At Best Money, we regularly help first-time buyers compare mortgage lenders as they prepare to enter the housing market. So we wanted to learn in which cities starter homes are most scarce. To do this, we collected Redfin data from the last three years across more than 60 major U.S. cities.

Using this data, we calculated which cities are easiest and hardest to find a starter home, where starter homes are largest and cheapest on average, where you can find the best bang for your buck, and more. Read on to learn more about our findings.

Key Takeaways

- Memphis, TN, Columbus, OH, and St. Louis, MO, have the most starter homes in the U.S.

- Honolulu, HI, New York, NY, and Las Vegas, NV, have the fewest starter homes in the U.S.

- Nationally, a starter home costs $379,432 and is 1,410 sq. ft.

- In an average market, 17.5% of homes qualify as starter homes.

- On average, starter homes in Houston, TX, and Denver, CO, are the largest.

- On average, starter homes in Cleveland, OH, and Fort Wayne, IN, are the most affordable.

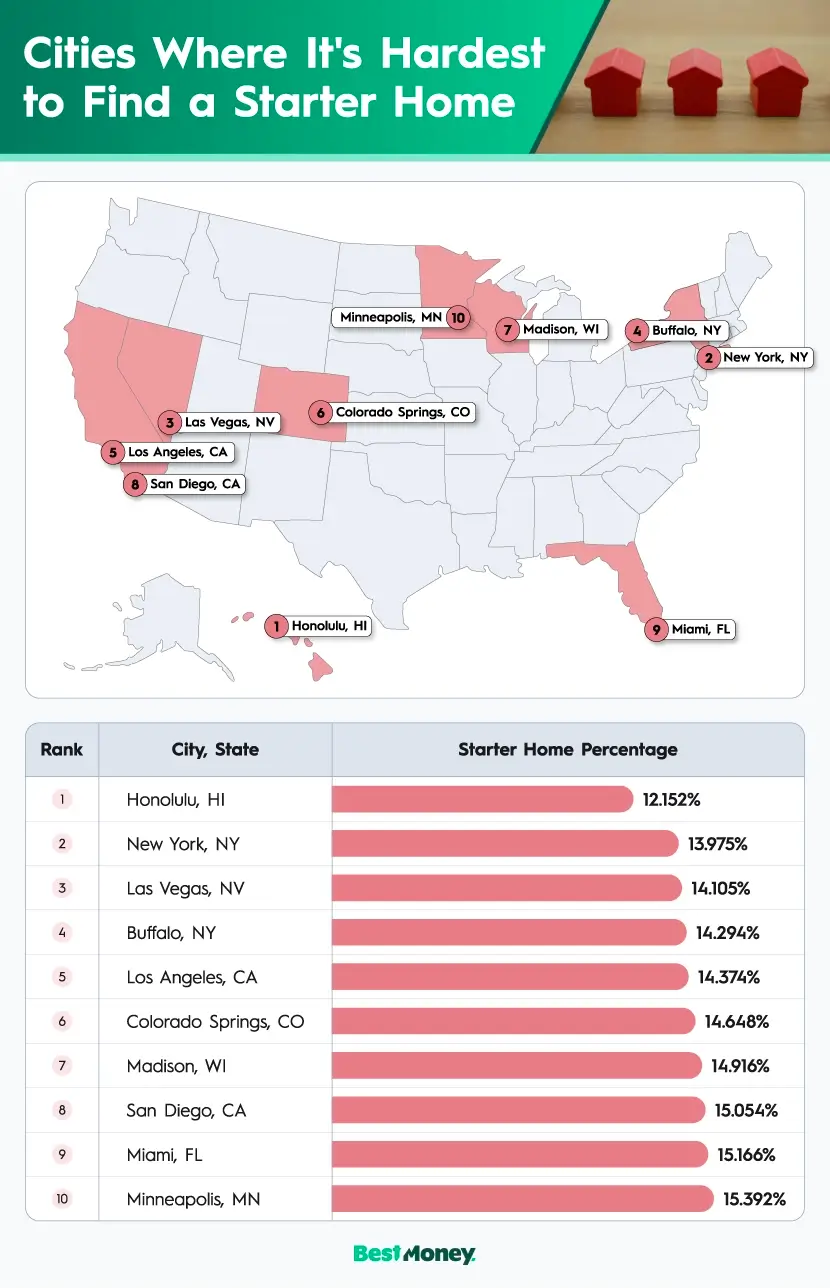

Where It’s Hardest for Americans to Find Starter Homes

Unfortunately, in an average housing market, only 17.5% of homes qualify as a starter home. Of the more than 60 cities we analyzed, 30 have an even lower percentage of starter homes available.

1. Honolulu, HI

Kicking off with the hardest cities to find a starter home is Honolulu, HI, with a percentage of 12.152%. While nearly 7,000 homes have sold in recent years only 847 were classified as starter homes.

2. New York, NY

New York, NY, follows closely behind with a starter home percentage of 13.975% making it the second hardest city for first-time home buyers. Perhaps one of the biggest contributors to this ranking is the median cost of a home in the Big Apple as the city ranks 9th for the most expensive starter homes ($580,000).

3. Las Vegas, NV

Many people visit Las Vegas, NV, to win big, but when it comes to Sin City residents looking to buy their first home, the luck seems to be limited. While the average price of a starter home is relatively low at $359,600, inventory in Las Vegas is also low at 14.11%, making it the third hardest city in which to find a starter home.

