How do you file? How much do you have to pay? Does every state require you to pay income taxes? We’ll answer these questions and more as we explore everything you need to know about state and federal taxes, including insights on the best tax relief services available.

Key Insights

- State and federal taxes are filed separately with different forms and payment addresses.

- State tax systems vary widely, from flat to progressive rates, with some states having no income tax.

- Federal taxes use 7 progressive brackets and apply to most earners above certain thresholds.

- State tax rules vary significantly, affecting overall tax burden despite consistent federal regulations.

What is State Income Tax?

Regarding income tax, there are both state and federal taxes. Let’s first look at state income taxes, which are based on your income. Tax rates may vary from state to state. There are also states where residents pay zero state income tax on their income (though they do pay federal income taxes).

State income taxes pay for public services such as education, healthcare, law enforcement, and transportation.

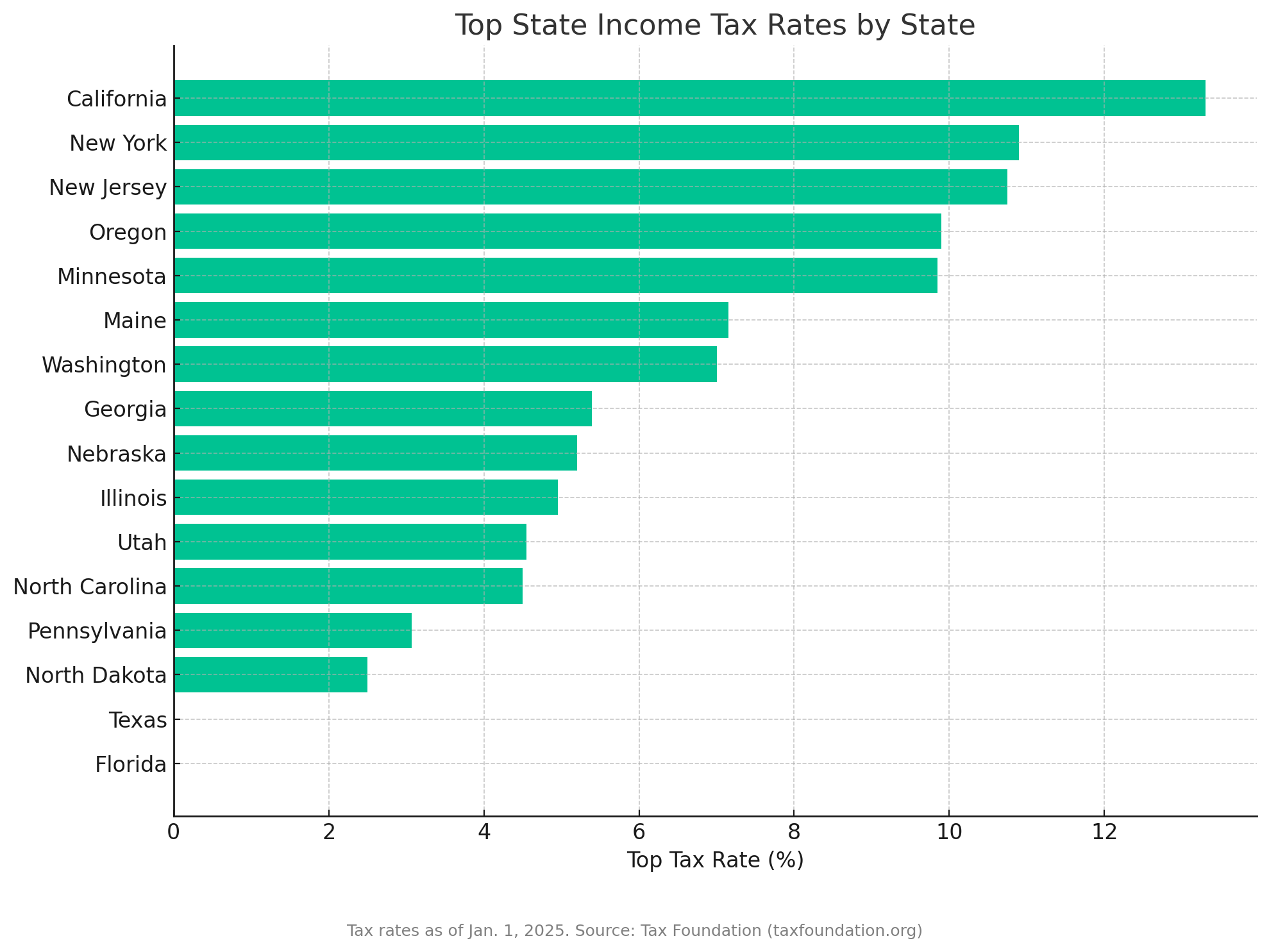

State income tax rates vary, but on the low end is North Dakota with a tax rate of 2.9%. On the high end, California residents who earn more than $1 million pay 14.4%.

So why pay state income tax?

State taxes are a legal obligation if you work and earn money. Not filing and not paying state income tax could result in penalties or fines.

When are State Taxes Due?

State taxes are due when federal income taxes are due: April 15 (unless this falls on a weekend, in which case, the deadline for filing state and federal taxes is the following business day).

Flat Tax vs. Progressive Tax: Key Differences

| Feature | Flat Tax | Progressive Tax |

|---|---|---|

| Rate Structure | Single fixed rate for all income levels | Higher income = higher rate |

| Calculation | Simpler to compute | More complex, with multiple brackets |

| Perceived Fairness | Same % for all earners | Those who earn more, pay more |

| Common Criticism | May favor high earners | May discourage financial growth |

States fall into one of three buckets when it comes to state income tax:

Flat tax

Progressive tax

No tax

The flat tax states charge the same percentage for everyone, regardless of how much they earn. Here are the states that currently use a flat-tax system:

States with Flat Income Tax

* Tax rates as of Jan. 1, 2025. Arizona, Colorado, Georgia, Idaho, Illinois, Indiana, Iowa, Kentucky, Louisiana, Michigan, Mississippi, North Carolina, Pennsylvania, Utah, and Washington have a flat income tax. Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, and Wyoming have no income tax. The remaining states use a graduated-rate income tax system.

Source: Tax Foundatio

In a progressive tax state, the more you make, the higher your tax rate. Those who make less money pay less percentage-wise than those who make more. The idea is that those who earn a higher income can afford to pay more in taxes.

Delaware State Income Tax Brackets (2024)

| Income Range | Tax Rate |

|---|---|

| $0 – $10,000 | 3% |

| $10,001 – $50,000 | 5.5% |

| $50,001 – $100,000 | 5.75% |

| $100,001 – $200,000 | 6.5% |

| $200,001 – $500,000 | 6.9% |

| Over $500,000 | 7.5% |

There are proponents for both systems. Those who support flat tax rates say they’re fairer to all and encourage economic growth. They also say they’re easier to calculate. Those against flat tax rates say those who make high incomes aren’t taxed enough and that this system favors the rich.

On the progressive tax side, proponents like that this system usually collects more in taxes since the higher tax brackets are taxed at a higher rate. Those against progressive taxes say it disincentivizes people to succeed financially.

Pros & Cons of Flat vs. Progressive State Taxes

Flat Tax

- Simple and easy to calculate

- Applies the same rate to all income levels

- Encourages economic growth (according to supporters)

- May favor high earners

- Seen as regressive by critics

- Less revenue for public programs

Progressive Tax

- Higher earners pay more in taxes

- Can reduce income inequality

- Generates more state revenue

- More complex to calculate and file

- May discourage financial growth

- Perceived as penalizing success

What Is Federal Income Tax?

In addition to filing and paying state income tax, you also have to file and pay federal taxes. Anyone with a qualifying salary must pay federal income taxes, which the U.S. government uses to fund defense, healthcare, education, infrastructure, and social programs.

Who Has to File and Pay Federal Income Tax?

Here’s a chart showing the requirements for filing and paying federal income taxes.

