This site is a free online resource that strives to offer helpful content and comparison features to our visitors. We accept advertising compensation from companies that appear on the site, which may impact the location and order in which brands (and/or their products) are presented, and may also impact the score that is assigned to it. Company listings on this page DO NOT imply endorsement. We do not feature all providers on the market. Except as expressly set forth in our Terms of Use, all representations and warranties regarding the information presented on this page are disclaimed. The information, including pricing, which appears on this site is subject to change at any time

As a digital-only bank, Citizens Access® avoids many of the costs associated with the banking industry. It passes these cost savings to its customers through its high-yield, low-fee savings account.

The Citizens Access® Savings account offers an impressive yield of 4.50% APY and charges no annual fee, services fees, or other hidden costs. Unlike some banks, which place high deposit minimums on high-yield accounts, Citizens Access® makes its savings account available to everyone. You can open a Citizens Access® Savings account with as little as $0.01 and make deposits of any amount.

Citizens Access® makes it easy to open an account and start saving. You can open an account in just five minutes and manage your account on the go with the Citizens Access® mobile app. It takes just a few clicks to set up recurring deposits into your savings account or to transfer funds to an external account of your choice.

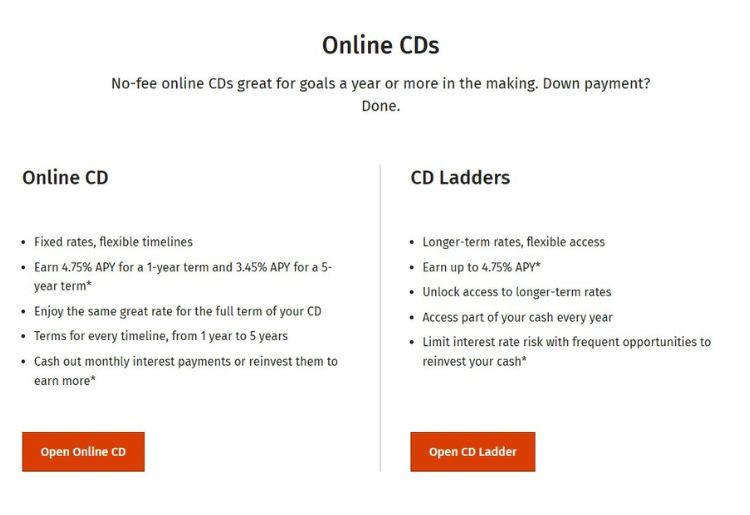

In addition to high-yield savings accounts, Citizens Access® provides several other banking and financial services. It offers online certificates of deposit (CDs) ranging from 11 months to 5 years as well as CD ladders. A CD ladder is a savings strategy and vehicle that allows you to divide your money among several CDs with different maturity dates. CD ladders grant you additional flexibility while also ensuring a suitable return on your investment. In addition to savings accounts and CDs, Citizens Access® provides traditional mortgages as well as mortgage and student loan refinancing.

Given its status as a digital-only bank, Citizens Access® has done away with several traditional bank features. For example, it doesn’t have any in-network ATMs or physical branches. However, it makes up for these deficits with great rates, ease of use, and low fees.

Citizens Access® Savings offers an APY of 4.50%. It doesn’t charge an annual fee, service fee, or any other hidden costs. You can open an account for as little as $0.01 and your interest rate doesn’t change regardless of the amount you deposit.

Like other banks, the interest rate and APY offered with Citizens Access® Savings accounts are subject to change. If you prefer to secure a long-term guaranteed rate you could opt to open a Citizens Access® online CD account. Available terms range from 11 months to 5 years.

| Product | Interest Rate | APY |

| Savings | 4.15% | 4.50% |

| 11-month liquid CD | 0.05% | 0.05% |

| 1 year CD | 4.64% | 4.75% |

| 2 year CD | 3.25% | 3.30% |

| 3 year CD | 3.30% | 3.35% |

| 4 year CD | 3.34% | 3.40% |

| 5 year CD | 3.39% | 3.45% |

You can reach the Citizens Access® Savings customer service team via phone or chat. Support is available 6am-12am (ET) Monday-Friday, 9am-5pm (ET) on Saturday, and 10am-5pm (ET) on Sunday. Alternatively, you can navigate to the Citizens Access® FAQs page to get answers to general questions about your account.

It’s easy to sign up for a Citizens Access® account. While its website is simple to navigate, some users report that the mobile app is difficult to use. However, the app was only released in 2022 and receives regular updates that target known bugs and other glitches.

Download the Citizens Access® mobile app to monitor and manage your account on the go. You can get the app from the Apple Store or Google Play on your iPhone or Android device. It allows you to check your balance, access statements, deposit a mobile check, and transfer funds in just a few clicks. The app features 2-factor authentication as well as biometric login security.

Citizens Access® uses several tools to protect your personal and financial information. Its website secures information using Secure Sockets Layer (SSL) encryption and two-factor authentication. All accounts are FDIC-insured.

If you detect unauthorized or suspicious activity, you can freeze withdrawals by logging into your account and managing your account permissions. Alternatively, you can contact the Citizens Access® dedicated fraud team. It offers 24/7 account monitoring to ensure your account stays safe from data breaches and hacks.

With Citizens Access®, you get a high savings rate without high fees or hassle. The savings account offers a competitive 4.50% APY without charging an annual fee, service fee, or any other hidden costs. You can open an account in only five minutes and manage your account online or through the Citizens Access® mobile app. If you’re looking to avoid the lines at a physical branch and earn a high yield on your deposits, then Citizens Access® may be right for you.

This review was created based on information gathered from the Citizens Access® website, customer testimony, and third-party reviews.