Even with this level of development, experts continue to urge users to fact-check information they receive from the tools. While some users are skeptical about AI responses, we found that 82% of Americans trust AI for financial information and guidance.

At BestMoney, we pride ourselves on providing consumers with the best tools, information, and resources to make the right financial decisions for them. That’s why we became curious about Americans’ experiences with asking AI for financial advice.

With more and more people turning to AI for help with everyday tasks and questions, we decided to uncover the root of Americans’ desire to use the technology and what topics they are asking for information and guidance on. To do this, we surveyed more than 1,200 Americans about their usage of AI for advice, how it has helped, and where it has fallen short. Read on to learn more about our findings.

Key Takeaways

- 82% of Americans trust AI for financial information and guidance.

- 58% of Americans have used AI to seek information or guidance on finances.

- 82% say their use of AI for finances has increased over the past 12 months.

- 64% say their financial health has improved since using AI.

- 74% say their confidence with finances has improved since using AI.

- 76% have taken action or made a financial decision based on AI guidance; 65% of those said the result was good.

- Americans are most likely to seek information about investing, budgeting, and savings.

- Nearly 1 in 2 Americans believe AI is superior to all the people in their life when it comes to asking for financial information and guidance.

The Financial Topics Americans Use AI for the Most

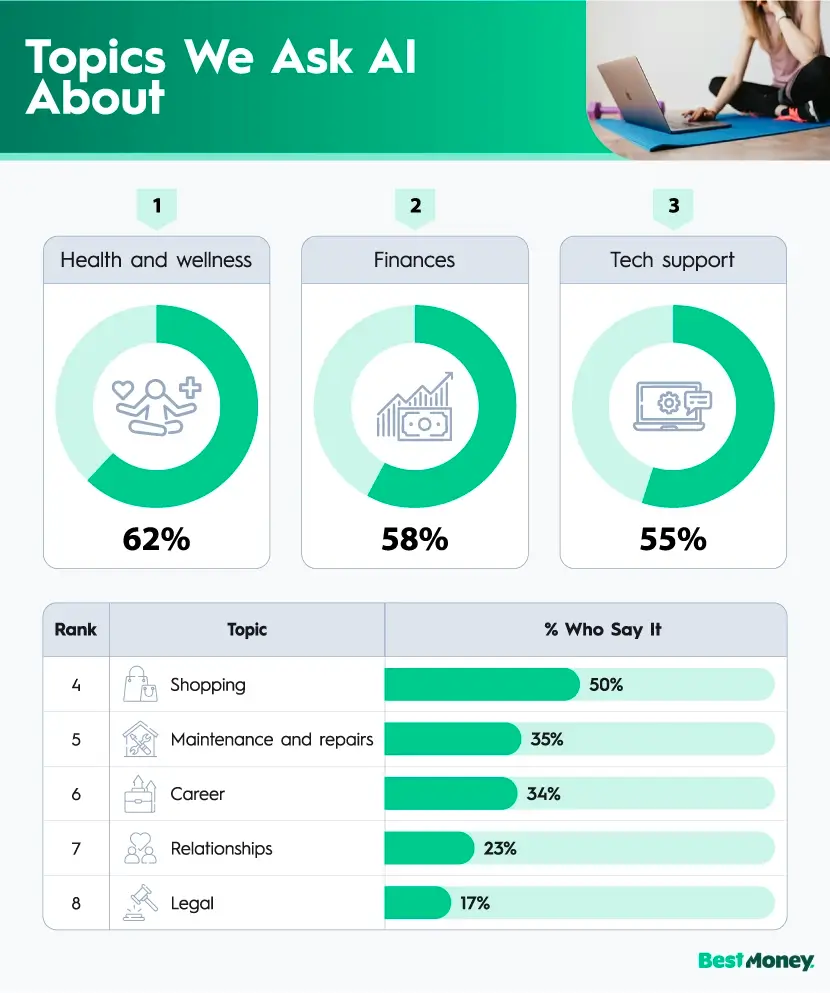

While some people only use chatbots for help with simple things like how to perfect their sourdough, others are treating the technology as a personal assistant for more serious topics. Overall we found that health and wellness (62%) and finances (58%) are the top two topics people turn to AI for guidance. This is followed by tech support (55%), shopping (50%), and maintenance and repairs (35%).

