Won’t affect credit score

100% secure

Takes two minutes

A personal loan can be a smart, predictable way to get the money you need. This guide breaks down how personal loans work, answers common questions, and offers tips for choosing the right one.

A personal loan is money you borrow from an online lender, bank, or credit union, which you repay in fixed monthly installments. Most personal loans are unsecured, meaning you don't need to put up collateral like your home or car. Your credit score and income determine how much you’ll qualify for.

💰 Upfront funds

A personal loan gives you money upfront, which you repay in fixed monthly payments.

📊 No collateral needed

You don’t need to put up your house or car, but your credit and income affect how much you’ll get and what rate you’ll pay.

🎯 Flexible use

You can use the loan for almost anything, like paying off debt, home repairs, or emergencies.

🧾 Understand the terms

Make sure you understand the terms and fees, and only take a loan if you’re sure you can afford the payments.

Here are the main benefits of getting a personal loan:

But remember: A personal loan is still money you have to pay back. Make sure the monthly payment fits your budget, and only borrow what you need.

It’s the extra money you pay on top of what you borrow, it’s the cost of borrowing. Most personal loans have a fixed rate, which means your monthly payment stays the same throughout the loan term.

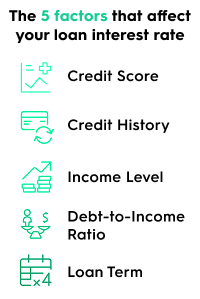

The interest rate you get depends on things like your credit score, income, loan amount, and how long you’ll take to pay it back. In general, the better your credit, the lower your rate.

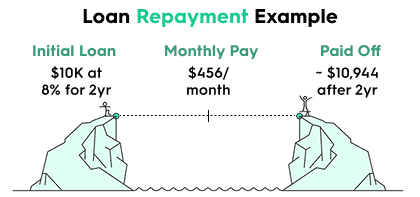

Example:

You borrow $10,000 at an 8% fixed interest rate for 2 years (8% of $10,000 = $800 per year).

Because interest is calculated on the remaining loan balance, you're paying 8% of a smaller amount each month.

👉 Pro tip: Always read the loan terms carefully. Interest rates, fees, and repayment details can vary between lenders and affect the total cost of your loan.

You can use the funds for almost anything, such as:

💳 Simplifying existing debts: This is the most popular use, rolling multiple debts into one.

🛠️ Home improvements: Upgrade your kitchen, bathroom, or backyard.

🏥 Medical bills: Cover unexpected procedures or ongoing care.

🛋️ Major purchases: Think appliances, furniture, or new electronics.

💒 Life events: Weddings, vacations, moving costs, you name it..

🚨 Emergencies: Handle surprise expenses without the stress.

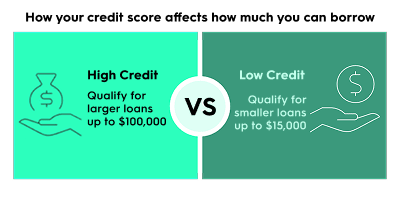

Most personal loans range from $1,000 to $50,000, though some lenders may offer up to $100,000 for highly qualified borrowers.

How much you can get depends on things like your credit score, income, existing debt, the purpose of the loan, and the lender’s specific requirements.

Example:

👉 Pro tip: Getting prequalified lets you see your potential loan amount without affecting your credit score.

You usually fill out a short form with basic info like your income, credit score range, and how much you want to borrow. The lender then does a soft credit check and shows you estimated rates, terms, and loan amounts.

Why it’s helpful:

Prequalification isn't a guarantee, but it's a smart first step before applying.

These are the 5 biggest factors lenders consider:

No, checking your rates won’t hurt your credit. Most lenders use a soft credit check when you get prequalified, which doesn’t affect your score.

However, once you officially apply for a loan, a "hard inquiry" will be made, which can cause a small temporary dip. Making on-time payments on your personal loan will help improve your credit over time.

The faster you pay it off, the less extra money (interest) you’ll have to pay.

Yes, some personal loans come with fees. The most common is an origination fee, a one-time charge for setting up the loan, usually 1%–5% of the loan amount.

Other possible fees include:

👉 Bottom line: Not all loans have fees, but many do. Always read the details so you know what you’re paying for.

It depends on the lender, but many personal loans are fast. Some online lenders can send the money the same day or next day after you're approved.

Banks or credit unions might take a bit longer, a few days to a week.

Need money fast? Look for lenders that offer same-day funding and have a quick online application.

Lenders usually ask for documents that confirm who you are and that you can repay the loan:

🪪 ID – like a driver’s license or passport

📄 Proof of income – pay stubs, bank statements, or tax returns

🏠 Proof of address – a utility bill, lease, or something official with your name and address

Finding the right personal loan can feel overwhelming, so many lenders, terms, and options. But you've already taken the first step.

Now it’s simple:

⬆️ Scroll up, enter the amount you need, and get matched with personalized loan offers—in under 2 minutes!