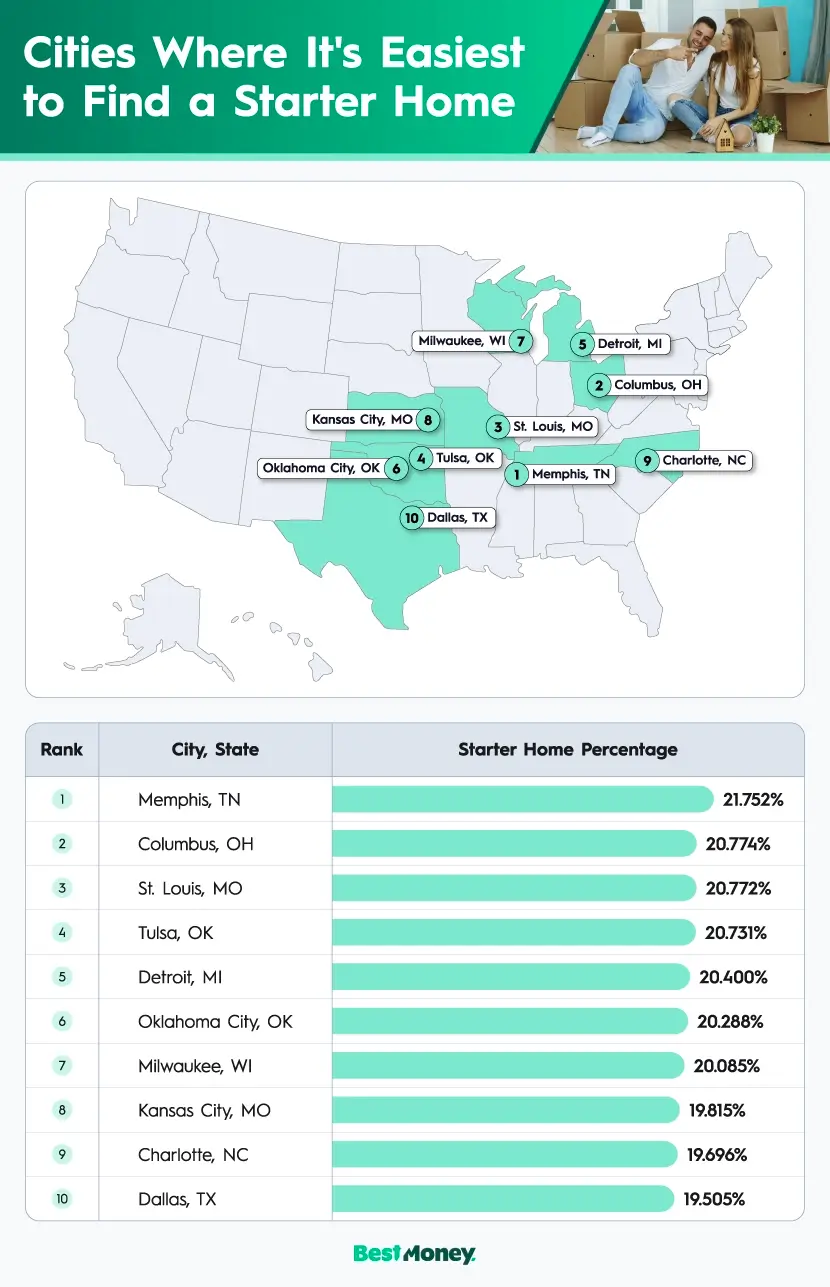

Where Americans Have the Most Luck Finding Starter Homes

From fewer smaller homes being built to higher prices across the board, many factors prevent young Americans from becoming homeowners. According to the National Association of Realtors, these changes have resulted in the median age of first-time home buyers to jump from their late 20s in the 1980s to 38 years old in 2024.

While this jump in median age can be daunting, there are still parts of the country that offer more inventory for those shopping for their first home. Both Oklahoma and Missouri are home to two cities each in the top 10 for the most starter homes. Similarly, North Carolina cities claim spots in the top 15.

1. Memphis, TN

Ranking first for the easiest city to find starter homes is Memphis, TN, with a percentage of 21.752%. In addition to the highest percentage of available homes, Memphis starter homes come in third for the lowest price tag on average at $196,000, tying with Pittsburgh, PA.

2. Columbus, OH

Columbus, OH, is up next with a starter home percentage of 20.774%, earning second place for easiest cities to find a starter home. While not as inexpensive as Memphis, Columbus starter homes are priced at an average of $280,000, which is lower than 60% of the cities analyzed in this study.

3. St. Louis, MO

Wrapping up the top three for starter home hot spots is St. Louis, MO, with starter homes making up 20.772% of all homes sold in recent years. St. Louis ranks 9th for the most affordable starter homes at an average of $215,200, but the city also ranks first for the smallest homes on average at 1,189 sq. ft. While you may dream of a big, open floor plan for your forever home, these small houses open the door to homeownership, while requiring less upkeep.

Cities Where Starter Homes Are Largest

Starter homes are often assumed to be small by default, but that isn’t the case everywhere. Nationally, the average starter home is about 1,410 sq. ft., but in some cities, first-time home buyers are discovering more generous layouts.

1. Houston, TX

Leading the way with the largest starter homes on average is Houston, TX, at 1,710 sq. ft. That’s about 70% larger than the average size of starter homes in St. Louis, MO.

2. Denver, CO

Although among the most expensive cities to buy a starter home ($491,920), Denver, CO, has the second largest starter homes on average at 1,689 sq. ft.

3. Austin, TX

Returning to Texas, Austin, TX, claims third place for the largest starter homes with an average size of 1,658 sq. ft.