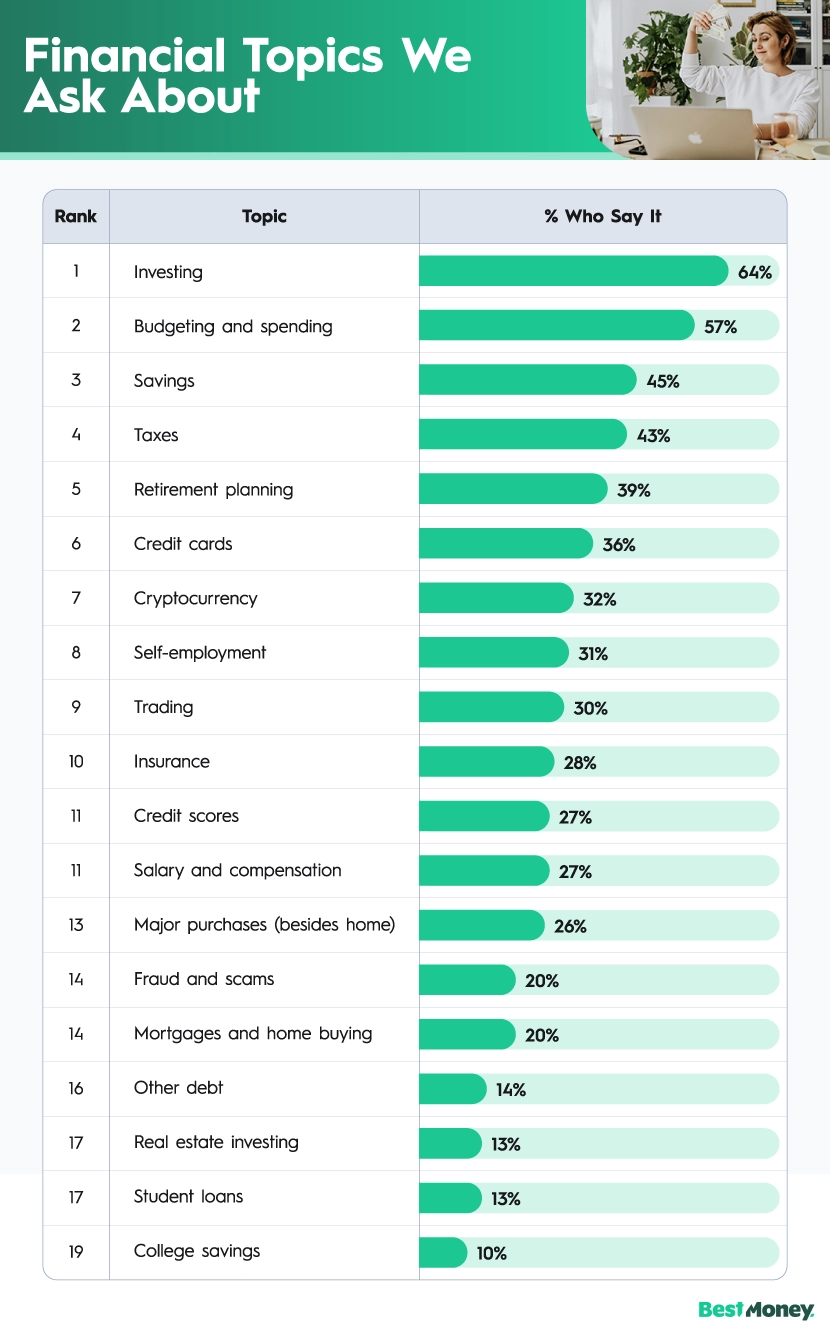

So with more than half of the country utilizing AI for financial advice, we wanted to understand which specific topics are being discussed. Leading the way with 64% of people reporting it is investing. For some Americans, advice is focused on learning the basics, while others are asking for specific advice to outline long-term financial plans.