Filing status | Age at the end of the year | Minimum gross income |

|---|---|---|

Single | Under 65 | $13,850 |

Single | 65 or older | $15,700 |

Head of household | Under 65 | $20,800 |

Head of household | 65 or older | $22,650 |

Married filing jointly | Under 65 (both spouses) | $27,700 |

Married filing jointly | 65 or older (one spouse) | $29,200 |

Married filing jointly | 65 or older (both spouses) | $30,700 |

Married filing separately | Any age | $5 |

Qualifying surviving spouse | Under 65 | $27,700 |

Qualifying surviving spouse | 65 or older | $29,200 |

If you make less than the amount that applies to you, filing a federal tax return is unnecessary. Check your state tax requirements to see if they hold true for your state income taxes.

What is the federal income tax rate?

The federal income tax rate depends on how much money you make. There are seven tax brackets (ranges) for different income levels, along with seven tax rates.

| 2024 Tax Rate | Single | Married Filing Jointly | Married Filing Separately | Head of Household |

|---|---|---|---|---|

10% | $0-$11,600 | $0-$23,200 | $0-$11,600 | $0-$16,550 |

12% | $11,601-$47,150 | $23,201-$94,300 | $11,601-$47,150 | $16,551-$63,100 |

22% | $47,151-$100,525 | $94,301-$201,050 | $47,151-$100,525 | $63,101-$100,500 |

24% | $100,526-$191,950 | $201,051-$383,900 | $100,526-$191,950 | $100,501-$191,150 |

32% | $191,951-$243,725 | $383,901-$487,450 | $191,951-$243,700 | $191,151-$243,700 |

35% | $243,726-$609,350 | $487,451-$731,200 | $243,726-$365,600 | $243,701-$609,350 |

37% | $609,351 or more | $731,201 or more | $365,601 or more | $609,351 or more |

These tax rates and tax brackets are subject to change each year, so make sure you have the most up-to-date information.

State vs. Federal Income Tax: Key Differences

The table below summarizes how federal and state income taxes differ in terms of rates, administration, filing requirements, and how funds are used.

| Category | State Income Tax | Federal Income Tax |

|---|---|---|

| Governing Authority | Individual state tax departments | Internal Revenue Service (IRS) |

| Who Must File | Varies by state, based on income and residency | Most U.S. citizens and residents above income thresholds |

| Filing Deadline | Typically April 15 (varies slightly by state) | April 15 (or next business day) |

| Tax Rates | Flat, progressive, or none (depends on state) | Progressive — 7 brackets (10% to 37%) |

| Standard Deductions | Varies — some offer none | Yes — e.g., $14,600 for single filers in 2024 |

| Use of Funds | Funds local services (education, transportation, etc.) | Funds federal programs (defense, Medicare, infrastructure) |

| Filing Forms | State-specific tax forms | IRS Form 1040 and schedules |

| States With No Income Tax | 9 states (e.g., T, FL, WA) | Not applicable — all states follow same federal rules |

You now know that you must file and pay state and federal taxes if you make a certain income unless you live in a state with no income tax. But what are the differences between federal and state income taxes? Do the same rules apply to both?

First, let’s look at the entity that collects the taxes. At the federal level, it’s the Internal Revenue Service (IRS); At the state level, it’s the individual state government office responsible for collecting state taxes.

Another difference is the tax rate. We’ve looked at the tax brackets for federal income tax, and we’ve seen that states have different tax rates. Some have progressive tax rates, others have a flat tax rate, and a few states don’t have income tax at all.

The requirements for filing taxes also are different for state and federal taxes. Nearly everyone who earns income (as well as business entities) in the U.S. must file a federal tax return if they make over a certain income threshold, depending on their filing status. For states, requirements vary. Sometimes, you must earn a certain threshold of income to be required to file.

Do Federal Income Taxes Differ by State?

The requirements, tax rates, and deadlines for federal income taxes do not vary by state. Each state, even if it does not have state income tax, has the same rules when it comes to filing federal income tax.

Do You Pay Taxes if You Live Abroad?

The short answer is yes, you will pay income taxes in the U.S. if you live abroad, though the amount may be lower. Once you have no ties to a given state, however, you will no longer be responsible for filing and paying taxes in the state you previously lived in.

If you live outside the U.S., speak with an accountant who understands how overseas taxes work to understand your responsibilities as an American citizen living abroad.

Which States Have No State Income Tax?

