If you can answer yes to 2 or more of the following statements, you can qualify for huge savings on your car insurance!

- U.S driver

- Drive less than 50 miles/day

- Pay over $65/month for car insurance

For years, insurance companies overcharged people who drive less than 50 miles/day, but these days are over. US drivers, now is the time to finally start saving the big bucks on your car insurance.

There are hidden ways to get car insurance discounts that you might not be aware of. For example, if you’ve never had a DUI, or your car includes built-in safety features, you could be getting a huge discount.

How Can I Reduce My Premium?

BestMoney.com, an online comparison service, is here to help you pay less! Use the site’s fast, free savings tool to find one of the more affordable rates out there for all drivers in {geo:state}.

Find My NEW Rate here >>>

How Does It Work?

First, you’ll answer a few general questions. Unlike a regular insurance agent, BestMoney.com uses this information to rule out any car insurance plans with unnecessary charges.

Next, you’ll be matched with a new insurance policy that can save you hundreds of dollars. There’s no fees, no phone calls, and it’s all instant!

The final step is to click on the button at the end of the short BestMoney.com quiz to get your extremely low rate. Once you click the button to go to the insurance provider’s site, the discounts BestMoney.com found will already be applied.

Important: Using this tool DOES NOT MEAN you’ll compromise on coverage. You could be recommended the SAME insurance provider at a cheaper price!

Start finding my savings >>>

Why Didn’t Anyone Tell Me About These Discounts?

If you’re asking yourself right now “how could I have been overcharged for so many years without knowing

about it?”

The answer is that although most insurance companies are aware of these discounts, sadly many regular people aren’t. But today, smart drivers like you have begun to take the search into their own hands, instead of relying on insurance agents who have their own agendas.

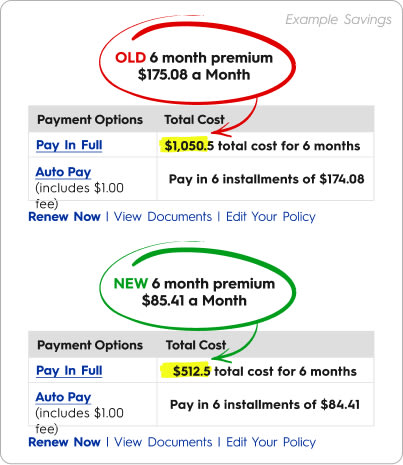

Recent survey data shows that people who compare several insurance providers save up to $820 per year on their car insurance premiums, for the same quality of coverage.

If you’re already insured, it is not too late to find a better policy. Despite what your current insurance company probably told you, you’re never locked in to a car insurance plan.

It’s time to take back control of your insurance plans so you can focus on driving, not wasting your hard-earned money on inflated premiums.

Here's How It Works:

Step 1: Select your age group to start the BestMoney.com quiz.

Step 2: Answer some general questions about yourself and your car.

Step 3: Be amazed by extremely high discounts from the top companies in {geo:state}.

Select Your Age Group:

If you drive for less than 2 hours a day, your next car insurance bill could be much lower… once you read this article, you’ll be amazed at how much you’re being overcharged.