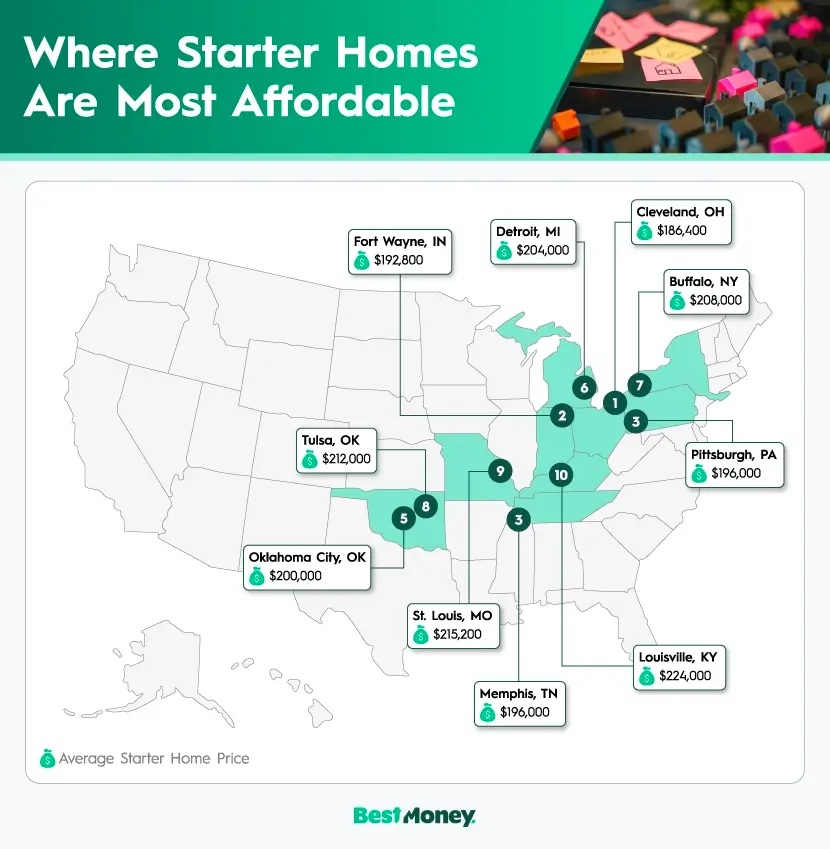

Cities with the Most Affordable Homes

While space can make a home feel more livable, ultimately cost is the biggest factor most Americans consider when shopping for their first home. When looking at starter homes across the country, we found the average price was $379,432, but houses in some parts of the U.S. are more affordable than others.

1. Cleveland, OH

Up first with the lowest average cost of starter homes is Cleveland, OH, at $186,400. While homes in this Ohio city are typically smaller on average at 1,207 sq. ft., the lower prices make the size more reasonable for a first home.

2. Fort Wayne, IN

Coming in second for the most affordable starter homes is Fort Wayne, IN, at $192,800. When considering the price compared to the size of the home, we found shoppers in Fort Wayne, IN, have access to the best deals at $143 per square foot.

3. Pittsburgh, PA & Memphis, TN

This is followed by a tie for third as starter homes in both Pittsburgh, PA, and Memphis, TN, come in at an average price of $196,000.

