According to the most recent Consumer Price Index (CPI) data from the Bureau of Labor Statistics (BLS), the CPI for consumer goods rose 0.2% in July 2025 on a seasonally adjusted basis. The 12-month index showed a 2.7% increase across all items.

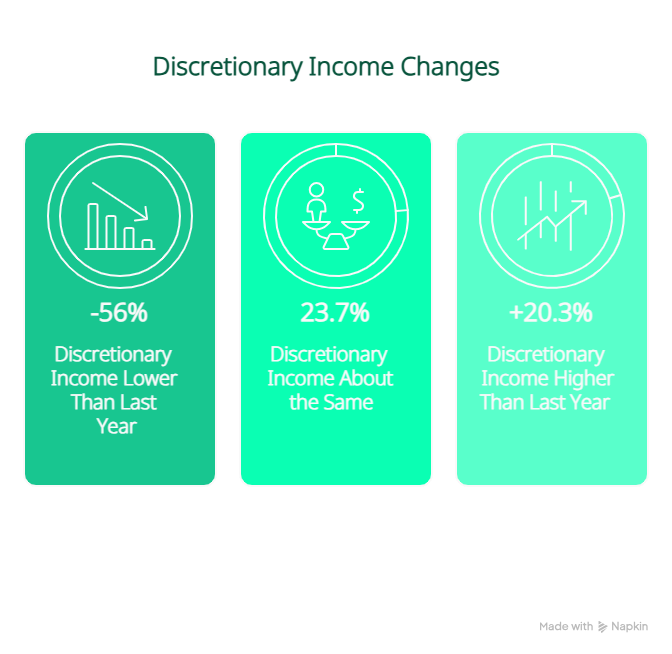

These rising costs, combined with lingering uncertainty about the long-term impact of tariffs on prices, result in tighter budgets for many consumers. We surveyed American adults to learn more about changes to discretionary spending among price hikes. More than half (56%) said they felt their discretionary income (or income remaining after the costs of housing, transportation, food and other necessary expenses) was lower than this time last year.

With no apparent end in sight, managing spending on a tighter budget may become a reality for many consumers. Still, that doesn’t mean it’s impossible to navigate financial challenges strategically. Leveraging budgeting tools, working to pay down debt and other financial best practices can help.

“The tough reality is that as much as we must take ownership and responsibility for our financial challenges, they are often the result of things out of our control. For that reason it is important not to take on blame or even shame for having to make difficult spending decisions. That said, even if it is not fair, we often have to change our spending habits to account for things out of our control,” said Bobbi Rebell, CFP and consumer finance expert at CardRates.com.

Consumer Price Index Up Across Most Major Categories

Inflation persists, and the effect on the prices of major consumer goods is apparent. The most recent CPI release, published August 12, 2025, found the cost of goods across many major spending categories was up in July.

For instance, the transportation services index rose 0.8% in July 2025, on a seasonally adjusted basis, while medical care services also rose by 0.8%.

It wasn’t all bad news, though. Costs were down for energy in July, including for energy commodities (like gas and fuel oil) and energy services (like electricity and piped utilities). Food costs remained stable month-over-month, following hikes earlier this year.

Still, prices were up overall comparing costs over the last year. The CPI for all items for the last 12-month period was up 2.7%, with increases noted in nearly all major categories (excluding energy and apparel).

According to BLS data, wages and salaries increased 3.6% in the 12-month period ending in June 2025, seemingly outpacing the rate of inflation. But according to the Bankrate wage-to-inflation index, wages still have not caught up with the existing wage-inflation gap.

The persistent wage-inflation gap, combined with steadily increasing costs and growing debt balances add up to financial challenges for many Americans.

Americans Cite Lower Discretionary Income, Trouble Covering Expenses

The increasing costs across major key categories seem to be having a direct impact on budgets. We surveyed 1,000 U.S. adults about their discretionary income, defined as net income remaining after the costs of housing, transportation, food and other necessary expenses.

More than half (56%) said their discretionary income was lower than this time last year, while 23.7% said it was about the same and only 20.3% said it was higher.

It seems Americans are struggling to cover expenses with their current income, too. Nearly 60% of survey respondents said they have had to pull money from savings in the last year to cover expenses.

“When you have the same amount of money coming in, but things you usually spend money on cost more, you’re forced to spend less on variable and discretionary things like groceries, dining out and entertainment. Failing to account for rising costs of normal bills and expenses can result in you constantly overspending, if you fail to adjust your spending limits on variable and discretionary costs,” said Raya Reaves, founder and finance coach at City Girl Savings.

Millennials More Optimistic That Budgeting Techniques Can Help

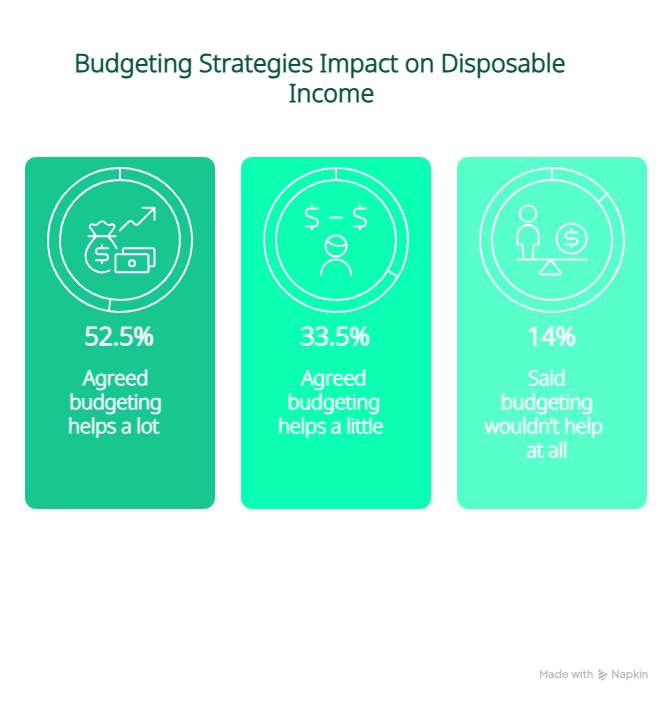

Though many survey respondents felt they have less money to work with this year than last (after necessary expenses), many also believed that property budgeting strategies could help to ease the burden.

