Won’t affect credit score

100% secure

Takes two minutes

Finding the right car insurance doesn’t have to be complicated. Whether you’re looking for basic coverage or full protection, this guide shows you how to compare providers, understand what affects your rate, and how to lock in the best deal, fast.

BestMoney makes it simple by connecting you with leading providers like State Farm, The General, Progressive, Geico, Allstate, Liberty Mutual, Bristol West, and more. Compare quotes in under 60 seconds, no credit check required, no obligation to buy.

Car insurance helps cover the cost of damage, theft, or liability if you’re involved in an accident. It’s legally required in most states, and having the right policy can save you from expensive out-of-pocket costs.

🔍 Compare rates in minutes

Shopping around can save you hundreds per year

💰 Cheap doesn’t mean less coverage

Many drivers qualify for good coverage at great prices

⚙️ Customize your policy

Choose from basic liability to full protection based on your budget

📉 Lower your rate with smart choices

Good driving, bundling, or switching providers can lower what you pay

📱 100% online process

Get quotes, compare, and buy your policy, all without a phone call

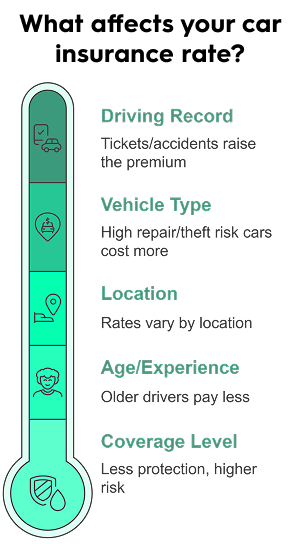

Insurance companies calculate your rate using a mix of factors:

Driving record – Tickets and accidents can raise your premium

Location – Rates vary by state, city, and even ZIP code

Vehicle type – Cars with high repair costs or theft risk often cost more to insure

Age and experience – Younger and new drivers typically pay more

Coverage level – More protection means a higher premium, but less risk for you

💡 Tip: Keep your driving record clean and review your policy annually, even one small change can lower your rate.

Car insurance is a legal requirement in most U.S. states (exceptions include New Hampshire and Virginia). Beyond legal compliance, it acts as a crucial financial safety net, covering costs associated with accidents, theft, or damage to your vehicle, and protecting you from liability.

Here are the most common car insurance coverage options:

🔹 Liability: Covers injury and property damage to others if you’re at fault (required in most states).

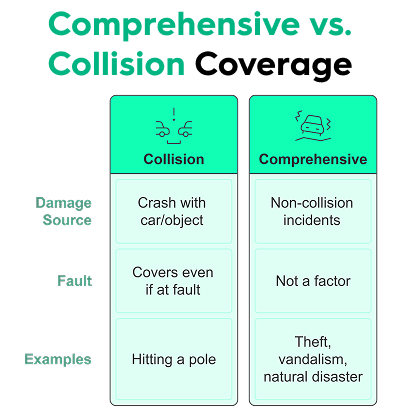

🔹 Collision: Pays for damage to your car from an accident, regardless of fault.

🔹 Comprehensive: Covers non-collision issues like theft, vandalism, weather.

🔹 Uninsured/Underinsured motorist: Covers your medical expenses and vehicle repairs if the other driver lacks coverage.

🔹 Medical payments insurance (MedPay): Covers your medical costs, regardless of fault.

🔹 Personal injury protection (PIP): Optional broader medical coverage for you and your passengers, often including lost wages and other expenses, regardless of fault (mandatory in some no-fault states).

💡 Need help choosing the right coverage? Answer the above quiz to get recommendations tailored to your specific needs.

» More in-depth explanation of the different types of car insurance types.

Choosing car insurance depends on your car's value, how much you drive, and how much risk you want to cover:

💸 Minimum liability – Cheapest option, good for older cars, but only covers damage you cause to others.

🛡️ Full coverage – Includes liability, collision, and comprehensive; best for new, leased, or financed cars.

🔧 Add-ons – Extras like roadside assistance, rental car reimbursement, or gap insurance give more protection but cost more.

Tip: If your car isn’t worth much, minimum coverage might be enough. But if you can’t afford to replace it, full coverage is often worth it.

» More tips for cutting car insurance costs.

Yes. You can switch insurers at any time, even mid-policy, without penalty in most states. Just make sure your new policy is active before canceling your old one.

These two types of coverage protect your vehicle from different kinds of damage:

Collision: covers damage from a crash with another car or object, even if it's your fault. Example: backing into a pole.

Comprehensive: covers damages to your car from non-collision-related incidents. Examples include theft, vandalism, fire, natural disasters (like floods, hail, or falling objects), or hitting an animal.

Tip: Full coverage usually includes both.

Most insurers ask for just a few details:

🚗 Car info – Year, make, model, and mileage.

🧍 Driver info – Name, address, license number.

🧾 Current insurance (if any) – Some discounts apply if you’re switching.

If you ever need to file a claim, follow these simple steps:

Call the police – Ensure safety and report the accident or theft immediately.

Document damage – Take photos, notes, and gather witness statements.

