If you’re a business owner trying to make payroll, cover rent, buy inventory, or fund your next big growth opportunity – but keep hitting roadblocks at the bank – you are not alone.

Thousands of American business owners find themselves in the same position every day: needing funding fast, but not knowing where to turn.

That’s where a service called BestMoney comes in: a powerful platform, already trusted by over 50,000 business owners, that connects small and medium-sized businesses to the financing they need, with minimal paperwork and often in less than 24 hours.

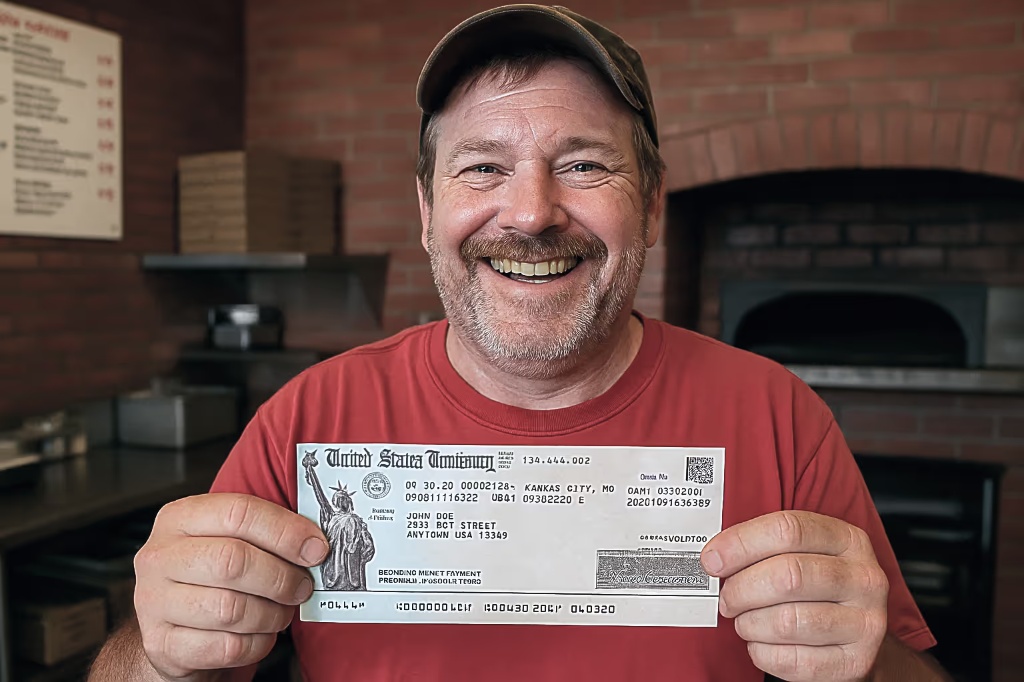

“I thought getting a business loan would be impossible with my credit score – which is less than stellar,” says Marcus, a restaurant owner from Austin, Texas. “But BestMoney made it easy. I was approved for $80,000 the same week. That money saved my business in a tough moment.”

Whether you’re recovering from a slow season, trying to make a big hire, or gearing up for your next expansion, BestMoney is helping thousands of business owners bridge the gap with fast, flexible funding.

Why Business Owners Are Using BestMoney To Find Funding Fast

Payout up to $2 Million

Traditional business loans from banks come with hurdles: long applications, strict requirements, and lengthy approval times. Even worse, many business owners find out after applying that they never had a chance of qualifying in the first place.

BestMoney flips that experience on its head. By using a simple online funnel, BestMoney asks you a few simple questions about your business and loan needs, like:

How much are you looking to borrow?

How long have you been in business?

What’s your monthly revenue?

What’s your credit score?

What do you need the loan for?

Based on your answers, BestMoney connects you with the lenders most likely to approve and fund your request – up to $2 million in as little as 24 hours.

And yes: even if you have low credit or a modest revenue, you may still qualify.

“I’d been putting off hiring staff because I wasn’t sure how I’d afford the ramp-up period,” says Amanda, owner of a boutique marketing agency in Chicago. “With BestMoney, I got matched to a lender who understood my growth plan and approved me for $90,000 within a day.”

What Would You Use The Money For?

BestMoney is designed for business owners who need funding for almost any reason:

Purchasing equipment or inventory

Investing in marketing

Hiring staff

Renovating or expanding physical locations

Paying down debt

Covering payroll or emergency expenses

And because BestMoney works with multiple lenders, the loan types can vary:

Working capital: General-purpose funding to cover day-to-day operations like payroll, rent, or short-term expenses.

Lines of credit: Flexible borrowing that allows you to draw funds as needed, great for handling seasonal dips or unexpected costs.

Short-term or long-term commercial loans: Lump-sum funding with fixed repayment terms, ideal for major purchases, renovations, or business expansion.

A Simple Quiz That Gets You Matched Fast

BestMoney’s quiz takes just a few minutes. No complex paperwork. No credit checks that hurt your score. Just a clean, modern experience designed to match you with the right lender based on only the important criteria:

Time in business: 6 months or more? You may qualify.

Revenue: Even if you’re only making $5K/month, there are options.

Credit score: Lenders available for scores as low as 550.

Business loans are not a one-size-fits-all service, and shouldn’t be treated as one. BestMoney tailors each match to your unique situation, so you don’t waste time applying for loans you won’t qualify for.

Why This Is A No-Brainer For Business Owners

Bank loans are slow. Many fintech platforms are confusing. BestMoney stands out because it is simple, fast, and designed for real-world business owners who don’t have time to waste.

Whether you’re trying to survive a tough quarter or take your business to the next level, BestMoney helps you take control of your finances without jumping through hoops.

And with no upfront costs, no impact to your credit score, and no obligation, there’s zero downside to checking out your options.

“I wish I had done this a year ago,” says Derek, a gym owner in Denver. “I lost months trying to get a loan through my bank. BestMoney got me funded in two days, on far better terms.”

| Feature | Traditional Bank Loans | BestMoney |

|---|---|---|

Application time | Several hours/ days | 2-5 minutes |

Approval time | 1-4 weeks | Same-day to 48 hours |

Credit score requirement | Typically 680+ | As low as 550 |

Funding speed | Can take weeks | Within 24-72 hours |

Required paperwork | Extensive (tax returns, financials, etc.) | Minimal |

Flexibility | One-size-fits-all loan products | Multiple loan types and lenders |

Impact to credit score | Hard inquiry | Soft inquiry |

Fees to apply | Varies | None |

Get Started Today

Answer A Few Questions - Answer a few simple questions about your business, such as how long you’ve been operating and your monthly revenue.

We’ll Compare For You - BestMoney searches its network of lenders to find the most suitable business loan options for your needs.

Get Matched - You get matched with a top lender – often the same day – so you can access funding fast and without the stress.

Joey Haddad is an insurance and finance expert at BestMoney.com. Joey holds certifications in Digital Banking & FinTech Fundamentals, bringing extensive expertise in risk assessment, business development, and customer service to his work.