In second place for the most common financial topics are budgeting and spending. Budgeting is a crucial piece of the personal finance puzzle as ensuring bills and other necessities are covered is the important first step to maximizing your income.

Once a person has a strong understanding of how they are spending and what money they have left over after bills are paid, they typically begin to look at their savings. This is the third most popular topic Americans ask AI for advice on as 45% report turning to the tech for guidance. Inquiries vary from one person to the next, with simple questions like, “How much should I save each month if I make $X?” to more in-depth questions like, “How much money should I have saved by 25 / 30 / 40?”

Coming in fourth place for financial topics are taxes with more than two-fifths of Americans seeking guidance. These days many people turn to online tools and services to help file their taxes because the process can be daunting. But in the age of artificial intelligence, many are opting to use the technology to learn more about tax deductions, the difference between state and federal taxes, and even how to file themselves.

Rounding out the top five, we find nearly 2 in 5 people looking to the future with a focus on retirement planning. Regardless of your age, planning for life after working can be crucial for a leisurely retirement. When it comes to retirement planning questions can range anywhere from “How does a 401k work” to more specific requests like “Can you help me create a savings plan so I can retire early?”

Why Americans Use AI for Financial Information and Guidance

From personalized explanations to privacy, there are many reasons a person would turn to AI for information. When asked about these guiding factors we learned that a majority of Americans (63%) appreciate the speed with which AI operates.

While AI can be useful for quick advice, it is important to keep in mind that the technology is not perfect, and faster doesn’t always mean better. Yoni Cohen, senior editor at BestMoney, reminds us that while speed is useful, “taking time with a professional to think through your goals, risks, and emotions can lead to decisions that are safer and more sustainable in the long run."

Up next for top reasons is cost with 56% of people reporting it. While traditional financial advice can feel out of reach for some due to fees or account minimums, AI tools are typically free or very low cost. Even still, for many people, AI is not replacing a websites that contain comprehensive financial information and advice, but rather filling a gap they could not afford to fill before.

Responsiveness (55%) is up next, ranking as the third most popular reason Americans turn to AI for financial advice. Although similar to speed, responsiveness refers to the ability to ask as many follow-up questions as needed while also receiving an immediate response. In addition to saving time, this responsiveness can also help financial topics feel more conversational and less like a one-time transaction.

The Results of Using AI for Financial Advice

Asking for advice is one thing, but how many people are actually listening and implementing the tips they receive from AI? To our surprise, 76% of Americans say they have taken action or made a financial decision based on AI guidance, and 65% of those said the result was good.

While some people have a financially savvy dad or aunt who can provide wisdom regarding their budgeting and investing, others try their best to avoid receiving unsolicited advice from people in their lives. In fact, we discovered that for nearly 1 in 2 people, artificial intelligence, in their eyes, is superior to all the people in their life when it comes to asking for financial information and guidance.

