While they can't replace human financial advisors for complex planning, they excel at routine tasks like checking balances, categorizing expenses, and providing basic guidance.

These tools work best when you understand their capabilities and limitations. Here's an evaluation of five leading AI finance assistants to help you determine which might be useful for your specific needs.

Top 5 Best AI Chatbots for Finance

Best for personalized budgeting insights: KAI by Kasisto

Best for creative savings methods: Cleo

Best for 24/7 customer service: Bank of America’s Erica and Wells Fargo’s Fargo

Best for investment advice and portfolio management: Schwab Intelligent Assistant

Best for real-time fraud detection: Capital One’s Eno, for Real-Time Fraud Protection

5 AI Chatbots That Can Answer Your Money Questions Instantly

1. KAI by Kasisto - for personalized budgeting insights

KAI is a banking‑grade conversational AI platform used by leading financial institutions. It powers in‑app chat experiences that let you ask natural‑language questions (e.g., “Why did my spending go up this month?”) and get clear, actionable answers.

What it can do

Analyze spending patterns across accounts and surface trends

Offer proactive “nudges” (e.g., unusual bill spikes, upcoming cash‑flow gaps)

Help with routine tasks like checking balances, transfers, and bill info

Provide contextual education (“what is APR?”, “how does overdraft work?”)

Why it stands out

Purpose‑built for banks (security, auditability, handoff to human agents)

Deployed by major institutions (e.g., DBS, Standard Chartered)

Think twice if you want a standalone consumer app. KAI is only available through participating banks/credit unions.

Cost: Included with participating banks (your bank’s standard fees may apply).

Availability: Inside partner banks’ mobile apps and websites (regions vary).

2. Cleo - for creative savings methods

Cleo blends budgeting with a playful, personality‑driven chat that keeps you engaged. Connect your accounts, and Cleo categorizes spending, suggests savings targets, and challenges you to hit goals.

What it can do

Track spending by category and flag patterns

Set up savings rules (round‑ups, challenges, auto‑stash)

Offer optional features like cash advances and a credit‑builder card

Why it stands out

Humor and “tough‑love” prompts can boost motivation

Mobile‑first design with fast onboarding

Think twice if you dislike snark or prefer strictly formal guidance. You’ll also need to be comfortable linking accounts.

Cost:

- Free basic;

- Cleo Plus from ~$5.99/mo;

- Cleo Builder from ~$14.99/mo (with credit‑building & cash‑advance features).

Availability: iOS, Android, and web.

3. Bank of America’s Erica and Wells Fargo’s Fargo - for 24/7 banking customer service

Two of the largest U.S. banks Bank of America and Wells Fargo offer always‑on assistants that reduce support friction and surface helpful insights.

What they can do

Answer everyday questions: balances, recent transactions, due dates

Help with transfers, bill reminders, alerts, and charge lookups

Summarize spending by merchant/category and flag anomalies

Why they stand out

Deep integration with each bank’s services, security, and notifications

Proactive insights (e.g., duplicate charges, recurring bill changes)

Think twice if… you’re not a customer of the respective bank. These assistants don’t replace financial advisors for complex planning (loans, investments, retirement).

Cost: Free for existing customers.

Availability: Bank of America mobile/online (Erica); Wells Fargo mobile/online (Fargo).

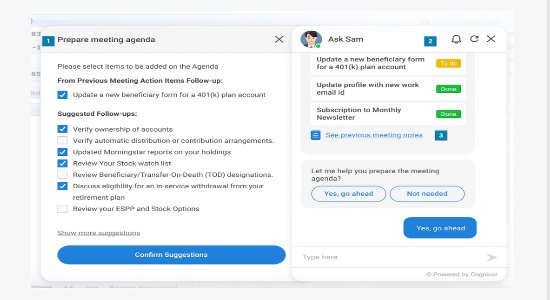

4.Schwab Assistant (with Schwab Intelligent Portfolios) — for investment guidance & portfolio automation

Schwab offers a voice/chat Assistant to help you navigate accounts and get quick answers, while Schwab Intelligent Portfolios (the robo‑advisor) handles portfolio construction, monitoring, and automated rebalancing.