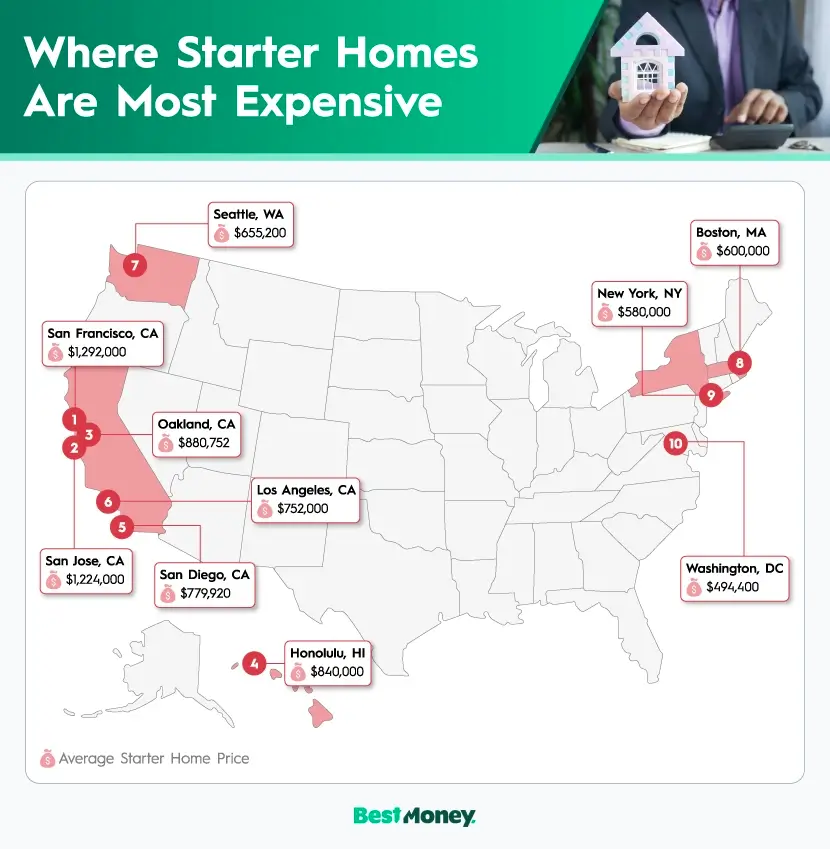

Cities with the Priciest Starter Homes

Pricey housing markets is certainly not a new topic, but we wanted to gain insight into the cities where first-time home buyers are facing the most expensive starter homes on average. Overall, we found California is the toughest place for shoppers looking to find a cheaper option as the state is home to 6 of the top 15 priciest cities for starter homes.

1. San Francisco, CA

Topping the list for the priciest starter homes is San Francisco, CA, with an average price of $1,292,000. To put this in perspective, that’s nearly 7 times more expensive than the average cost of a home in the most affordable city, Cleveland, OH ($186,400).

2. San Jose, CA

Up next on the list is San Jose, CA, with an average starter home price of $1,224,000. Mixed with the lower percentage of starter homes available (15.781%), shoppers in San Jose are likely to have a more difficult time finding their first home.

3. Oakland, CA

Rounding out the top three is another California city, Oakland, CA, with an average price of $880,752. In addition to being among the most expensive homes, Oakland also ranks 14th for the smallest starter homes on average (1,298 sq. ft.), resulting in less bang for your buck as a first-time homeowner.

Find the Right Lender with Best Money

Buying a home, while a daunting task for first timers, is a monumental achievement. Once you find the right starter home, you can say goodbye to renting and start investing in a property that is completely yours.

At Best Money, we know that when shopping for houses, finding the best lender is just as important as finding the right home. That’s why we researched top mortgage lenders to provide a guide to help you find the right fit for you.

Simply enter details regarding your credit score, loan amount, and estimated closing date, and we’ll provide the best lenders that match your needs. Whether you’re looking to purchase your first home or refinance your current mortgage, the team at Best Money has your covered.

Methodology

In January 2026, we analyzed 5.8 million records of home sales across more than 70 metro areas in the U.S.

Our analysis focused on sales of houses and townhouses that occurred in the last three years that exist within 30 miles of the center of a major city. This established a baseline denominator we call total sales. We then calculated what percent of total sales classify as "starter homes." We define a starter home as a property meeting both of the following criteria:

1) Sale price ≤ 80% of the local median sale price. This identifies homes priced in the lower tier of affordability for that market, targeting entry-level buyers who cannot afford the typical (median) home.

2) Square footage ≤ 25th percentile for the market. This captures smaller homes, which historically constitute the starter home segment as first-time buyers typically purchase modest-sized properties before trading up.

Seven metro areas were excluded from this analysis, for one or multiple reasons related to insufficient data. Due to local non-disclosure restrictions and/or MLS syndication complexities, not all cities have a reliable amount of home sale data in Redfin's database. Those cities are: Lubbock, TX; El Paso, TX; Salt Lake City, UT; Albuquerque, NM; Durham, NC; Wichita, KS; and Newark, NJ.

The BestMoney editorial team is composed of writers and experts covering a full range of financial services. Our mission is to simplify the process of selecting the right provider for every need, leveraging our extensive industry knowledge to deliver clear, reliable advice.