Won’t affect credit score

100% secure

Takes two minutes

Finding the best home insurance doesn’t have to be confusing or expensive. Whether you're buying your first home or want better coverage, comparing home insurance quotes online is the easiest way to save money and secure tailored protection.

Here's what you'll learn:

🏡 Compare to save big

Homeowners can save up to $500/year by shopping and comparing online.

📋 Standard coverage has limits

Flood insurance is usually excluded.

🚨 Review your policy annually

Most homeowners overpay or underinsure.

💰 Bundle to boost your savings

Combining home and auto policies can reduce costs by 10–25%.

Not all homeowners insurance policies are created equal. Some insurers offer better rates for newer homes, bundled policies, or high-risk zones like flood areas. Comparing quotes online helps you:

💰 See side-by-side premiums and deductibles

🕵️ Identify hidden fees and coverage gaps

🧾 Spot discounts like bundling auto and home

🌊 Filter for flood insurance or underground utility protection

Quick tip: You could save up to $500/year just by switching providers after comparing multiple offers.

👉 Ready to compare quotes?

Use our 60-second tool to get matched with top insurers in your ZIP code.

A standard homeowners policy typically covers:

Optional but often essential add-ons:

🌊 Flood insurance (usually not included)

🏊 Swimming pool liability

🧵 Sewer or drain backup

🌎 Earthquake protection

It’s not just about price. Look for:

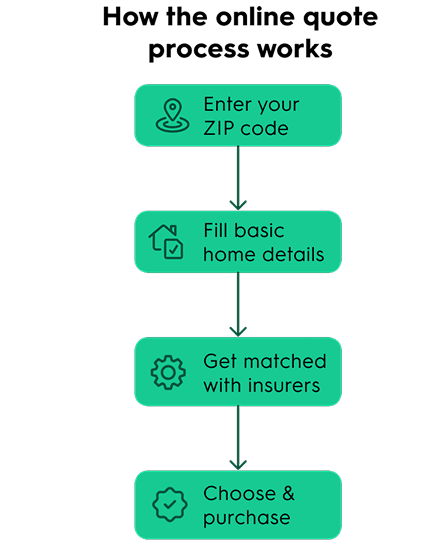

Online quote tools let you:

Most users finish in under 2 minutes, no phone calls or paperwork required.

Absolutely. You can tailor your plan with:

🌊 Flood insurance - if in a FEMA-designated zone

🏊 Pool liability - required in some states

🧵 Underground service line protection - like water/gas

💍 Riders for valuables - such as jewelry, instruments, or fine art

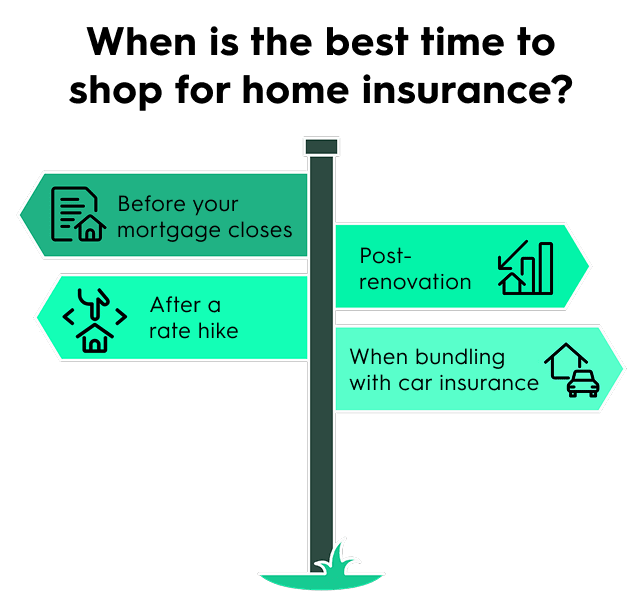

Timing can impact your savings and eligibility. Ideal times include:

Many homeowners overpay without realizing it. These factors impact your premium:

📍 Location risk (floods, wildfires, hurricanes)

🧱 Home age and structure

💳 Credit score & claims history

🏗️ Roof type and building material

Pro tip: Rate gone up this year? Shop quotes again. You might find a better deal today.

It’s not just about the lowest rate, reliability and service matter.

Look for providers with:

Is flood insurance included in homeowners insurance?

No. Most homeowners policies exclude flood damage. You’ll need a separate policy, especially if you live in a FEMA flood zone.

When should I compare home insurance quotes?

At least once a year, and definitely after any rate increase, renovation, or change in coverage needs.

Can I buy home insurance without a home inspection?

Yes. Most insurers today allow you to purchase coverage based on your answers. Some may require post-purchase inspection.

How long does it take to get a quote online?

Less than 2 minutes with most tools. You’ll see options instantly.

What coverage do I need for my mortgage lender?

Lenders usually require dwelling coverage that equals the loan amount. They may also require flood insurance in high-risk areas.

Do I need extra insurance if I have a pool?

Yes. Liability coverage should be increased, and some states require specific pool protection.

Does bundling really save money?

Yes. Bundling home and auto can save you 10–25% annually, depending on the provider

AI was used in the creation of this content, along with human validation and proofreading.