What it can do

The Assistant: answer how‑to questions, find balances/holdings, route you to the right tools

The robo‑advisor: build and monitor a diversified ETF portfolio, automate rebalancing/tax‑loss harvesting (where eligible)

Why it stands out

Clear separation of duties: the chatbot assists; the robo‑advisor manages the portfolio

Think twice if… you need complex, highly personalized planning (advanced tax/estate strategies)—a human advisor is still best for that.

Cost:

- Schwab Intelligent Portfolios® has no advisory fee.

- Schwab Intelligent Portfolios Premium® adds unlimited CFP® guidance for $300 upfront + $30/month.

Availability: U.S. investors via Schwab’s app and web.

See how to use Schwab assistant

* Not investment advice: The chat interface provides education and navigation. Portfolio advice is delivered by the robo‑advisor program and/or human advisors under their respective terms.

5. Capital One’s Eno — for real‑time fraud protection

AI chatbots like Capital One’s Eno focuses on security and purchase control. It monitors transactions for unusual activity, sends proactive alerts, and helps you take action quickly.

What it can do

Send instant alerts for suspicious charges or merchant anomalies

Help freeze/replace a card and confirm transactions

Generate virtual card numbers (merchant‑specific) to protect your real card online

Why it stands out

Strong emphasis on security, with practical tools for everyday shopping

Think twice if… you’re not a Capital One customer—Eno is limited to Capital One accounts.

Cost: Included for Capital One customers.

Availability: Capital One mobile app, browser extension, and online banking.

Quick Compare: Best AI Money Assistants

Side-by-side comparison of popular AI finance chatbots with best-for use cases, capabilities, pricing, and availability.

| Chatbot | Best For | Key Abilities | Cost | Where It Works |

|---|---|---|---|---|

| KAI by Kasisto | Personalized budgeting insights | Conversational banking; spending analysis; proactive nudges; bank-enabled payments & transfers | Included with participating banks | Inside partner banks’ apps & websites (availability varies) |

| Cleo | Creative savings motivation | Budgeting & spend tracking; savings challenges & round-ups; optional cash advance & credit builder | Free basic; Plus from ~$5.99/mo; Builder from ~$14.99/mo | iOS, Android, web |

| BofA — Erica | 24/7 self-service for BoA customers | Balances & transactions; bill help; spending insights; alerts & reminders | Included for Bank of America customers | Bank of America mobile app & online banking |

| Wells Fargo — Fargo | Guided banking for WF customers | Balances & transactions; transfers; bill help; spending summaries; goal prompts | Included for Wells Fargo customers | Wells Fargo mobile app & online banking |

| Capital One — Eno | Real-time security & purchase control | Fraud & charge alerts; merchant-locked virtual card numbers; help freezing/replacing card | Included for Capital One customers | Capital One app, browser extension, & online banking |

*Note: The chat interface provides guidance and self‑service. Where applicable, portfolio construction/management is handled by the bank’s robo‑advisor program, not the chat UI.

How These Tools Actually Work

- Natural Language Processing:You can ask questions in plain English ("Why did my grocery spending increase?"), and the AI attempts to categorize your expenses and identify trends. However, spending categorization isn't always accurate, especially for cash transactions or unusual merchants.

- Automated Insights: These systems can identify unusual spending patterns, but they may also flag legitimate changes (like seasonal expenses) as anomalies. Security systems may similarly flag legitimate transactions or spending patterns as suspicious. Review their suggestions rather than acting on them automatically.

- Proactive Notifications: While helpful for catching forgotten bills or unusual charges, frequent alerts can become noise. Most platforms allow you to customize notification preferences.

- Human Handoff: When requests become complex, most systems offer escalation to human representatives, though wait times and availability vary by provider.

Realistic Expectations From AI Finance Assistants

These AI assistants work best for routine tasks and basic insights. They can help you track spending patterns, set simple goals, and handle everyday banking questions. However, they have important limitations:

- Analysis Quality: Transaction categorization depends on merchant data quality and may require manual corrections

- Advice Limitations: They provide information and suggestions, not personalized financial advice or fiduciary guidance

- Context Gaps: They may miss important nuances in your financial situation that a human advisor would catch

- Error Potential: Chatbot responses should be treated as guidance, not definitive advice. Always verify important information independently

For complex financial planning, tax strategy, estate planning, or major investment decisions, human professionals remain essential.

