guidance to build long-term stability

Perfect if you're: Living paycheck to paycheck and need a safety net for financial emergencies.

Try Payactiv Now!

4. Acorns - Effortless Wealth Building

Best for: Beginner investors who want to start small

Acorns transforms spare change from everyday purchases into a diversified investment portfolio. It's investing made so simple, you'll barely notice it happening.

The magic of micro-investing:

Round-up feature: Automatically invests your spare change from purchases

Low barrier to entry: Start investing with just $5

Expert-managed portfolios: Choose from 5 risk levels, from conservative to aggressive

Automatic diversification: ETFs across stocks, bonds, and alternative assets

Cashback rewards: Convert spending into additional investments

Real results:

Average user invests $627 in their first year through automatic savings

4.05% APY on savings accounts

Over 13 million users managing $25+ billion in assets

Perfect if you're: New to investing and want to build wealth without thinking about it.

Download Acorns App Now

5. Betterment at Work - Retirement Planning Simplified

Best for: Workplace retirement benefits that actually make sense

Betterment revolutionizes employer retirement plans with transparent pricing, extensive integrations, and tools that focus on real-world retirement needs.

What sets it apart:

350+ payroll integrations for seamless setup

All-in pricing model eliminates hidden fees

Realistic projections: Focus on actual spending needs, not arbitrary income targets

High success rates: 99% probability for pre-retirement adequacy, 96% for post-retirement withdrawals

Financial literacy tools integrated throughout the platform

Perfect if you're: An employer looking to offer genuinely helpful retirement benefits, or an employee whose company uses Betterment.

Get Betterment Now

6. YNAB (You Need A Budget) - Master Zero-Based Budgeting Best for: Taking complete control of your money through intentional budgeting

Best for: Taking complete control of your money through intentional budgeting

YNAB transforms budgeting from a restrictive chore into an empowering financial strategy. Every dollar gets a job before you spend it, eliminating financial anxiety and guilt.

The YNAB philosophy:

Zero-based budgeting: Assign every dollar a specific purpose

Real-time adjustments: Move money between categories as life happens

Four foundational categories: Bills, needs, wants, and savings

Flexible framework: Especially helpful for irregular income

Mental wellness benefits:

Eliminates financial stress through proactive planning

Reduces decision fatigue with clear spending priorities

Creates genuine peace of mind through transparency

Builds confidence in your financial decisions

Investment: $8-9 monthly subscription Perfect if you're: Ready to be actively involved in managing your money and want complete financial clarity.

Try YNAB Now

7. Credit Karma - Credit Monitoring Meets Debt Strategy

Best for: Monitoring credit health while actively managing debt

Credit Karma provides free credit monitoring alongside powerful debt management tools, helping you understand how your financial decisions impact your credit score in real time.

Comprehensive credit support:

Weekly credit score updates show immediate impact of your actions

Free credit report access with detailed analysis

Personalized recommendations for debt consolidation options

Visual debt-to-income tracking to monitor your progress

Dispute resolution tools for addressing credit report errors

Perfect if you're: Working to improve your credit score while paying down debt and want to see your progress in real time.

Visit Intuit Credit Karma Now

8. Chime - Banking Without the Stress Best for: Fee-free banking that supports your financial wellness

Best for: Fee-free banking that supports your financial wellness

Chime eliminates the hidden fees and penalties that create financial anxiety, offering transparent banking designed to support your financial health.

Revolutionary banking features:

No hidden fees: No monthly fees, minimum balances, or overdraft penalties

SpotMe protection: Up to $200 overdraft coverage without fees

Early direct deposit: Access your paycheck up to 2 days early

High-yield savings: 3.75% APY to grow your emergency fund

Credit building: Credit Builder Visa® helps improve your score (average 30+ point increase)

50,000+ fee-free ATMs nationwide

Mental wellness benefits:

Real-time spending alerts prevent overspending

Eliminates surprise fees that cause financial stress

Creates mental space for healthier financial decisions

Perfect if you're: Tired of traditional bank fees and want banking that actively supports your financial goals.

Try Chime Mobile Banking App

Choosing the Right Apps for Your Journey

These apps work best when combined strategically:

Start with basics: Chime for fee-free banking + YNAB for budgeting control

Build for the future: Add Acorns for effortless investing + Credit Karma for credit monitoring

Get support when needed: Payactiv for emergencies + Questis or BrightPlan for professional guidance

Plan for retirement: Advocate for Betterment at Work in your workplace benefits

Remember: The best financial app is the one you'll actually use consistently. Start with one or two that address your most pressing needs, then gradually build your financial toolkit as your confidence and needs grow.

Your financial wellness journey is unique—these tools are here to support you every step of the way.

The BestMoney editorial team is composed of writers and experts covering a full range of financial services. Our mission is to simplify the process of selecting the right provider for every need, leveraging our extensive industry knowledge to deliver clear, reliable advice.