As you’ve learned, there are no state income tax states where residents aren’t required to file or pay state income taxes. These states include:

Alaska

Florida

Nevada

New Hampshire*

South Dakota

Tennessee

Texas

Washington**

Wyoming

* New Hampshire residents do have to pay a 3% tax rate on interest and dividends income.

** Washington residents pay 7% on capital gains income.

Which States Have the Highest State Income Tax?

Depending on which state you live in, you might pay more in taxes. Let’s use the example of a person whose filing status is single and who earns $100,0000.

California has the highest income tax rate, 9.3%, on incomes over $100,000. Hawaii is second highest, with a 7.9% state tax, and New Jersey comes third with a 6.37% tax rate.

Do I File My State and Federal Taxes Separately?

Yes, there are two separate forms to fill out for federal and state income tax, so you’ll need to file each separately. Your payment, if you owe money, also is sent to a separate address.

If you use a software program like TurboTax to file your taxes, all the information you provide on your finances will be used for both state and federal taxes, though you will pay to file each separately once you complete the process.

State and Federal Income Tax Example

While we can’t create a perfect example of state and federal tax, since each situation is different, and you may have various deductions or credits that affect your tax liability, let’s look at a simplified example using two different states and federal income tax.

We’ll use someone filing as a single who earns $60,000 annually and the 2024 deductions and tax brackets.

Federal Calculation

The federal level's standard deduction for a single filer in 2024 is $14,600. So we’ll deduct that from the $60,000 income to get $45,400 as our taxable income.

This taxable income level of $45,400 falls in the 12% tax bracket for 2024. Keep in mind that the entire income isn’t taxed at 12%. The first $11,600 is taxed at a lower bracket of 10%, which amounts to $1,160.

The remaining $33,800 is taxed at 12%, which is $4,056. Add that to the $1,160 to get a total federal tax bill of $5,216.

California State Income Tax Calculation

Now let’s assume this person lives in California, where the standard deduction in California is $5,363. That makes our taxable income $54,637 ($60,000-$5,363).

This falls into the 8% tax bracket for 2024. Again, the entire $54,637 isn’t taxed at 8%. It’s a bit more complicated to calculate. Here are the tax brackets we need to consider, as well as the amount of taxes this person would have to pay for each bracket.

| 1% | $0 to $10,412 (pay $104.12) |

| 2% | $10,413 to $24,684 (pay $285.42) |

| 4% | $24,685 to $38,959 (pay $570.96) |

| 6% | $38,960 to $54,081 (pay $907.26) |

The total for these brackets is $1,867.76. Now, the remaining $556 that sits in the 8% tax bracket would require $44.48 in taxes for a grand total of $1,912.24 in California state income taxes.

Arkansas State Income Tax Calculation

For some perspective on different state taxes, let’s run the same example with Arkansas, where the standard deduction is $2,200, making our taxable income $57,800. This falls into the 4.4% tax bracket.

Again, you’ve got to calculate the income at each tax bracket:

| $0 - $5,099 | 0.0% |

| $5,100 - $10,299 | 2.0% (pay $104) |

| $10,300 - $14,699 | 3.0% (pay $131.97) |

| $14,700 - $24,299 | 3.4% (pay $326.36) |

The remaining $33,500 will be taxed at 4.4%, totaling $1,474. Add that to the numbers above to get a total state tax bill in Arkansas of $2036.33.

Interestingly, despite the lower tax rate, Arkansas residents pay a little more in state taxes. That's due to the brackets and how wide or narrow they are.

Bottom Line: Consider State and Federal Income Tax Separately

Everyone who earns a salary over a certain threshold is responsible for filing and paying state and federal taxes, though the fortunate few who live in a state with no income tax state won’t have to pay a dime for state taxes.

If you’re new to income tax, educate yourself on your responsibilities as a taxpayer, and always file and pay your taxes on time, or else you risk being charged a penalty or late fees.Tax Foundation

Su Guillory is a business and finance writer at BestMoney.com, specializing in tax relief, debt consolidation, personal loans, and student loans. She has authored several business books and been published on sites including Forbes, Nav, SoFi, and AllBusiness. Su’s extensive expertise in credit and financial strategies helps readers make sound decisions.