Contact your insurer – Submit your claim.

Wait for approval – An adjuster will assess your case.

Receive your payout – Once your claim is approved, you will be reimbursed for covered damages, minus your deductible.

Looking to cut your rate? These proven strategies can help:

🏡 Bundle policies: Combine auto with home or renters insurance for a discount

📉 Raise your deductible: Pay less each month, but more out-of-pocket if you file a claim

🎓 Take a defensive driving course: Can earn discounts, especially for young or high-risk drivers

📱 Use telematics: Let your insurer track your driving via app or device for safe driver savings

🔄 Compare rates annually: Shop around at least once a year or when your life changes

Every driver’s needs are different. Here's how to decide what coverage works for you:

🔹 Minimum coverage: Best for older cars or tight budgets, but offers limited protection

🔹 Full coverage: Adds collision and comprehensive, ideal for new, leased, or financed cars

🔹 Optional add-ons: Consider extras like roadside assistance, rental reimbursement, or gap insurance for extra peace of mind

💰 Save money: Drivers who switch save an average of $762 per year.

⚡ Fast & easy: Get quotes in under 1 minute, no long forms or hassle.

🛡️ No credit impact: Checking car insurance quotes will not affect your credit score.

🎯 100% free service: No cost, no commitment.

🏆 Top insurers: Access leading, nationwide providers.

We understand that every insurance provider offers unique policies and pricing. To simplify your search, we've partnered with a diverse network of top-rated car insurance companies, allowing you to easily compare multiple coverage and pricing options. This ensures you can confidently choose the policy that best fits your individual needs.

Our extensive network of top providers includes, but is not limited to:

Allstate

Geico

Progressive

Farmers Insurance

Gainsco

Liberty Mutual

The General

Nationwide

AAA

Amica

Root

USAA

State Farm

Bristol West

Costco

Mercury

Travelers

American Family

Freeway

Elephant

Experian

Direct Auto

Erie

Farm Bureau

Dairyland

Your car insurance premium is the price you pay for coverage, and it depends on a mix of personal, vehicle, and policy factors:

🚗 Driving record – Accidents, tickets, or claims raise your rate; a clean history usually lowers it

🚙 Vehicle type – Sports cars, luxury models, and cars with high repair costs tend to cost more to insure

📍 Location – Urban ZIP codes with more traffic, theft, or bad weather often come with higher rates

👤 Age and gender – Young or inexperienced drivers (especially males) generally pay more due to higher risk

💳 Credit score – In many states, better credit = lower insurance prices, as it signals financial responsibility

🛣️ Mileage – Drive less, pay less. Lower annual mileage often means lower premiums

📋 Coverage level and deductible – More coverage and lower deductibles increase the premium, but also boost protection

Yes, this coverage protects you if you're hit by someone with little or no insurance. It covers your medical bills and car repairs when the at-fault driver can't pay.

Try these proven ways to cut your rate:

🌟 Drive safely and avoid tickets

🏡 Bundle with home or renters insurance

🔄 Shop around and compare quotes each year

📈 Raise your deductible (if you can afford it)

🎓 Ask about discounts (good driver, student, multi-car)

Ensure safety: Move to a safe location and check for injuries.

Call the police: Report the accident to the police.

Exchange info: Collect names, contact details, and insurance information.

Document the scene: Take photos of the accident, vehicle damages, and any relevant details.

Notify your insurer: Report the accident as soon as possible.

Yes. In most states, insurers use your credit score to help predict risk. A higher score often means a lower premium.

Usually, yes. Insurance follows the car, not the driver. So if you borrow someone’s car with permission, their policy typically covers you. But always double-check both policies to be sure.

Gap insurance covers the difference between what your car is worth and what you still owe if it gets totaled. It's smart for new, leased, or financed cars that lose value fast.

A ticket can raise your premium, especially if it's recent or severe. The impact depends on your insurer, state, and driving record. Some discounts may disappear too.

You answer a few questions about your driving habits, location, and insurance needs, and we’ll generate a list of the best offers from top insurers.

No, taking the quiz will not affect your credit score. It’s simply a comparison tool that helps you explore your best options without any credit check.

Yes, BestMoney is a trusted and reputable platform that helps users compare financial products, including car insurance. It partners with top-rated insurers to provide transparent and competitive offers.

Nope. There’s no obligation. You can view your offers, compare, and choose only if you're ready.

It depends on your needs. Use our quiz to find insurers that match your profile, then compare coverage, price, and reviews.

At least once a year or any time your situation changes (new car, move, added driver). Rates and discounts shift often.

Yes. Some providers specialize in coverage for high-risk drivers. Companies like The General, Bristol West, and Progressive offer options for drivers with past accidents, DUIs, or low credit scores.

If your state requires an SR-22, we’ll match you with providers who offer it. Companies like The General and Progressive often support this.

Yes, you can switch car insurance at any time. However, check your current policy for cancellation fees or refund policies. Many insurers offer refunds for unused premiums if you switch mid-policy.

Whether you’re looking for budget-friendly insurance or comprehensive protection, our comparison tool is designed to help you find the right coverage for your needs.