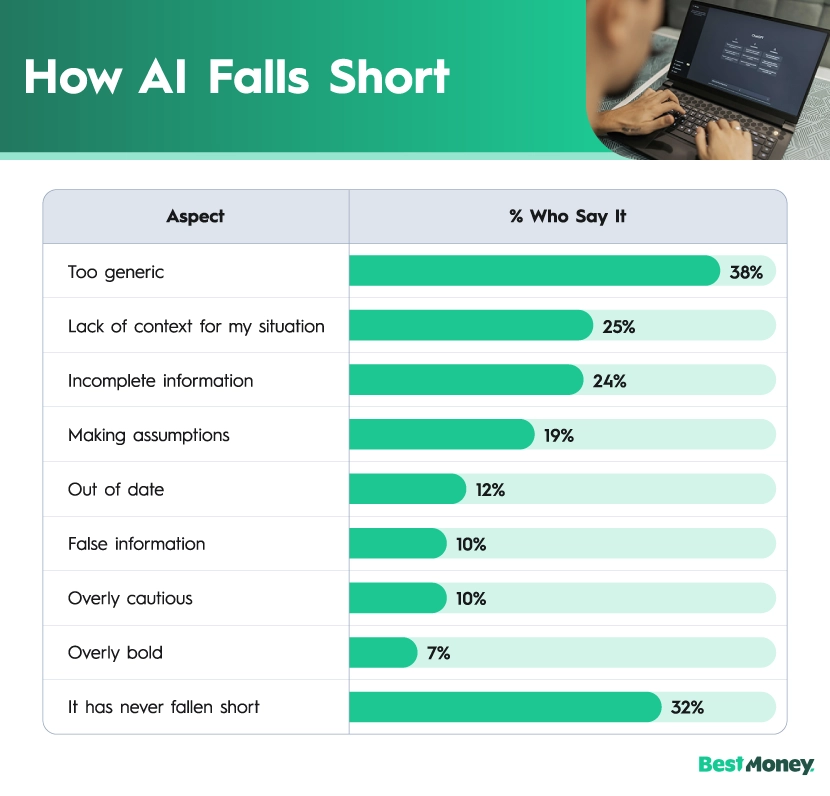

Although many people have come to trust AI and its advice, the technology is not perfect and at times can fall short. When asking about these shortcomings, we learned nearly 2 in 5 people felt the information shared was too generic. For some, AI advice leans on broad rules of thumb that may not match their specific needs or priorities.

This is one area in which opting for a human advisor or financial website can be more beneficial. Cohen reminds us that “AI can be a great starting point for learning about your options, but real-life information from an authoritative source can connect the dots in a way a generic tool simply can’t.”

This connects to the second most common way Americans say chatbots fall short as 1 in 4 people note its lack of context for their situation. Afterall, AI only knows the information you provide it with regarding your personal details. So if you leave out an important piece of the financial puzzle, it is less likely than a human advisor to catch the mistake and ask about the missing information.

Incomplete information is up next, ranking third with 24% of people reporting it. In finance, missing details about taxes, fees, or eligibility rules can lead to misunderstandings or half-formed plans that need a professional to fully flesh out.

In the end, Cohen reminds us that “AI is a fantastic way to educate yourself and get quick answers to simple financial questions, and we encourage people to use it that way. But when it comes to making big decisions that affect your life and family, a professional can bring experience, judgment, and nuance that no AI tool can fully replicate.”

Turn to Comparison Sites for Financial Advice

When you're looking for direction and guidance on your finances, you want tools that give you quick answers and ones you can trust. But in a world filled with online financial products and solutions, it can be time-consuming to wade through your options and compare which ones work best for you. Fin AI might serve as a starting point as you dive into your questions, but sites like BestMoney can help you every step of the way, giving you the confidence to quickly compare products and shop for the best fit for your finances.

We help simplify your decisions with expert guidance on a range of financial choices, whether it be the best credit card or lender to handle your home loan. While AI may leave you wondering whether you have the latest expert information for your decisions, you can be sure that we offer the industry insight you need to make the right choice.

Methodology

In this study, we surveyed more than 1,200 Americans about their usage of AI for advice. We asked a variety of questions from the habits in their life that they use AI for, the financial topics they ask about most, how effective the information or guidance has been, where it has fallen short, and more.

The BestMoney editorial team is composed of writers and experts covering a full range of financial services. Our mission is to simplify the process of selecting the right provider for every need, leveraging our extensive industry knowledge to deliver clear, reliable advice.