When asked if successful budgeting strategies could help adjust to less disposable income, 52.5% agreed it would help a lot, with another 33.5% saying it would help a little and only 14% saying it wouldn’t help at all.

Millennials (ages 30 to 45) were the most optimistic that budgeting could lessen financial strain from less income. Only 8.6% of these respondents said successful budgeting strategies wouldn’t help adjust to less disposable income at all, compared to 17.1% of Gen Z (ages 18 to 30), 14.5% of Gen X (45 to 60) and 17.1% of Americans over 60.

How Successful Budgeting Can Help Mitigate Challenges

“Unfortunately no one can truly predict where prices will go — only that we don’t have clarity these days….It is important for consumers to focus on what they can control: their own personal economy,” said Rebell.

Whether or not you have less money to spend than you did before, a strong budget can be a bedrock for navigating all kinds of financial challenges. Primarily, budgets help you to have a plan in place when there is turbulence.

“The numbers may not tell a story that we like, but they do give us the information we need to make a plan,” said Rebell. “The best plans are the ones that are intentional, not spontaneous or made up on the fly. It is only natural for us as humans to get a little less diligent with tracking our spending and slip into habits that can drain our money unintentionally.”

You can work to build a successful budget with these steps:

Monitor your spending. The first step toward building a budget is knowledge around your spending habits. Before you can set a realistic expectation for spending, you need an idea of how much you are already spending per month in major categories and how it compares to your income. You can start with expense tracking for a month, sorting purchases into buckets like bills, groceries and gas either manually or with a digital tool.

Identify overspending. With your expenses in hand, you can start to dig in and identify any areas where you may be spending more than you need to. “Some of the first things to look at: our grocery utilization rate. We often buy things with every intention of eating/drinking them before they go bad. The reality is often very different. Creating systems to minimize and ideally eliminate food waste can be a huge money saver without really any pain or sacrifice. The same goes with cutting subscriptions and any recurring charges that are ‘nice to have’ but not really needed,” said Rebell.

Be willing to make cuts. Unfortunately, if your income isn’t matching up to your spending, then you will likely have to make some sacrifices — especially for discretionary costs. “It’s not fun to spend less on things we enjoy, but if they are non-essential, it’s an easy way to make sure other costs don’t feel the burden,” said Reaves.

Consider automating savings to build an emergency fund. While many Americans noted that they had to pull from savings in the last year to cover expenses, you won’t be able to do so if you do not have a healthy emergency fund in place. It can be difficult to build your savings balance if money is already tight, but not impossible. According to Rebell, automating savings — or setting aside even a small amount to fund your savings account from each paycheck — can yield great results.

Allow your budget to change as your lifestyle does. Sticking to the budget you set up for yourself is important, but your budget isn’t a one-and-done document. It is a living tool that will change with your lifestyle. If you find you have more money for discretionary purchases, for instance, you can add in line items for luxuries you may have cut in the past.

Leverage budgeting tools for support. When a budget only exists in your head, it can be difficult to hold yourself accountable, or even notice when you’re spending too much. The right budgeting apps can help. “A simple spreadsheet can do wonders, but apps like YNAB, Rocket Money and EveryDollar can also be effective,” said Reaves. Still, Rebell cautions that downloading an app only works if you stick to it, so you should only employ tools that work with your habits.

Strategies for Increasing Your Discretionary Budget

Budgeting can help when money is tight, but it isn’t the only way to manage a decrease in income. In some cases, you may want to find opportunities to increase your discretionary budget, rather than having to make cuts.

“You can [try] to offset the difference by increasing your income. Side hustles, asking for a raise and second jobs can help ensure you can keep spending consistent,” said Reaves.

Additionally, you may be able to free up funds for discretionary spending from other parts of your budget. Debt payments, for one, can eat up income, and you may be able to reduce them.

“Balance transfer credit cards can give you breathing room in your budget to afford higher prices while paying down debt,” said Andrea Woroch, money saving expert.

“These cards offer no interest periods of up to 21 months, saving you more money by avoiding high monthly fees as you pay off debt. This means, you will have a lower monthly payment to afford higher prices in other areas,” she added.

For other kinds of debt, you may consider a debt consolidation loan or refinancing.

Managing Spending Amid Rising Costs

Unfortunately, there is still uncertainty about the future of inflation for the remainder of 2025 and looking ahead. Still, rising costs are something you can prepare for with the right planning — and it doesn’t hurt to be ready.

“I think costs will continue to rise steadily — this will always be something people need to keep in mind. Having additional income streams, saving an appropriate amount and reducing non-necessary spending can help ensure people aren’t thrown off financially when that time comes,” said Reaves.

Emily Sherman is a personal finance expert at BestMoney.com, specializing in online banking. Her work has appeared in U.S. News & World Report, Buy Side from the Wall Street Journal, Newsweek, and more. As a veteran journalist, Emily leverages her expertise to help readers make informed financial decisions.