Privacy and Security Considerations

- Use Official Channels: Only access these assistants through your bank's official app or website. Phishing attempts often target financial chatbot users.

- Limit Sensitive Information: Avoid sharing complete account numbers, Social Security numbers, or temporary access codes in chat interfaces.

- Understand Data Usage: Review privacy policies to understand how your financial data is stored, analyzed, and potentially shared. Some platforms use transaction data to improve their algorithms.

- Enable Security Features: Use multi-factor authentication and consider virtual card numbers where available.

- Verify Before Acting: Chatbot responses should be treated as guidance, not definitive advice. Always verify important information independently.

Remember the Limitations: Chatbots cannot provide fiduciary advice and may make errors in analysis or suggestions.

Which Assistant Fits Your Needs?

- If you want spending insights and your bank offers it: KAI provides sophisticated analysis within your existing banking relationship.

- If you need motivation for saving: Cleo's gamified approach can be effective, but requires comfort with a third-party app and potential monthly fees.

- If you primarily need basic banking help: Your bank's built-in assistant (like Erica or Fargo) handles routine questions without additional setup.

- If you want investment account navigation: Schwab's assistant helps with account questions, while their robo-advisor handles portfolio management.

- If security is your primary concern: Eno excels at transaction monitoring and fraud prevention tools.

Conclusion

AI chatbots can be valuable tools for routine financial management and basic insights, but they work best when integrated into a broader financial strategy rather than replacing human judgment entirely.

The most effective approach is often to use these tools for what they do well—routine questions, pattern recognition, and basic automation—while consulting human professionals for complex decisions and long-term planning.

Before choosing any assistant, consider whether the features align with your actual financial management needs and comfort level with automated tools. The best chatbot is the one you'll actually use consistently and appropriately.

Frequently Asked Questions (FAQ)

Are these AI assistants free to use?

It depends on the provider. Bank-provided assistants (like Erica, Fargo, and Eno) are typically included at no extra cost for customers. Standalone apps like Cleo offer a free basic version with optional paid premium features.

Are these AI assistants safe to use?

When accessed through official channels, these tools generally use banking-grade security. However, no system is perfect, and you should avoid sharing sensitive information like full account numbers or passwords in chat interfaces.

Do I need to link my bank accounts?

Yes, for them to be effective. Assistants from your bank already have secure access to your account data. Third-party apps like Cleo require you to link your accounts via a secure service (like Plaid) to analyze your finances and provide personalized insights.

Can they move my money without my permission?

No, you are always in control. An AI chatbot will never move money on its own. It can only initiate a transfer or payment after you have given a clear, specific command and confirmed the action.

How accurate are their spending analyses?

Accuracy varies based on transaction clarity and categorization algorithms. Review their categorizations regularly, especially for cash transactions or unusual merchants that may be misclassified.

Can they give me personalized investment advice?

The chat interface provides education, not direct advice. Chatbots like the Schwab Assistant are designed for navigation and answering questions (e.g., "What is an ETF?"). Actual, personalized investment advice is generated by a separate robo-advisor program (like Schwab Intelligent Portfolios) or a human advisor.

Can they actually save me money?

They can help identify spending patterns and automate some savings, but the actual savings depend on your actions based on their insights. They're tools to support your financial decisions, not magic solutions.

What happens if they make a mistake?

Most platforms allow you to correct categorizations and provide feedback. For significant errors affecting account actions, contact your financial institution directly rather than relying solely on the chatbot interface.

Do I need to use multiple assistants?

Generally no. Most people find one well-integrated tool more useful than juggling multiple interfaces. Choose based on your primary banking relationship and most important features.

The BestMoney editorial team is composed of writers and experts covering a full range of financial services. Our mission is to simplify the process of selecting the right provider for every need, leveraging our extensive industry knowledge to deliver clear, reliable advice.